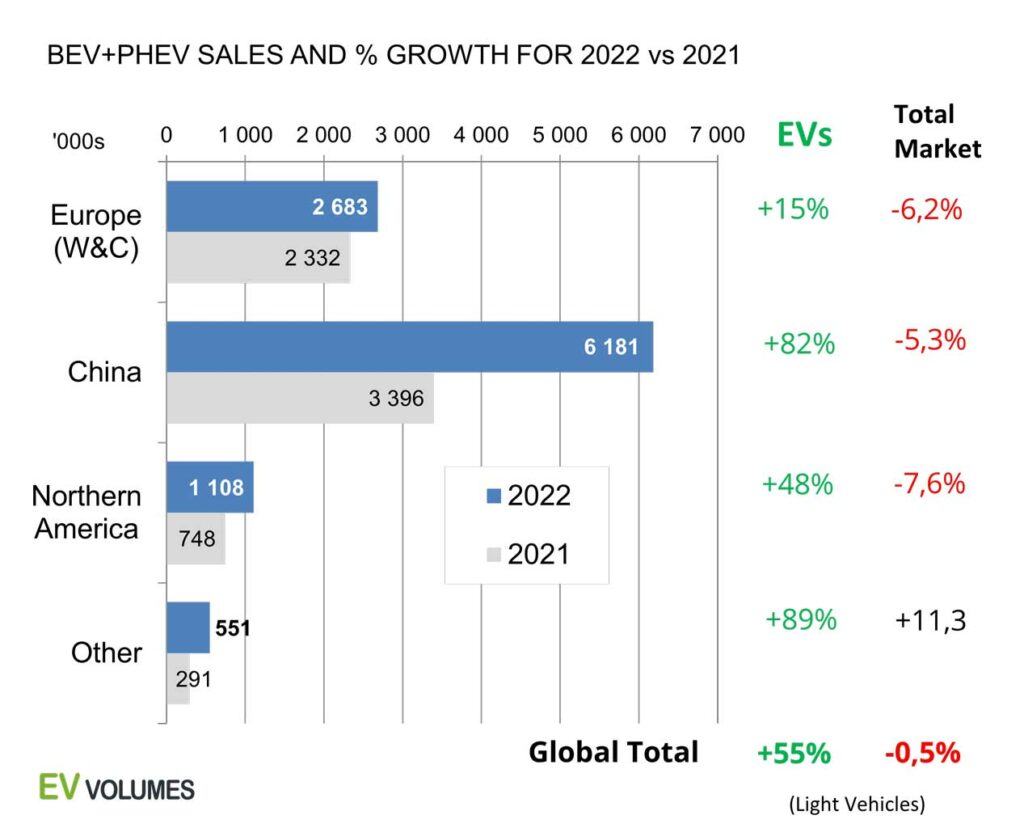

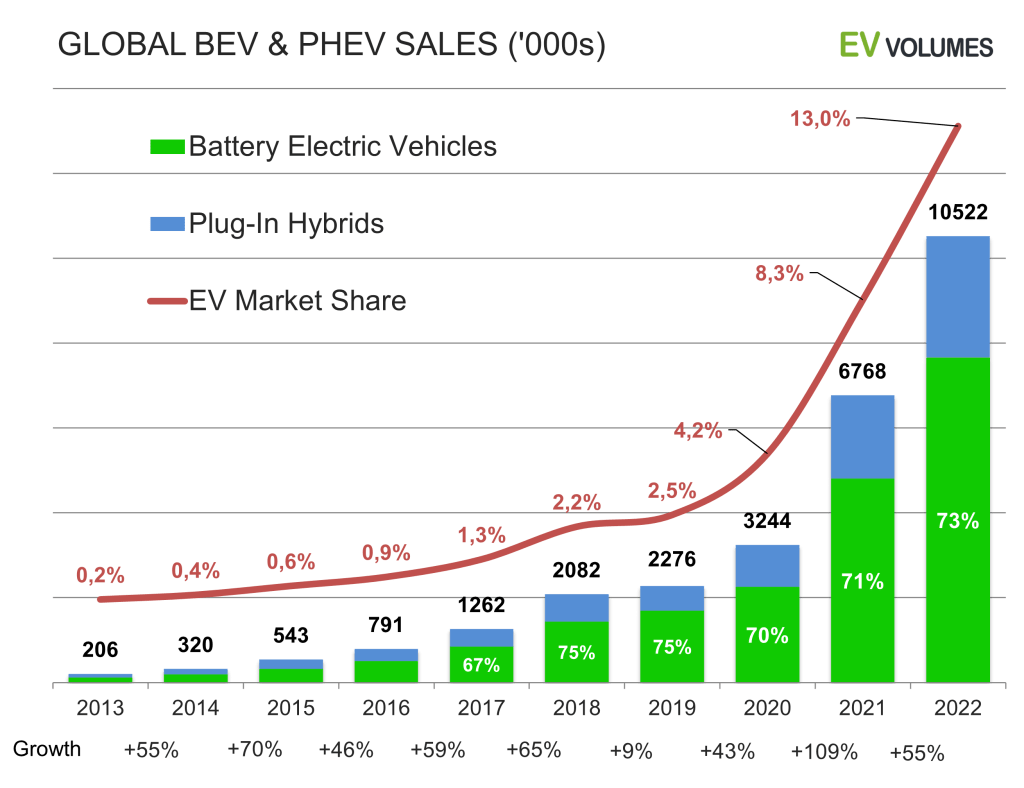

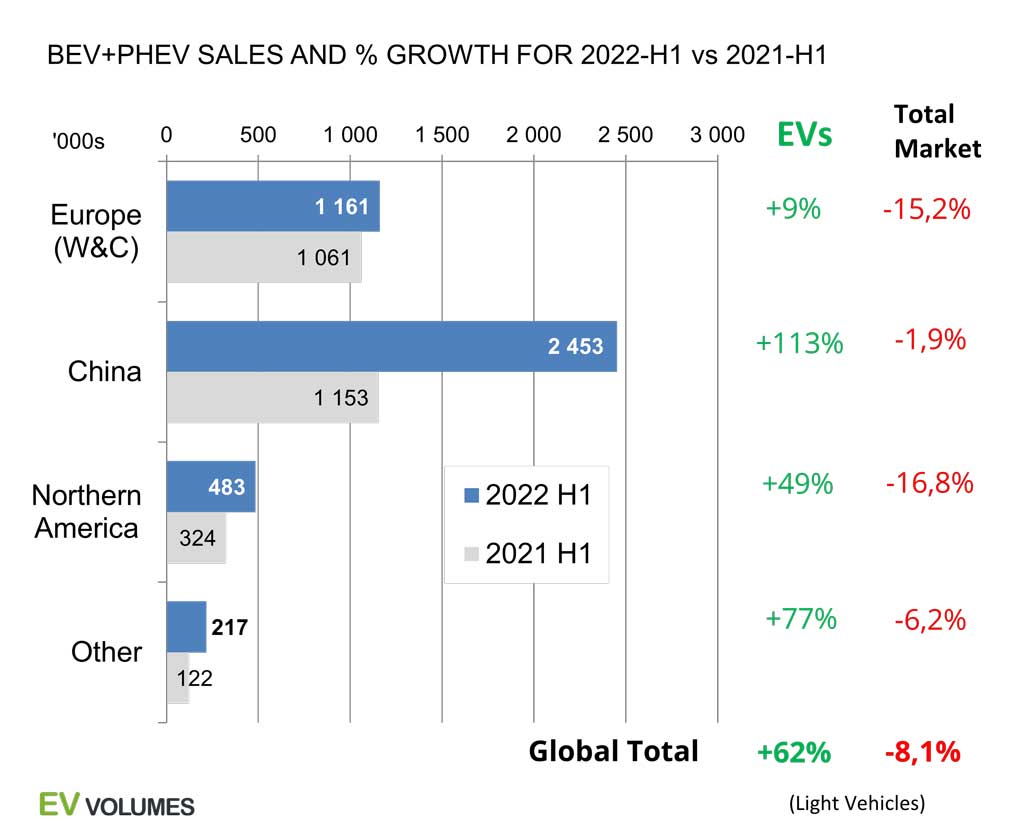

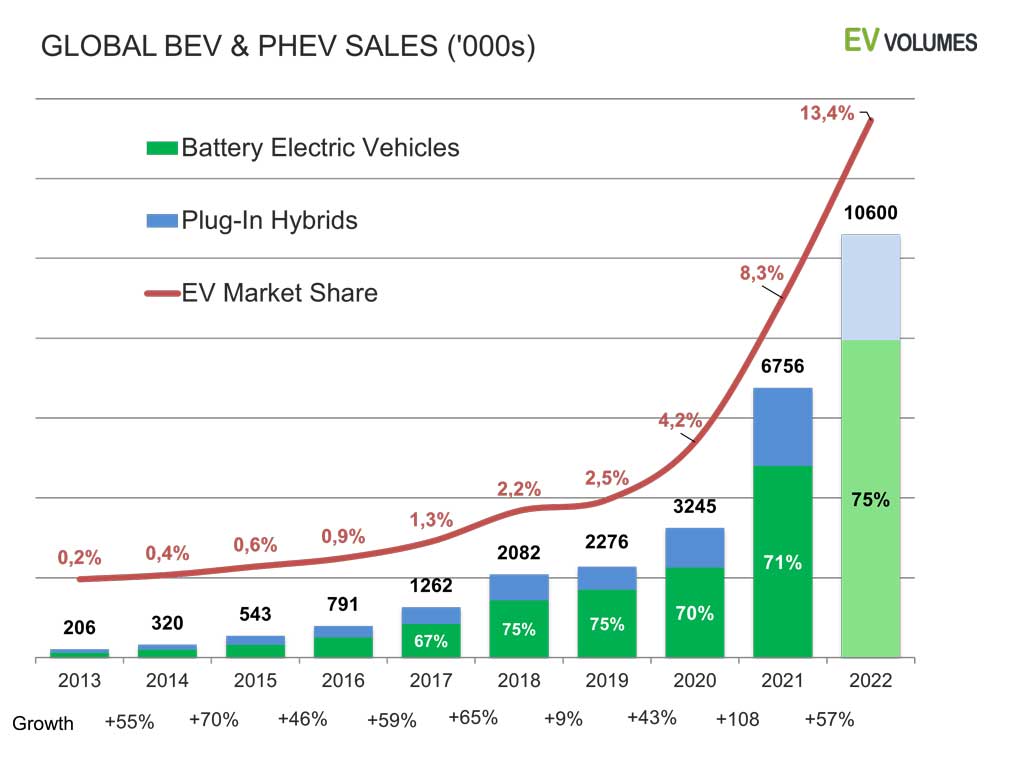

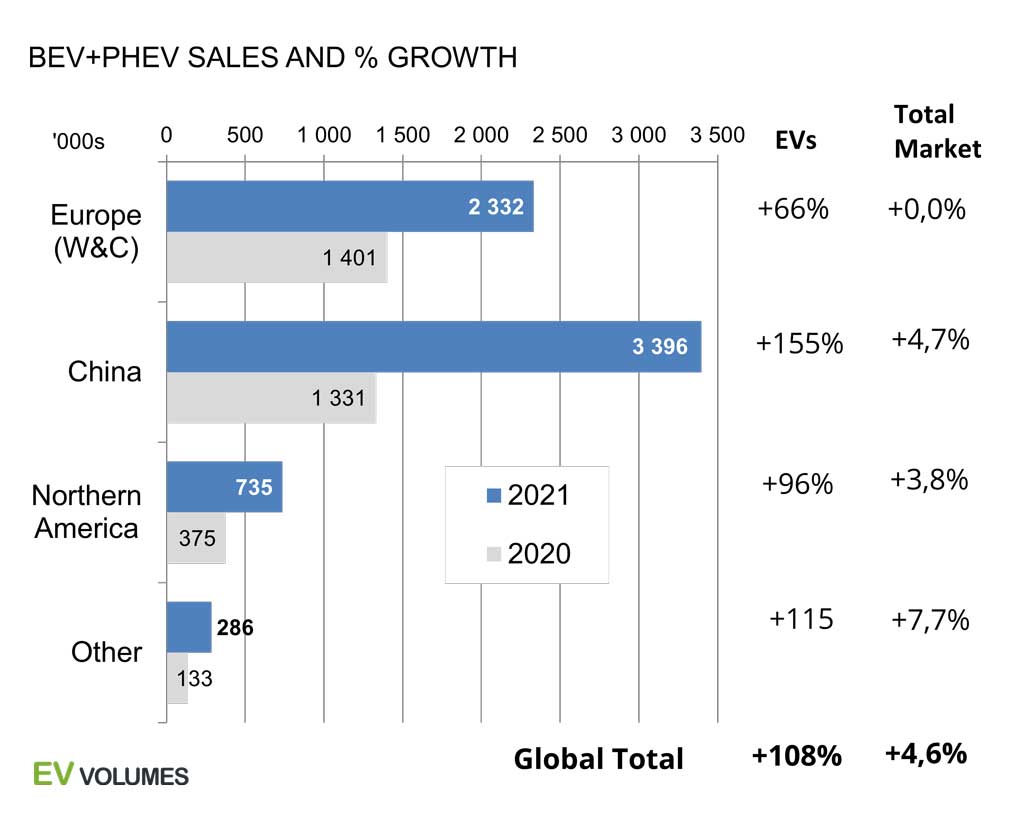

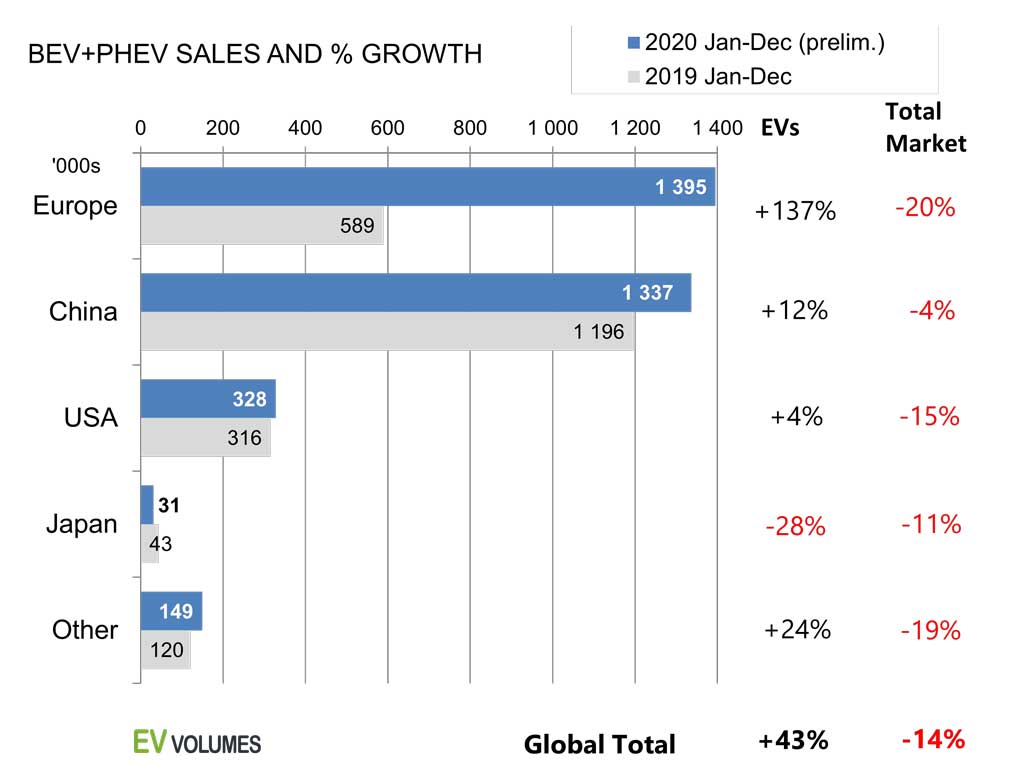

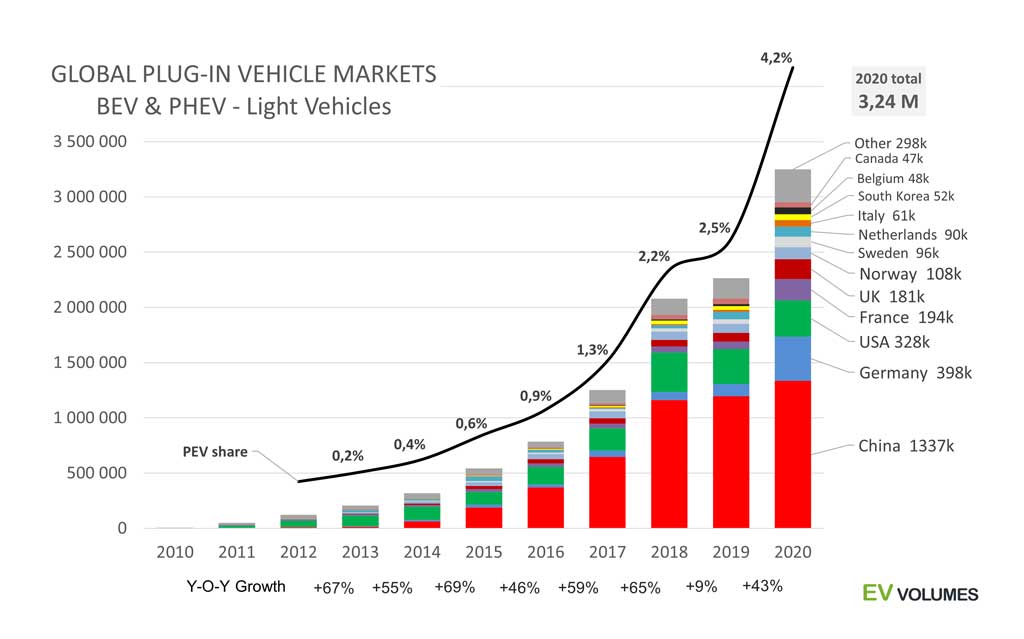

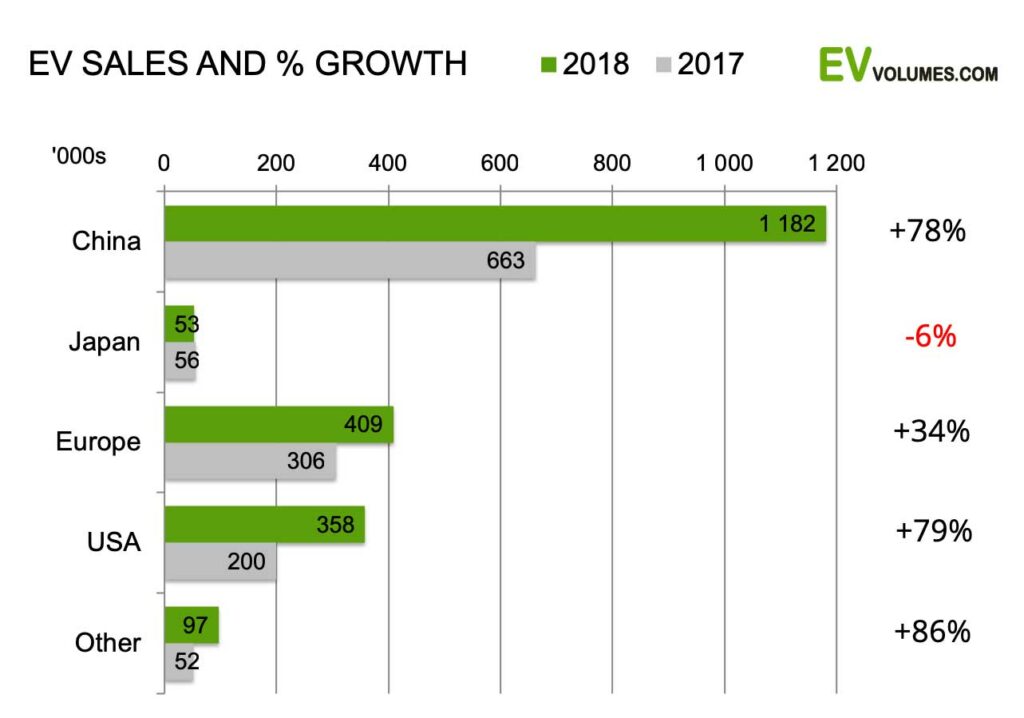

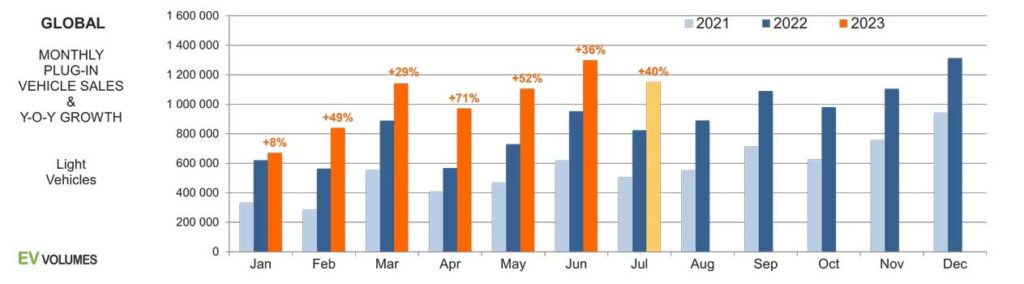

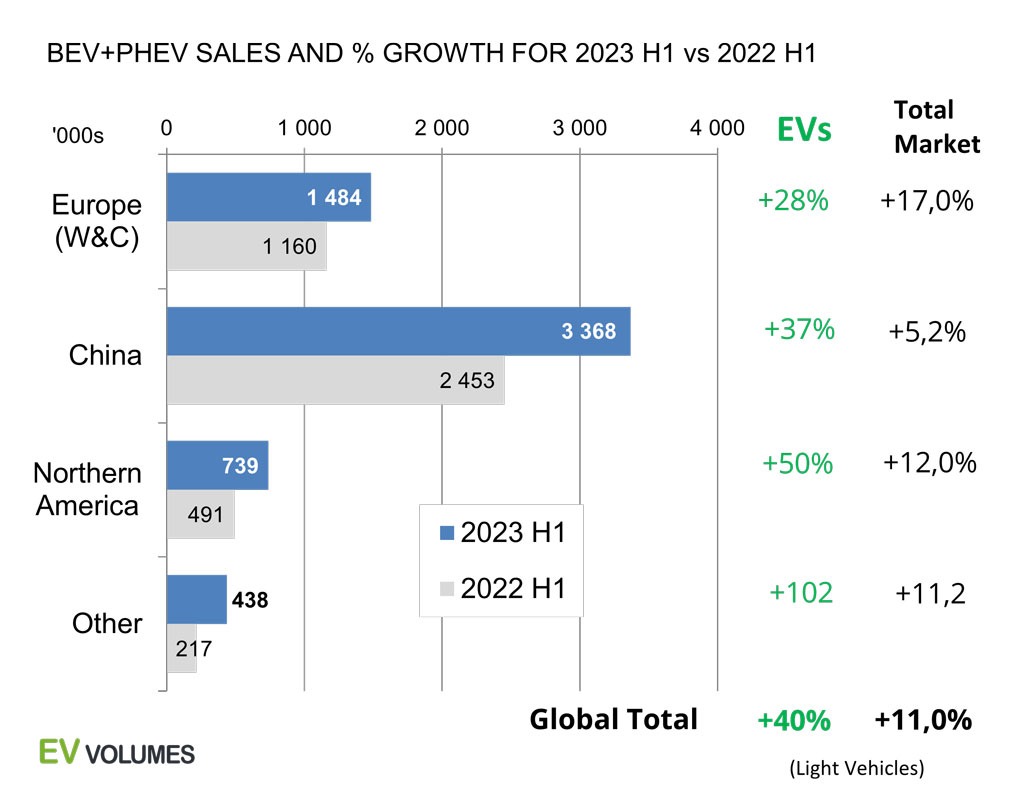

Global EV sales continue strong. A total of 6 million new Battery Electric Vehicles (BEV) and Plug-in Hybrids (PHEV) were delivered during the first half of 2023, an increase of +40 %. 4,27 million were pure electric BEVs and 1,76 million were PHEVs. Preliminary July results show +40 % growth again. The regional growth pattern has shifted: China EV sales increased by +37 % in 2023 H1 y/y, compared to +82 % in 2022 vs 2021. Sales in Western and Central Europe were up +28 % in H1 compared to just +15 % growth in 2022. EV sales in USA and Canada are +50 % higher YTD to June than last year. EV sales outside the aforementioned markets increased by 102 %, albeit from a low base. Overall vehicle markets saw a considerable recovery, with +17 % y/y growth in Europe in H1 but weaker and more volatile in China. The global light vehicle market was 11 % higher in 2023 H1 than in 2022 H1 but still trailed the 2015-2019 average by five million units on an annualized basis.EV shares continued to climb in all markets. BEVs (10 %) and PHEVs (4,1 %) stood for 14,1 % of global light vehicle sales at the close of H1, compared to 11,3 % in 2022 H1. Norway had the highest market share of EVs in H1 (BEVs 75 % + PHEVs 6 %), China had 30,5 %, Europe 19,7 % and USA 8,7 %. The fastest growing markets were Indonesia with 6000 BEV & PHEV units for H1, +886 %, Thailand with 39 500 units, up +370 %, Turkey with 12 300 units, up +326 % and Australia with 47 400 units, up +248 %.

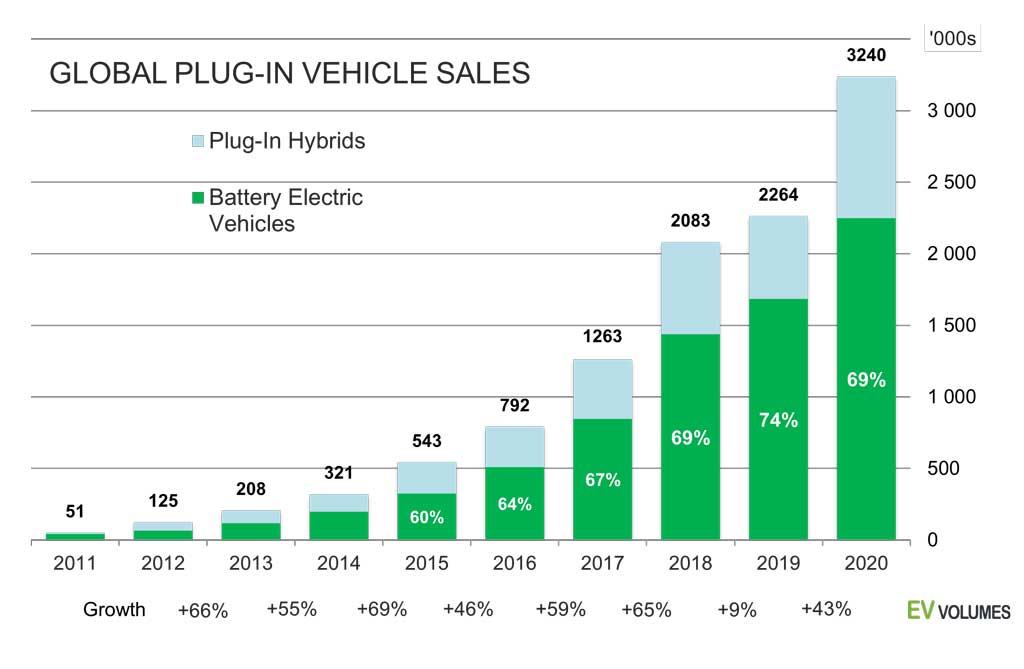

PHEVs stood for 29,6 % in the BEV-PHEV mix in 2023 H1 compared to 27,2 % in 2022. The PHEV volume increase was 891 000 units in H1, most of it (754k) in China. High sales of BYD PHEVs and the renaissance of Range Extender Electric Vehicles (EREVs) are the main reason. Also, mini-EVs like the Wuling Hongguang found fewer buyers in a tougher economic environment. As they are all BEVs their decline is dragging down the BEV share within China’s New Energy Vehicle (NEV) volume.

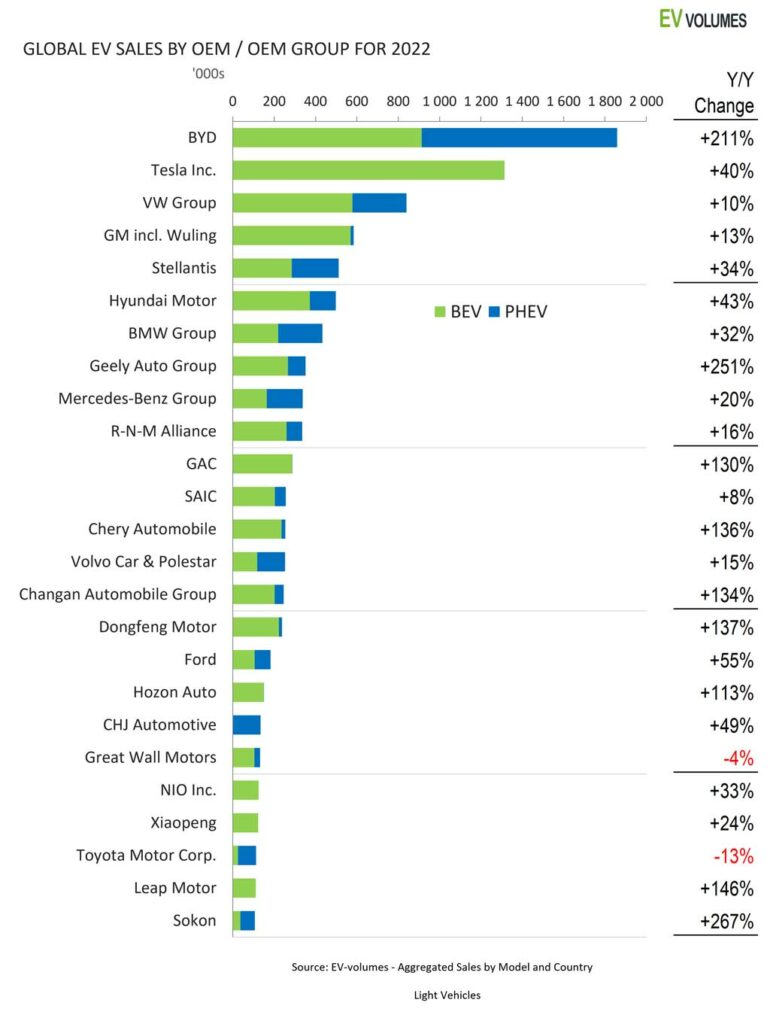

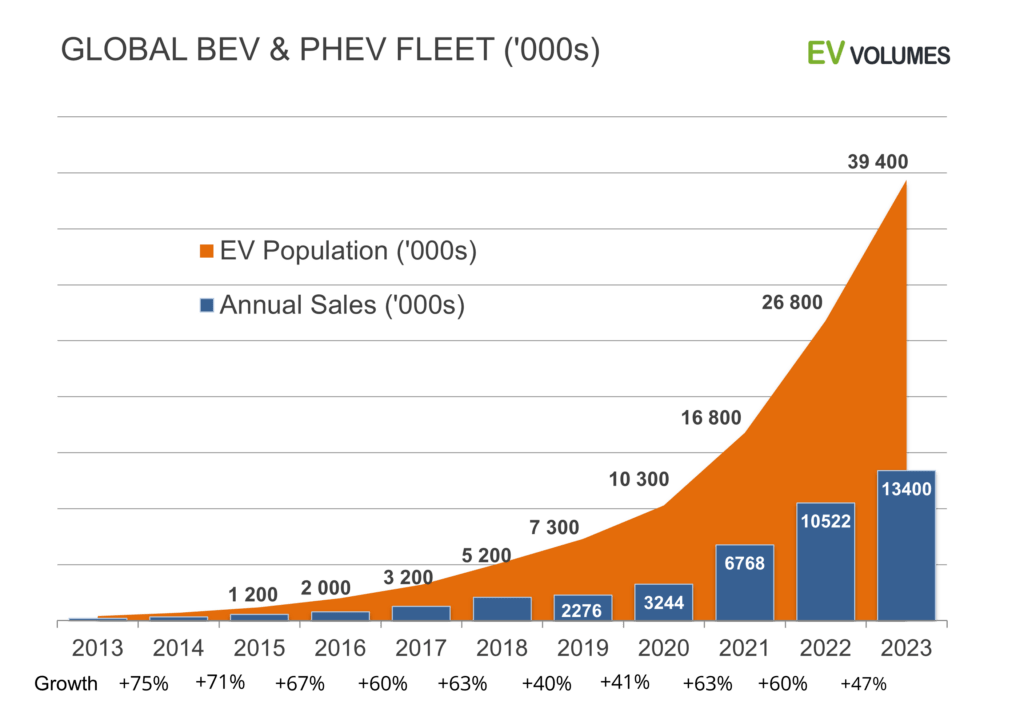

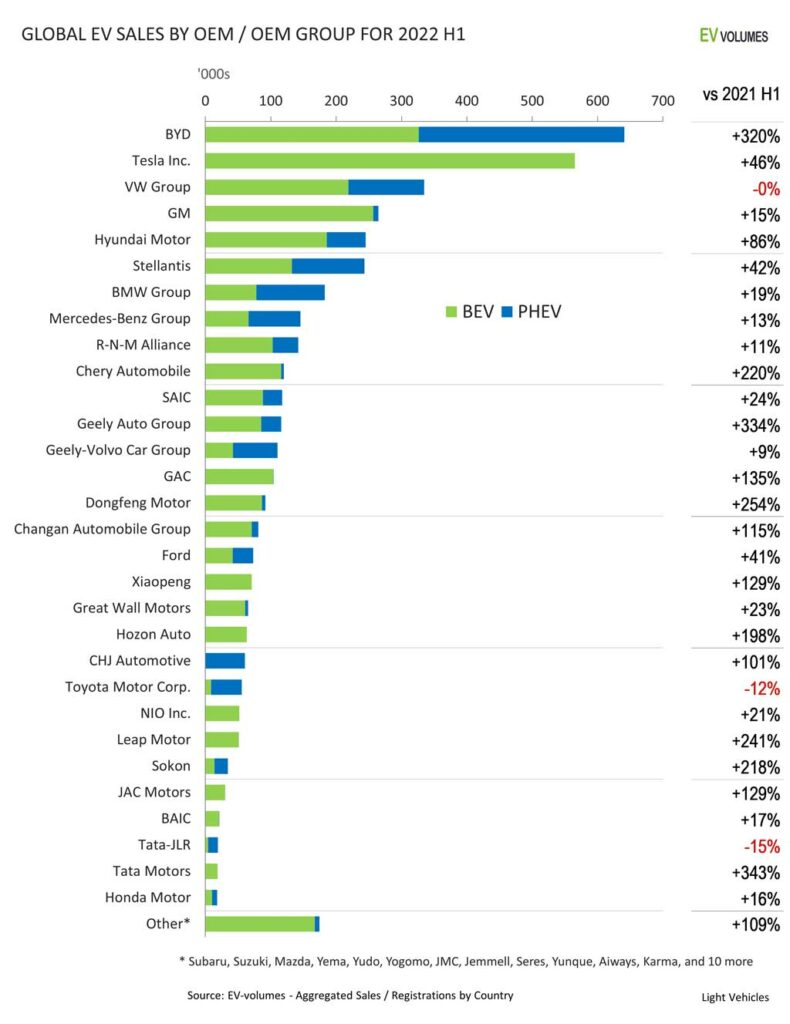

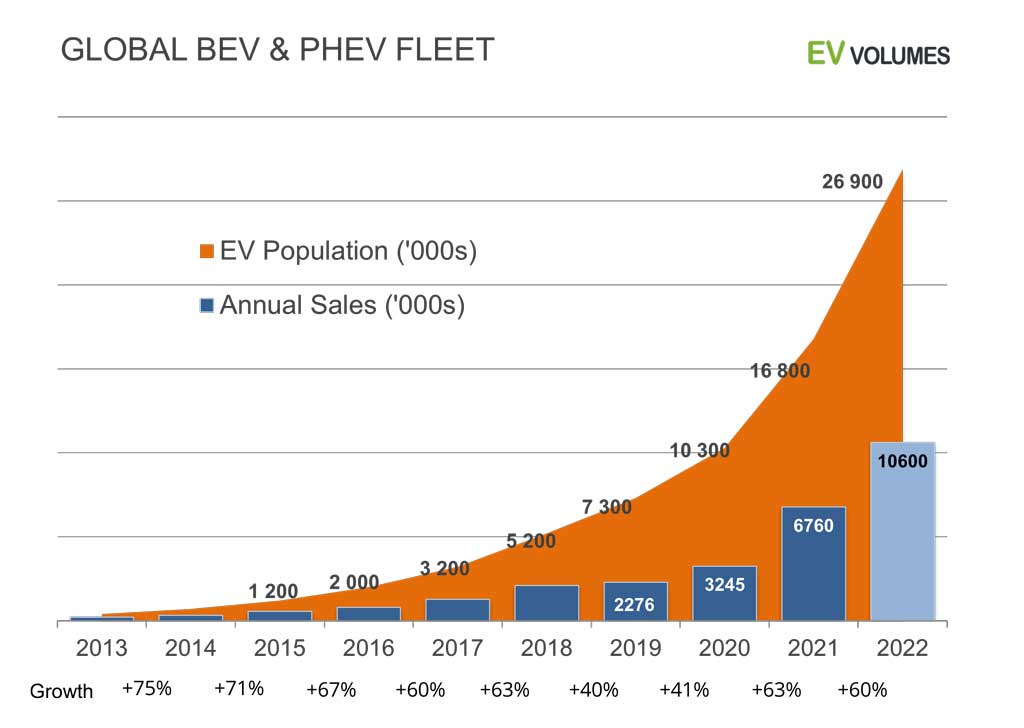

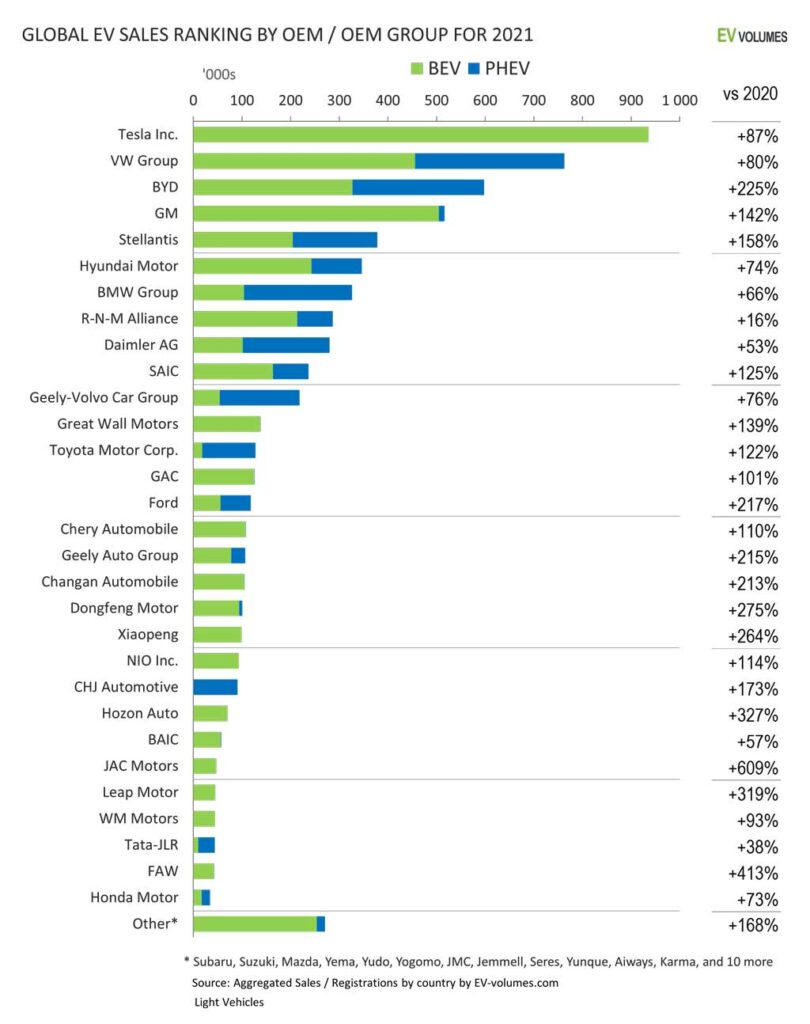

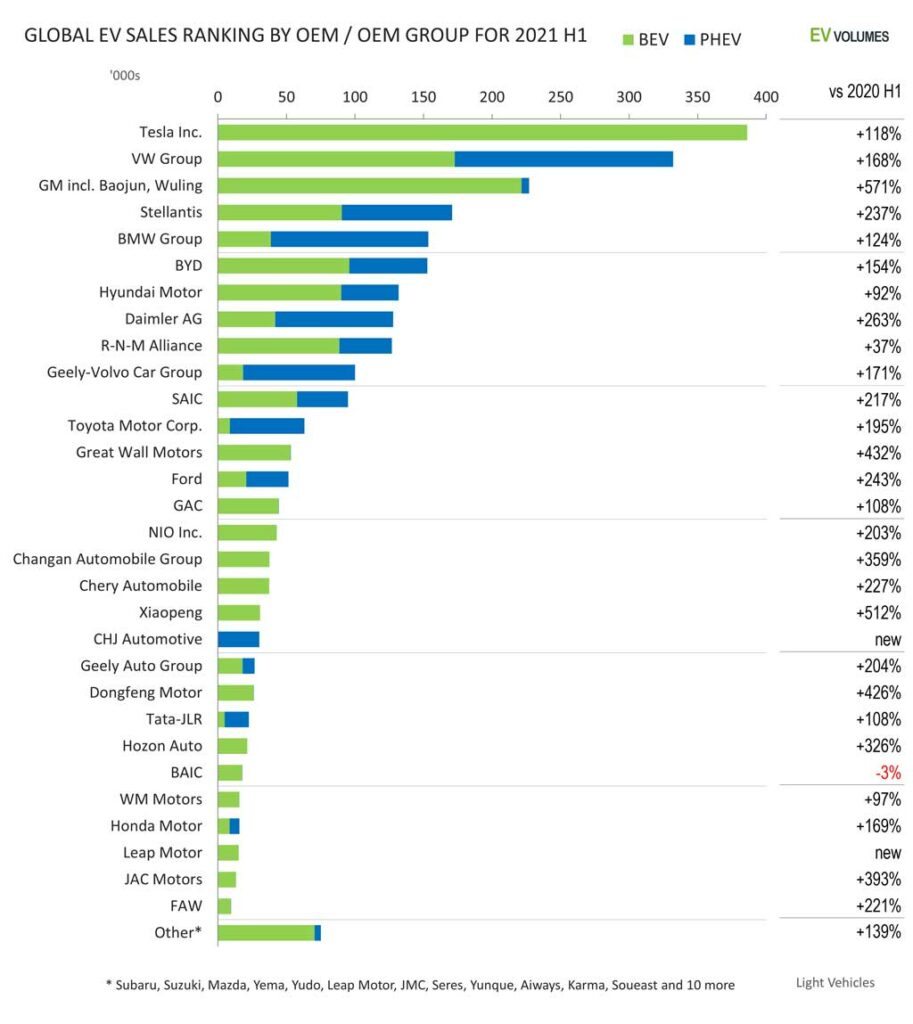

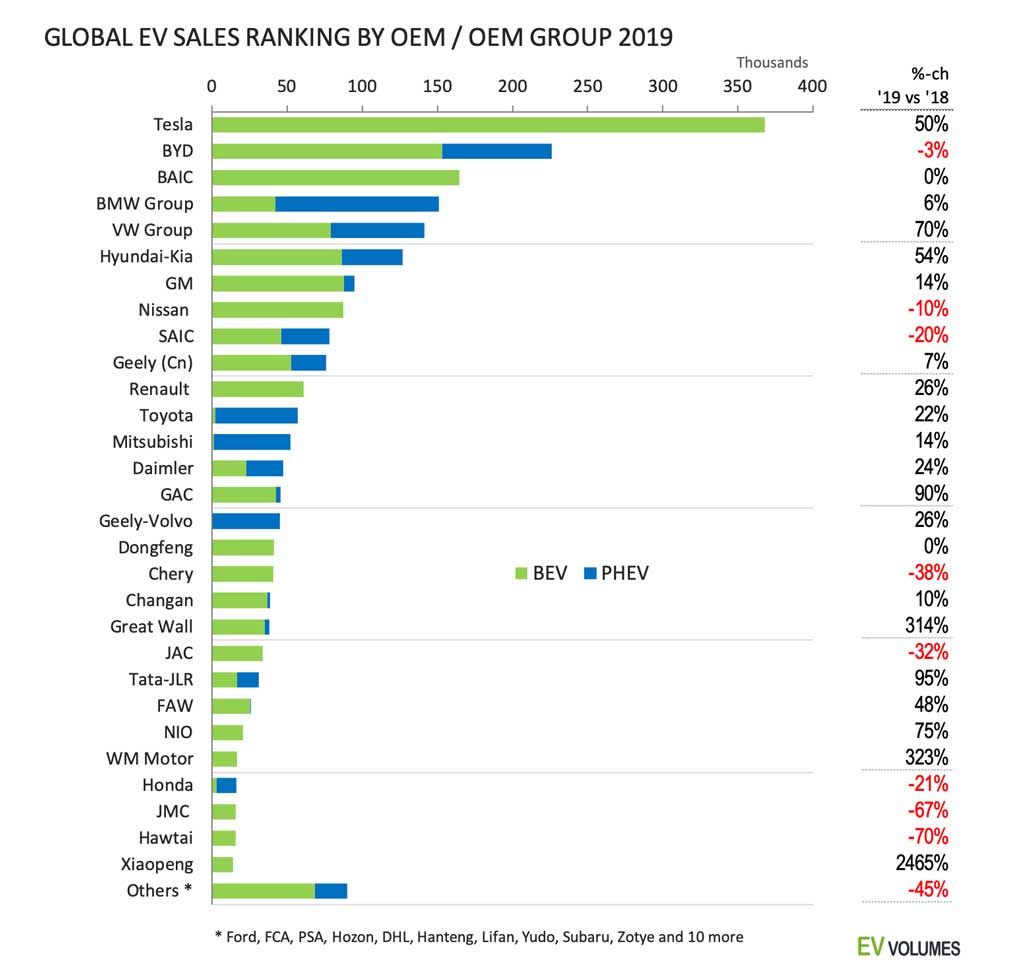

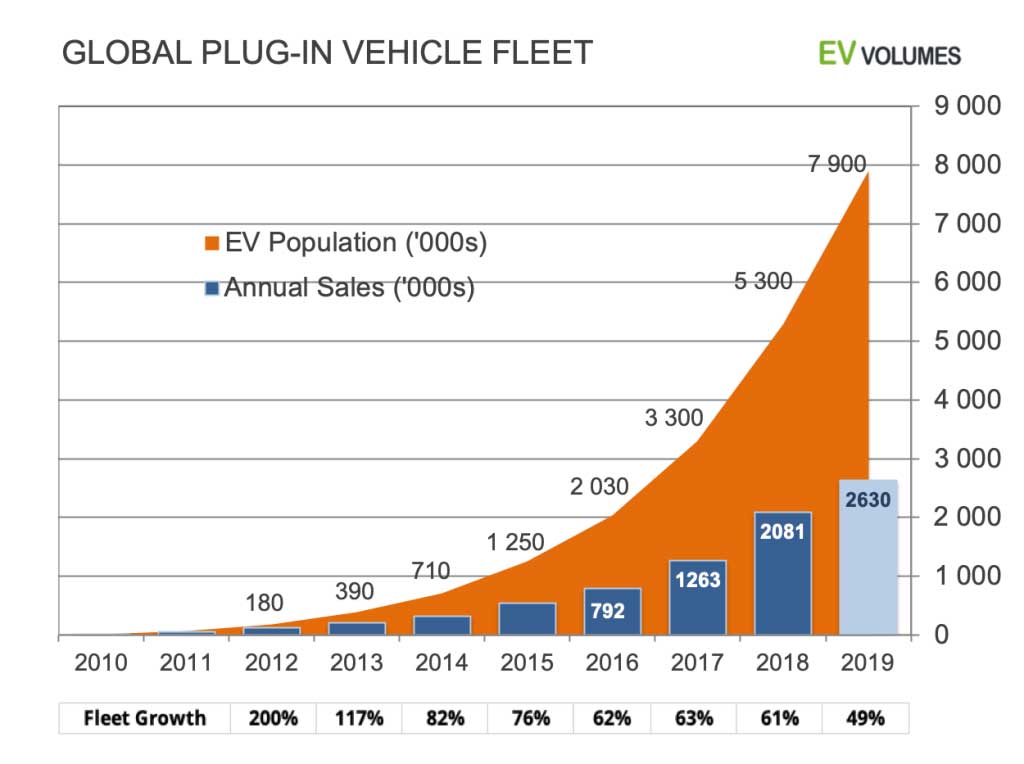

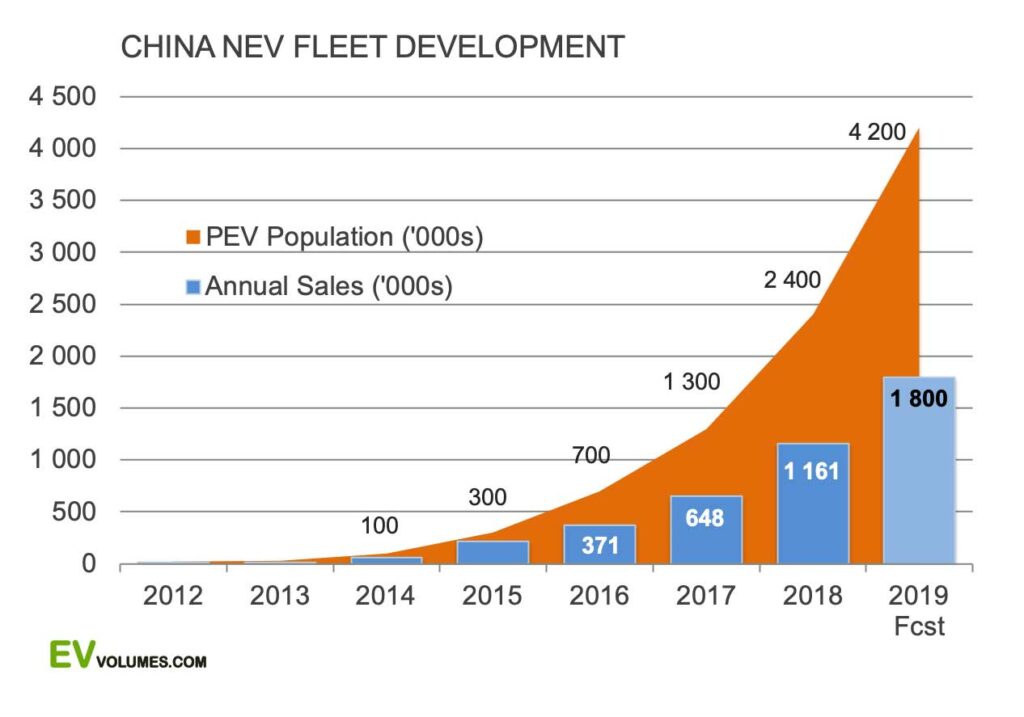

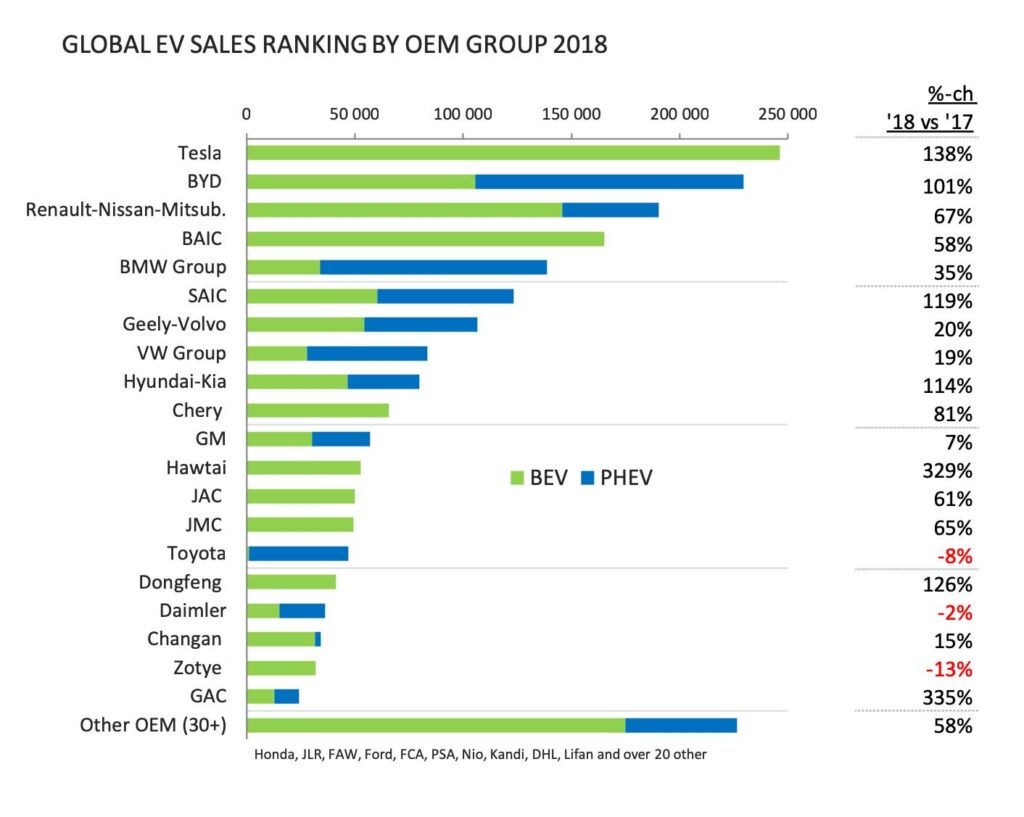

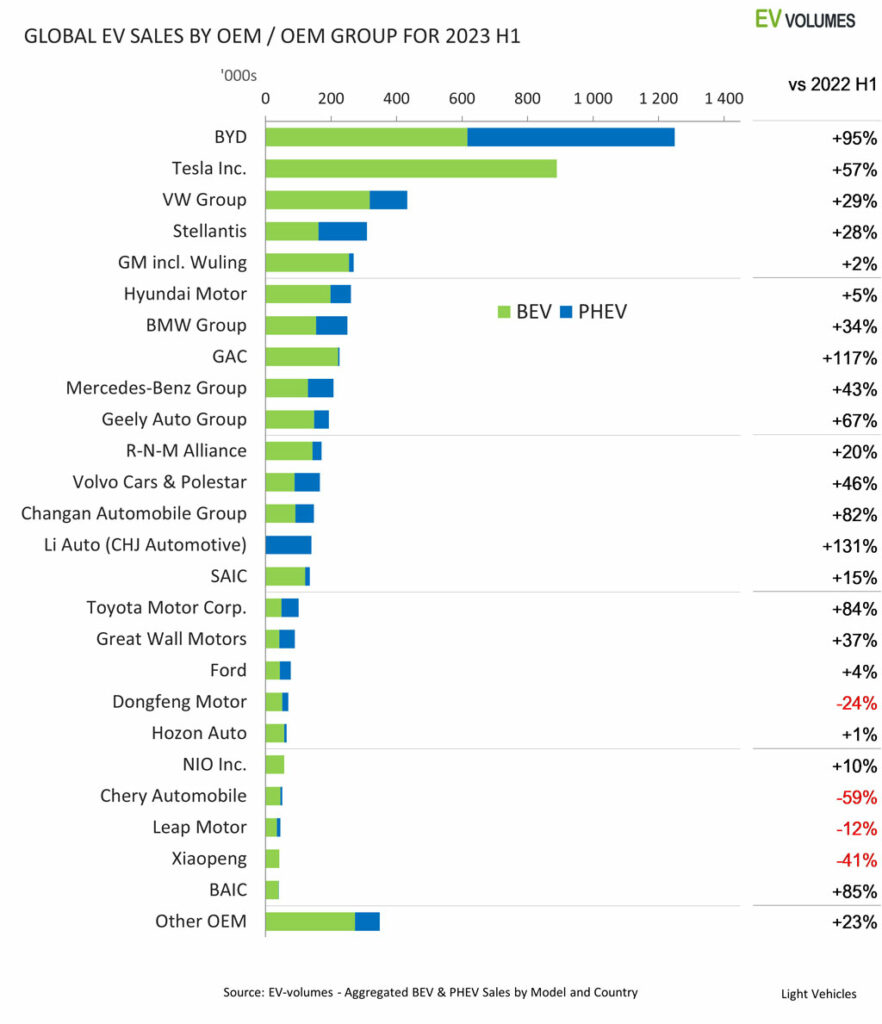

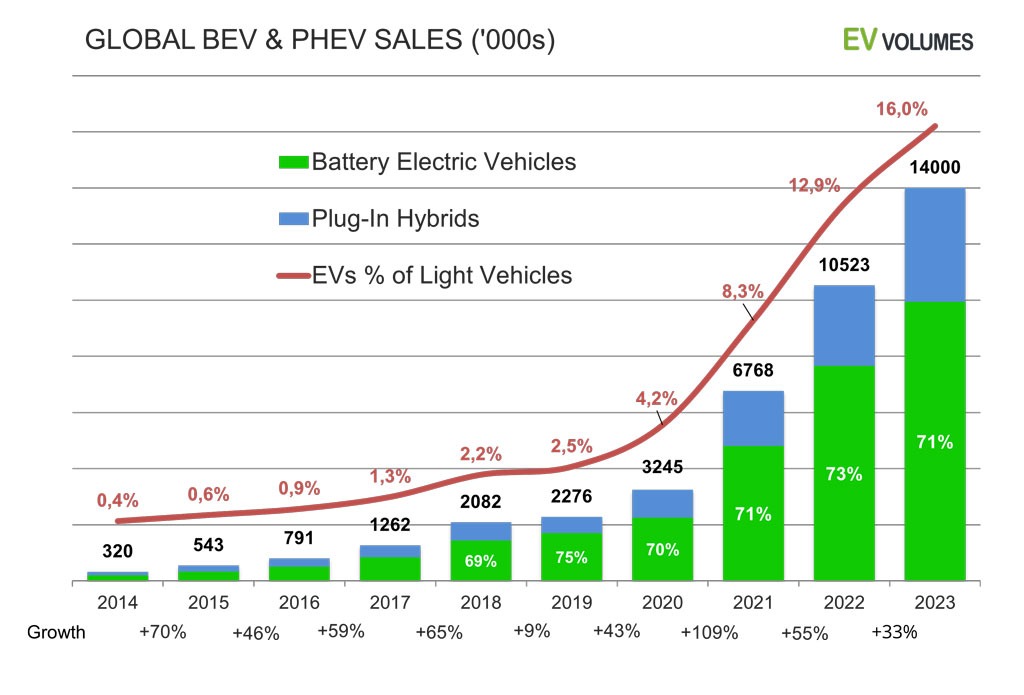

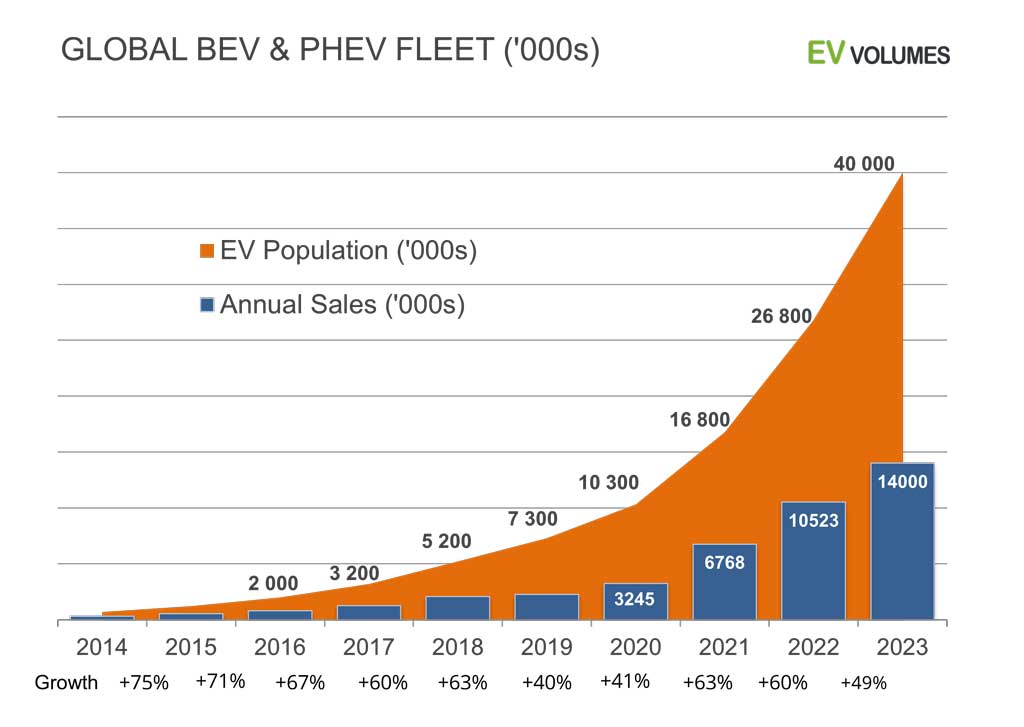

BYD nearly doubled H1 sales to 1,25 millionb units, making it #1 in the global EV sales ranking, with their 633 000 PHEV sales included. Counting BEVs only, Tesla still leads by a wide margin with 889 000 units delivered in H1.For the full year of 2023, we expect sales of 14 million EVs, growth of +33 % over 2022, with BEVs reaching 10 million units and PHEVs 4 million units. By the end of 2023 we expect 40 million EVs in operation, counting light vehicles, 70 % of which are BEVs and 30 % PHEVs. Sales of Fuel Cell Vehicles (FCEV) in the light vehicle sector have declined by -25 % so far this year and remain below 20 000 units annually. Current sales are from five vehicle models and most sales are in South Korea and USA. We estimate their current population to be about 60 000 units.

EVs gain further share in a broad auto market recovery

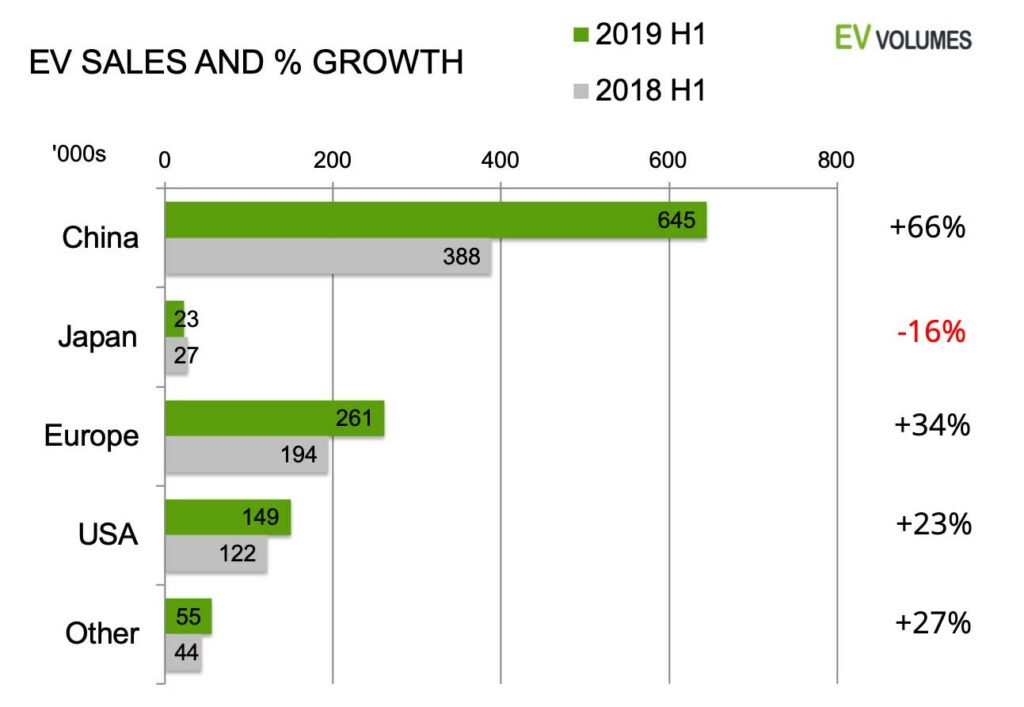

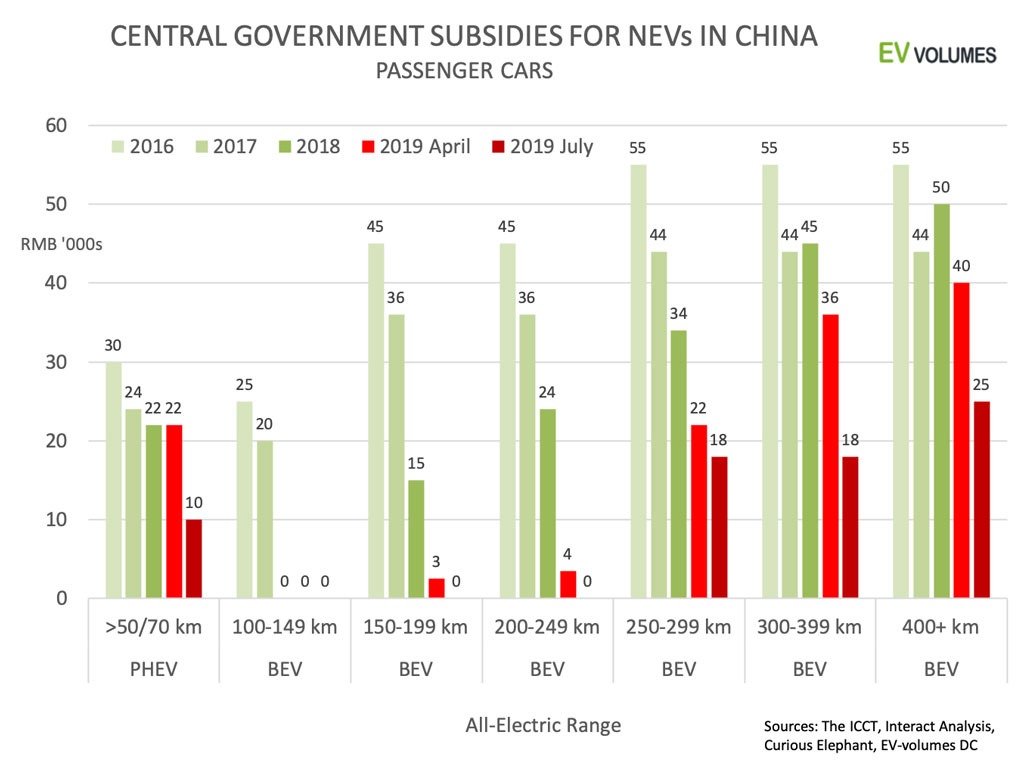

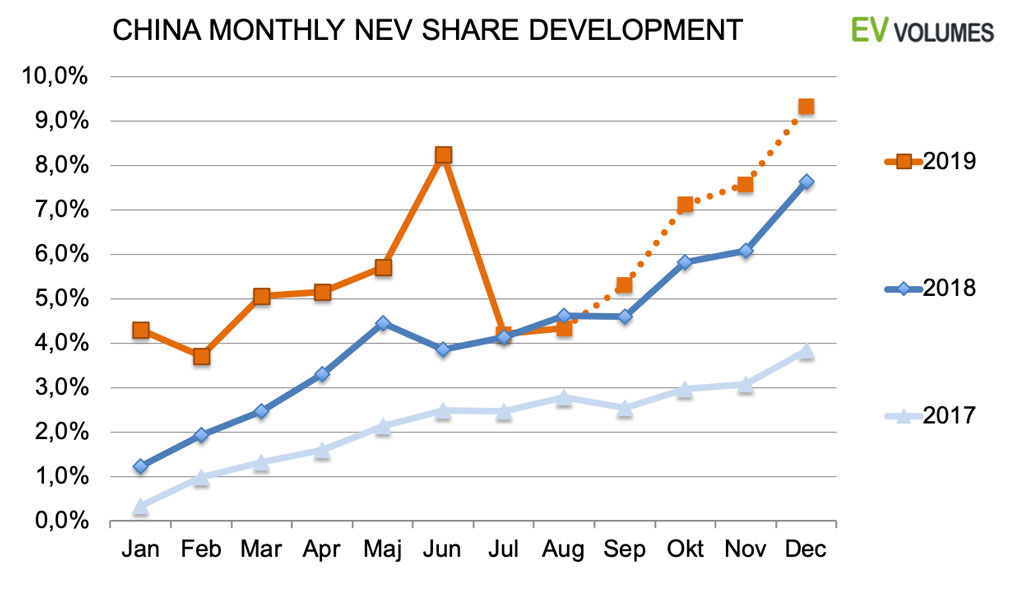

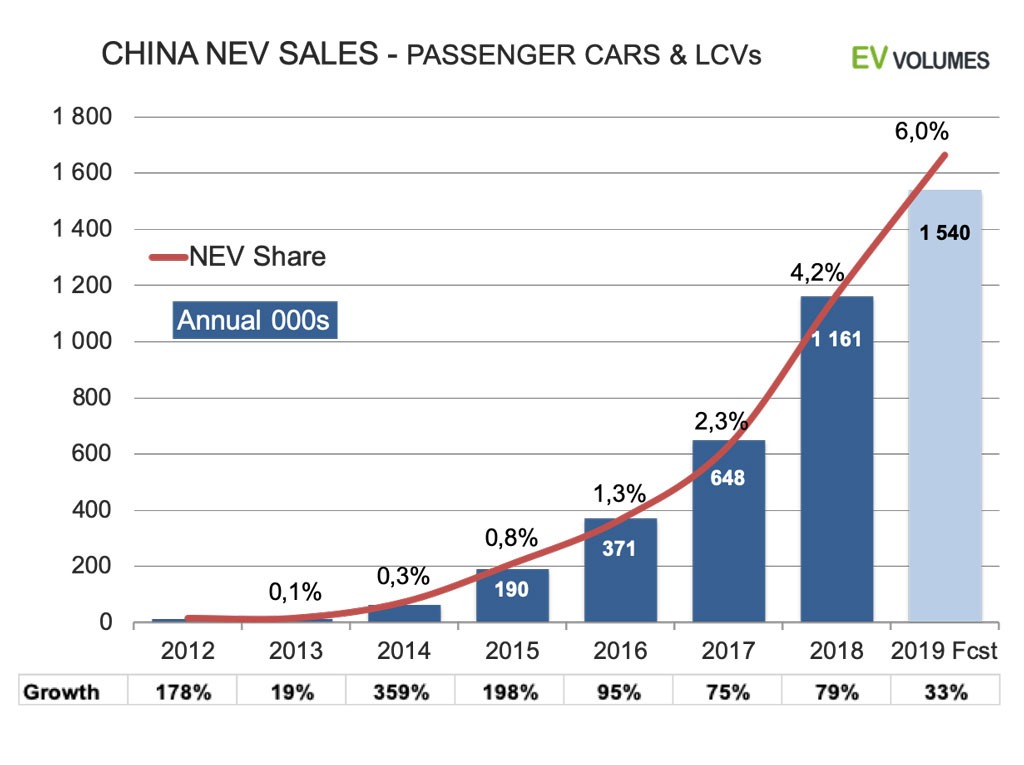

Global sales of BEVs and PHEVs have grown by 40 % in H1, supported by a broad recovery of total auto sales, posting a 11 % increase, so far. The 2023 numbers compare to depressed sales during 2022 H1. Meanwhile, the buyers market has returned. Component supply constraints have eased, vehicle inventories are replenished and vehicle prices are coming down, despite high inflation in other sectors. H1 delivery volumes were further supported by pent-up demand and by fulfilling accrued orders. We expect lower y/y volume increases for the remainder of the year. Europe’s EV demand is of CO2 mandates and receives less support from OEMs and by direct subsidies, which were slashed in several countries. Circulation tax incentives are mostly intact, however. The 28 % y/y EV growth is helped by a 17 % increase in overall vehicle sales. China NEVs sales have lost their central subsidy, while the 10 % purchase tax exemption stays until further notice. Regional price wars among EVs and ICEs alike have boosted sales numbers in Q2, more than compensating for the losses in Q1. NEV sales (+37 % y/y) grew 7 times faster than total light vehicle sales (+5,2 % y/y) during H1 and reached a market share of 33 % in June. EV sales in USA and Canada combined were +50 % higher than last year, in a +12 % larger light vehicle market. USA alone had +54 % growth in H1, Canada +16 %. Considering that the 2022 vs 2021 EV sales growth was as high as +50 % in the US, the real impact of the 2023 Inflation Reduction Act (IRA) is yet to be seen. The non-triad markets combined had the highest % gains in EV adoption (+102 %), most of them from a low base. The largest market in this group is South Korea with 82 400 BEV+PHEV sales YTD June and an EV share of 11 %. Next is Japan with 73 700 EV sales YTD, +112 % EV growth and 3,1 % EV share. The EV share in all non-triad countries combined is only 2,8 % in 2023 but growing fast now.

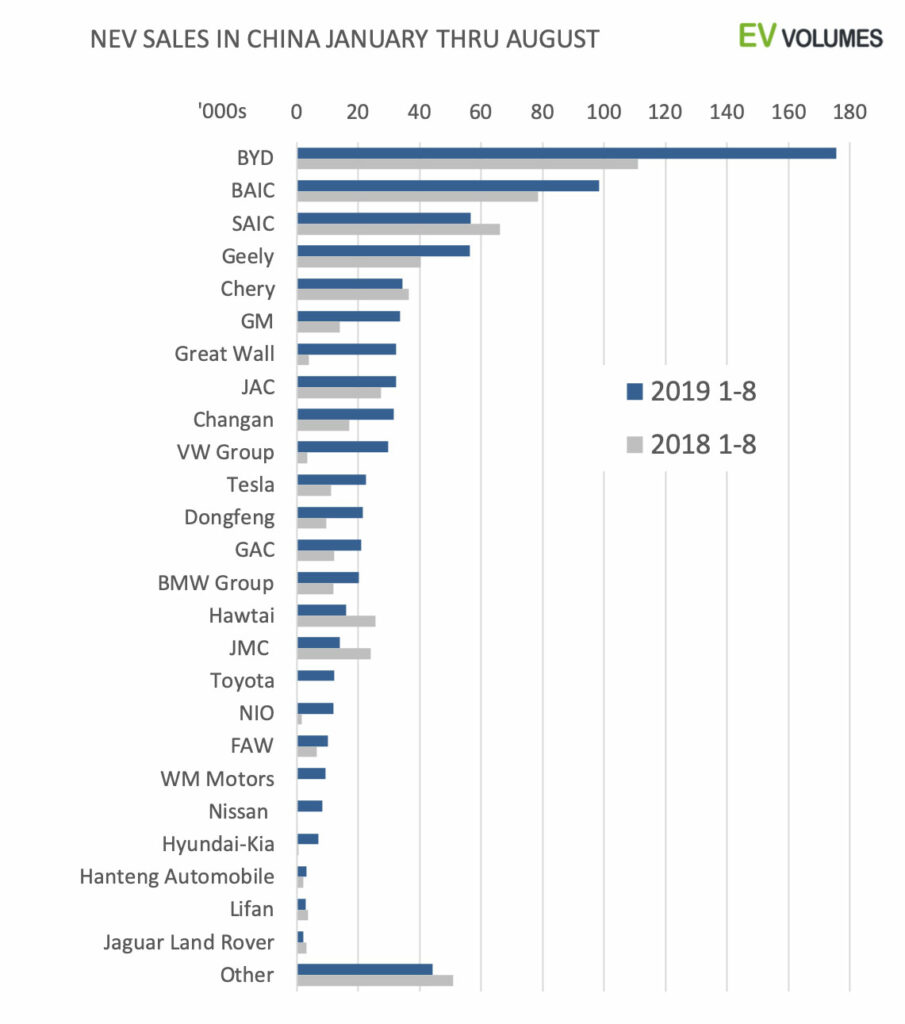

Consolidation in China

At the top, BYD sold nearly twice as many BEVs + PHEVs compared to 2022 H1. BYD is the largest maker of PHEVs and the second largest maker of BEVs. The company currently sells 17 BEV models and 8 PHEV models. Tesla leads global sales of BEVs by a large margin, with a share of 20,8 % in all BEVs sold worldwide. With a H1 growth of +57 %, Tesla gained EV sector share again, as did BYD. Some EV OEMs prioritize volume and market share growth, like BYD, Tesla, GAC (Aion) and Li Auto. Or they protect the tight margins they may have on EVs, like VW, Stellantis, Hyundai, BMW, NIO and Volvo. Insufficient battery supply hold back Ford and GM. Many others face dire straits, neither growing volumes, nor breaking even, with no profitable ICE sales to back them up. The H1 results for volumes and growth indicate distress for several Chinese OEM in the top-25 ranking. The “Other OEM” portion contains a further 25 companies with decreasing and unsustainably low sales volumes. 11 % of China’s NEV production, 428 000 units Passenger Cars and LCVs, were exported during 2023 H1, mostly BEVs. 2/3rd of these exports were Non-Chinese brands, with Tesla (166k), Volvo-Polestar (49k) and Renault (Dacia, 27k) leading. Chinese brands stood for 149 000 NEV exports during the first half of this year, nearly 3 times the volume of 2022 H1. The strongest exporters are SAIC (MG, Maxus, 80k), BYD (42k) and Geely, if 18k Lynk & Co are included.

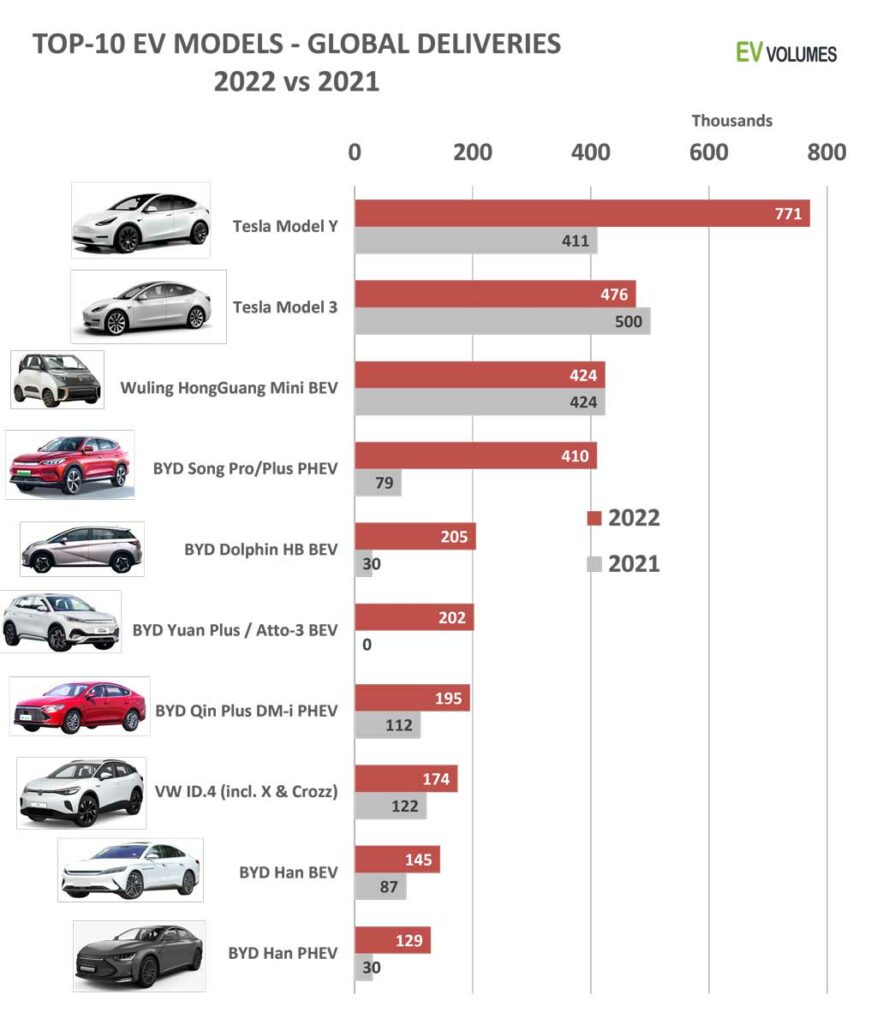

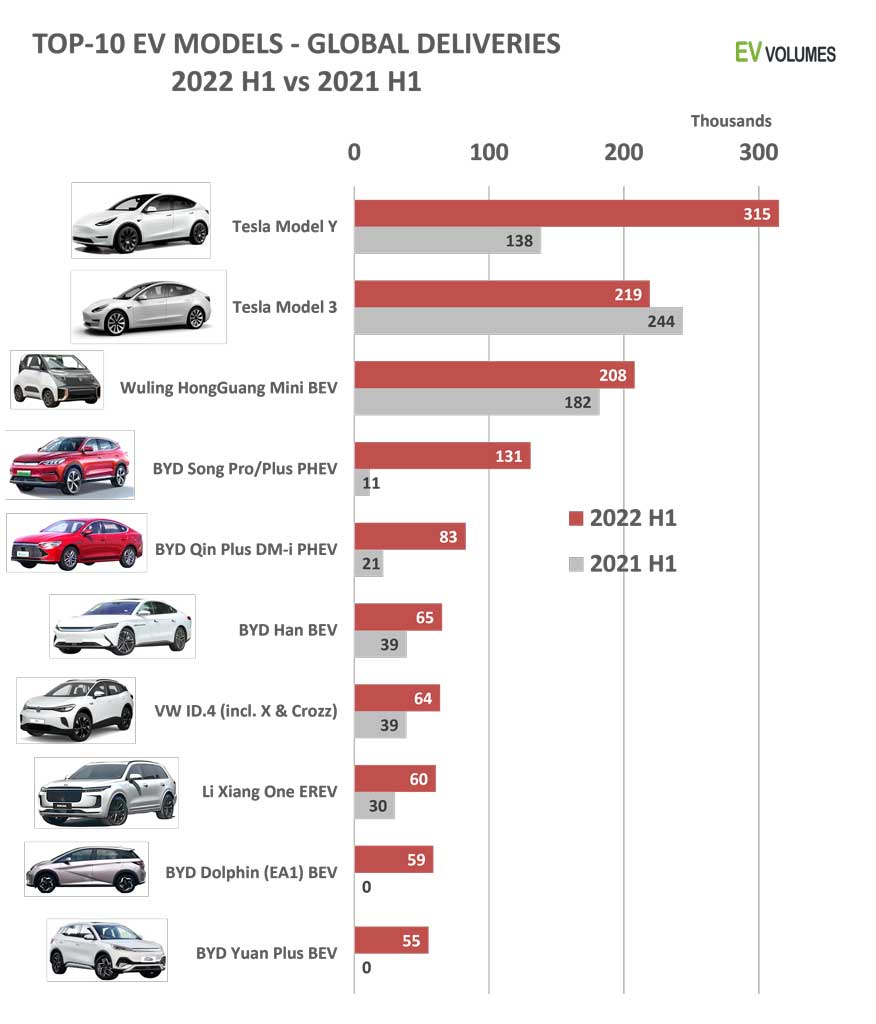

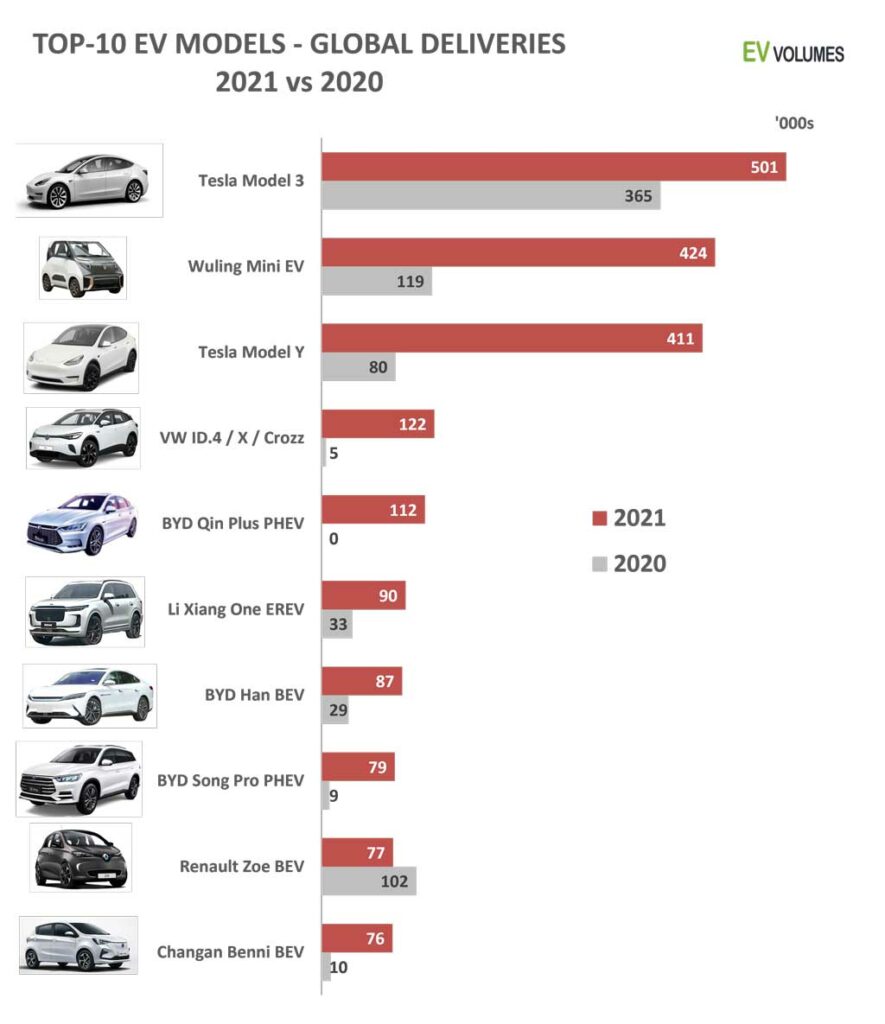

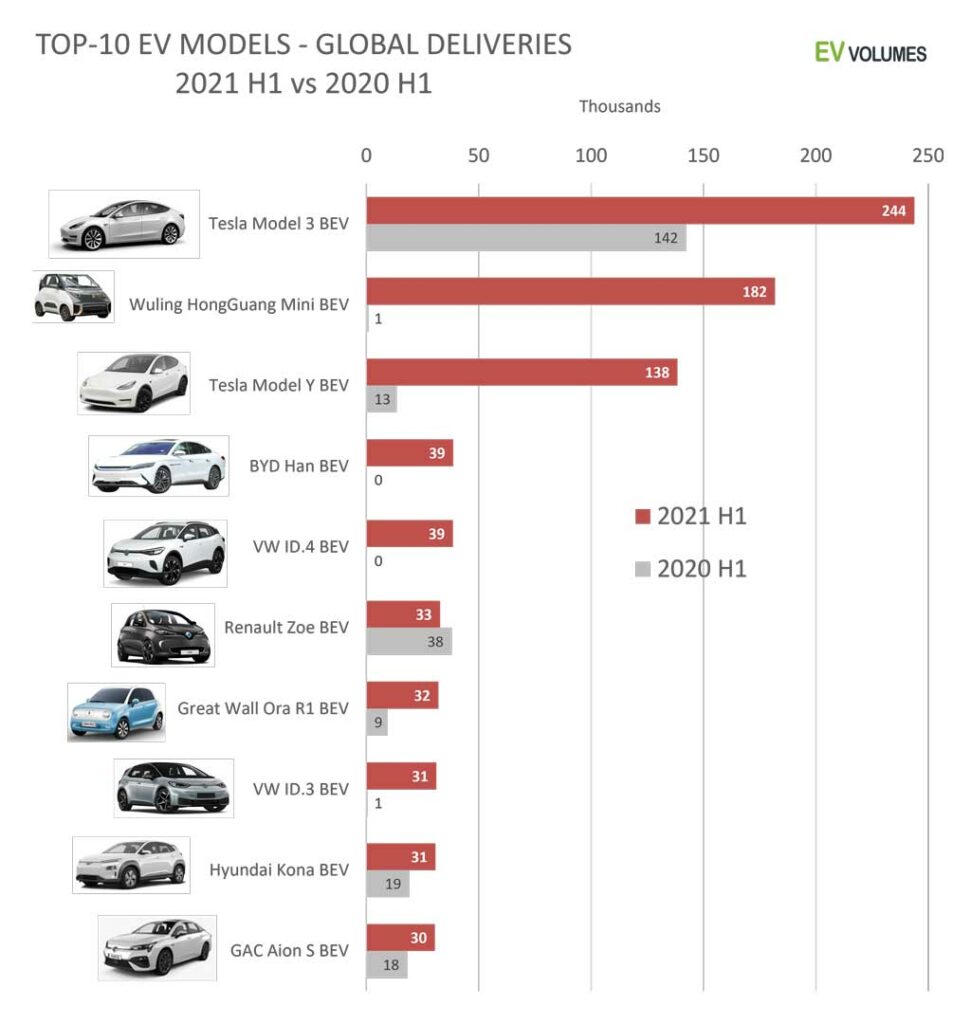

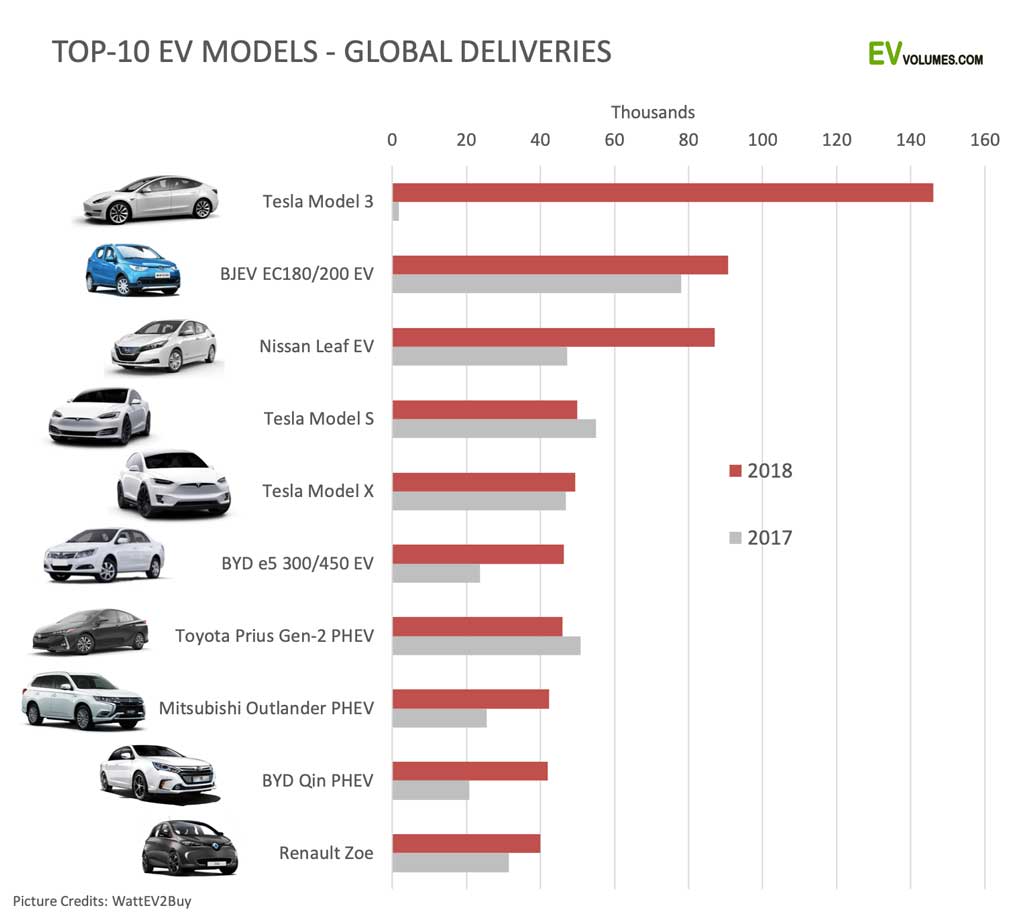

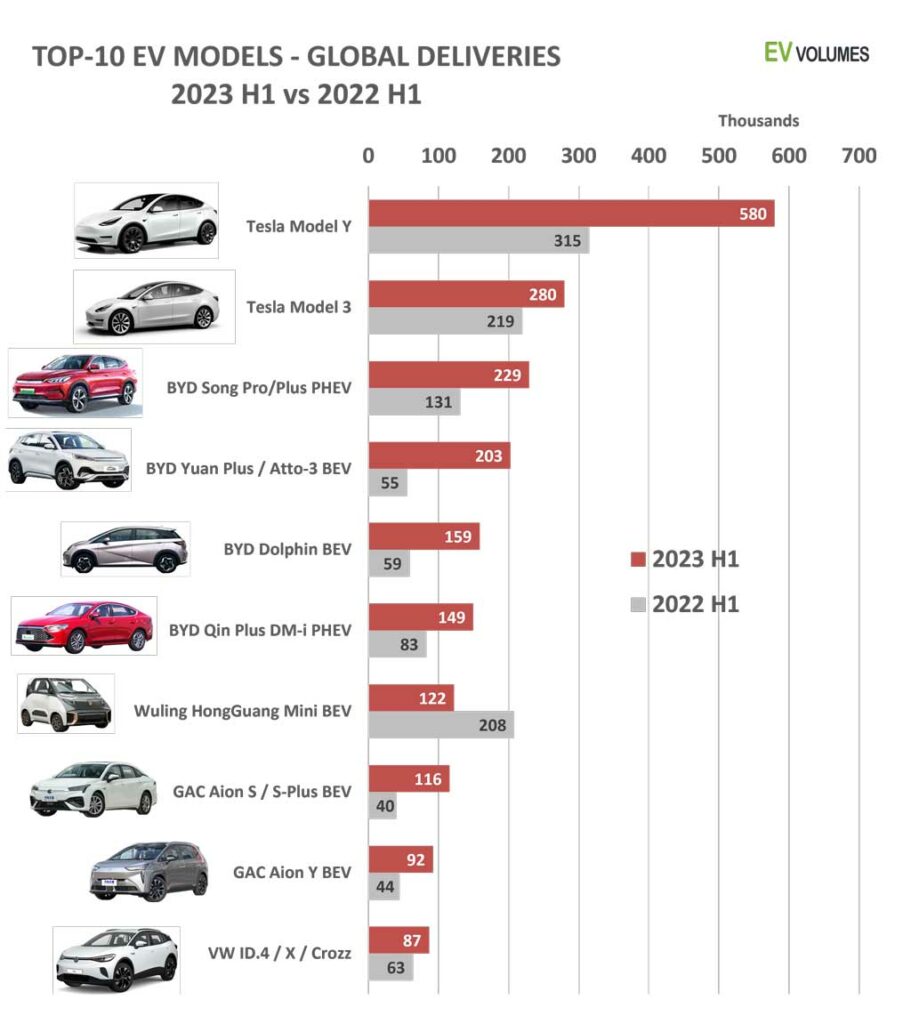

Tesla and Chinese brands dominate the Top-10

The Tesla Model-Y leads the global EV sales ranking by a significant margin. It is now also the world’s best selling vehicle of all categories, including ICEs. The Model-Y is produced in USA (Fremont, CA and Austin, TX) in China (Shanghai) and in Berlin (Germany). The Model-3 recovered from the initial cannibalism by the Model-Y in 2022 and starts growing again. In the sedan category, only Toyota’s Camry and Corolla had higher sales in H1, at significantly lower retail prices than for the Model-3. BYD has four models in the top-10, two mid-size PHEVs and two compact BEVs, introduced in 2022. The Yuan Plus is BYDs leading export model, with 37 100 units sold outside China. The compact cross-over is known as the Atto-3 in most export markets. GM-Wuling’s Mini EV sales saw a significant decline, as the A00 segment stagnates and new players have entered it. GAC (Guangzhou Automobile, state owned) has entered the top-10 with two models of it’s Aion brand. The Aion-S is a mid-size BEV sedan, the Aion-Y is a compact BEV cross-over. The VW ID.4 is the best selling model from a European brand. Sales include the ID.4 X and ID.4 Crozz made by VW’s joint ventures with SAIC and FAW in China.

Outlook for 2023

We expect global sales of 14 million BEV and PHEV for the full year of 2023. The EV market share reaches 16 % in a total light vehicle market of 87,5 million units. EVs grow by 33 % in a total market up 7,5 %. In China, our forecast is 8,1 million NEVs (BEVs & PHEVs) for a share of 34,7 % in Light vehicle sales. The current sales trend would suggest an even higher number but we remain cautious about the China economy. Recent news and data are not suggesting a broad post-covid recovery, rather the opposite. For Northern America (USA & Canada) we expect 1,7 million units and 55 % growth over 2022. The EV incentives from the Inflation Reduction Act (IRA) should boost sales further but domestic OEM (except Tesla) are slow to seize the market opportunities, plagued by inhouse battery supply shortages and/or highly unprofitable EV sales. Imports do not receive the IRA grants. Europe’s EV adoption is ahead of CO2 mandates and there is little inducement for legacy OEMs to push EV sales with small or negative margins. Direct EV incentives are being reduced but tax savings still are intact in most countries. We expect 19 % EV growth to 3,2 million units sales and a market share of 22,5 %. The main growth drivers so far are Tesla, Chinese imports, Volvo-Polestar the VW brand and the strong recovery of total vehicle sales in H1. We expect the effect of the latter to wane in H2. Many of the Non-Triad countries have entered a high growth trajectory, supported by EV exports from China, mostly by Tesla. EV sales in Indonesia, Thailand, Turkey, Australia and Brazil, all large vehicle markets, have grown by +200 % and more in H1-2023, starting from very low levels. Inhibitors for catching up with the Triad regions are high import duties and the absence of a domestic EV industry.

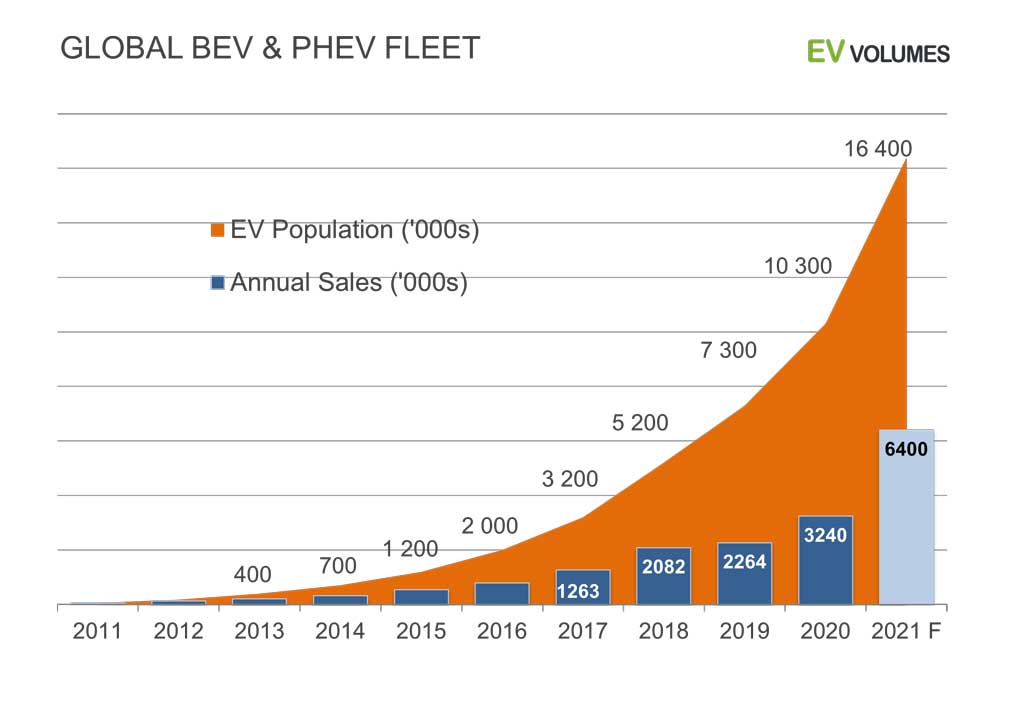

40 Million EVs On The Road at 2023 Year End

Adding this year’s 14 million BEVs and PHEVs to the existing stock gets the number of EVs in operation to nearly 40 million, word-wide, counting Light Vehicles. With ca 1,3 billion light vehicles in operation, this is still just 3 %. Counting BEVs only it is 2,1 % of the global fleet. The number of vehicle on the road worldwide is increasing by 40 million cars and light trucks every year. This year, 10 million of this increase (25 %) are BEVs. The other 30 million vehicles entering the fleet (75 %) are still burning petrol or Diesel. In a scenario towards 100 % zero-emission in global new vehicle sales in 2045 (as an example for the math), the total number of vehicle in operation reaches 1,8 billion in 2045. By then, 40-45 % of this stock are BEVs, but the sobering truth is also that, with current scrapping rates, the majority of the worlds Light Vehicles still need to burn fuels in 2045. The full transition to BEVs needs to accelerate, because the positive impact on CO2 emissions comes with a considerable delay. Fast EV adoption is a prerequisite for sustainable personal mobility.

Close

Close