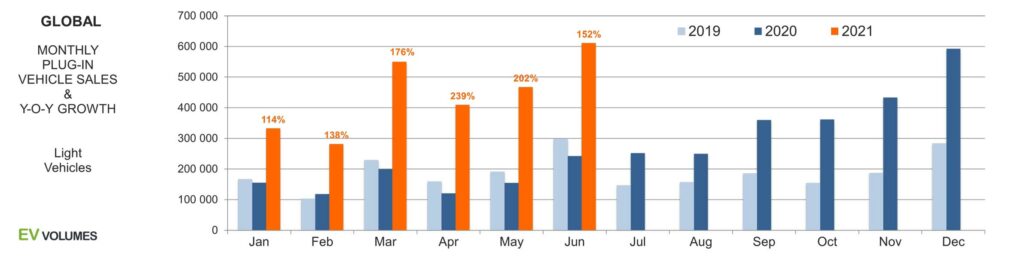

EV sales are back on track. A total of 2,65 million new EVs found new owners during the first half of 2021, an increase of +168 % compared to 2020. The recent increases speak hyper-growth but need to be seen relative to the low base of 2020 H1. During the 1st wave of the pandemic, global sales of EVs stayed -14 % below 2019 H1 volumes as vehicle markets declined by -28 % during 2020 H1. The market recovery shaped up in 2020 H2 with rapid gains in volumes and shares for EV, esp. in Europe, driven by attractive products, extensive green recovery funds and the 95g CO2 mandate.

For 2021, all regions and most countries witness strong increases in EV sales, with growth rates 3 to 8 times higher than for total light vehicle markets. The share of BEV+PHEV in global light vehicle sales increased from 3 % in 2020 H1 to 6,3 % this year. Europe (EU+EFTA+UK) leads with 14 % EV share for the first 6 months combined, up from 7 % a year ago. A caveat is that half of Europe’s EV sales are PHEVs, compared to 80 % pure electric outside Europe. The tailpipe emissions of PHEVs are completely depending on the charging and driving habits of their users, whatever the catalog value says. To their benefit it can be said that countries with high PHEV market shares usually have high BEV market shares as well.

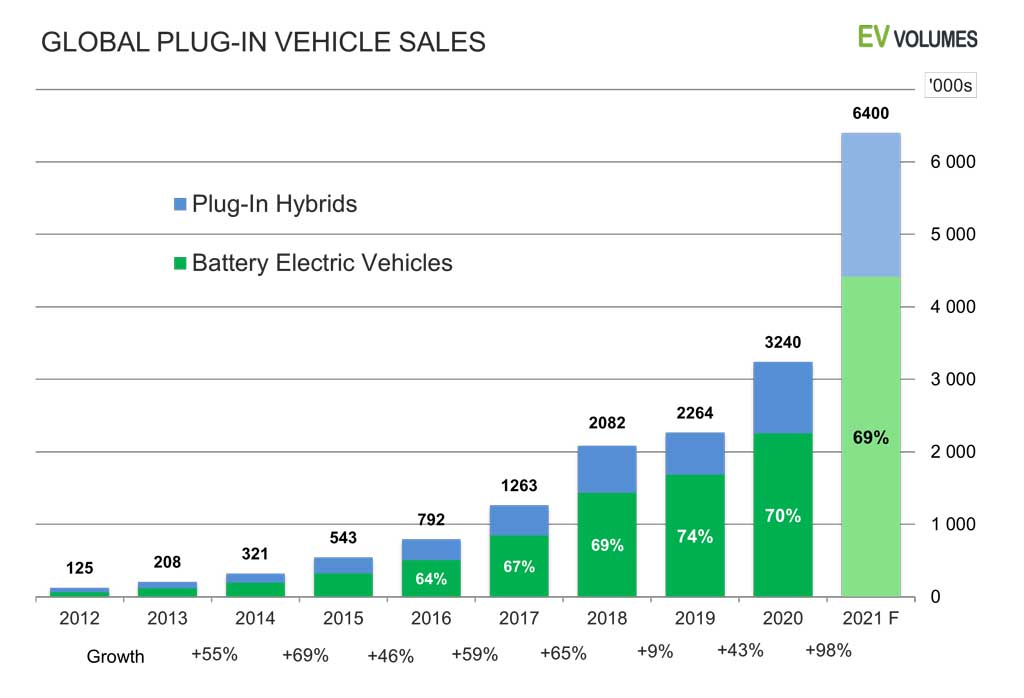

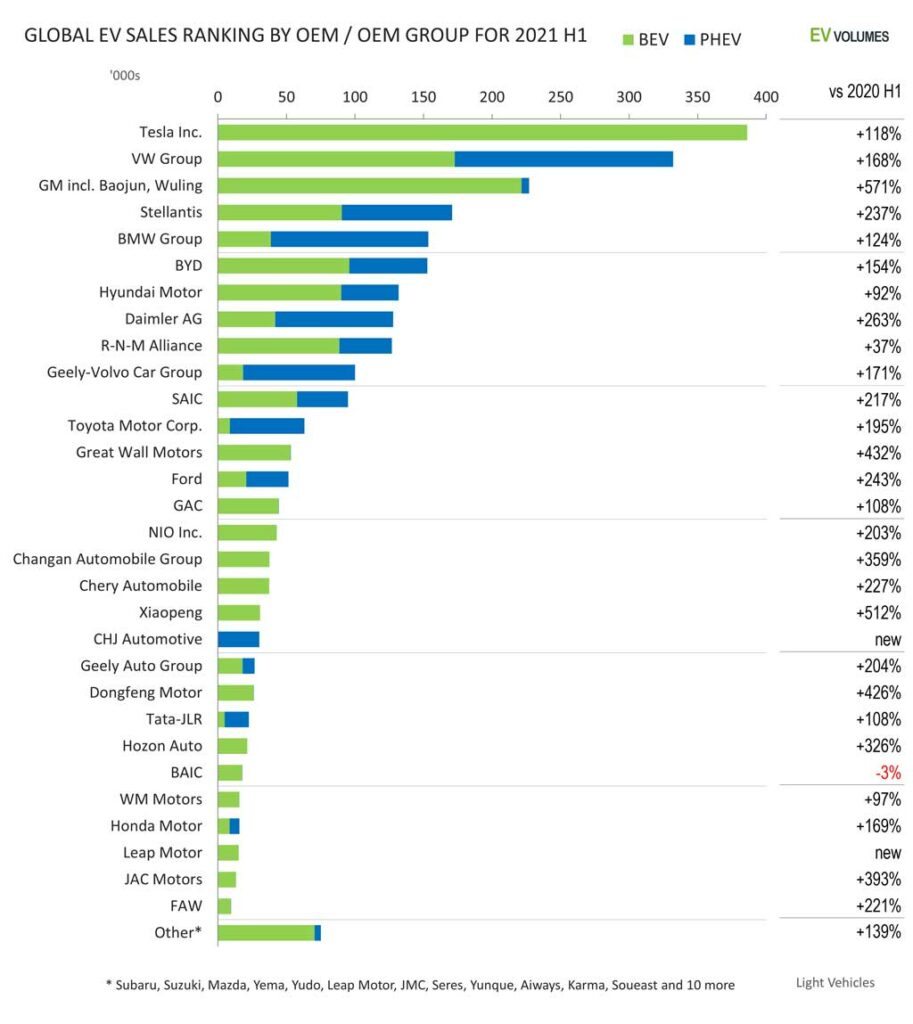

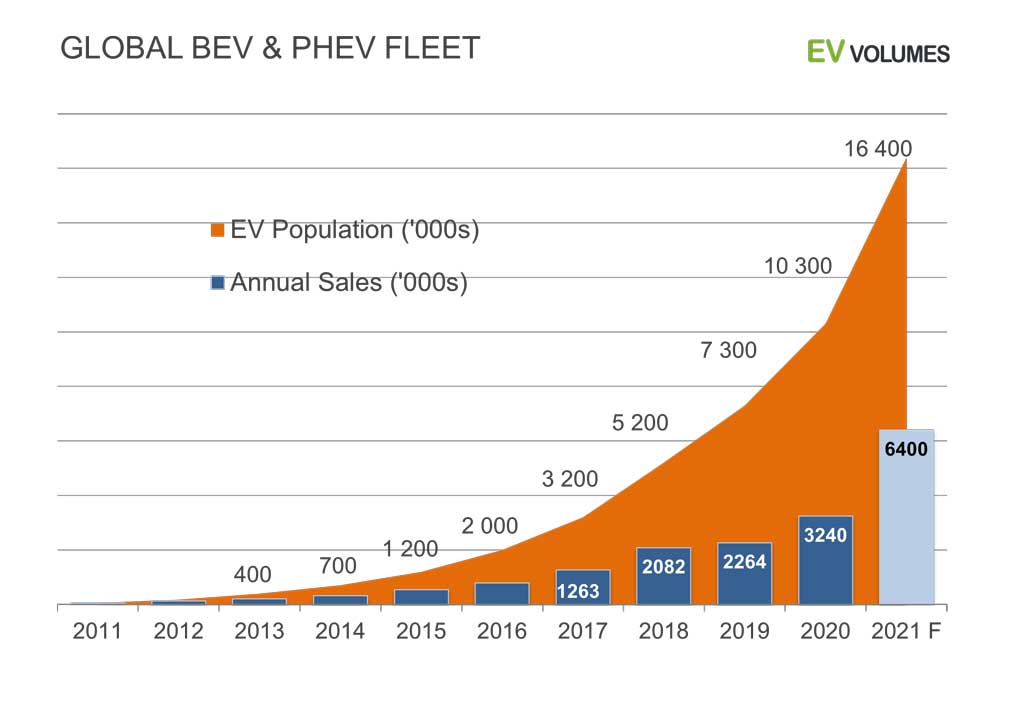

Tesla leads global EV sales with 386 000 units (all BEV) delivered during H1, followed by the Volkswagen Group with 332 000 units, thereof 172 700 BEVs and 159 400 PHEVs. GM comes in 3rd with 227 000 units (221k were BEV), including over 180k of Mini-EVs from their SGMW joint venture in China. Growth was robust in all product segments except for sportscars. In the product segment mix, the trend is from sedans and compacts into SUVs. Most striking, though, is the re-bound of mini-EVs in China, now at ultra-affordable prices of 30-60 000 RMB. Read Wuling Hongguang Mini EV, Great Wall Ora R1, Chery eQ, SAIC Roewe Clever, Baojun and others. Around 300 000 units of them were sold during H1, a quarter of all NEV sales in China. They offer a long due improvement over countless, dodgy Low-Speed Vehicles from the earlier days, which are now banned by regulators. The new breed is exempted from some M1 vehicle requirements, often receives no subsidies but is, nevertheless, counted in the Chinese NEV tally. Including these, we expect sales of 6,4 million EVs in 2021, a growth of 98 % over 2020, with BEVs reaching 4 million units and PHEVs 2,4 million units. Growth rates will come down from the +168 % seen in H1, as volumes compare to a higher base during the 2020 H2 recovery. By the end of 2021 we expect over 16 million EVs in operation, counting light vehicles, 2/3 BEVs and 1/3 PHEV.

Rapid growth in all regions

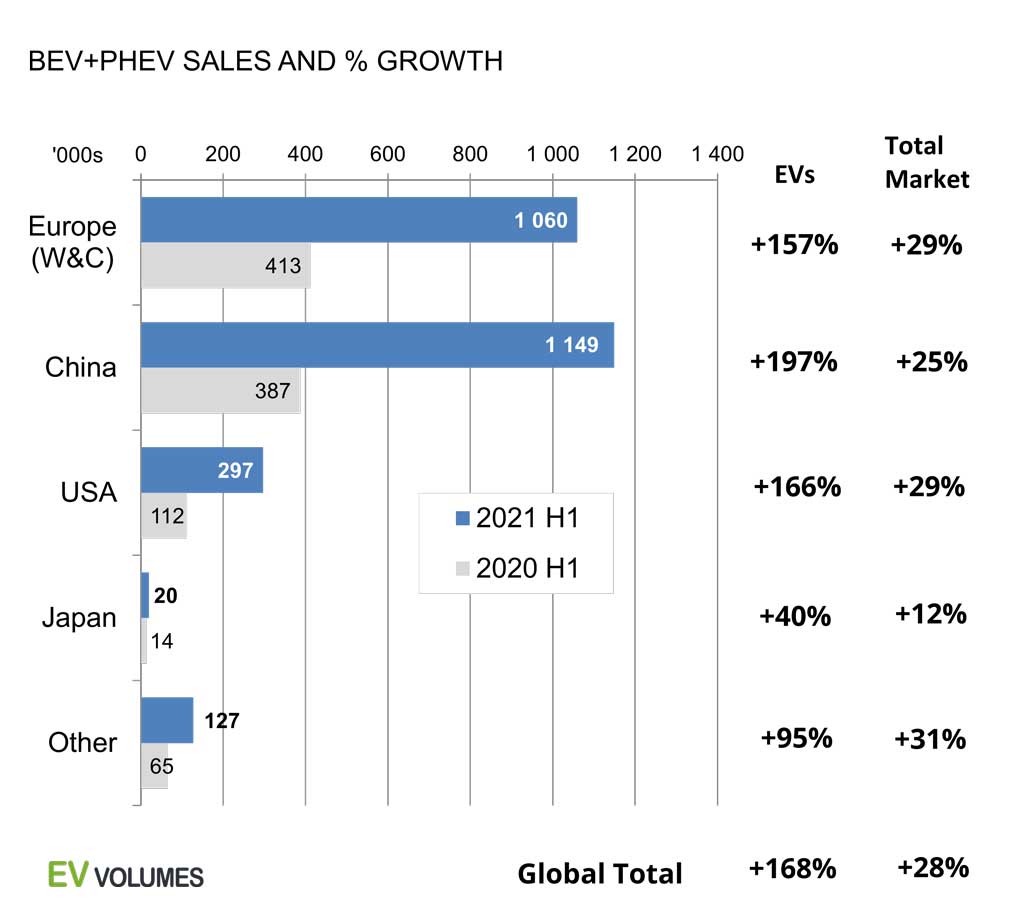

Global light vehicle markets have partly recovered from the -28 % slump in 2020 H1 and increased by +28 % combined (which is still 8 % lower compared to 2019 H1). The recovery is uneven, though. Western Europe auto sales, which were hit hardest during the pandemic (-40 % y/y in H1-2020), rebounded by +29 % this year but are still 20 % below the 2015-2019 average.

EV sales held up better during the crisis, lost only -14 % during 2020 H1 and for this year their growth rates are 3 to 8 times higher than for the underlying vehicle markets.

Because of the low-base-effect, growth rates were extraordinary during the first 6 months of 2021, reaching 157 % in Europe, 197 % in China, 166 % in USA and 95 % in the remaining markets. The recent uptake is impressive and it is broad based: Except for Japan, all major markets posted new records in EV sales and share during the first half of the year.

New all-time-highs will be common also during the 2nd half, but growth rates will be significantly lower as the low-base-effect diminishes.

EV sales trending towards 6,4 million for 2021

Global EV sales for 2019 and 2020 stayed below trend. In 2019 when “regulatory storms” in Europe and China reduced demand and supply of popular offers. In Europe, the WLTP introduction forced many high-selling PHEV models into the shop for e-range upgrades. In China, regulators cracked down on products with substandard safety and range. Dozens of models had their sales halted and several combatants went out of business. In 2020, the first wave of Covid-19 caused and unprecedented slump in car sales but also increasing support by policy makers. In both years, EV sales would have been higher, in a business as usual situation.

2021 is far from business as usual, but EV sales are back on track. January to June deliveries have increased by 1,66 million units compared to 2020, in a global light vehicle market that gained 9,17 million units. We expect a similar volume gain for EVs in H2.

6,4 million in 2021 and 98 % growth y/y seems a lot, yet the trend in volumes/shares of the last 12 months, more choice of better, affordable products, solid policy support and higher public awareness all underpin this forecast. The YTD SAAR would support an even higher number. The downside is in component shortage and events in China relating to sudden changes in regulation or business conditions.

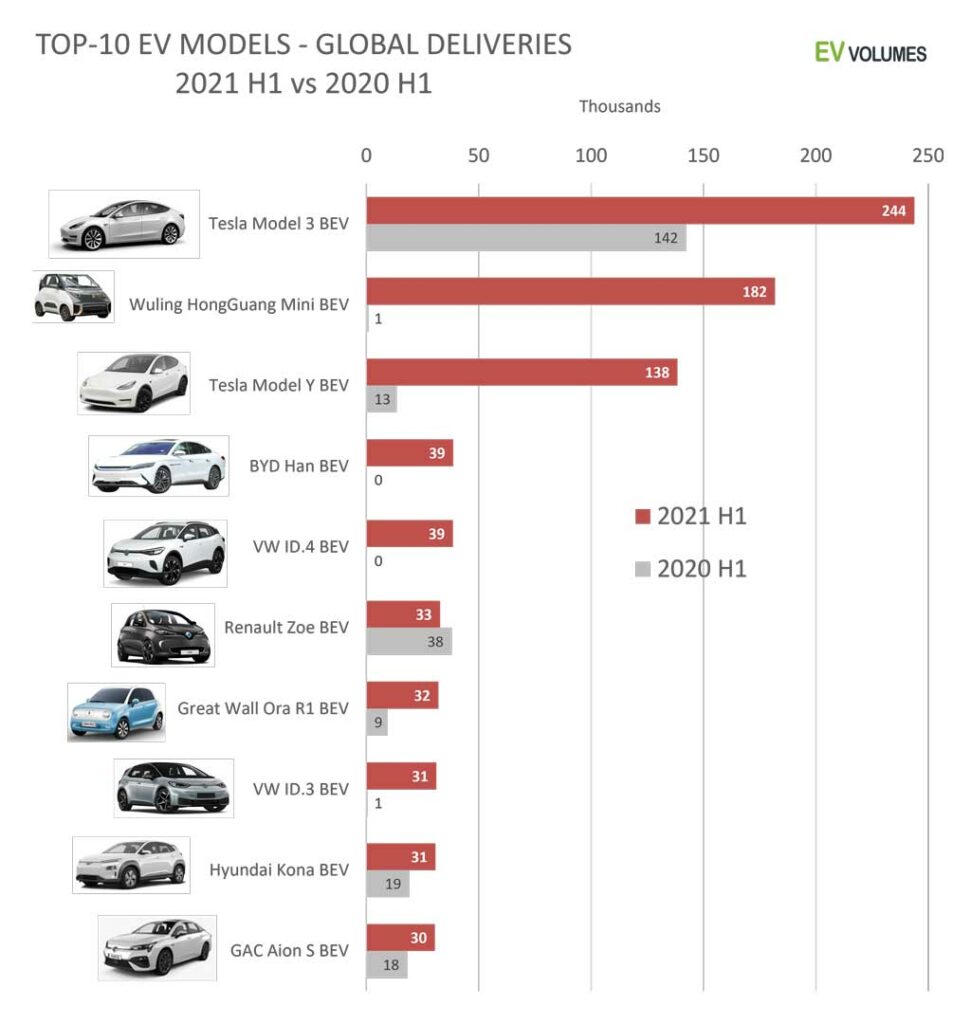

The Top-10 best selling EVs are all BEVs now

For the first time, this picture shows only BEVs in the global top-10. The first PHEV ranks #16, the Volvo XC40. On #11 you would find the Li Xiang One which is, technically, a Range Extender EV like the Chevy Volt and the BMW i3 Rex. With H1 sales of 30 000 units in China only, it is poised to become the best selling large SUV in 2021, counting plug-ins. Probably a hint where PHEVs need to go for staying future-proof.

Tesla maintained the first spot with the Model-3 adding another 102k over 2020 H1, with increases in all sales regions. The Model-Y is fully available in USA/Cda, had the China ramp-up in Q1 and is not available in Europe yet. The full year potential is higher than 138k indicate.

The Mini-EV by GM-Wuling was mentioned earlier. The BYD Han is available since late 2019 and pioneered an new type of large capacity LFP battery, called “Blade Battery”. There is a PHEV version selling ca 1/3rd of the Han BEV volume.

The VW ID.4 is still being ramped up. June sales were 12 300 units globally, indicating higher potential. The 38k include the China made ID.4 Cross (FAW) and ID.4 X (SAIC). High-volume deliveries of the ID.3 started in September 2020. After a swift roll-out in Europe and 57k registrations in 2020 (28k in December alone), sales in 2021 have continued at a more leisurely pace.

Renault Zoe sales had to give way to the onslaught of six new B-Segment entries from three Stellantis brands, which were all in ramp-up during 2020 H1 and have full sales now. Great Walls Ora brand charms China’s youth with retro inspired minis since 2019. The R1 is their most popular model aka “Black Cat” in China.

Tesla leads, VW Group catching up – including PHEVs

Consistent, steep increases of EV sales in all regions enabled nearly all OEM to grow their sales over 2020 H1. Global EV deliveries increased by 168 % y/y in total; OEMs with higher growth have increase their share in the EV sector.

Tesla has more than doubled deliveries compared to last year and stays on top. More sales of Model-3, the Model-Y intro and higher production/sales in China were the main drivers. VW is closing in, esp. by more sales in Europe; their growth in PHEVs was somewhat higher than in BEVs, even with the ID.3 and ID.4 launches.

Despite absence in Europe, GM posted huge gains from their joint ventures for mini EVs with Wuling and SAIC, also sold more Bolt EVs in USA. The few PHEVs are from Buick in China. Stellantis is rapidly expanding their EV portfolio across multiple brands on common architectures, including a large array of new light commercial vehicles, which has not ramped up to full potential, yet. BMW needs more BEVs to grow faster. The i4 and iX are still some months off. The Renault-Nissan-Mitsubishi Alliance lost ground in all regions and most product categories.

BYD, like many other Chinese OEM, are recovering from the slump in 2019 H2 and 2020 H1. For BYD, Geely, BAIC, JAC, FAW, JMC, volumes have returned to the level of 2019 H1, not more. The Chinese start-ups Nio, X-Peng, Hozon, Li Xiang (CHJ), Leap Motor are gaining sector share from low volume bases. SAIC is the EV export leader among China based OEMs. Within their 95k volume for H1, 22k were exported, mostly to Europe. Tesla (25k) and Volvo (26k) exported slightly more from China.

Among Europe OEM, Porsche and Volvo have the highest share of EVs (BEV+PHEV) in their sales; over 30 % for Porsche and 20 % for Volvo. Japanese OEM are growing from low bases and have BEV+PHEV shares of 1 % or less in their sales. This compares to a 6,3 % market average.

16,4 million EVs in operation by the end of 2021

Adding 6,4 million BEVs and PHEVs in this year gets the number of EVs in operation to 16,4 million, counting light vehicles. With ca 1,5 billion light vehicles in operation, this is still just 1,1 %.

The number of vehicle on the road worldwide is increasing by 40 million cars and light trucks every year, the entire current vehicle population of the UK. 85 % of this additional fleet is still using petrol or Diesel this year. In a scenario towards 100 % zero-emission global vehicle sales in 2040 (as an example for the math), the total number of vehicle in operation reaches 2 billion, over 40 % are BEVs, but over 50 % of them still need to burn fuels.

The full transition to BEVs needs to accelerate, because the full impact on CO2 emissions comes with a considerable delay. Restricting the use of fossil fuels for the remaining ICE fleet is not a desirable solution. Fast EV adoption is a prerequisite for personal mobility.

Close

Close