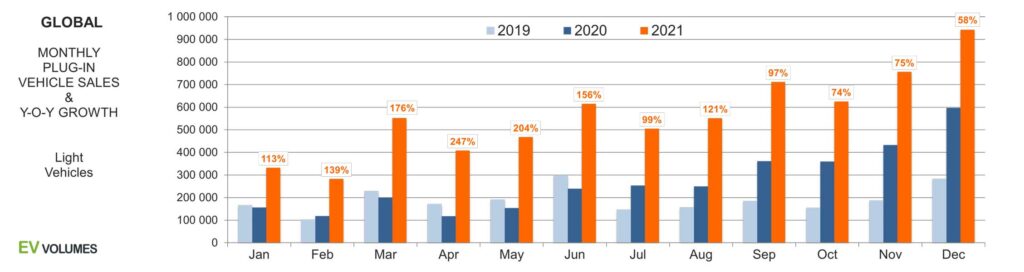

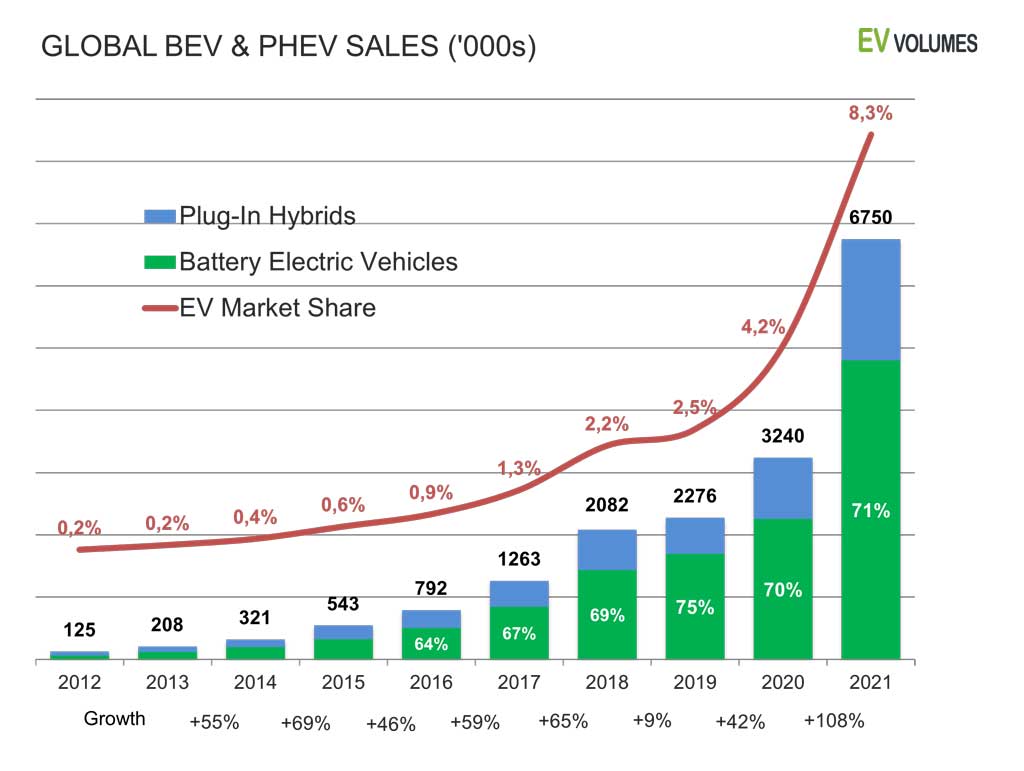

Global EV sales reached 6,75 million units in 2021, 108 % more than in 2020. This volume includes passenger vehicles, light trucks and light commercial vehicles. The global share of EVs (BEV & PHEV) in global light vehicle sales was 8,3 % compared to 4,2 % in 2020. BEVs stood for 71 % of total EV sales, PHEVs for 29 %. The Global auto market improved by only 4,7 % over the crisis year of 2020. As in 2020, EVs again were resilient to set-backs in auto demand and supply.

The remarkable growth rate of 108 % y/y needs to be seen relative to the low base volume of 2020. Caused by regulations and Covid-19, global EV sales of 2019 and 2020 were below the long-term trajectory and in 2021 they returned back to trend. While the y/y growth looks extreme, the 2021 volume is still fair.

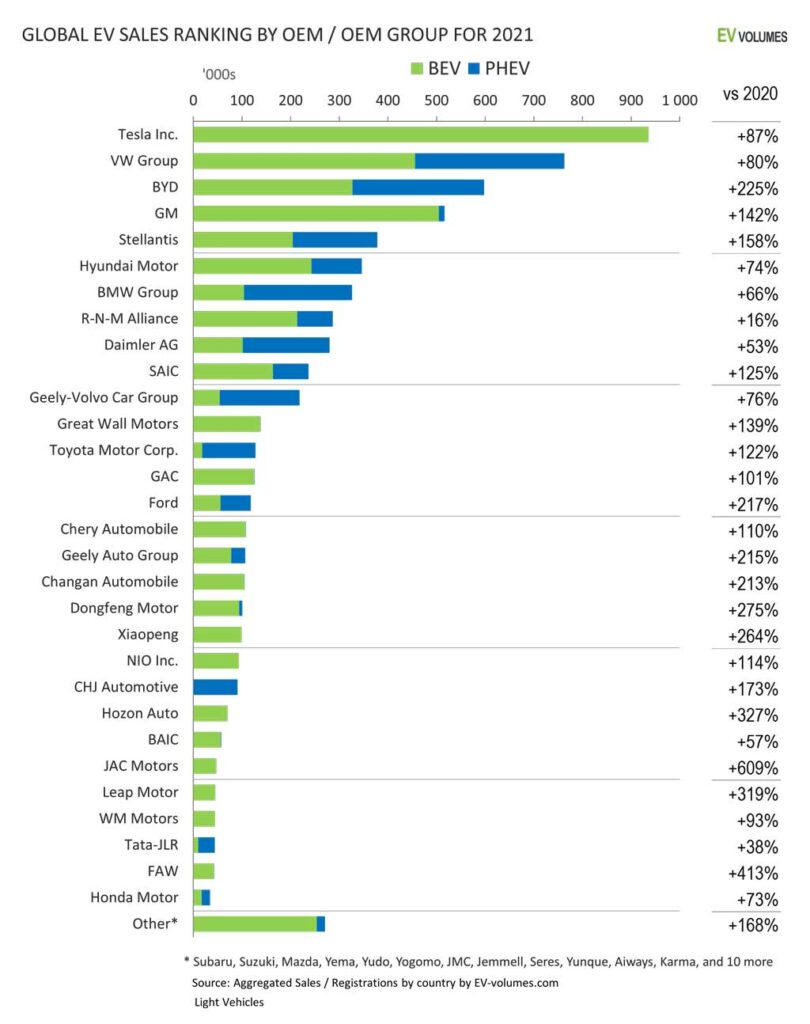

Tesla had its share in it, leading the OEM EV ranking with 936 000 deliveries, 436k more than 2020. The Model-3 reached 501 000 units and became the 2nd most sold midsize nameplate after the Toyota Camry. The Volkswagen Group stayed on rank 2 and BYD climbed 4 positions to #3. BYD delivered nearly 600 000 units (w/o buses), over 400 000 more than in 2020.

Following the headwinds in 2019 and 2020, global EV sales were back on track in 2021. For this year we expect EV sales to return to more normal growth and reach around 9,5 million units, higher if remaining issues in supply and logistics are resolved.

Highest Annual Growth since 2012

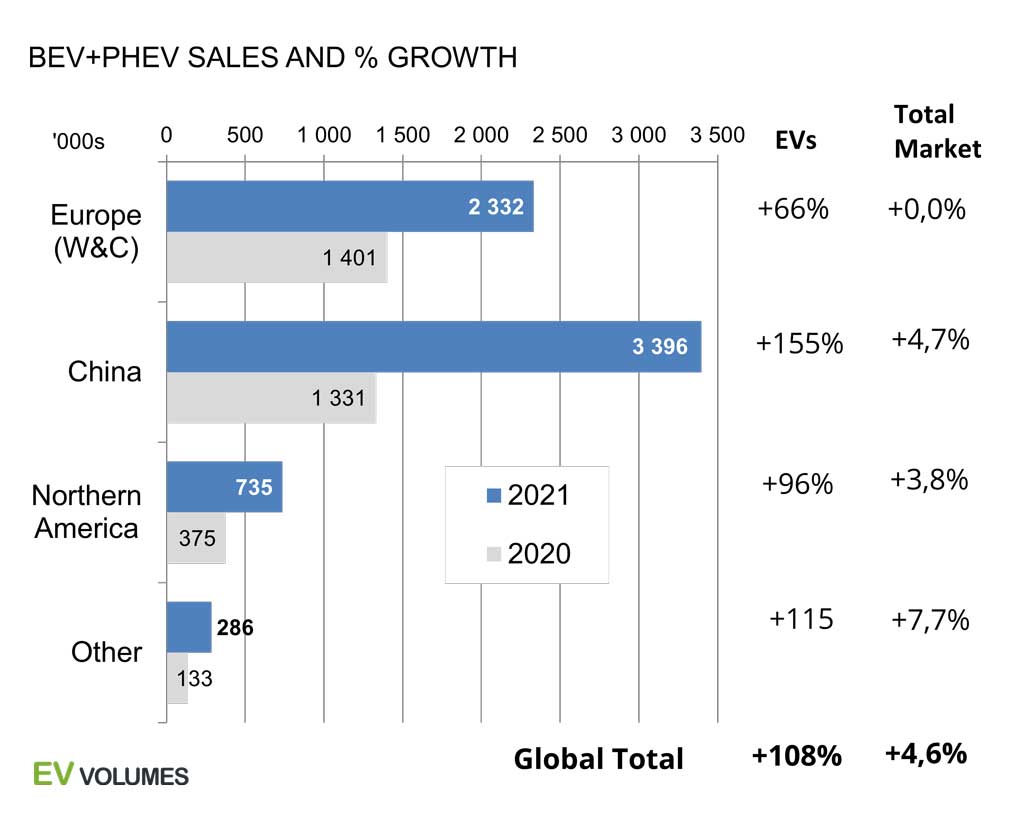

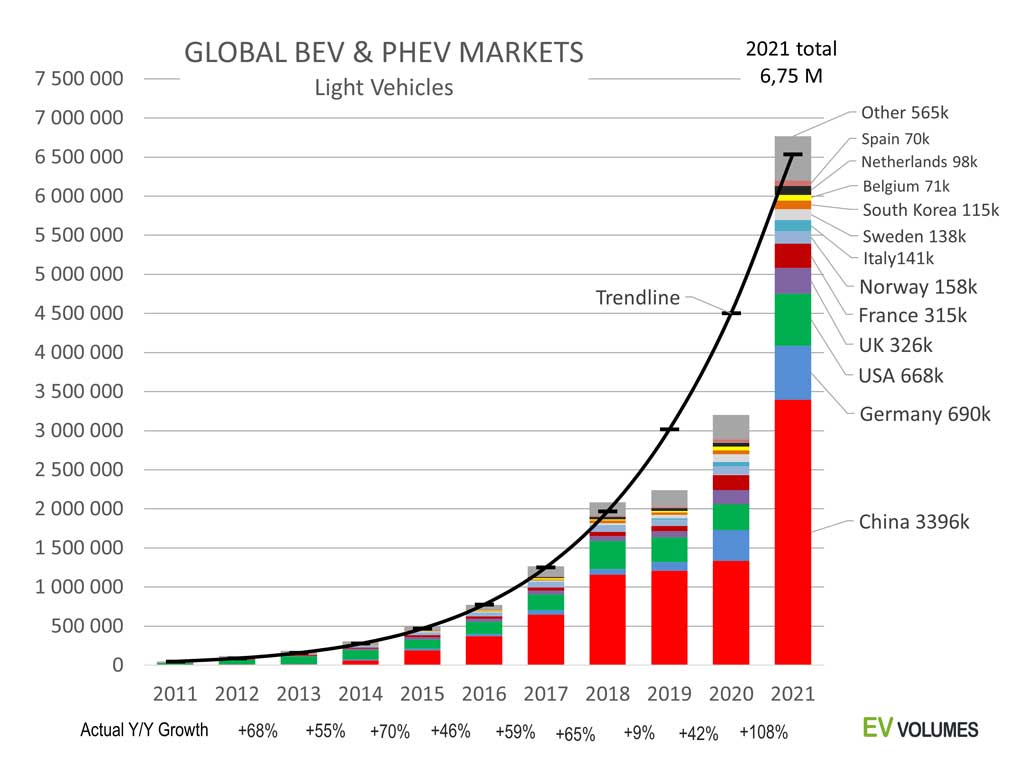

China NEVs sales emerged stronger than ever from the steel bath during 2019 and 2020. Sales jumped by more than 2 million units, more than the combined volume increase of all other regions combined. Growth in Europe stayed lower as it compares to the boom in 2020 H2. Northern America sales benefited from the roll-out of attractive, new offerings by nearly all OEM and from better availability of Tesla Model 3 & Y. Consistent, high growth also among the remaining countries: South Korea increased by 64 200 units to 114 500 EV sales. Israel, Australia, India, Japan contributed with additional sales of more than 10 000 units each. Many smaller EV markets e.g. Brazil, New Zealand, Saudi Arabia, Singapore increased EV sales by over 200 %. Most OEMs have noticeably enhanced their EV offers beyond Europe, China and North America.

Doubling from a Modest Base

With total light vehicle sales recovering by only 4,6 % from the crisis year of 2020, the 108 % growth of EVs means doubling their market share. Variations between the market regions are strong, though: In Europe the EV share increased from 10 % to 17 %, with a 26 % peak in December, in a persistently weak total market. In Northern America EVs had 4,4 % share (2,3 % in 2020), in China their share increased from 5,5 % to 13,3 %. For the remaining 70 markets we are tracking, the combined EV share was 1,5 %. BEVs increased by 1 % in the EV mix with most of the gains occurring in the 2nd half of 2021. Their volume increased to 4,80 million units, PHEVs sold 1,94 million units and FCEVs 15 400 units.

Back on Track

The 108 % growth from 2020 to 2021 looks extreme, but it follows 2 years of restrained increments. Growth from 2018 to 2019 was hampered by the crack-down on the China NEV industry by tougher regulation. In Europe, many high-volume PHEVs were halted for battery upgrades to reach the 50g CO2 WLTP standards. 2020 saw 138 % y/y growth in Europe with the 95g CO2 mandate and a broad increase of EV incentives. EV sales in China and North America stayed flat again, heavily affected by the pandemic. In 2021, the increases normalized in Europe to +66 %, while the other regions made up for 2 years of stagnation. The trendline shows the likely historic development without these events. 2021 sales returned to the historic trendline, with extra momentum from booming sales of mini-EVs (A00 category) in China. They increased by another 500 000 units with strong inflow from the former Low-Speed-Vehicle category.

Made in China Counts

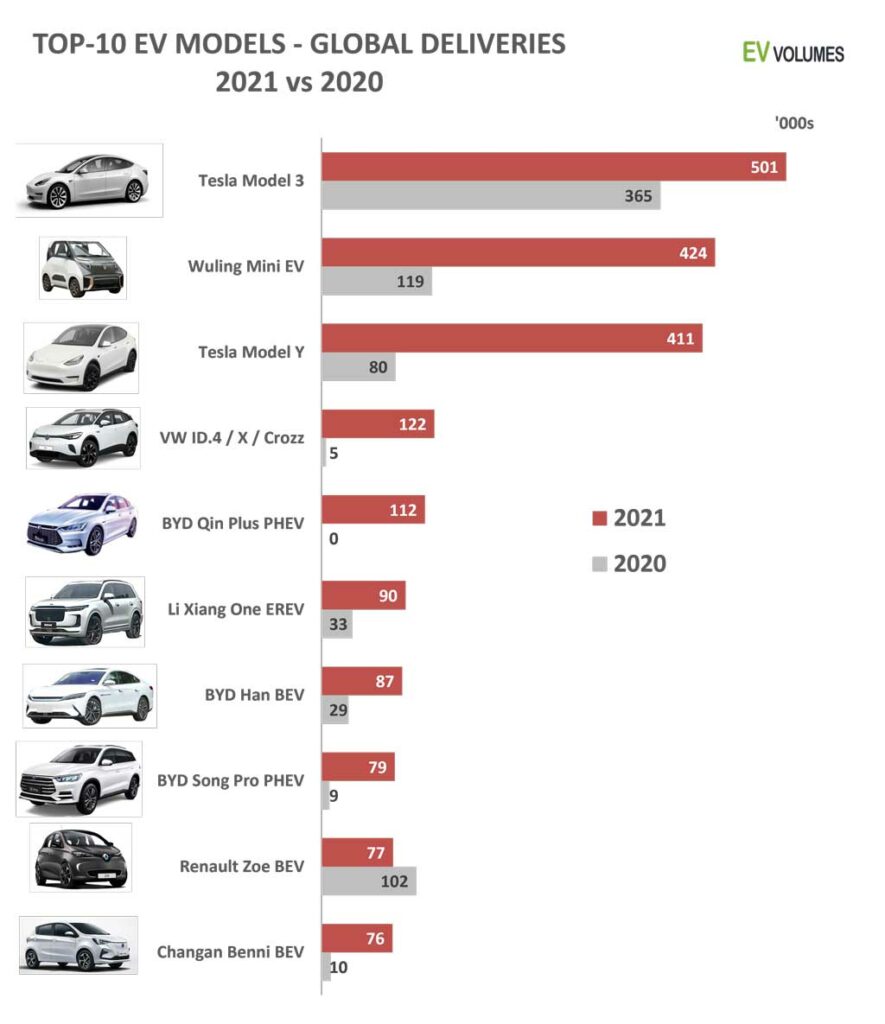

The Model-3 was the worlds best selling EV since 2018 and 2021 was no different. It ranked #2 among all mid-size car nameplates, ICEs included. Only Toyota’s Camry sold more units. Among the 501 000 global Model-3 deliveries 270 000 were made in China and 120 000 were exported from China. The #2, the Wuling Hongguang Mini EV went to the market at the right time to replace countless, third-rate Low Speed Vehicles which are banned from further sales. It trades for equivalent 4000 to 5000 USD. The Tesla Model-Y came in as #3 despite still being ramped up in China and not delivered in Europe before August 2021. We expect it to move into 1st place in 2022. On #4 the VW ID.4 with 122 000 sales worldwide; its Chinese siblings ID.4 X and ID.4 Crozz contributed with 49 400 units. 17 300 units went to USA and Canada, still from Europe production. BYD has 3 models in the top-10, the Qin Plus PHEV, the Han BEV and the Song Pro PHEV. All 3 are available as BEV and PHEV. Adding the other EV variant would change Qin plus sales to 167 500 units, total Han sales to 117 400 units and Song Pro sales to 108 300 units. Among EVs, the BYD Han is now the best selling large sedan, worldwide. The best selling large EV SUV is the Li Xiang One from CHJ Automotive with 90 500 sales in China only. It marks the renaissance of the Range Extender EV, a concept which has been introduced in a number of Chinese SUVs recently. The instant success of upmarket EVs from Chinese OEM, including many start-ups, has become a notable trend in the vast Chinese EV market. The Renault Zoe has aged fast and faces fierce competition from newer sub-compact cars and SUVs in Europe. Sub-compacts (Car-B) are a very Europe-centric category and the Zoe is the only EV in this list without a China production base.

Only Winners – More or Less

The hyper-growth in China’s EV sales created higher %-gains for the Chinese than for the America, European, Japanese and Korean players. The big winner was BYD which, after 2 years of declining sales, returned with exceptional gains for existing and new EV entries. Many of the 2021 launches did not have a full year of sales and we expect further, rapid sales increases for BYD. Among the international OEMs Ford, GM and Stellantis grew fastest. Ford with the new Mustang Mach-E; GM with booming Mini-EV sales from their partner Wuling and Stellantis by a large number of product launches which had their first full year of sales in 2021. For most others, growth stayed below 100 %. Volume gains were still massive for EVs, while the decline for ICE-only variants accelerated. Tesla remains on top, BEV only, and the distance to the Volkswagen Group, has increased by 100k. 2021 saw some notable changes in the OEM ranking: BYD climed from #7 to #3, Stellantis climbed from #9 to #5, the Renault-Nissan-Mitsubishi Alliance dropped from #3 to #8, Daimler down from #8 to #9, SAIC passed Volvo for #10. Positions for VW and GM are unchanged. Apart from ever advancing SAIC, the China NEV sector expansion supported even other State Owned Enterprises in the EV business like BAIC, Changan, Dongfeng, FAW and GAC, Many of them were in contraction mode between 2018 and 2020, with vast portfolios of hit and miss products. BAIC’s decline from the #1 maker of BEVs in China to an also-ran is a sobering tale. Better news from the Chinese EV start-ups: CHJ (Li Xiang), NIO, XPeng, Hozon, WM Motor and Leap Motor have not reached the 100 000 unit mark yet, but most of them now look back on 4 years of steady growth in volume and share. CHJ stands out, reaching 90 500 sales after 2 years with just one product, a luxury SUV, and in just one market, China. The combined 2021 volume of the aforementioned 6 start-ups is comparable with that of Stellantis.

Close

Close