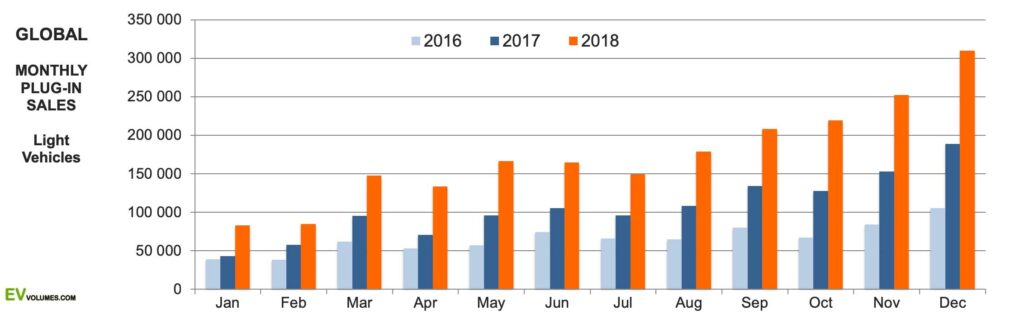

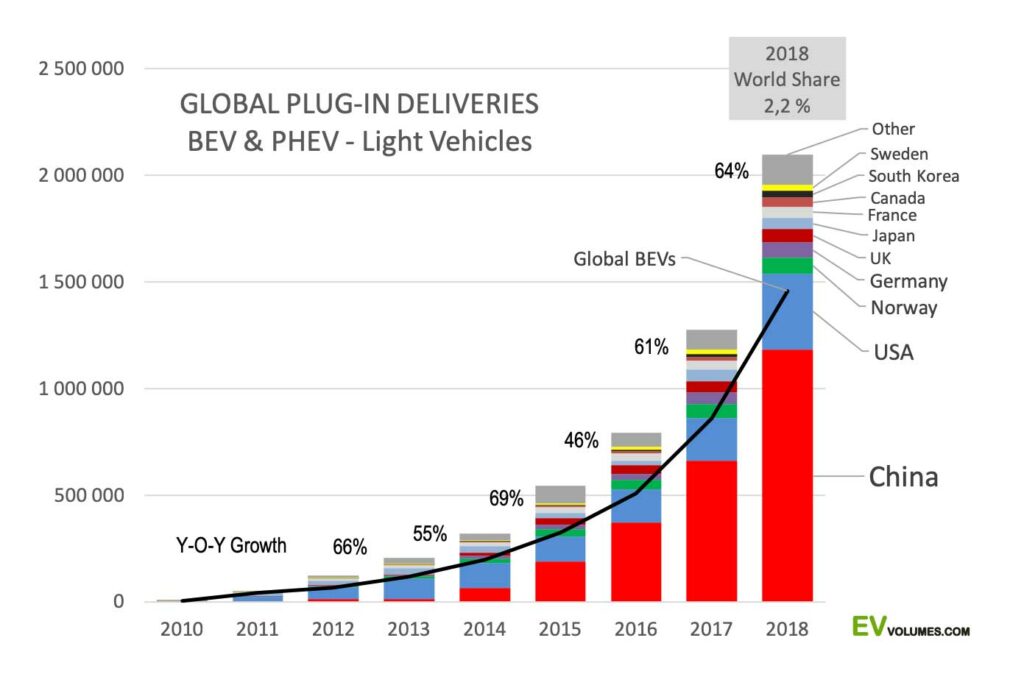

Global plug-in vehicle deliveries reached 2,1 million units for 2018, 64 % higher than for 2017. These include all BEV and PHEV passenger cars sales, light trucks in USA/Canada and light commercial vehicle in Europe and China. Their share in the global light vehicle market was as high as 3,8 % in December and 2,2 % for 2018 in total. 69 % of sales were all-electric (BEV) and 31 % were plug-in hybrids (PHEV). All-electric vehicles have gained 3 % share in the mix since 2017, driven by growth in China, the arrival of the Tesla Model-3 and losses for PHEVs in Europe when the new fuel economy test procedure WLTP became effective in September.

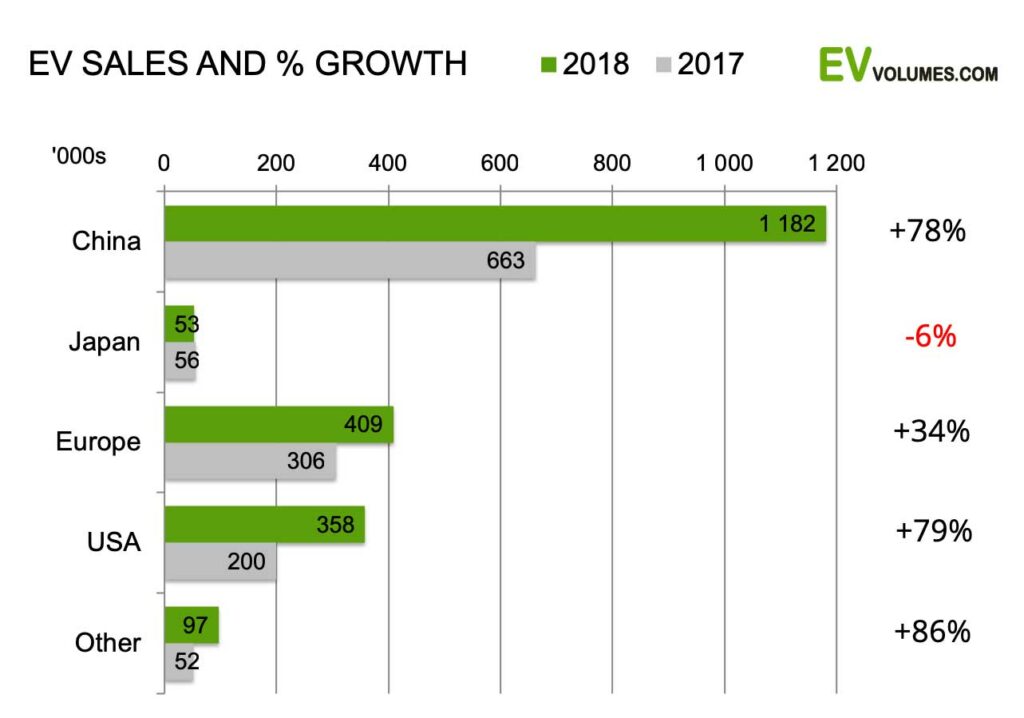

The, by far, largest growth contributor was China, where sales increased by over 500 000 units to 1,2 million in 2018. China stood for 56 % of all plug-in sales. Europe growth was more moderate at 34 %, held back by tight inventories, long waiting lists for popular BEVs and the run-out of high-selling PHEVs. Plug-in sales in USA increased by 79 % and the long awaited Tesla Model-3 contributed with 138 000 units, most of them in the second half of 2018. Deliveries were limited to USA and Canada during the first year. It still became the best selling EV of all categories in 2018 and even dominated luxury car sales in North America. Sales outside China, Europe and USA were 150 000 units (+39%), with Japan again in reverse, but other markets like Canada and South Korea growing much faster than average.

The smaller car markets lead in EV adoption. The share leader is Norway, as usual, where 40 % of new car sales were Plug-ins in 2018. Iceland comes 2nd with 17,5 % and Sweden 3rd with 7,2 %. Our Europe story for 2018 has more details on this. Among the larger economies, China leads with a plug-in share of 4,3 %. All other car markets with over 1 million total sales show around 2 % for 2018.

At the end of 2018 the global fleet of plug-ins was 5,4 million, counting light vehicles. Medium and heavy commercial vehicles add 600 000 units to the global stock of plug-ins. Their global deliveries were 120 000 units in 2018, thereof 98 % in China and 80 % were large buses. For 2019 we expect plug-in sales of 3,2 million light vehicles and 140 thousand heavy vehicles.

As usual, feel free to publish diagrams and text for you own purposes, mentioning us as the source.

China stands for 56 % of sales and for 63 % of growth

China has further advanced its position as the growth motor of the EV industry. 520 000, or 78 % more NEVs were sold in 2018. In December, deliveries reached over 200 000 units for the first time and the NEV share in all light vehicles sold was 7,9 %. In contrast to booming NEV sales, the overall car market saw a severe downturn in the second half of 2018. Y-o-y declines accelerated in Q4 and reached as much as -20 % for January 2019. Has the ICE crisis started?

Japan losses are solely related to the Toyota Prius Plug-in, which has been in steep decline since the arrival of the 2nd generation Leaf in Q4 of 2017. Excluding the Prius, Japan’s plug-in sales increased by 38 %, with Leaf and Outlander gaining the most.

Europe was a mixed bag, with sales held back by supply constraints in larger EV markets, triple digit %-increases in South and Central Europe, a strong recovery in The Netherlands and incentive changes to promote more sales of pure EVs. The increases for total Europe was 34 %, but could have been 20-30 000 units higher with better availablitity.

The USA result was all about the Tesla Model-3, which stood for 138k of the 158k increase last year. 80 % of the Model-3 volume was delivered during the 2nd half of 2018. Others include Canada (42 700 sales, +124 %), South Korea (31 700 sales, +134 %) and many fast growing, smaller EV markets around the world.

Growth in Isolation

This shows the top-10 markets for plug-ins, underlining the significance of China in the development of the sector. 4,3 % NEV share in the worlds largest car market of 27,5 million light vehicles generated 1,2 million of volume. Business is kept local: Few units (2500 according to our records) were exported from China and NEV imports accounted for just 24 000 units. Imported plug-ins are burdened by the usual import duties and do not receive NEV subsidies. The only way to sell at equal terms is to produce EVs (incl. their batteries) in China and all OEMs are rushing to do so. In 2018, still only 58 000 plug-ins were made and sold in China by western brands, half of this volume by BMW.

USA came a distant second, despite the Model-3 splash. Norway remained on #3, closely followed by Germany. The triad China, Europe and USA stood for 93 % of global sales in 2018. Volume is one indicator, another is share in new vehicle sales. Check our Europe 2018 article for an overview by country. To find out more about the success of NEVs in China, watch out for our next article on China 2018, which is coming soon.

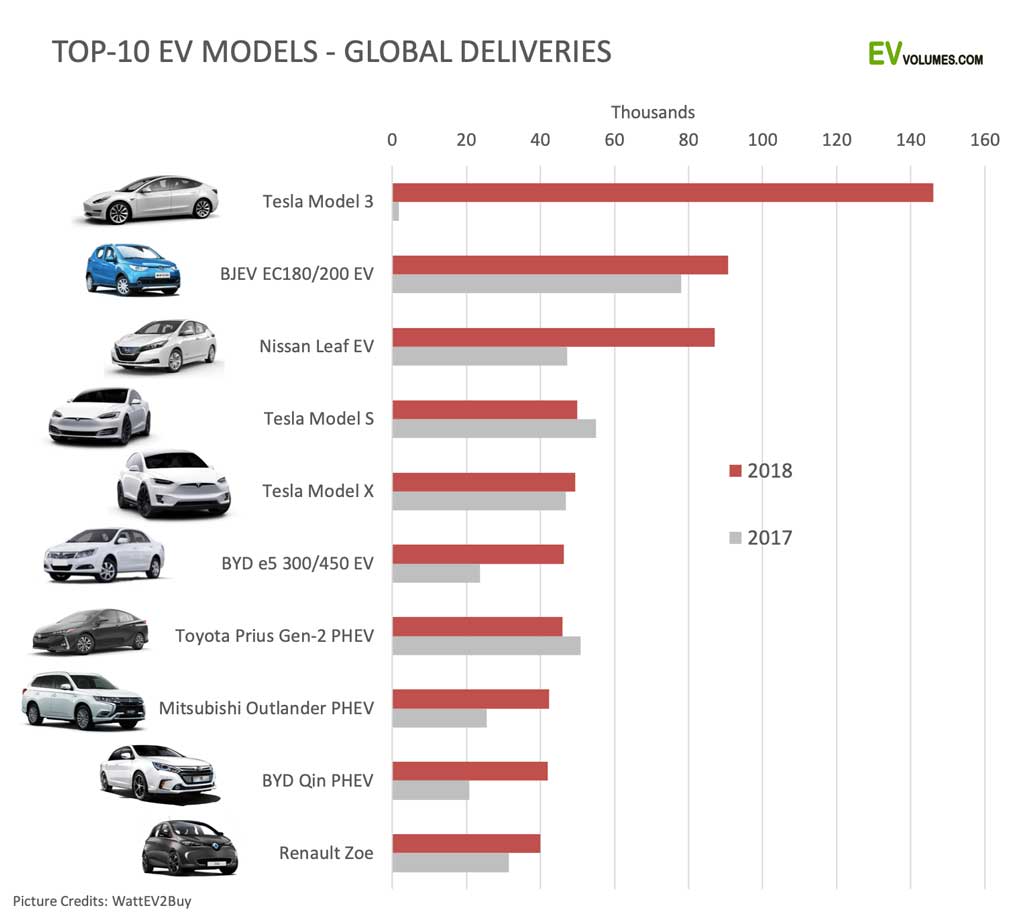

Global Top-10 Best Selling Models

As expected and still impressive, the new Tesla became the world’s best selling plug-in by a large margin, despite only selling in high volume during the 2nd half and only in USA and Canada. All were high-spec, long range variants; the 35 000$ base car is still some month off. Even if growth for S and X was close to zero, Tesla had all their models in the top-5.

The #1 of 2017, BAIC EC180 lost momentum before and during a battery upgrade and could not keep up with the rapid sector growth. It is still the #1 in China. The Nissan Leaf Gen-2 did much better than average, even if its battery specification got a lukewarm reception. 87 000 were sold, 84 % more than 2017, making 2018 the best year ever. The BYD e5 had a facelift and battery upgrade and i clearly paid off.

Toyota’s main contender Prius PHEV lost more than half of its volume in Japan; strong gains in USA/Cda could not compensate. The Outlander PHEV started selling in North America (sic!), became an instant hit in Canada and sold better in most other countries as well. The BYD Qin, the first PHEV in China back in 2014, is in its 3rd iteration now and still going strong. The #2 in Europe, Renault Zoe, grew another 27 %. It was launched in 2012 and the next generation starts selling in late 2019 or early 2020.

The top-10 stood for 30 % of the global volume in 2018. At the end of last year, 220 EV models were sold worldwide, for China their number was 150.

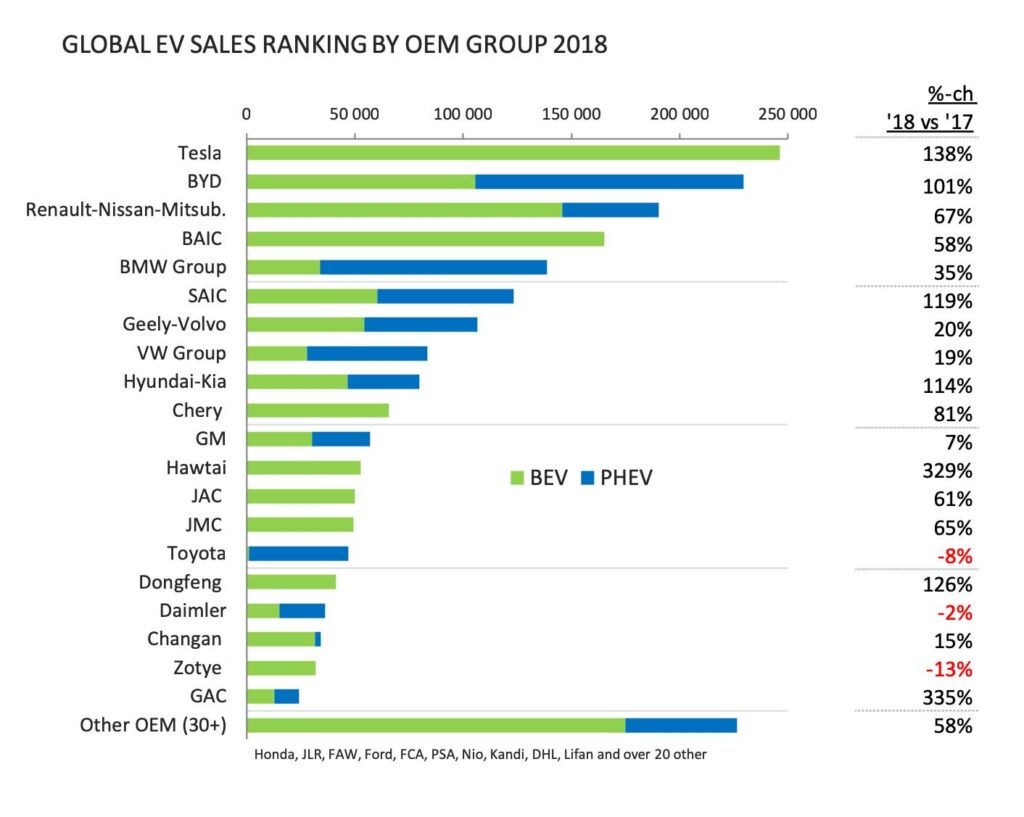

Tesla and BYD Take the Price

Depending on which vehicle categories are counted, both, Tesla and BYD lead the 2018 ranking. Counting light vehicles (Cars, SUVs, MPVs, Light Trucks, LCVs) Tesla is #1. Including medium & heavy trucks and buses, BYD leads the tally. BYD is one of the leading producers and exporters of electric buses with ca 13 600 deliveries 2018, 7 % outside China. The diagram is for light vehicles only. While volume is similar, their business could not be more different: BYD has ICE origins, offers 7 BEV plus 4 PHEV models and has 99 % of sales in China, through dealers. Tesla does with 3 models, all electric, sells in over 30 countries, online, and provides its own charging network.

Most OEMs posted solid increases in sales, but with global growth at 64 % last year, increases below that number mean lost sector share. Their list is long and mainly consists of western manufacturers, plus Toyota. Weak BEV portfolios are the main reason for this, in an environment that promotes real zero-emission vehicles more than plug-in hybrids. GM, Ford, VW, Daimler, BMW, Volvo and JLR offered only 8 BEV models altogether in 2018. They will introduce 4 new BEVs later this year in Europe – demand is high, already.

Beneath the top-20 there are at least another 30 smaller manufacturers for cars and another 10 for electric light commercial vehicles. Most of them are Chinese and operate in their local domain, a city or province. Many of them are EV start-ups, with varying chances for success. Even if badge-engineering is commonplace, there are few signs of sector consolidation, yet. The number of players keeps growing, every month.

Exponential Growth of Sales and Fleet

By the end of 2018, the plug-in vehicle population reached around 5,4 million worldwide, an increase of 64 % over 2017. Still, the impact on the total vehicle stock will be hardly noticeable in most countries. 5,4 million plug-ins on a global light vehicle population of around 1,3 billion is just 0,4 %, one in 250. Growth is exponential, though, and the overall picture will change much faster than historic sales suggest. Adoption of successful technology is along S-curves, not straight lines.

For 2019 we expect plug-in sales to grow by another 52 % and reach 3,2 million units globally. China is likely to strengthen its significance further and reach 2 million sales. For Europe we expect 540-580 000 units and for the US 440-480 000 units. The 3,2 million units include passenger vehicles and light commercial vehicles. It converts to a share of 3,4 % in a total light vehicle market of 93,4 million units, -1,5 % lower than 2018. 69 % of the 2019 volume are expected to be BEVs. The global fleet reaches 8,5 million under these conditions.

Close

Close