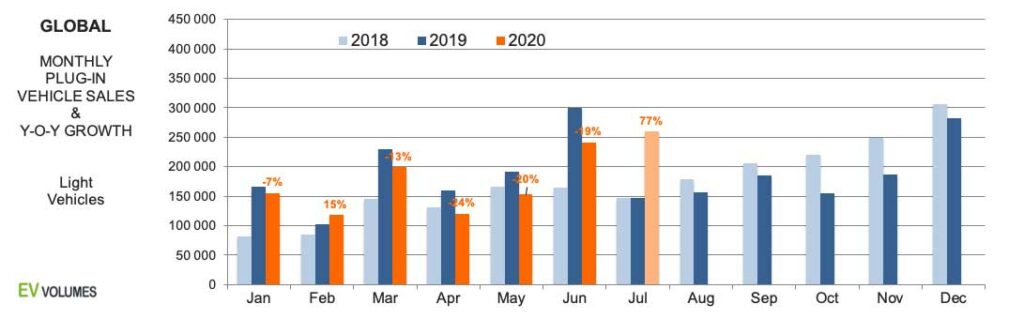

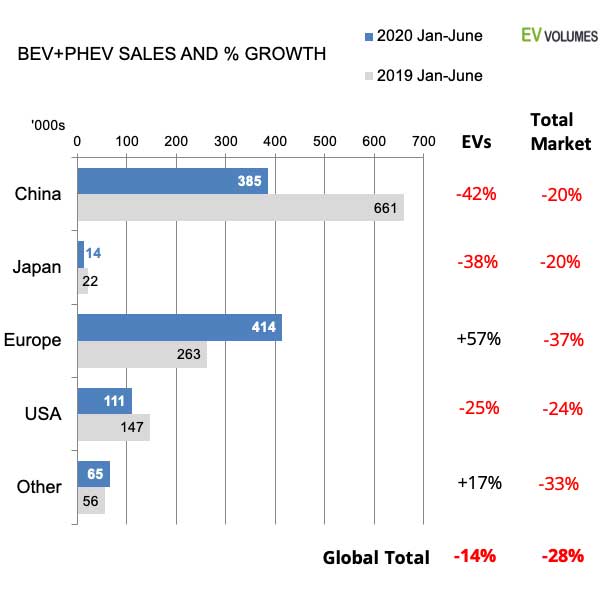

The 1st half of 2020 was overshadowed by the COVID-19 lockdowns, causing unprecedented declines in monthly vehicle sales from February onwards. For the first 6 months of 2020 the volume loss was 28 % for the total light vehicle market, compared to H1 of 2019. EVs held up better and posted a loss of 14 % year-on-year for H1, globally. The regional developments were very diverse, though: In China, where the 2020 numbers compare to the still healthy sales of 2019 H1, NEVs lost 42 % y/y in a car market that was down 20 %. Lower subsidies and more stringent technical requirements are the main reasons. In USA, the sales of EVs followed the overall market trend.

Europe is the beacon of EV sales in 2020 with 57 % growth for H1, in a vehicle market which declined by 37 %. The rapid increases of EV sales started in September 2019 and gained further momentum this year. The WLTP introduction, together with changes in national vehicle taxation and grants created more awareness and demand for EVs. The industry geared up to meet the 95 gCO2/km target for 2020/2021. Over 30 new and improved BEV & PHEV models were introduced in the 2nd half of 2019 and production ramped up to high volume, despite a 1-2 month industry halt.

Six European countries have introduced additional green recovery incentives to promote higher EV sales, starting in June and July. Preliminary results for July give an indication for the effect on EV adoption in H2: The top-10 EV markets in Europe increased sales by over 200 % combined. We expect very strong uptake for the remainder of the year, with sales passing the 1 million mark and monthly market shares of 7-10 %. The global BEV & PHEV share for 2020 H1 is 3 %, so far, based on sales of 989 000 units. The smaller car markets continue to lead EV adoption. The share leader is Norway, as usual, where 68 % of new car sales were BEVs & PHEVs in 2020 H1. Iceland came 2nd with 49 % and Sweden 3rd with 26 %. Among the larger economies, France leads with 9,1 %, followed by UK with 7,7 %. Germany posted 7,6 %, China 4,4 % %, Canada 3,3 %, Spain 3,2 %. All other car markets with over 1 million total sales showed 3 % or less for 2020 H1.

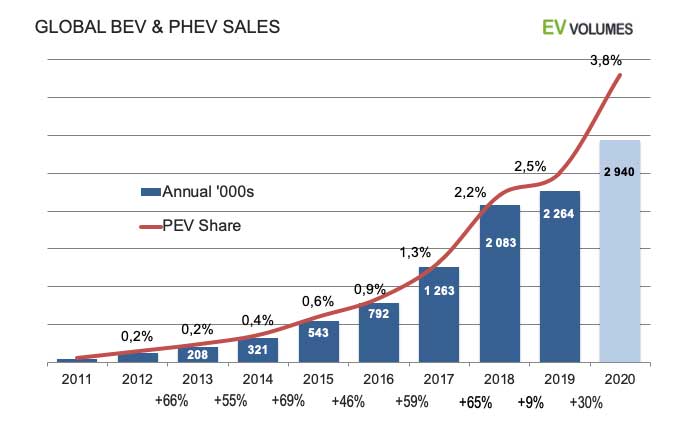

Our expectation for 2020 is around 2,9 million world-wide BEV & PHEV sales, unless a broad resurge in COVID-19 forces important EV markets into severe lock-downs again. The global EV fleet will reach 10,5 million by the end of 2020, counting light vehicles. Medium and heavy commercial vehicles add another 800 000 units to the global stock of plug-ins.

As usual, feel free to publish diagrams and text for you own purposes, mentioning us as the source.

Europe Bucks the Trend

Supported by generous incentives and better supply of new and improved EVs, Europe became the clear winner of 2020 H1 and is much likely to lead the growth during the entire 2020. The impact of COVID-19 on vehicle markets was most severe in Europe, but EV sales grew by 57 %, reaching 6,7 % light vehicle share, or 7,5 % when counting EU+EFTA markets only. This compares to 2,9 % market share for 2019 H1, a formidable increase. Europe’s share in global BEV & PHEV sales increased from 23 % to 42 % within a year. More EVs were sold in Europe than in China, for the first time since 2015. The largest volume growth contributors were Germany, France and the UK. Except for Norway (-6 %), all larger European EV markets posted gains this year.

China’s decline of NEV sales and shares started in July 2019 and continued through H1 of 2020, amplified by the market slump during February and March. For H1, the 2020 numbers compare to the 2019 period before subsidy reductions and further technical requirements strangled demand and supply. The losses amount to a dismal -42 % on that basis. China stood for 39 % of global BEV & PHEV volumes in H1, down from 57 % in 2019 H1. Preliminary July results indicate a recovery of NEV sales, with ca 40 % increase over July 2019.

The losses in Japan continued, with broad based decreases, especially among importers.

USA volumes were held back by a 7 week shut-down of Tesla from end of March until mid-May and there were few news from other OEM. The new Tesla Model Y contributed with 12 800 units in H1. Imports from Europe posted high volume declines as European OEM prioritise deliveries to Europe where they are more badly needed. The highlights for H2 volumes in North America will be the new Ford Mach-E and high-volume deliveries of the Tesla Model-Y.

“Other” markets include Canada (21k sales, -19 %), South Korea (27k sales, +40 %) and many fast growing, smaller EV markets around the world

Miles Ahead

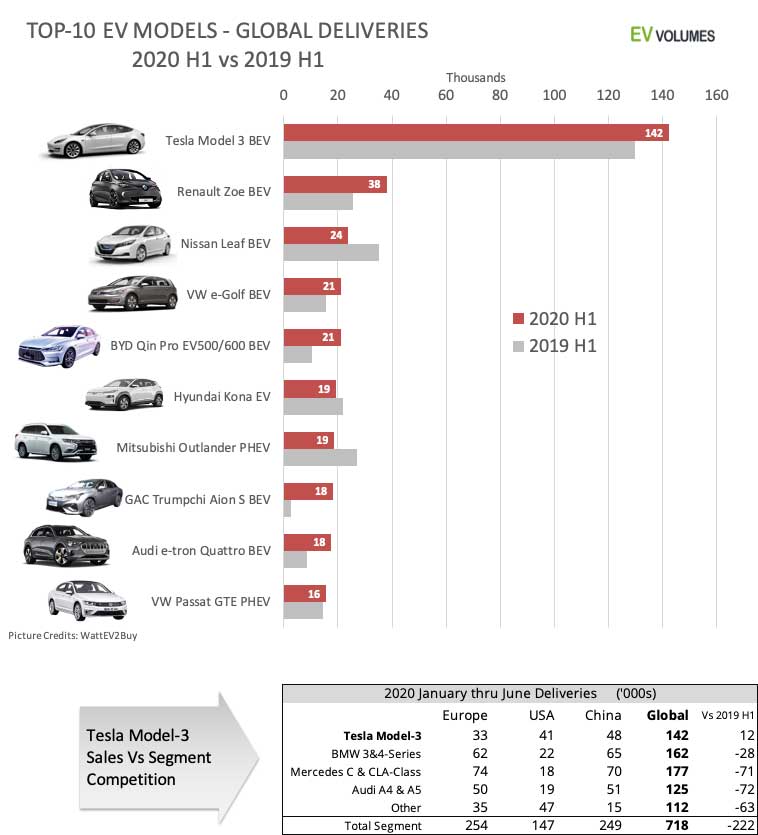

The lead of the Model-3 is impressive, with over 100 000 more sales than the #2, Renault Zoe. World-wide, one out of seven EV sold was a Tesla Model-3. While sales took a beating in Europe and North America, it gained by local production in China, where it has become the best selling NEV model by a large margin. Global sales are now close to the leading ICE competitor models’.

With the sharp decline of China NEV sales, many Chinese entries have disappeared from the top-10. Remaining are the BYD Qin Pro and the GAC Aion S, both are long range BEV sedans, popular among private buyers, company pools and ride hailers.

The Renault Zoe was re-designed for MY2020, Europe deliveries started in Q4-2019 and sales where 48 % higher than for the predecessor. The Nissan Leaf lost another 32 % compared to last year, with losses in all regions, showing that Nissan is less and less committed to the Leaf. It is in good company: BMW i3 sales were 51 % lower than last year, it will not have a successor and is left to fade away.

On the contrary, the soon to be dropped e-Golf is still going strong (+35 % y/y), as VW pushed production and sales in the advent of the new ID.3. The Hyundai Kona is now made in the Czech Republic for Europe sales, which will improve availability in H2 of 2020

The first PHEV in the top-10 is the venerable Mitsubishi Outlander, introduced 2013, face-lifted 2 times and still one of the few PHEVs which can use DC fast-chargers. Sales in H1 were 31 % lower y/y and a successor model is uncertain at this time.

The Audi e-tron quattro has become the leader in the large SUV category, a position firmly held by the Tesla Model X since 2017. The global sales roll-out began in Q4 of 2018 and sales have doubled compared to 2019 H1. The VW Passat GTE volume is from, both, the Europe version (56 %, mostly Station Wagon) and the China made version (44 %, all Sedans).

China in Reverse

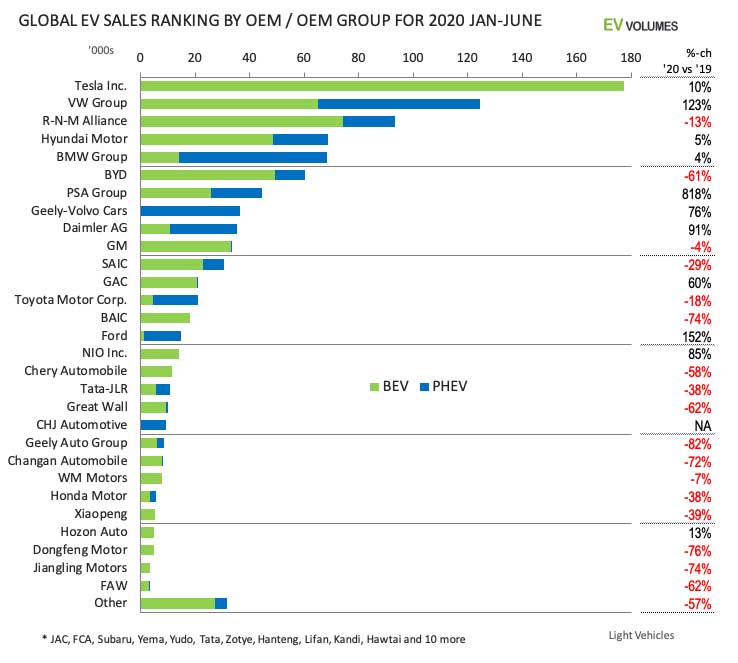

COVID-19 has affected the entire industry, yet, the common features for EV growth and decline are the combinations of products, policies and market presence. EV sales of European OEM were favoured by new, attractive BEVs and PHEVs launched into an environment with stringent CO2 targets, looming ICE bans and increasing financial incentives. In China, the 99 % home market exposure, combined with high dependence on subsidies, became the nemesis of many Chinese OEM, while Tesla and many foreign OEM thrived with better products from local plants. The top-5 are now all global players; operating from proprietary platforms with local adaptions.

A broad consolidation of China’s NEV industry seems inevitable as the sales slump has left many smaller players in a distressed state. NIO and GAC are exceptions, but they already co-operate on R&D and production. For many others the future is uncertain. The larger Chinese OEMs created vast NEV portfolios in recent years, but many of these new entries are short-lived or sell in tiny numbers when they do not meet changing technical requirements and discerning consumer taste. There is still room for innovative, distinct brands like the Li Xiang One, the first entry by CHJ Automotive. This large SUV, the first range extender EV in the segment, made it into the top-10 in China after just 6 months, despite an unestablished brand, up-market pricing and adverse market conditions.

Our Expectation for 2020

EV sales lost 14 % in the first half of 2020, compared to a 28 % decline in vehicle markets. This relative success can be attributed to rapid growth in Europe and many fast growing EV markets outside the China-USA-Europe triad: Mexico, South Korea, Australia, Hong Kong, Taiwan, Israel, to name the largest contributors. The recovery started in May and July saw car sales in many countries overshooting relative to normal seasonality. High EV growth in H2 is warranted by an unprecedented availability of attractive models, combined with green recovery funds in many countries, particularly in Europe.

For Europe we expect 1,1 million BEV and PHEV sales (+85 %), for China 1,2-1,3 million, (+7 %), for USA 360k (+14 %) and 200k in all other markets combined (+28 %). 2,9 million globally is our baseline forecast. The possibility for a broader re-surge on COVID-19 increases the forecast uncertainty. Further nationwide lock-downs are unlikely, but local outbreaks at OEM or suppliers could lead to undersupply and delays in important launches of new EV entries. In the worst case, the 2020 result could be 15-20 % below the base case, shifting most of the lost volume into the next year.

Close

Close