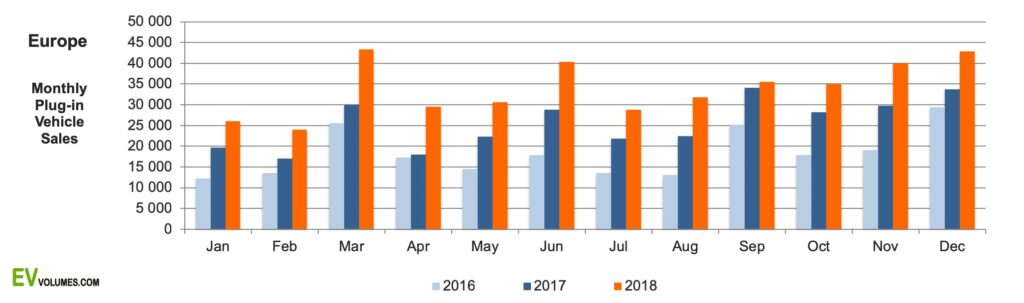

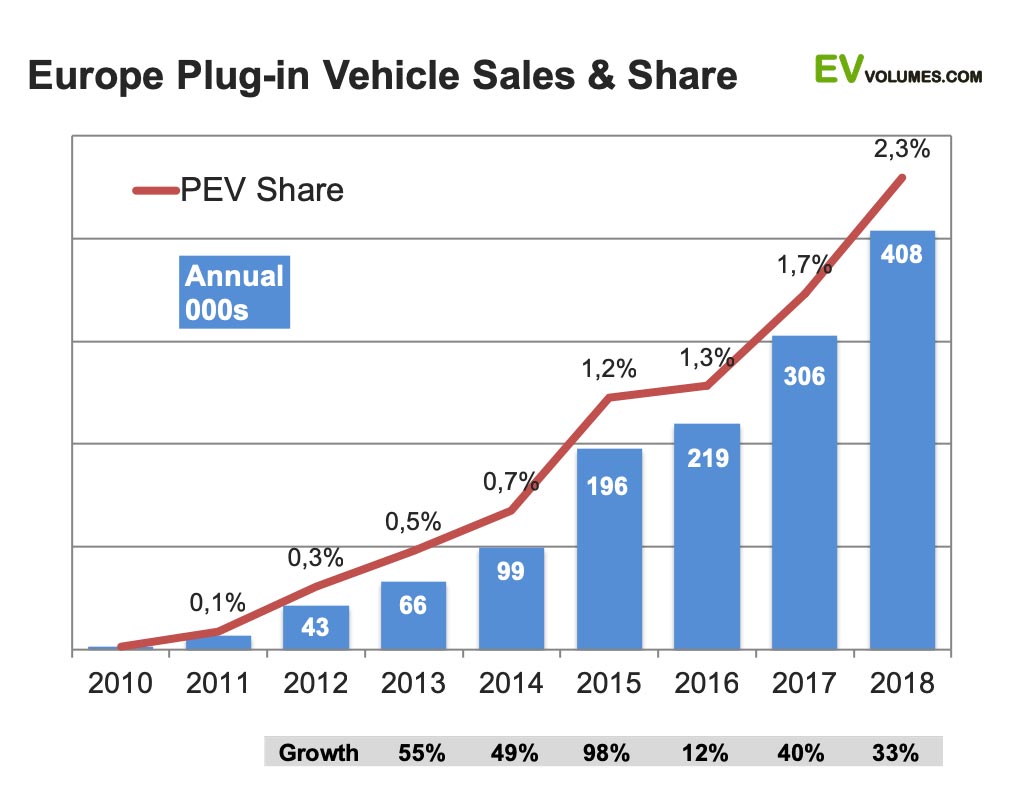

Plug-in vehicle sales in Europe reached 408 000 units in 2018, 33 % higher than in 2017. These include all Battery Electric Vehicles (BEV) and Plug-in Hybrids (PHEV) in Europe, passenger cars and light commercial vehicles. The plug-in share of the European light vehicle market was 2,3 % for the year and reached 3,5 % in December, the highest ever for a single month. In terms of volume, September and the 4th quarter was affected by the WLTP introduction and the dwindling supply of popular PHEV models. The new WLTP requires more elaborate testing than the outgoing NEDC and back-logs in variant type approvals were common, not just for PHEVs.

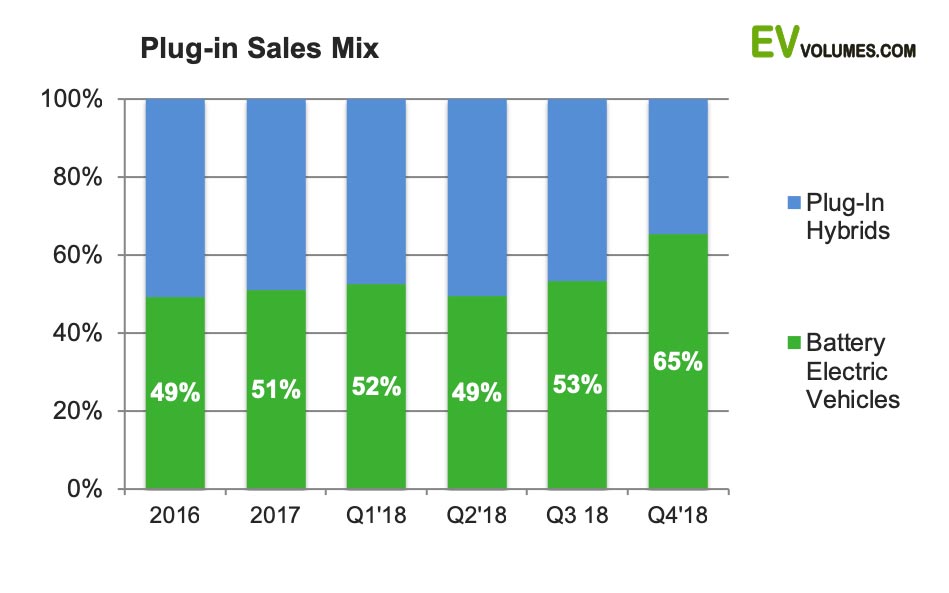

Worse for PHEVs, many of them need battery upgrades to stay below 50g CO2/km in the new WLTP regime. These upgrades are being implemented, but it will take until Q3 of 2019 until all popular PHEVs are back on the market. Consequently, plug-in volumes increased by just 26 % in the 2nd half of 2018, following 43 % y-o-y increase in the 1st half. The 2018 result for plug-ins could have been at least 20k higher without the afore mentioned supply constraints. A positive side-effect was that the portion of BEVs increased to 65 % in Europe, where it was around 50 % during the previous 3 years.

The overall market was shaky during H2: 27 % overshooting in August (vs 2017), when the industry did its best to deliver ICE cars (incl PHEVs) with the outgoing, more favourable NEDC fuel economy certifications. This was followed by -21 % pay back in September, -5 % in October and -6 % in November. The year ended with +0,4 % for light vehicles (by ACEA) and a total of 17 750 000 units in the EU and EFTA markets.

An EV share of 3,5 % in December bodes well for high growth in 2019, with another 35-40 % increase in sales. New entrants will provide great support for higher adoption: The Audi e-tron quattro, Mercedes EQC, Porsche Taycan and the Tesla Model-3 are new for Europe in 2019. BMW brings the Mini in BEV variants, PSA finally enters the scene, Volvo and Land Rover launch PHEV SUVs later in the year. Many of the currently halted PHEVs will return with better batteries. The Nissan Leaf BEV, the current #1 in Europe, gets a 50 % larger battery in May, the #3, BMW i3 got 30 % more e-range for MY19. Both are likely to post further, high gains in 2019.

Growth close to trend amid supply constraints

Except for a special event, the 2015 boom and 2016 bust of PHEV sales in the Netherlands, EV adoption in Europe is a story of consistent and accelerating volume increases. Growth in 2018 has experienced set-backs since September, but, accounting back-log from insufficient supply, it still follows our expectation of a general adoption trend. Unlikely a straight line, rather an S-curve. EV volumes have quadrupled within 4 years, but are still a 2,3 % niche in the vehicle market. And EVs still represent only 0,4 % of all 320 million cars and LCVs on European roads.

Consistent, double digit growth rates can change the picture fast, though. Continuing with last years increase of 33 % for the next 10 years, would lead to around 50 % EV share in sales and 10 % share in the European vehicle fleet.

What drives the growth towards mainstream adoption? To make a long story extremely short: (1) more choice of long-range, affordable EVs, (2) levelling of purchase/ownership cost to comparable ICEs, (3) reliable, convenient charging possibilities, (4) restrictions and bans for ICE sales/use, (5) binding mandates for CAFE and emission controls. Number 5 does not directly drive car buyers’ choices, but without (5) there is less of (1,2,3).

Progress on these drivers is gradual and uneven. Few European car markets witness their combined force. Current actions and future plans still support a rapid increase in EV adoption throughout the coming decade.

Enforced shift to BEV

The usual 50:50 split of BEV and PHEVs sales in Europe has come to an end. Enforced by revised taxation schemes and more stringent ICE emission testing (WLTP), demand (and supply) shifts towards BEVs, which easily take all these hurdles. In the 4th quarter, BEVs stood for 65 % of EV sales, in December their share was 69 %. The complete 2018 is lower, at 56 %, as it includes 8 months of the pre-WLTP sales pattern.

We have expected this for some time, as a natural development in the coming years; now it comes imposed, with the WLTP drama. Too early it may be. PHEVs are still needed during the transition towards electrified transport. Further delays during 2019 could certainly cause a dent in the overall sector development.

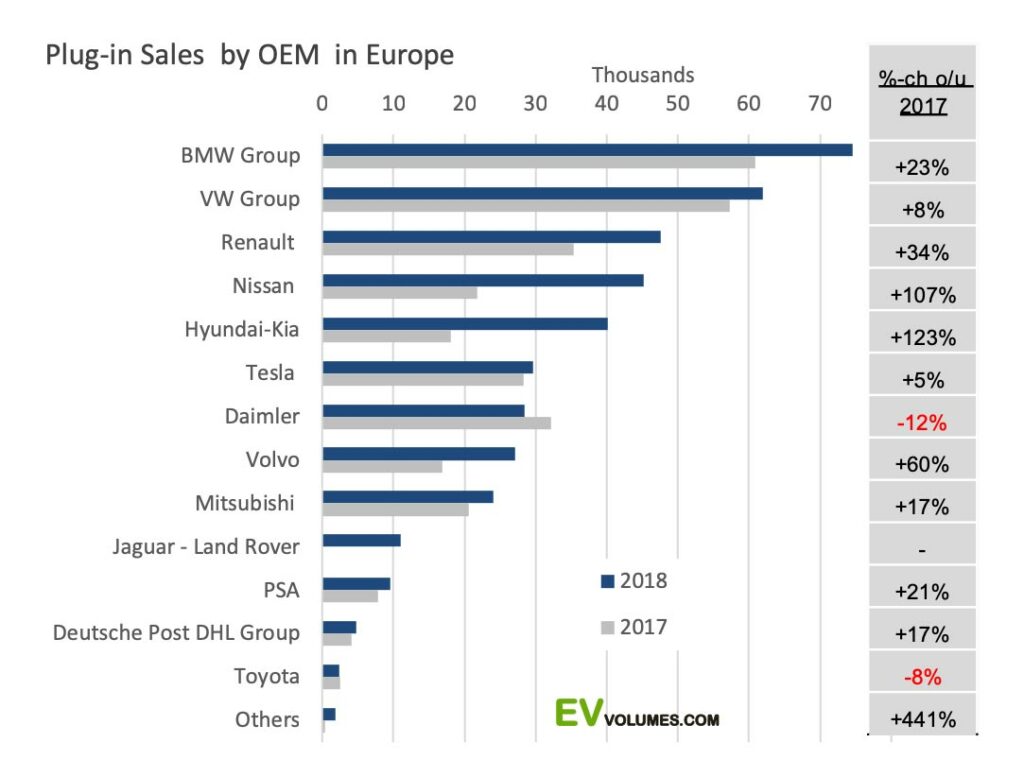

Losses for Daimler and Volkswagen

Plug-in sales of VW, Audi and Daimler were hit hardest by the WLTP intro. Popular PHEV entries like the Mercedes GLC350e and C350e, the VW Golf GTE and Passat GTE, the Audi A3 e-tron and Q7 e-tron were stricken from the price lists during Q4. The C-Class and E-Class PHEVs are back with new 300e and 300de monikers and batteries of 13,5 kWh capacity, more than twice the 6,2 kWh in the previous models. PHEVs from VW, Audi and Porsche should reappear during the first half of this year.

BMW was less affected by the WLTP intro and became the solid #1 in Europe plug-in sales. The 5-Series PHEV sales held up well, so did the 2-Serien MPV and the Mini Countryman. But the PHEV versions of the recently renewed 3-Series and X5 will not be available until the next model-year in Q3-2019. Q4 of 2018 had just run-out sales of their predecessors.

BEV brands have done better. The new Leaf more than doubled Nissan volumes, the Renault Zoe, the very close #2 in the model ranking, increased by another 25 %, Tesla S&X sales remained, at least, stable. Huge gains in NL were leveled by losses in most other countries. Volvo, still without BEVs, mastered WLTP better than others, so did the Range Rovers of newcomer JLR. The i-Pace contributed with the major part, 6400 units.

The winners, in terms of volume and growth, are Hyundai-Kia, though. They have introduces 6 BEV and PHEV models during the last 30 months and, following supply problems, deliver in higher numbers now. The Hyundai Kona BEV and Ionic BEVs were their best sellers in Q4 in Europe.

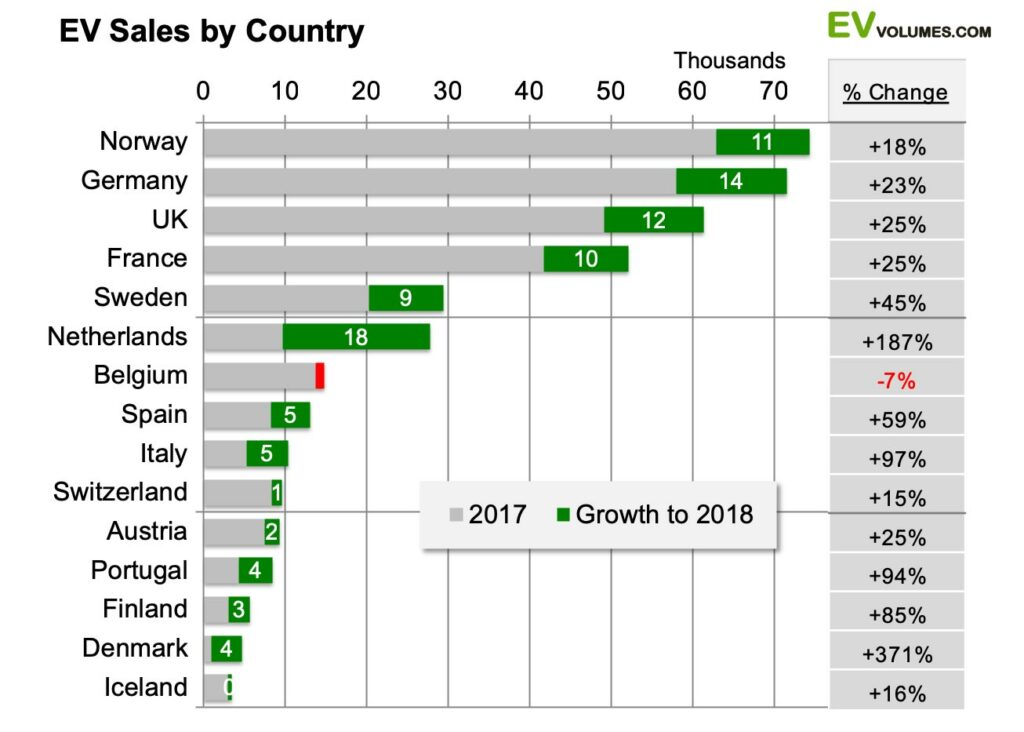

Strong progress for EVs in most countries

Norway kept the #1 spot for the Europe’s largest EV market for another year. Sales in Germany were pulled down by the PHEV draught in the second half, otherwise it had won the cup in 2018.

Nearly all Europe markets showed growth during 2018, though at varying pace. Plug-in sales in Netherlands and Denmark have turned around to rapid increases, following years of volume losses in adverse incentive schemes. France and UK continue with moderate increases as their domestic OEMs (PSA, Ford, Vauxhall) have less than compelling offers in the sector. Belgium has cut the incentives on luxury PEVs and sales declined by 7 %. South Europe markets grew faster than the Europe average of 33 %, albeit from smaller bases.

Fast growing Italy could become a highlight of 2019. Effective March 1st, buyers of EVs below €50 000 retail price receive a €6000 subsidy, while taxation will increase sharper for vehicles with higher fuel consumption. And yes, Fiat will be in the game, starting with the 500e, made in Italy.

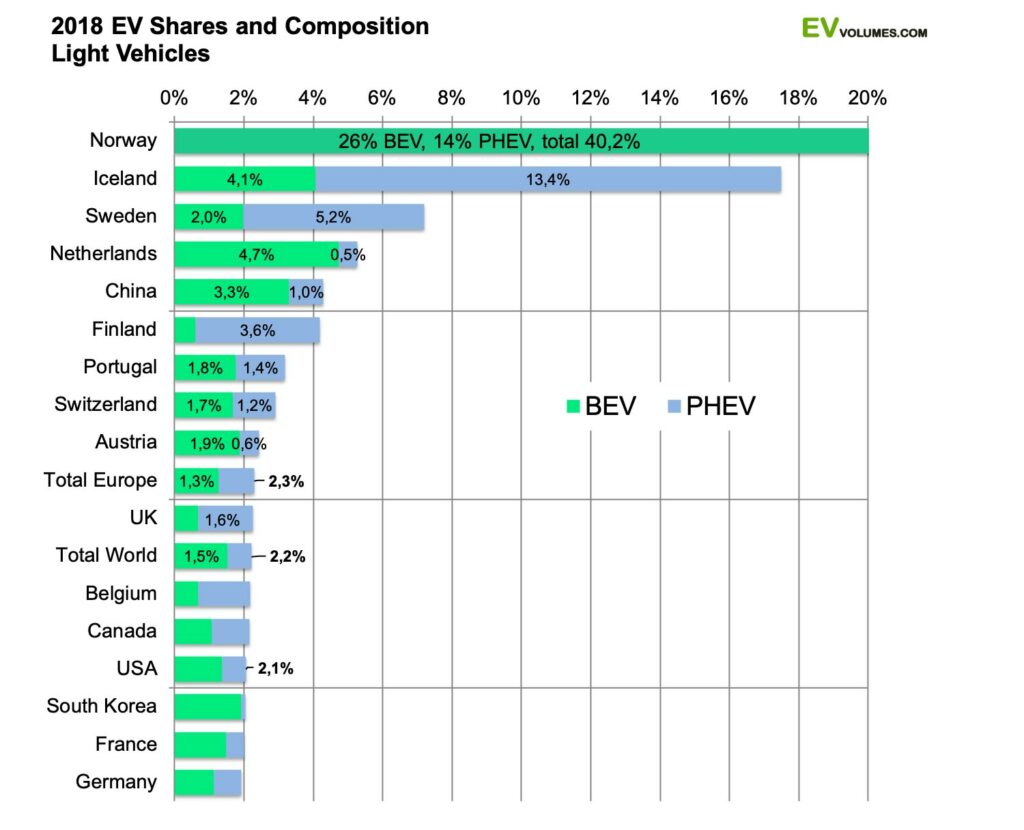

Smaller car markets lead EV adoption

The chart shows the share of EVs in the individual vehicle markets and the sales composition of BEV / PHEV. Norway is, as usual, off the scale. The plug-in share increased by another 8 percent-points to 40 % in 2018. If you have seen even higher numbers, they consider passenger cars only, where the share is another 6 %-points higher. It explains why Norway can be Europe largest EV market, even if its total vehicle market is just around 200 000 units per year.

Another observation is that EV adoption is lead by smaller car markets. Except for China, none of the larger car markets above 1 million units per year notably exceeds the world average EV share of 2,2 %. The reasons are manifold.

The BEV/PHEV mix is mostly a result of differences in taxation and incentives. Treated equally, PHEVs are still the preferred choice. 2018 policy changes promoted more BEV sales: Sweden introduced a Bonus-Malus taxation system in July, Norway got more weight conscious on PHEVs again, the Netherlands and Belgium reduced PHEV incentives, more ICE bans were announced, Europe introduced the WLTP and a 37,5 % CO2 reduction mandate.

It was effective: The year started with a 47/53 % mix of BEV/PHEV sales and ended with a 69/31 % ratio for December.

Close

Close