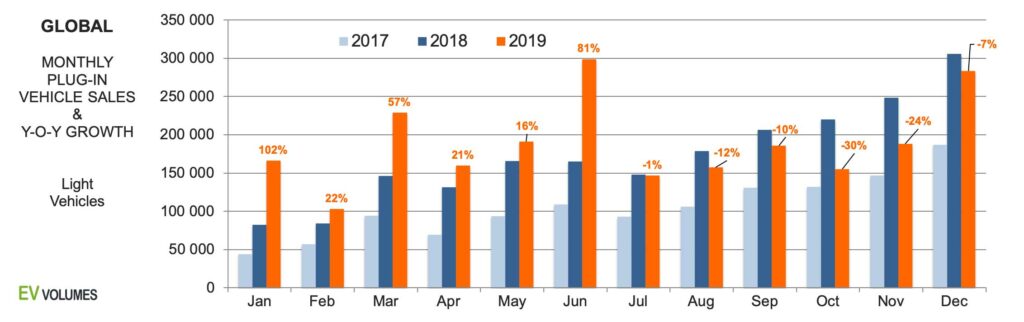

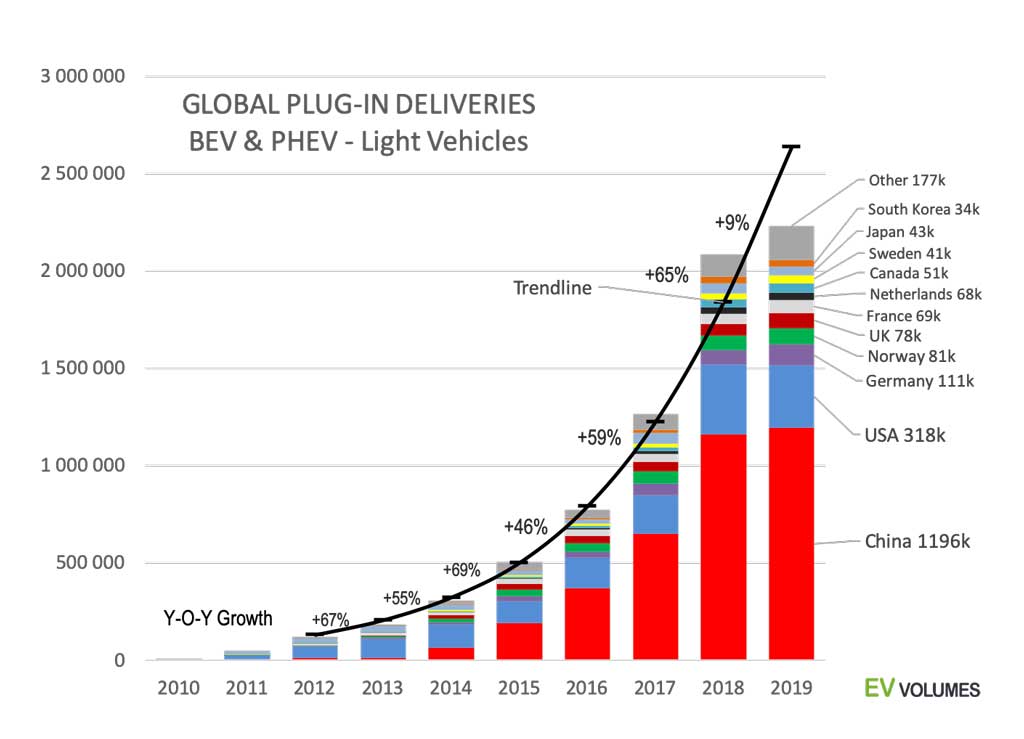

Global plug-in vehicle deliveries 2019 reached 2264 400 units, 9 % higher than for 2018. This is a clear departure from the growth rates of the previous 6 years, which were between 46% and 69 %. The reasons are in the developments in the two largest markets, China and USA, where sales stagnated in the 2nd half of 2019 and stayed significantly below the sales boom in 2018 H2. In USA, sales of most plug-in models decreased compared to the boom in 2018 H2. In China, further slashing of subsidies, paired with more stringent technical regulation caused a crash in NEV demand and supply, starting in July.

Europe became the beacon of 2019 EV sales with 44 % growth, accelerating towards the end of the year. The WLTP introduction, together with changes in national vehicle taxation and grants created more awareness and demand for EVs. The industry geared up to meet the 95 gCO2/km target for 2020/2021. Over 30 new and improved BEV/PHEV models were introduced in 2019, many of them in Q4, which will push EV sales in this year and the next.

The global BEV&PHEV share for 2019 was 2,5 % and the smaller car markets continue to lead EV adoption. The share leader is Norway, as usual, where 56 % of new car sales were Plug-ins in 2019. Iceland came 2nd with 24,5 % and the Netherlands 3rd with 15 %. Among the larger economies, China lead with a plug-in share of 5,2 %, UK posted 3,2 %, Germany 2,9 %, France 2,8 %, Canada 2,7 %. All other car markets with over 1 million total sales showed 2 % or less for 2019.

At the end of 2019 the global fleet of plug-ins was 7,5 million, counting light vehicles. Medium and heavy commercial vehicles add another 700 000 units to the global stock of plug-ins. Their global deliveries were 100 000 units in 2019, thereof 95 % in China and mostly as large buses.

Amid COVID-19, the outlook for 2020 global EV sales becomes more difficult. We expect high growth in Europe throughout the year, high growth in USA and other markets in H2, but China could become another disappointment. The preliminary EV sales data for January and February is very positive in Europe, encouraging in USA, but dismal in China, where the total vehicle market was down 80 % in February. If quarantines and factory closures continue into Q2, insufficient parts supply affects the global car industry during a longer period and the lost volumes are unlikely to be recovered during this year. In China, this gets another dimension when dealers remain closed and buyers have to stay at home.

As usual, feel free to publish diagrams and text for you own purposes, mentioning us as the source.

Europe gears up

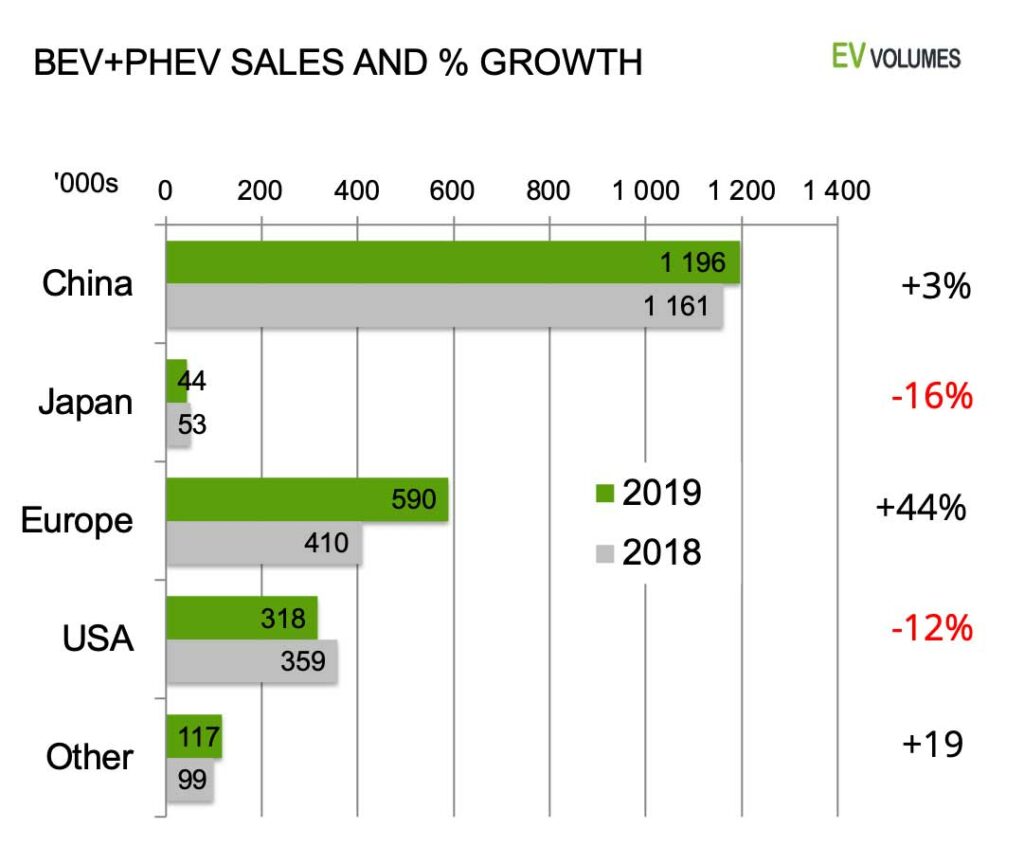

China’s NEV sales still showed 3 % small increase in 2019, despite the crash in H1. Growth was a brisk 70 % for H1 until the 2nd round of subsidy reductions and further technical requirements strangled demand and supply. In H2, when usually 70 % of NEVs are delivered, sales contracted by 31 % versus 2018. The total car market was down 12 % y/y during H1 and 4 % y/y during H2. China still stood for 53 % of global BEV&PHEV, down from 56 % in 2018.

Europe became the winner of 2019 with 44 % volume growth y/y. Europes share in global BEV&PHEV sales increase from 20 % to 26 % within a year. The largest volume growth contributors were Germany and the Netherlands. Nearly all European markets posted gains last year.

The losses in Japan continued, with the 3 leading domestic entries all in decline. Only Tesla and BMW increased their Plug-in sales in 2019.

USA posted an unexpected loss of 12 % versus 2018. The next section gives more details about the developments. Others include Canada (51k sales, +19 %), South Korea (34k sales, +7 %) and many fast growing, smaller EV markets around the world.

More details for USA and China

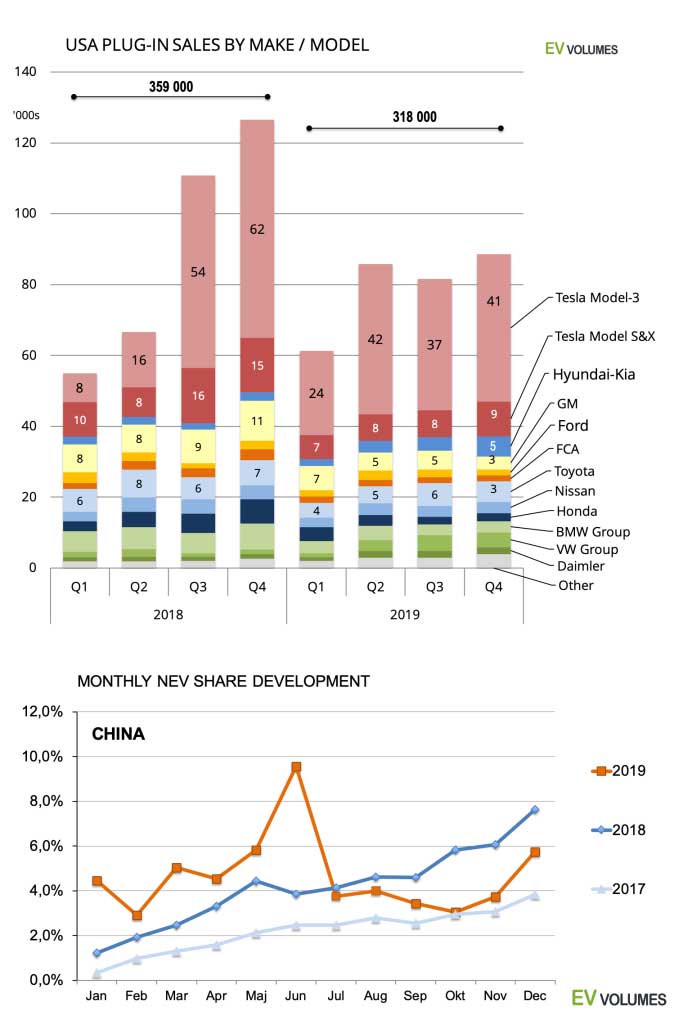

The upper chart compares the quarterly USA plug-in sales of 2019 compared to 2018. The 12 % decline, from 359k to 318k was caused by a number of factors: Tesla Model-3 sales of H2-2019 compare to the 2018 period when Tesla delivered on all the pre-orders since 2016, while H2 of 2019 more reflected running demand in the US. Also, Tesla skipped the 75 kWh battery version for Model S&X in Q1, increasing the starting price for the remaining 100 kWh version by $3000 on the S and by $6000 for the X, in exchange for improved range, notwithstanding. The market did not buy it all and S&X were down 35 % (by 17 600 units) for the year. US sales of the Model-3 increased from 140k in 2018 to 145k in 2019.

USA sales of OEMs other than Tesla show a combined decrease of -17 %, vs -6 % for Tesla. US and Japanese brands stood for most of the decline, while European and Korean OEM gained from new model introductions, like the Audi e-tron Quattro and the Hyundai Kona.

The lower diagram shows the share development NEVs in China. Monthly demand anticipated the 2 steps of subsidy cuts, becoming effective in April and July, with many deliveries pulled ahead into March and June. After that, the crash became a fact, hitting especially the price-sensitive segments and most domestic EV makers. Some of the smaller Chinese companies have only sold a few hundreds of cars during H2. How and when they can return to normal business is still uncertain.

December deliveries indicated a partial market recovery, but 2020 started with a February shut-down of most car manufacturing after the COVID-19 outbreak. January, with fewer working days than last year, had a 50 % slump of NEV sales. February and March will reflect “state of emergency”, with 80 % declines in February, hopefully less in March. Imports most likely gain in this situation.

Over half of the global volume is still in China

This shows the top-10 markets for plug-ins, underlining the significance of China in the development of the sector. 4,7 % NEV share in the worlds largest car market of 25,4 million light vehicles generated 1,2 million of volume in 2019. Business is kept local: Few units (4700 according to our records) were exported from China and NEV imports accounted for just 56 500 units, over 80 % from Tesla. Imported plug-ins are burdened by the usual import duties and do not receive NEV subsidies. The only way to sell at equal terms is to produce EVs (incl. their batteries) in China and recent efforts start to pay off: For 2019, we have counted 196 000 units China made NEVs, which were sold under foreign brand names, more than double the volume of 2018. GM leads (63k units) with the Baojun mini-EV from their SAIC J/V, followed by the VW Group (47k) and BMW (32k). Tesla started late in December.

USA remains a distant #2 despite the Tesla success story. Germany (111k) passed Norway as Europe’s largest EV market. The triad of China, Europe and USA stood for 93 % of global BEV&PHEV sales in 2019. The trend-line indicates that the weak 2019 results contains a good measure of “pay-back” to 2018, when an over-heated China NEV market coincided with high volume production of the long-awaited Tesla Model-3.

Tesla accelerates

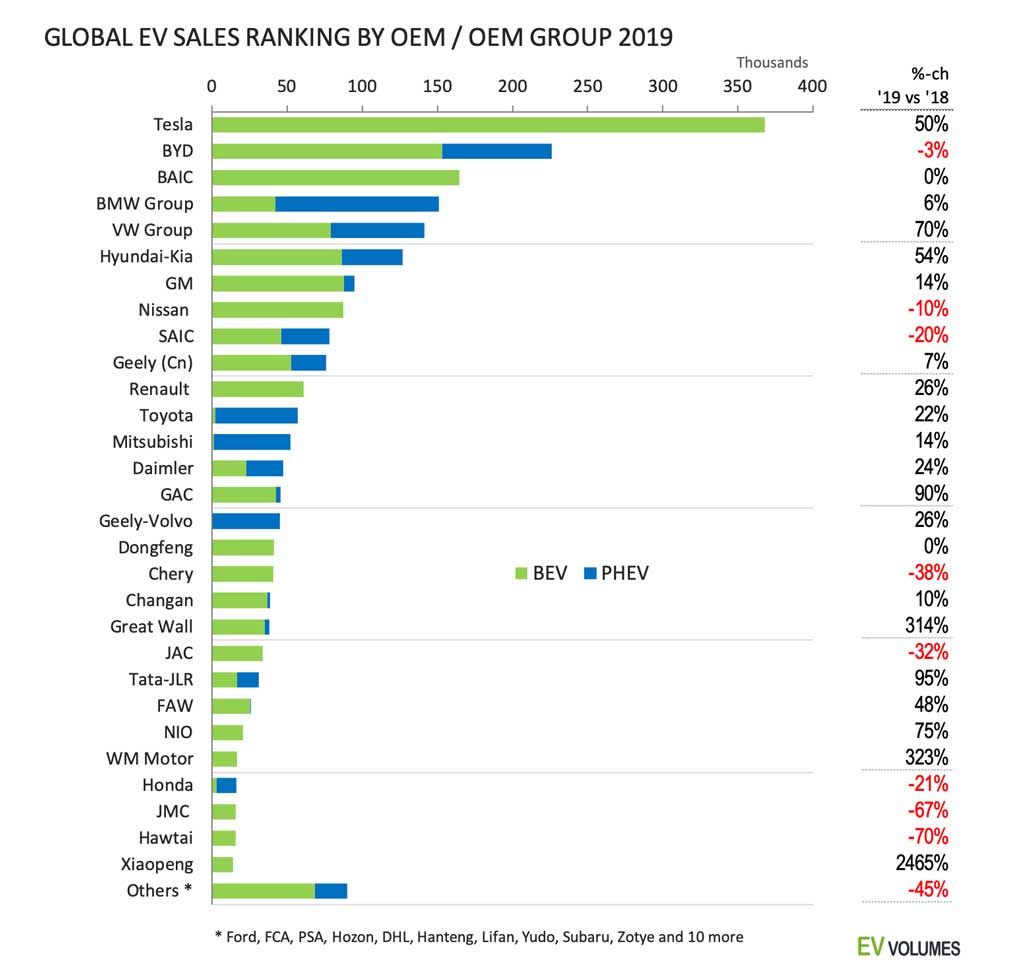

Tesla completed the roll-out of the Model-3 which is now available in 48 countries, the top-3 markets being USA (145k), China (34k, all imported) and the Netherlands (30k). With 368 000 deliveries incl. Model S&X, a 50 % increase over 2018, Tesla commanded 16 % share of global BEV&PHEV volume in 2019, 22% if only BEVs are counted.

The slump in China means that most of China’s previously fast growing NEV makers faced steep declines during the 2nd half of the year. Notable exceptions were Guangzhou Auto (GAC) with their new Aion S Sedan, Great Wall with the Ora mini-EV and FAW. Also the EV start-ups NIO, WM-Motor and Xiaopeng fared well, albeit from small volume bases. The larger Chinese OEMs created vast NEV portfolios in recent years, but saw volumes of many fresh entries crumple when they did not fit revised policies and requirements anymore. Waste at its worst.

Besides Tesla, the winners in terms of volume and growth were the VW-Group and Hyundai-Kia. VW mostly by expansion of local NEV production in China, Hyundai by the success of the Kona EV. BMW defended its #4 position, not more; GM gains from the Baojun J/V with SAIC in China. The Renault-Nissan-Mitsubishi Alliance would be #3 with combined volumes of 201k. One by one, Renault (Zoe) and Mitsubishi (Outlander) were among the winners, while Nissan (Leaf) was not. Toyota started building the Corolla/Levin PHEV siblings in China, adding 15k of sales, the ageing Prius PHEV is in decline. Volvo does with PHEVs only, but in nearly all models and in 58 markets, making the most out of it. JLR had the first full year of sales for the all-electric i-Pace and the Range Rover PHEVs, they now sell in 60 countries around the world.

BEV and Model-3 domination

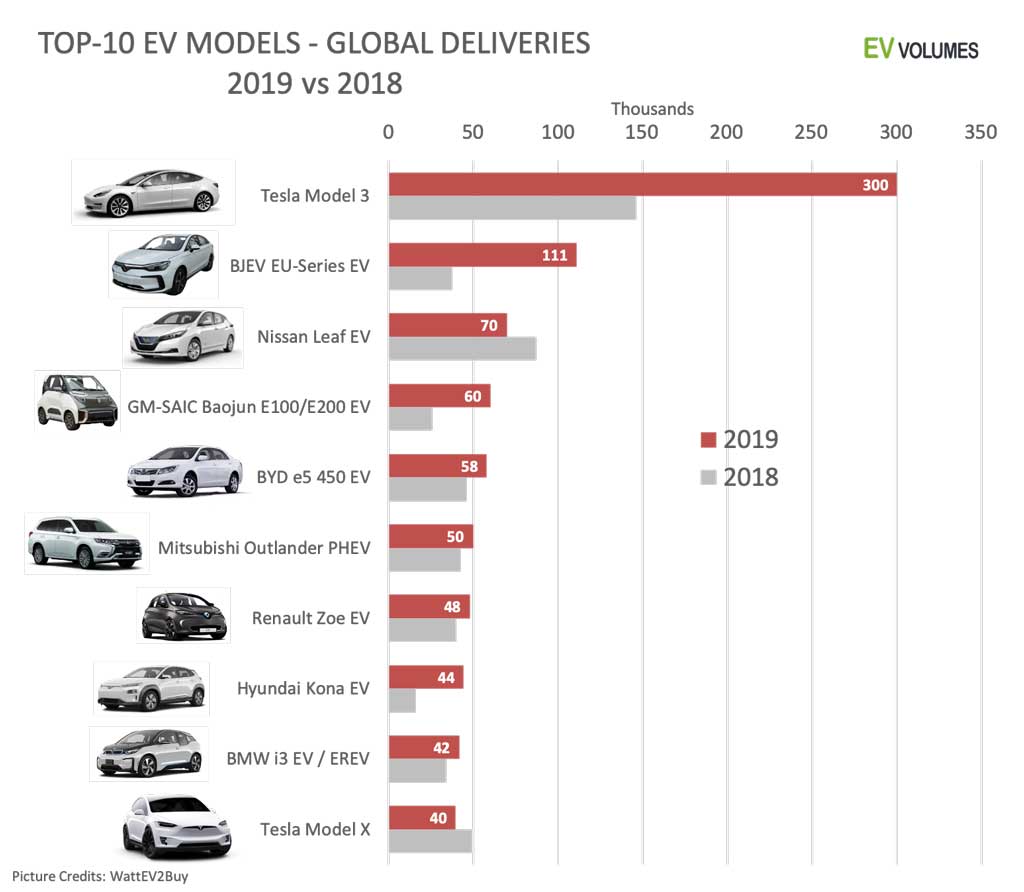

As expected, the new Tesla became the world’s best selling plug-in, with 300 000 deliveries last year. High volume sales outside USA/Canada started in January 2019 and nearly all the additional volume vs 2018 were from exports. The car sells without advertising or rebates and demand remained strong throughout the year.

Beijing based BAIC landed a real hit with the 2nd generation of the EU 260/400 series, aka EU5. It has become very popular among the cities taxi operators and hide hailers, supported by the plan to convert the taxi fleet to EVs and savings on operating cost.

The Nissan Leaf lost 17k compared to last year, despite the intro of a larger 62 KWh battery variant called e+, at a €6000 price premium. Too much in an environment where battery upgrades are offered every 2nd year without significant price hikes, read BMW i3, which is still going strong.

The BYD e5 gained for similar reasons as the BAIC EU5, but mostly around Shenzhen, where it is built.

The only PHEV in the 2019 top-10 is the venerable Mitsubishi Outlander, introduced 2013, face-lifted 2 times and still one of the few PHEVs which can use DC fast-chargers.

The Renault Zoe got re-designed for MY2020, Europe deliveries started in Q4 and reached 7500 units for 2019. 40k units were from the old model, unit sales unchanged vs the year before.

The Hyundai Kona BEV became an instant success, reasonably priced and with a 64 kWh battery option. A large order back-log indicates that the 44k do not reflect the real demand for this small SUV.

Excluding entries with less than 50 units of sales, 250 individual BEV and PHEV models (nameplates) were available worldwide during 2019. The top-50 models stood for 74 % of the global volume.

Close

Close