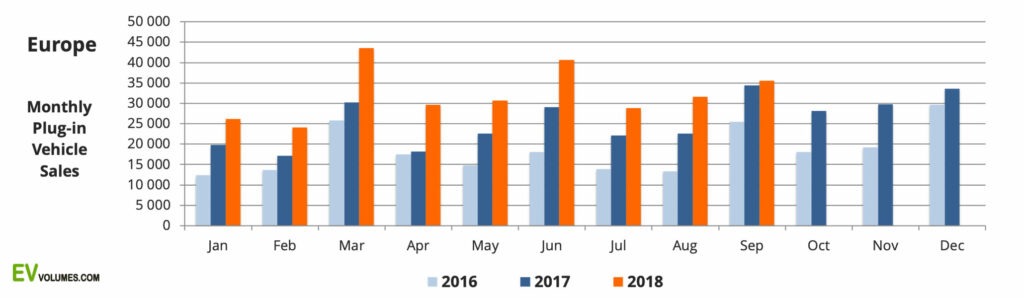

Plug-in vehicle sales in Europe reached 291 000 units at the end of Q3-2018, 35 % higher than for the same period of 2017. These include all Battery Electric Vehicles (BEV) and Plug-in Hybrids (PHEV) in Europe, passenger cars and light commercial vehicles. The plug-in share of the European light vehicle market reached 2,7 % in September, the highest ever for a single month. In terms of volume, September was overshadowed by the implementation of the new WLTP for fuel consumption. Plug-in volumes increased by just 3 % in September y-o-y, but in a total market down over 20 %, the plug-in share reached a new record. The downturn in September is the pay-back for 25 % overshooting in August, when the industry did its best to deliver ICE cars (incl PHEVs) with the outgoing, more favourable fuel economy certifications.

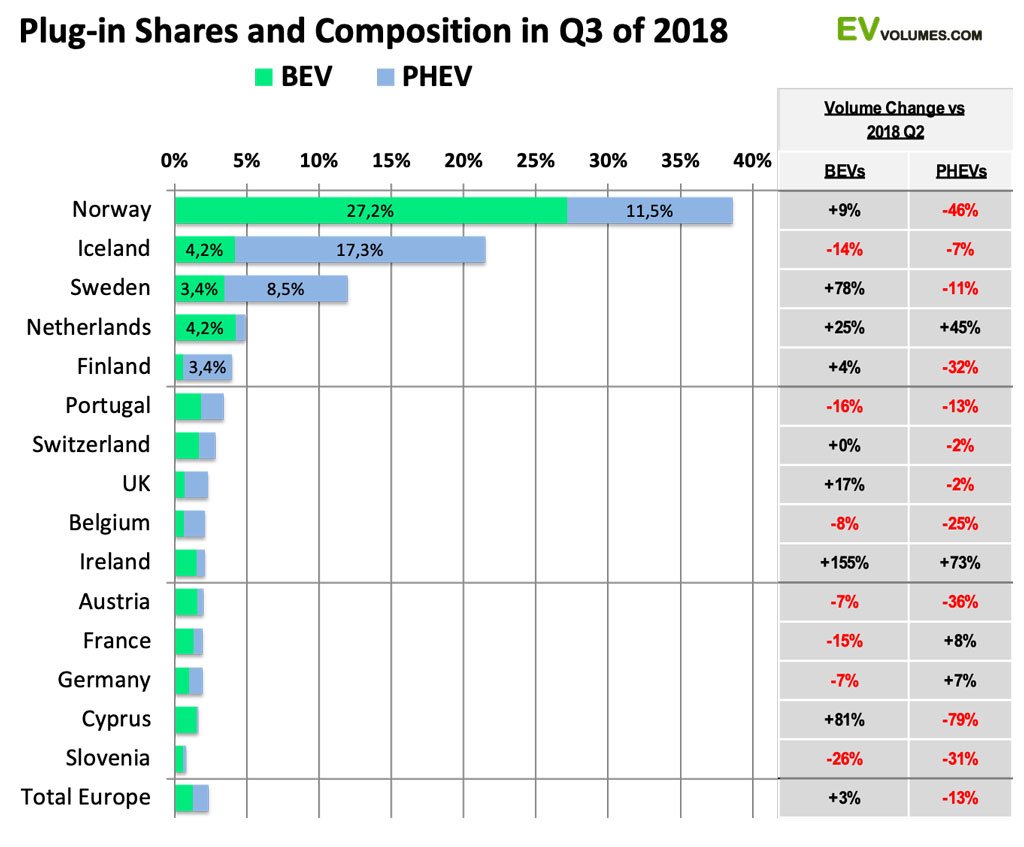

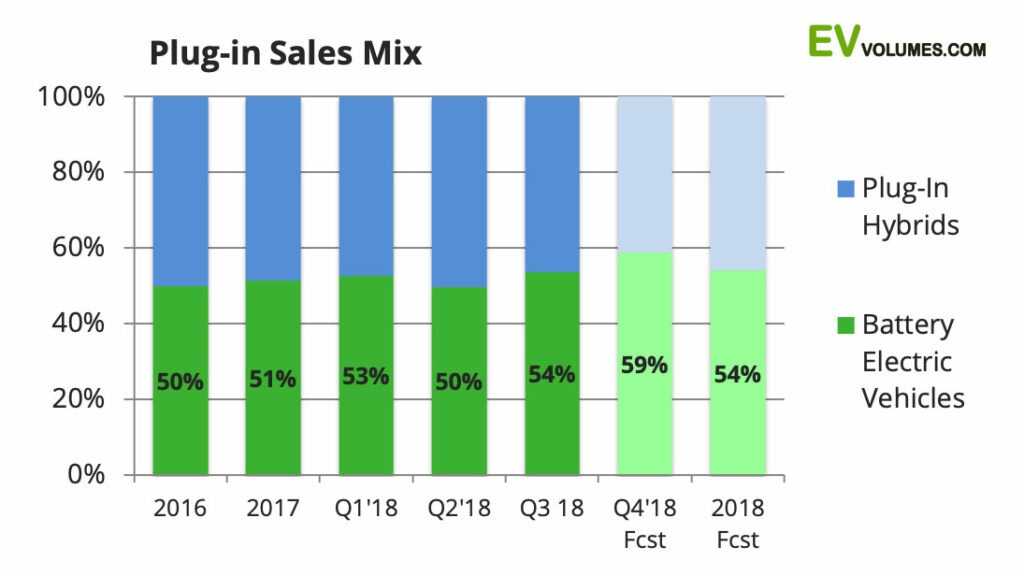

In addition, the new WLTP is much more elaborate than the outgoing NEDC and back-logs in variant type approvals are common. Low selling variants get lower priority in the test labs. This includes many PHEV variants of German OEM and inventories are drying up now. PHEV registration were down significantly in September and the first numbers we have for October show little improvement. Supply constraints for PHEVs have lead to higher sales of pure electric cars, which reached 62 % of all plug-in sales in September, where an average of 50 % is normal for Europe. For the complete Q3, PHEV sales were down 13 % vs Q2 and BEV sales were up 3 %. Volume losses were higher than gains.

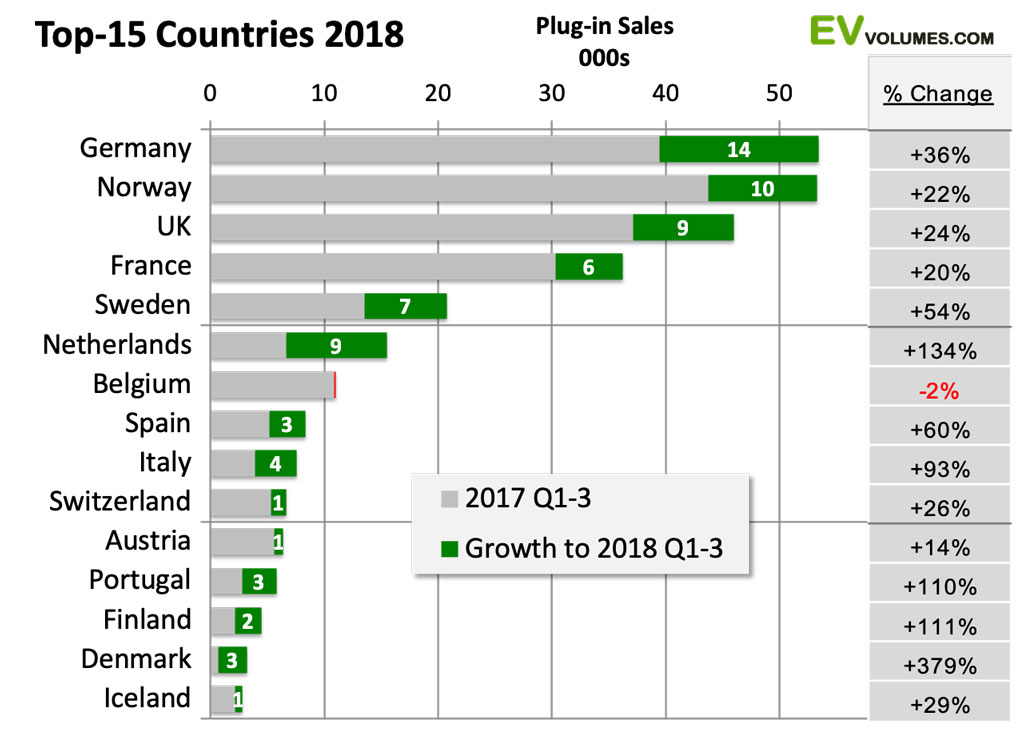

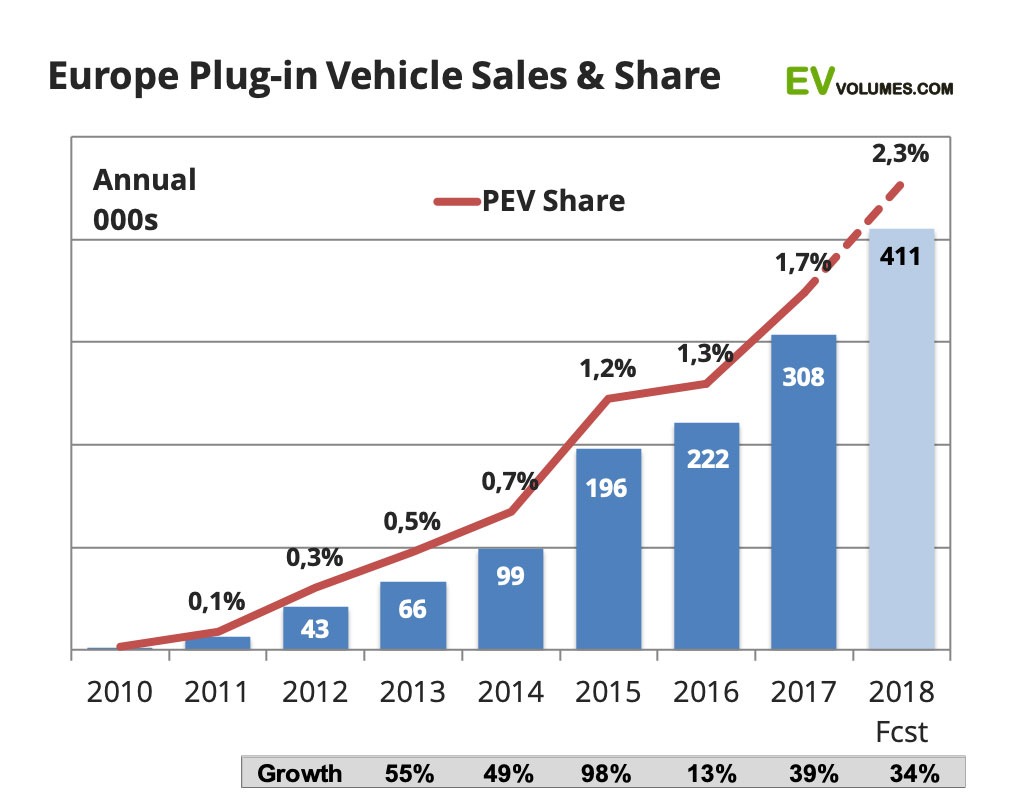

Nearly all Europe countries, except Belgium and Greece, posted growth for 2018 YTD, many of them over 100 %, albeit still from low volumes. For the full year of 2018 we now expect 410 000 plug-ins to be delivered in Europe, and a market share of 2,3 %. This is 20 000 units lower than our previous outlook in June and is solely related to supply constraints.

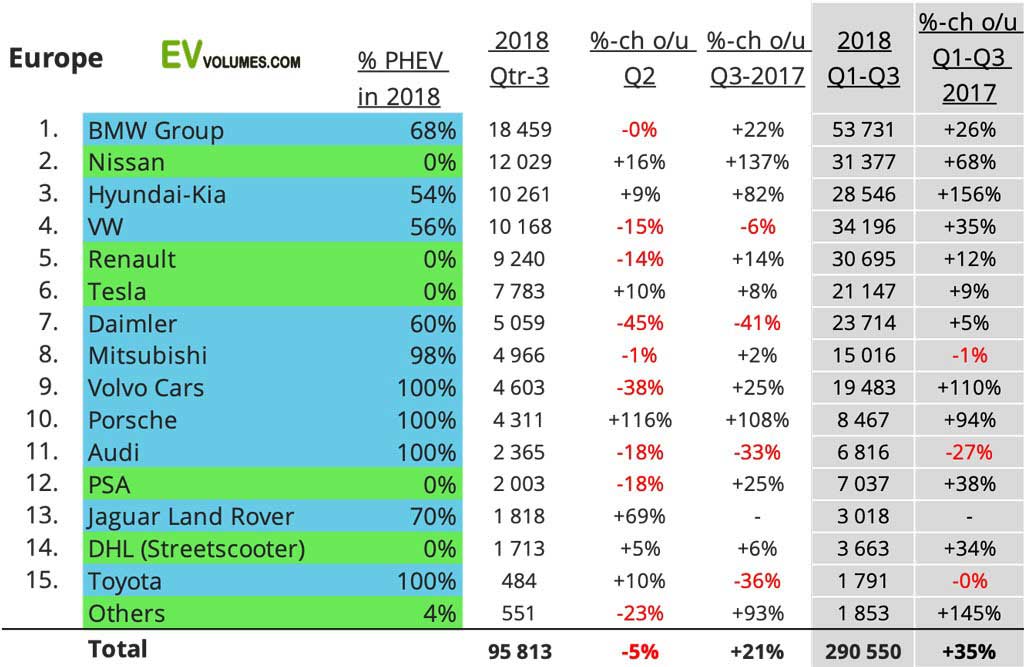

PHEV heavy-weights lose volume

VW, Audi and Daimler are hit hardest by the WLTP regarding plug-in sales. Most of their portfolio are PHEVs and their supply is drying up. Sales of popular PHEV entries like the Mercedes GLC and C-Class, the VW Golf and Passat, the Audi A3 and Q7 are declining fast. Model-year 2019 models are not available yet and it’s still unclear when they will be.

BEV brands have generally done better. The Q2 to Q3 drop of Renault and PSA can be explained with the August vacation doldrums in France. Otherwise they still show gains.

BMW still appears to be less affected, as the Mini Countryman and the BMW 2-series MPV are still selling well. Losses on the other PHEV models are accelerating, however. The successor of the popular 3-series PHEV will not be available until summer next year.

Porsche had a huge boost in Q3 by the new Cayenne, September deliveries indicate that the WLTP trouble starts even there.

Volvo had the low-point in the beginning of Q3 and sales are now recovering again.

BEVs compensated – partly

Since we published the results for the 1st half year, Norway’s Q3 share increased by another 2 %, Iceland crossed the 20 % line and Sweden reached 12,5 %. The Netherlands approach 5 % share, most of it BEVs. Then it drops quickly, reaching around 2 % in the larger economies.

Q3 was eventful regarding policies, with Sweden introducing the Bonus-Malus taxation system in July, Norway getting more weight conscious on PHEVs again, Germany announcing the Berlin package and, of course, the WLTP certification mandate from 1st September. It caused the August boom and the September bust in Europe’s car sales.

The effects on plug-in sales can still appear erratic when seen over one quarter, by country. The broader trend is a shift towards pure electric, as incentives favour more BEV sales and many PHEVs are on hold. Comparing Q3 with Q2, even seasonality (France, Belgium) can play in.

All in all, PHEVs sold 13 % less than in Q2, where they should have sold 10 % more. BEVs sold 3 % more than in Q2. A faster shift to more BEV sales was hampered by supply. The combined back-log of BEV deliveries can be as high as 70 000 units in Europe, with waiting times of up to 15 to 18 months for electric SUVs (Kona, Niro) from Hyundai-Kia.

Germany reaches Norway volume, South Europe on fast track

At the close of Q3, Germany lead the European country ranking over Norway by a tiny margin, 53 500 plug-in registrations, vs 53 300 in Norway, including LCVs. August, September and also preliminary October results have Norway on top again. Much likely, Norway will keep the #1 spot for 2018 after all, when the year is over.

Most Europe markets showed growth during the first nine months of 2018, though with varying pace. Plug-in sales in Netherlands and Denmark have turned around to rapid increases, following years of volume losses in adverse incentive schemes. France and UK continue with moderate increases as their domestic OEMs (PSA, Ford, Vauxhall) have less than compelling offers in the sector. Belgium has cut the incentives on luxury PEVs and sales declined by 2 %. Most others have double or triple digit growth during the period, albeit from smaller bases.

In total, Europe plug-in sales grew by 35 %, compared to Jan-Sep 2017. Q1 increased 40 %, Q2 by 45 %, Q3 by 21 %. Supply is likely to delimit the pace in the 4th quarter as well. With some optimism that the announce production increases of e-Golf, i3, Zoe, and Kona hit the market, we expect 30 % y-o-y growth for the 4th quarter. More PHEV certifications could relax the situation further.

Shifting to pure-electric

The usual 50:50 split of BEV and PHEVs sales in Europe is coming to an end now. Enforced by revised taxation schemes and more stringent ICE emission testing (WLTP), demand (and supply) shifts towards BEVs, which easily take these hurdles. In September, BEVs stood for 62 % of plug-in sales. The complete Q3 is lower as it includes the run on PHEVs in August. For Q4 we are expecting a BEV share of 59 % or higher.

We have expected this for some time, as a natural development in the coming years; now it hits us earlier, triggered by the WLTP drama. Too early it may be. PHEVs are still needed during the transition towards electrified transport, but they need to get better than just being NEDC cycle beaters. Further delay would certainly cause a dent in the overall sector development.

Growth still on track – for now

Growth in Europe has experienced set-backs since September, which are likely to continue into Q4. We do not expect the PHEV shortage to be compensated by BEV sales. Most car buyers will not easily replace one by the other and there are bottlenecks on BEVs, too. We have reduced the outlook for 2018 to a total of around 410 000 units, 20 000 lover than in the previous round. The resulting share is 2,3 % of Europes light vehicle sales.

The reduction is merely supply related. OEMs and their supply chains are still underestimating the short and mid-term demand of BEVs and PHEVs. Still, the increase over 2017 is 34 %, coming from the strong results of the first 8 months.

Regarding population, the number of plug-ins on the road reaches over 1,3 million cars and LCVs at the end of 2018. This is 43 % more than at the end of 2017, but it still represents only 0,44 % of the European light vehicle fleet.

Close

Close