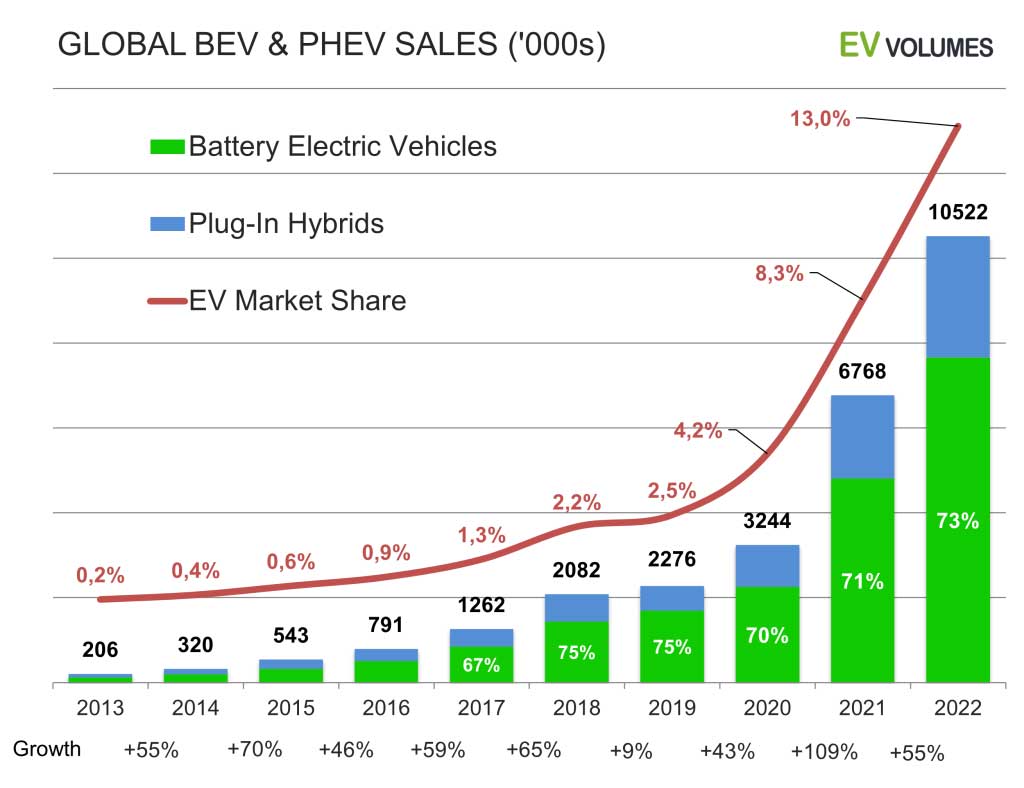

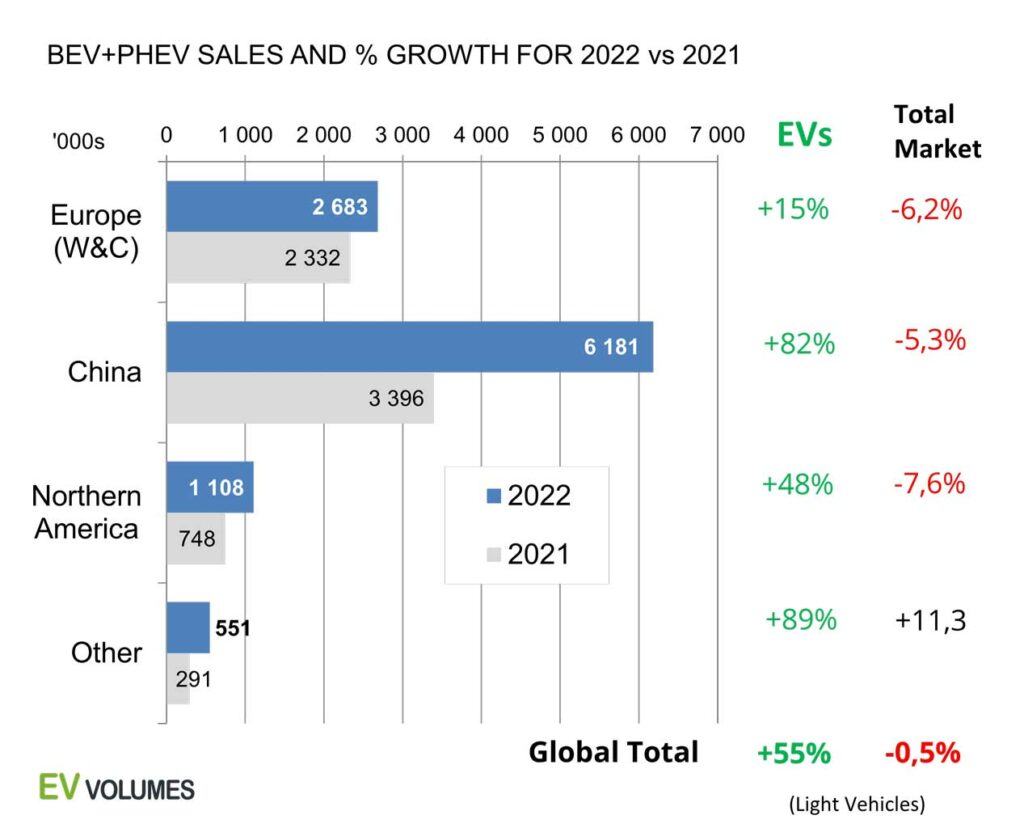

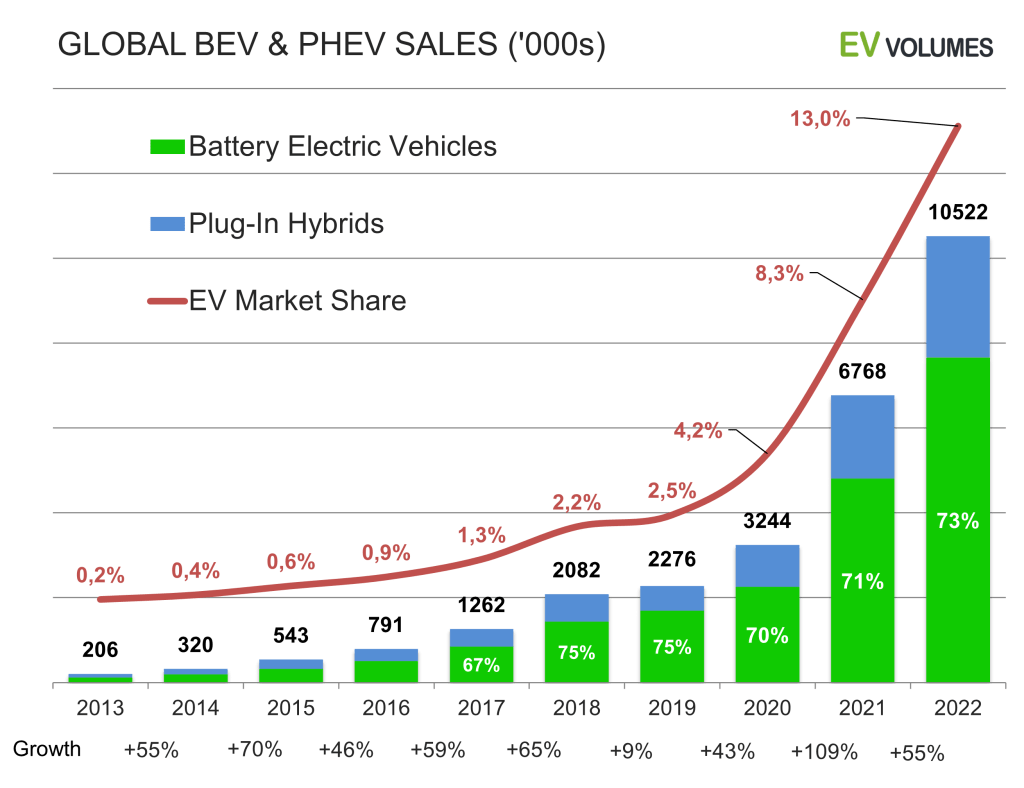

Global EV sales continued strong. A total of 10,5 million new BEVs and PHEVs were delivered during 2022, an increase of +55 % compared to 2021. The regional growth pattern is shifting, though. Following 2 years of steep sales increases in Europe, EVs gained only +15 % over 2021 there. Weak overall vehicle markets and persistent component shortages have taken their toll, exacerbated by the war in Ukraine. EV sales in USA and Canada increased by 48 % year-on-year, despite a weak overall light vehicle market which plunged by 8 % during 2022 y/y. The 2nd half of 2022 saw a cautious recovery of auto markets as numbers compared to the low results of 2021 H1. Global light vehicle sales for 2022, 81 million units, were still -0,5 % lower than in 2021 and -15 % below pre-2020 levels.

China NEV sales defied all headwinds the country faced otherwise (real estate crisis, Covid outbreaks and lock-downs) and increased by another +82 % year-on-year. BYD more than tripled sales to 1,85 million units, making it the #1 in the global sales ranking, if their 944 500 PHEV sales are included. Counting BEVs only, Tesla still leads by a wide margin with 1,31 million units delivered in 2022.

PHEVs stood for 27 % of global Plug-in sales in 2022 compared to 29 % in 2021. While their sales volumes still increased, their share in the PEV mix is in decline, facing headwinds from incentive cuts and improving BEV offers. Sales growth is increasingly depending on the degree of electrification. While BEVs grew by +59 % and PHEVs by +46 %, non-chargeable Full Hybrids grew by +15 % and Mild Hybrids by +1 % y-o-y. Global sales of vehicles which can be charged from the grid (10,5 m) were higher than for non-chargeable vehicles (8,4 m) for the first time in 2022. ICE-only vehicle sales declined by -7 %; their share in global light vehicle sales is 76,8 %, compared to 82,2 % in 2021. FCEV remain irrelevant for the electrification of light vehicles; their deliveries stagnated at 15 400 units in 2022, which is 0,02 % of the global, annual light vehicle volume.

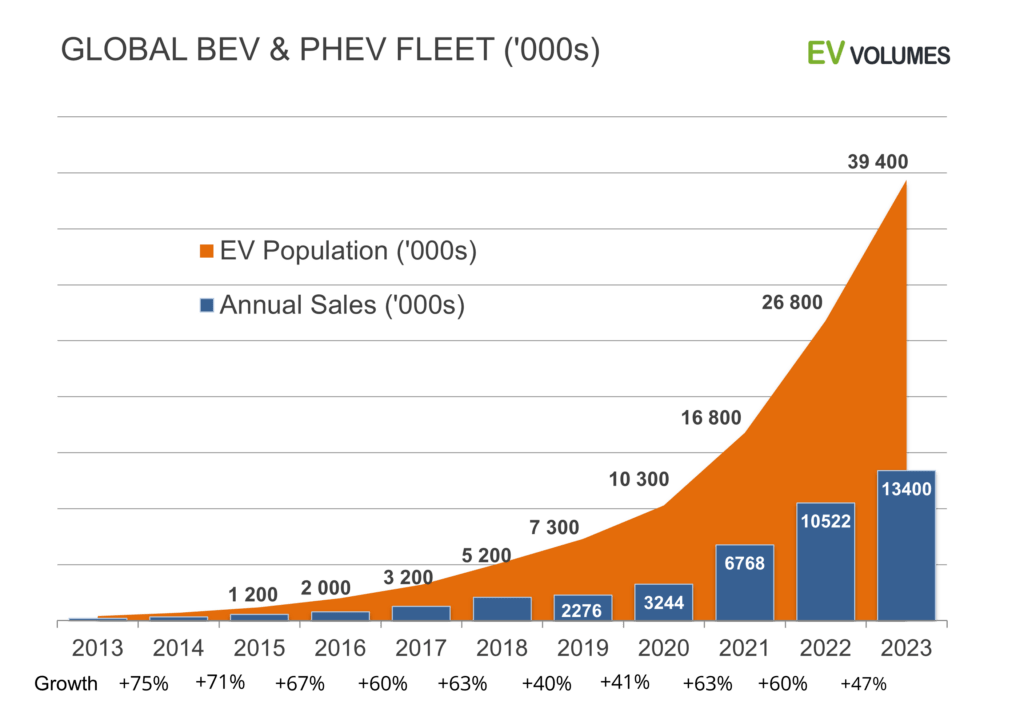

Rapid EV adoption in weak auto markets has boosted EV shares further. BEVs (9,5 %) and PHEVs (3,5 %) stood for 13 % of global light vehicle sales in 2022, compared to 8,3 % in 2021. Norway had the highest market share of EVs in H1 (BEV 71 % + PHEV 8 %), China had 27 %, Europe 20,8 % and USA 7,2 %. The fastest growing markets were Indonesia (from 1k to 10k), India with +223 % to 50k, nearly all BEVs, New Zealand +151 % to 23k for 20 % market share. EV supply and adoption is now spreading rapidly into the global south. November and December of 2022 saw demand distortions by coming reductions of EV grants in Europe and China and the IRA in the US for 2023. Demand for EVs and ICEs alike were pulled into 2022 or pushed into 2023. We expect irregular EV sales and shares in several countries for Q1 of 2023. For the full year of 2023, we expect sales of 14,3 million EVs, a growth of 36 % over 2022, with BEVs reaching 8 million units and PHEVs 2,6 million units. By the end of 2023 we expect nearly 40 million EVs in operation, counting light vehicles, 73 % are BEVs and 27 % PHEVs.

EVs Resilient to Market Declines

Most mature auto markets experienced double-dips in sales during the 2020 through 2022 period. Following the Covid crunch of 2020 and a +5 % recovery in 2021, 2022 sales dipped again, by 0,5 % vs 2021, with mature economies losing 5-10 % of auto sales. Meanwhile, most developing economies, notably India and the ASEAN countries continuing a their strong recovery.

EV sales were resilient to weak auto markets: They over-performed by 21 % in Europe, by 87 % in China, by 55 % in Northern America and by 78 % in the Non-Triad markets. While global light vehicle sales lost -0,5 % y/y, BEVs and PHEVs increased by +55 %. The relative weakness in Europe’s EV growth relates to the EV boom in 2020 / 2021 and the repercussion from the war in Ukraine.

China is, by far the largest EV market, with 59 % of global EV sales in 2022. Their role as the largest EV production base is even stronger, with 6,7 million units, 64 % of global volume, made in China. Nearly 580 000 EVs were exported from China, most of them (407k) by Western brands. The largest exporters were Tesla, SAIC, Dacia, Polestar, Volvo, Lynk & Co, BMW and BYD. All others exported below 10 000 units each.

OEM Ranking for BEV & PHEV Deliveries

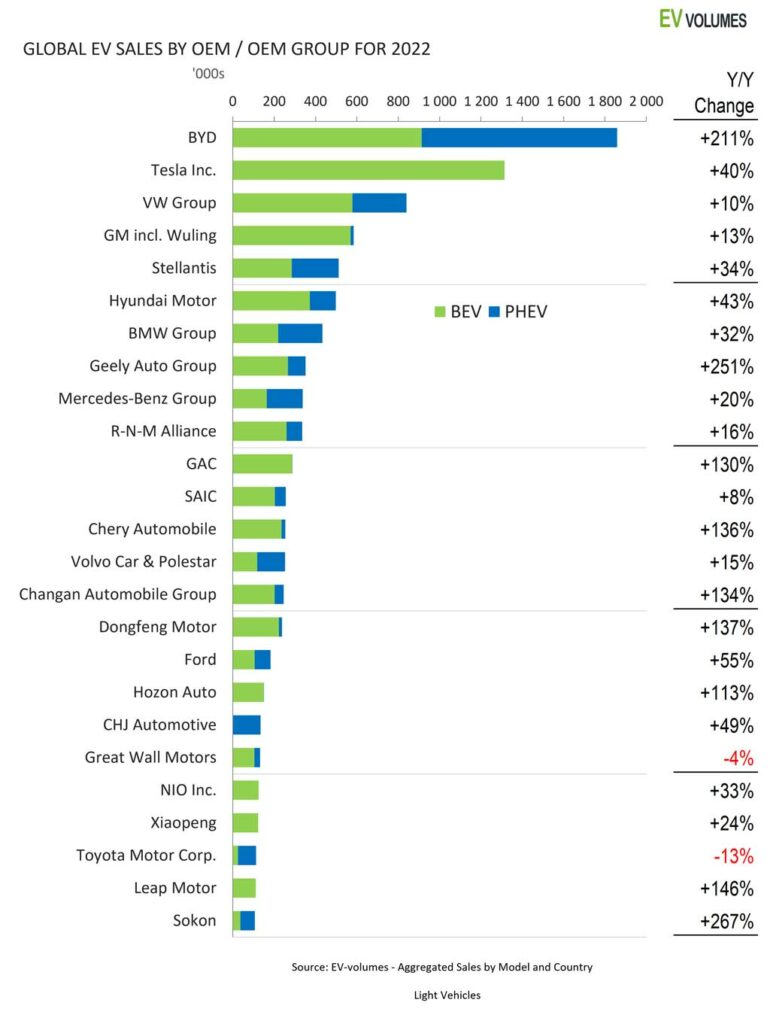

Robust increases of EV sales enabled nearly all OEMs to grow their sales in 2022. Global EV deliveries increased by +55 % y/y in total; OEMs with higher growth have increased their share in the EV sector.

BYD sold over 3 times as many BEVs+PHEVs compared to 2021, by boosting sales of existing models, successfully introducing new models and by entirely focusing production and sales on BEVs and PHEVs. Non-chargeable variants were phased out, ending in April 2022. BYD is now the largest maker of PHEVs and moved from rank #3 in 2021 to #1 for BEVs & PHEVs combined.

Tesla leads global sales of BEVs by a large margin, with a share of 17 % in all BEVs sold worldwide. Year-on-year growth was +40 %, less than for the sector, but from a high base.

The VW Group increased EV sales by just +10 %, staying flat in Europe compared to last year; BEVs gained, while PHEVs lost. Growth in China was +44 % y/y and +18 % in North America. The most popular EVs from the group were the VW ID.4, the ID.3, the Skoda Enyaq and the Audi Q4 e-tron, all of them BEVs and all MEB based.

The Wuling Mini EV has reached it’s sales peak; GM gained only +13 % for that reason. Excluding the Mini EVs, GM’s combined growth for EVs was +68 %.

Stellantis gained EV sector share in Europe and USA but with a small presence in China, Stellantis could not participate in the high growth there. The +34 % volume gain is still better than for many other western OEM.

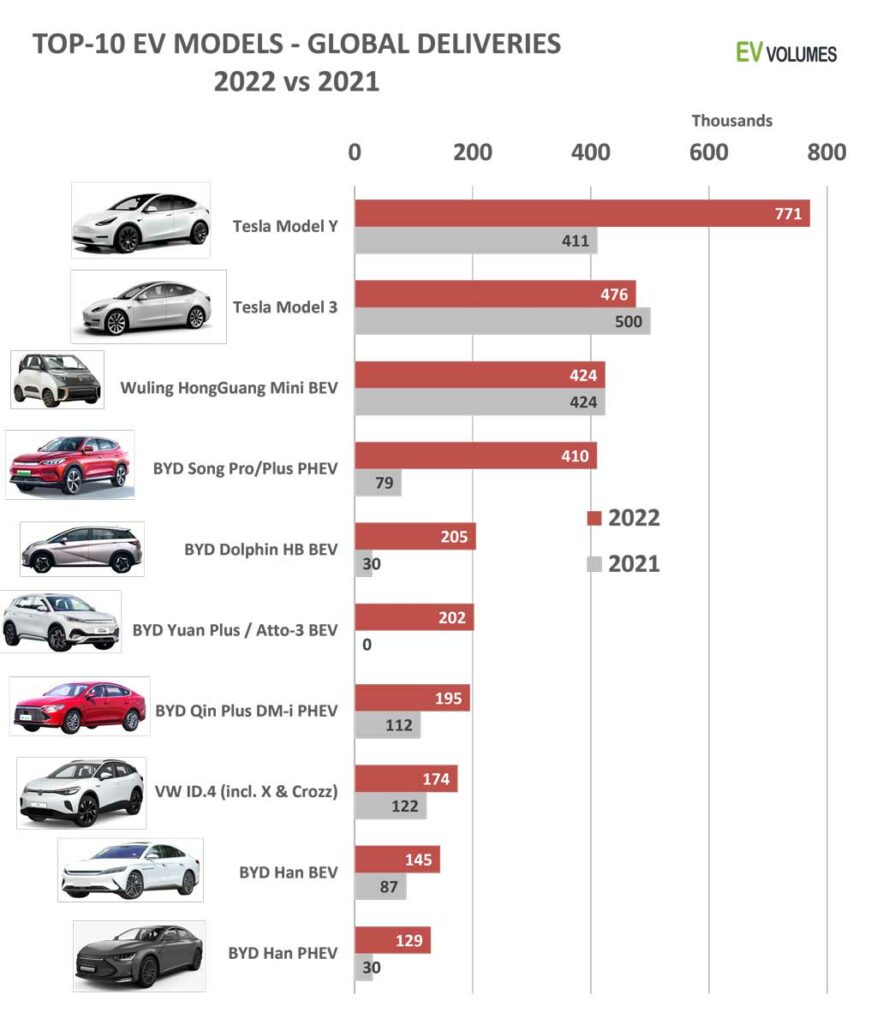

Top-10 Dominated by Tesla and Chinese Models

Tesla has a new best-seller, the Model Y, not only in the EV sector, but within all SUVs and Cross-Overs in this category, including ICEs. Household nameplates like the Toyota Highlander, Ford Explorer, BMW X3, Mercedes GLC, BYD Song, etc. usually sell 300-400 000 units per year globally. The Model Y reached 771 000 units in 2022, far more than any other ICE vehicle in this size and price bracket. The Model-3 took a beating, though, as Tesla prioritized production of the more sought after and more profitable Model Y. Still, the Model-3 outsold the Wuling Mini-EV last year for the first time.

GM-Wuling’s Mini EV sales stagnated as it faces more competition from similar concepts like the Chery QQ and other ultra-cheap mini commuters.

BYD had 6 models in the global top-10, with the Song, Qin, Han and Tang as the world’s four best selling PHEVs; a legacy from their regular ICE business which BYD abandoned in April last year. The Song PHEV is a mid-size SUV of 470cm length / 168cm height, the starting price was 153 000 RMB in 2022, less than half of a Tesla Model Y. There is a Song BEV variant with 71 kWh battery capacity for 180 000 RMB, which sold 67 000 units in 2022. The newcomers Dolphin and Yuan Plus had a flying start and are exported in larger numbers now.

The VW ID.4 is the best selling model from a European brand. Sales include the ID.4 X and ID.4 Crozz made by VW’s joint ventures with SAIC and FAW in China.

Outlook for 2023

Elevated fuel prices, concerns about climate change and energy security continue to support higher EV demand. Supply is catching up with demand now and waiting times are coming down. OEMs are reducing prices where margins allow, which improves affordability as a further catalyst for higher sales. We expect 14,3 million EV sales in 2023 with a market share of 17 % in global light vehicle sales. EV sales grow by +36 % in a global light vehicle market increasing +5 %.

For China we expect an NEV share of 35 % with volume growth of 30 % y/y to 8 million units BEVs & PHEVs, which is in line with e.g. CPCA expectations. The central NEV grant was dropped for 2023, but the purchase tax exemption stays for NEVs. Other stimuli for more private consumption could follow, if the economy develops below growth targets. The real NEV incentive is still the favorable allotment of number plates, which is restricted for ICEs in metropolitan areas.

For USA and Canada combined we expect BEV & PHEV sales to grow by +71 %, for a share of 11,5 % in total light vehicle sales. The IRA will stimulate EV growth in USA, favoring EVs produced in the North American region. The compliance with coming battery and material sourcing requirements is still unclear for many EV entries, however. BEVs and PHEVs assembled in USA, Canada and Mexico stood for ca 77 % total PEV sales in the US last year, up from 73 % in 2021.

Subsidy cuts and achieved CO2 compliance dampen the volume and share growth for EVs in Europe compared to the 2020 and 2021 boom. For 2023 we still expect Europe EV sales to increase 26 % over 2022 as EV tax incentives vs ICE vehicles stay intact in most counties. Over 60 new BEV and PHEV entries are expected for 2023, offering more choice and value improvements. Pure-play EV makers will see high growth as many legacy OEM prioritize margins instead of maximizing sales.

Fast but not fast enough

The number of EVs in operation world-wide reached nearly 27 million at the end of 2022, counting light vehicles. With ca 1,5 billion light vehicles in operation, this is still just 1,8 % of the global fleet and 1,3 % counting BEVs only. At the end of 2023 the BEV share reaches 2,5 % of light vehicles in operation.

The number of light vehicle on the road worldwide increases by 40 million units on average every year, as many as the entire current vehicle population of the UK. Last year, 8 million of this increase (20 %) were BEVs. The other 32 million newcomers (80 %) are still burning petrol or Diesel.

In a scenario towards 100 % zero-emission global light vehicle sales in 2045 (as an example for the math), the total number of BEVs in operation reaches 1,1 billion, while the total number of vehicles in operation reaches 2 billion in 2045. By then, over 55 % of the stock are BEVs but the sobering truth is also that, with current scrapping rates, over 40 % of vehicles in operation still need to burn fuels.

The full transition to BEVs needs to accelerate, because the positive impact on CO2 emissions comes with a considerable delay. Fast EV adoption is a prerequisite for sustainable personal mobility.

Close

Close