Europe’s electric vehicle (EV) market has slowed in the first half of 2024. But how will it affect the market this year and beyond? Neil King, head of forecasting at EV Volumes, presents the latest forecast with Autovista24 special content editor Phil Curry.

Europe’s new light-vehicle market, made up of passenger cars and light-commercial vehicles (LCVs) is undergoing a difficult year in 2024, following its bounce back from various challenges last year.

The passenger-car market has seen slow growth, with declines in March and May, while the LCV market is currently performing well, but offers smaller volumes into the new light-vehicle sector.

The latest figures are compared to a period, however, where volumes increased rapidly, following the impact of a supply-chain crisis in 2021 and 2022. This was exacerbated by the war in Ukraine, and the fallout from the COVID-19 pandemic.

Yet, the market this year is more subdued, due to high interest rates and the continuing cost-of-living crisis.

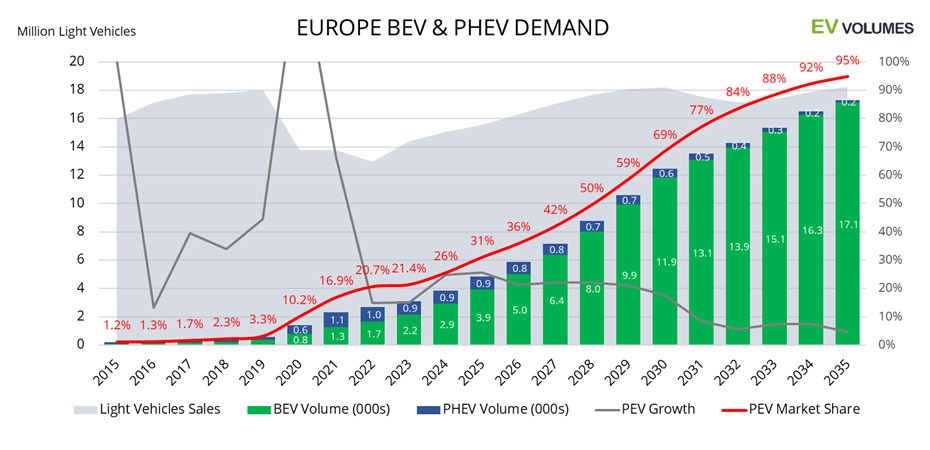

With this in mind, EV Volumes has revised its forecasts from March 2024. The European new light-vehicle market is now expected to grow by 2.6% this year, a lower figure than the 3.1% improvement forecast earlier this year.

The 15.1 million units this equates to is far short of the 18 million vehicles registered in Europe during 2019. EV Volumes does not see the European market returning to this level during the current forecast horizon, which runs to 2035.

EV market fluctuates

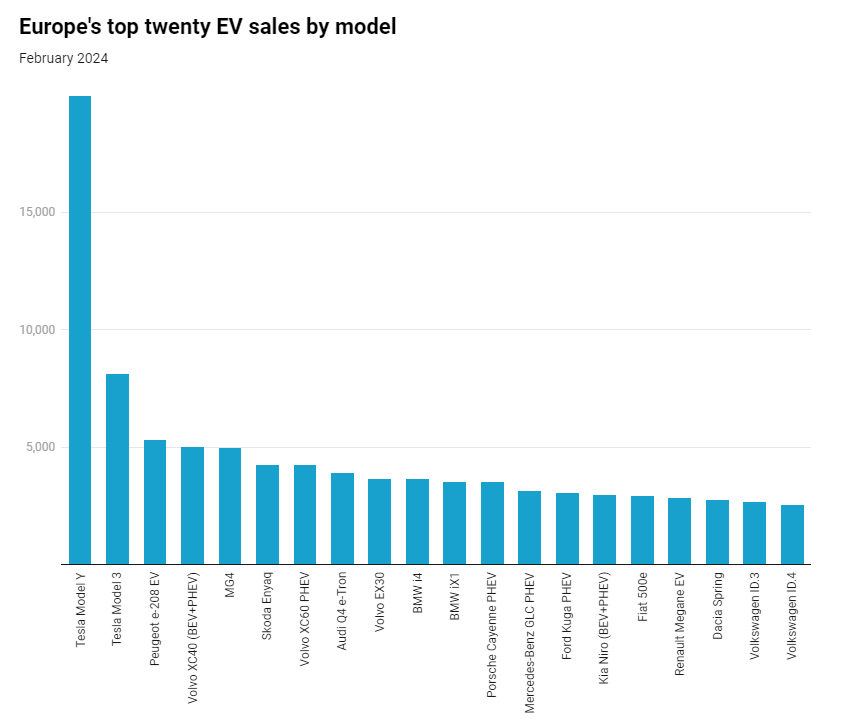

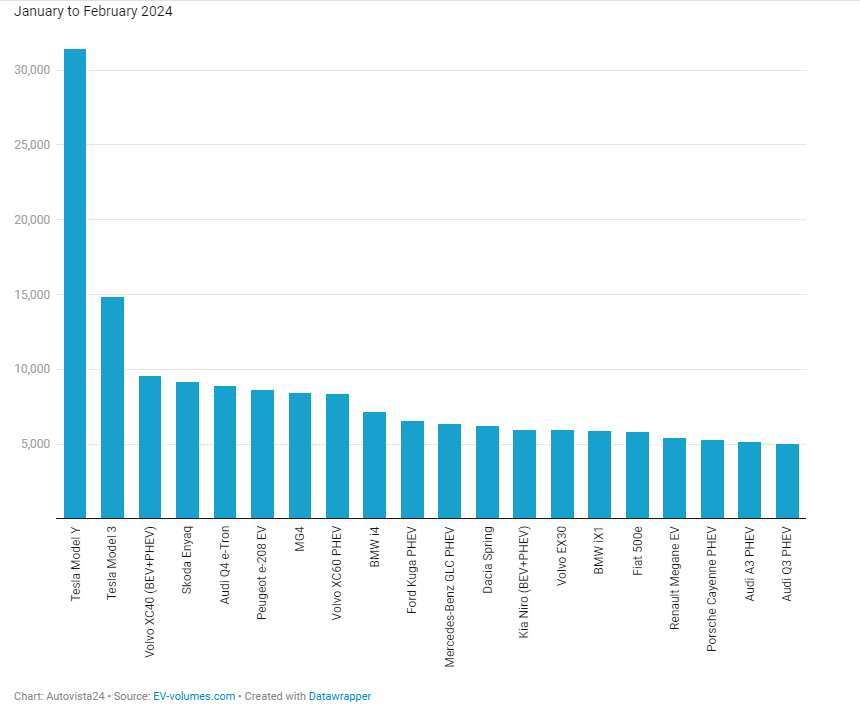

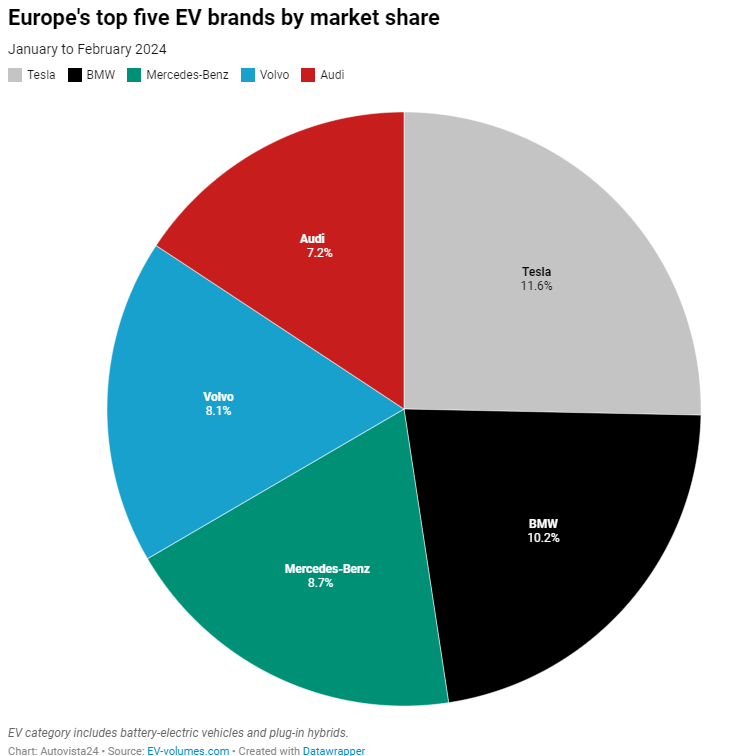

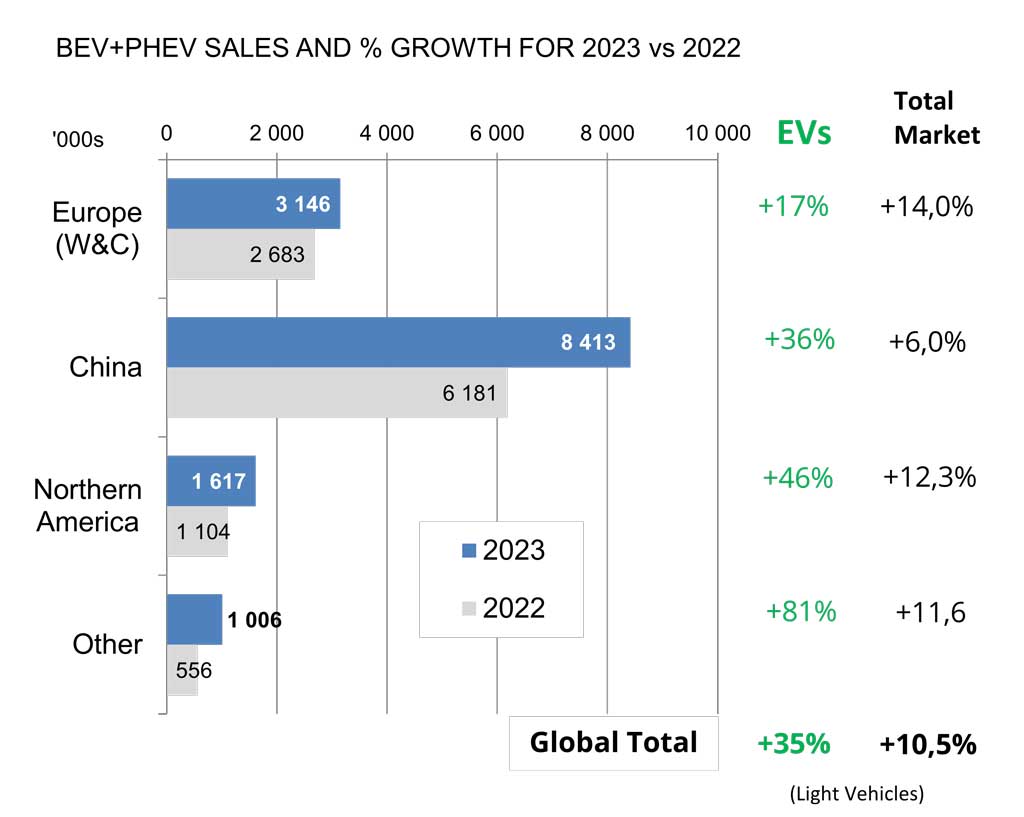

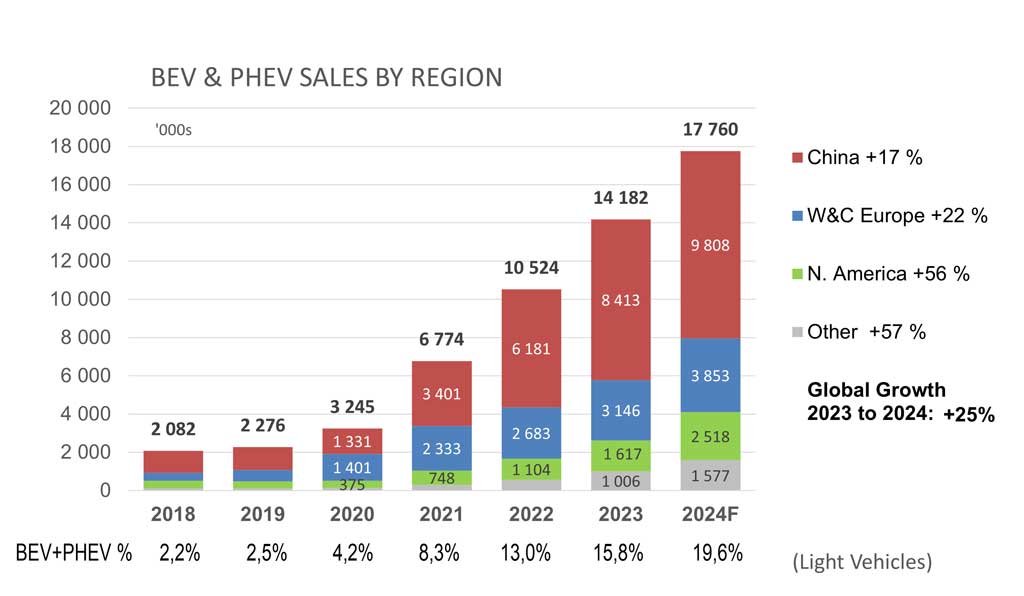

In 2023, European new EV deliveries, made up of battery-electric vehicles (BEVs) and plug-in hybrids (PHEVs) increased by 17.4% year on year. A total of 3.15 million units were registered, gaining a 21.4% market share, up from the 20.7% share seen in 2022.

This is despite many countries, including Germany, France and Ireland, reducing incentives for EVs during the year, especially for PHEVs. Even Norway, a leading market in plug-in adoption, ended its VAT exemption in the year.

Germany abruptly ended incentives for BEVs in December, Ireland reduced purchase subsidies in July, and France has further reduced their incentives, removing them completely for company-car buyers and vehicles imported into Europe. Also, in January of this year, Switzerland completely removed the 4% import tax exemption for BEVs.

In addition, most legacy OEMs can stay safely below their CO2 limits without selling more EVs. This means they can turn their attention back to more profitable internal-combustion engine (ICE) vehicles.

However, there have been positive steps in the EV market this year. Italy has introduced a new incentive scheme, while countries such as Spain and Poland are considering the revision of plug-in purchase subsidies.

There are also more affordable BEVs rolling out, such as the Citroen e-C3. Meanwhile, global EV leader BYD has expansion plans for the region, as do other Chinese OEMs.

Slowdown continues

EV Volumes has lowered its forecast for EVs in Europe’s new light-vehicle market this year. The sector is expected to grow by 4.9% compared to 2023, despite the anticipated lacklustre growth of the wider light-vehicle market. The technology is predicted to account for around 22% of all new light-vehicle sales.

Volumes of BEVs are forecast to grow 5.4% and take a 68.9% share of the EV market. However, EV Volumes forecasts 3.7% growth for PHEVs, as they offer a stepping stone to full electrification. In addition, incentive changes mean BEVs have lost their price advantage in markets such as Germany, for example.

This forecast does not factor in the import duties that the European Commission is proposing to apply on BEVs imported from China. Talks between both governments are continuing, with Chinese authorities looking to avoid tariffs of up to 38.1% being applied to vehicles imported into Europe. Should talks fail, these will apply provisionally from 4 July, with final tariffs confirmed in November of this year.

Compared to the previous forecast, EV Volumes has slightly lowered its 2024 volume and share expectations for EVs in Europe. This is partially because of the lower overall market outlook, but is mainly due to the sluggish growth across multiple markets and the lacklustre recovery of BEV demand in Germany in particular.

The European market share of EVs is now forecast to reach 25.9% in 2025, down from the previous forecast of 29.4%. In 2030, this will grow to 62.2% (originally 67.3%) and will reach 94.1% in 2035, a slight reduction from the previous 94.5% figure.

The forecast for 2035 includes some tolerance for timing interpretations of the continent’s zero-emission vehicle (ZEV) mandate. It also allows for exemptions for ICE vehicles that may be deemed unsuitable for full electrification.

LCV Growth

New LCVs still lag far behind in EV uptake. Yet their 49% growth in 2023 is encouraging, especially compared to the 16% growth for passenger cars.

High prices compared to diesel LCVs are still a barrier to adoption. However, key new products such as the Ford Transit, Renault Trafic, and VW Transporter BEVs, will bolster demand. Upgraded versions of the small, medium, and large electric vans offered by Stellantis brands will also improve volumes.

EV Volumes now forecast that the EV share of LCVs will climb from 7.5% in 2023, which itself was up from 5.8% in 2022, to an 8.6% hold of the market in 2024. This will increase to an 11.8% share in 2025, with the technology taking 53.4% in 2030.

Long term, the ZEV mandate for 2035 will further accelerate the transition to pure-electric LCVs. The forecast assumes that all Western and Central European markets will follow the directive, allowing for some exemptions and grace periods. Therefore, the ZEV share does not reach 100% in 2035, but EV Volumes forecast a 93.3% share, compared to 94.2% for passenger cars.

The role of e-fuels and other CO2-neutral ICE fuels is still uncertain but will likely be limited to niche concepts, also depending on national tax regimes. EV Volumes also expect the deployment of hydrogen fuel-cell vehicles (FCEVs) to be limited in light commercial vehicles, with their share peaking at just 0.02%.

Go to Autovista24 for related articles.

Close

Close