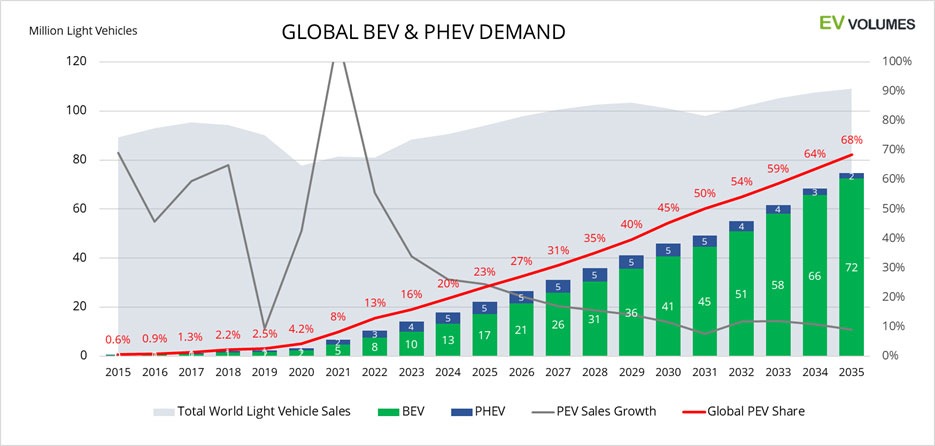

We forecast that global EV sales, comprising battery-electric vehicles (BEVs) and plug-in hybrids (PHEVs), will reach 14.1 million units in 2023. This equates to EV sales growth of 34% compared with 2022.

Meanwhile, the entire light-vehicle market, which includes passenger cars and light-commercial vehicles, is only predicted to rise by 9%. EVs are therefore expected to take a higher 16% share of the global light-vehicle market this year.

This market penetration rate is slightly lower than predictions made earlier in the year, especially as the 2023 EV share in China is now forecast to be 33%, down from 35% previously. However, over 300,000 additional EV sales are now expected globally in 2023, largely thanks to a stronger outlook for total light-vehicle sales in China.

EV uptake has weakened in North America, while recent subsidy cuts in European markets like Germany, Sweden and the UK have damaged demand, particularly for PHEVs. Accordingly, the global EV share is predicted to be lower throughout the decade than previously forecast, reaching 23.5% in 2025, then 45.3% in 2030, and 68.4% in 2035.

The unit volume of global EV sales is set to triple from 10.5 million in 2022 to over 31 million in 2027. It is expected to more than double to over 74.5 million units in 2035.

The number of EVs in operation will rise rapidly. But with 1.33 billion light vehicles currently on the road, EV-volumes forecasts that by the end of 2030, electric vehicles will only account for 15% of the global parc, assuming normal scrappage rates.

This will increase to nearly 30% by the end of 2035, with EVs only accounting for half of all operational light vehicles by 2042.

Tesla to take the EV lead from BYD

Once again, China is the main driver for global volume and growth. However, it is also the main source of forecast uncertainties, with economic headwinds hanging over the automotive sector alongside potential policy changes that could disrupt EV uptake.

Buoyed by the Chinese market and an increased PHEV offering, BYD overtook Tesla to become the world’s biggest EV manufacturer in 2022. For 2023, BYD is expected to deliver over three million EVs, compared to 1.8 million units for Tesla.

However, Tesla remains the largest BEV player globally. With the rollout of the refreshed Model 3 and the Cybertruck, as well as an anticipated compact crossover and hatchback in 2024 and 2026 respectively, it is forecast to be the leading EV maker globally from 2025.

Meanwhile, Volkswagen (VW) Group is expected to exceed the one million EV mark in 2024, with Hyundai Motor, General Motors (GM), and Stellantis expected to follow suit in 2025.

Lower European expectations

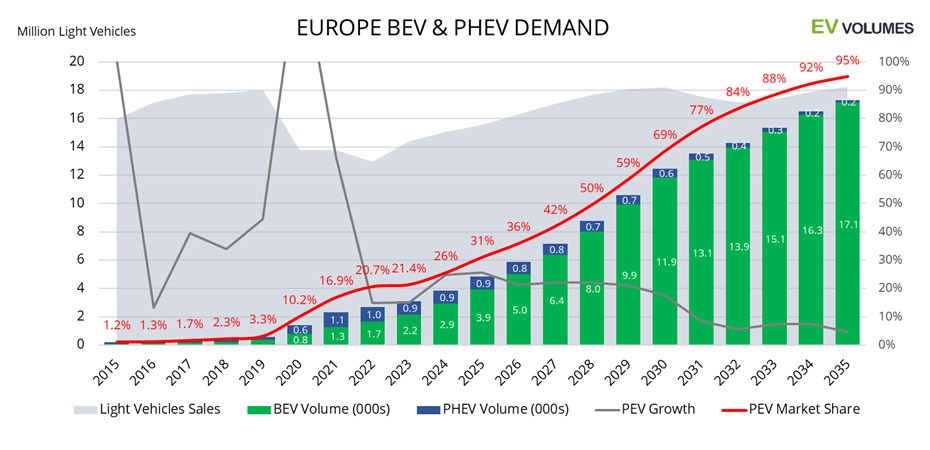

In Europe, better products, higher EV incentives and the 95g/km CO2 mandate for average fleet emissions stimulated demand and supply beyond expectations in the second half of 2020 and 2021. BEVs and PHEVs accounted for 16.9% of Europe’s new light-vehicle market in 2021, before reaching 20.7% in 2022.

The volume of EV sales increased by 15% in 2022 while Europe’s total light-vehicle market declined 6% year on year. For 2023, European EV sales can be expected to gain a further 15% over 2022, supported by a brisk light-vehicle market recovery of 11.3% year on year.

PHEV numbers are retreating, meaning BEVs are broadly responsible for year-on-year growth. The all-electric powertrain is expected to see another year of 30% volume growth, trending towards a 70% share of the 2023 EV market.

EV-volumes has improved its outlook for total European light-vehicle sales but lowered its EV share and volume expectations. This is because of the lacklustre performance of PHEVs, the end of incentives for non-private buyers in Germany, as well as the UK extension of the new-car internal-combustion engine (ICE) ban from 2030 to 2035.

While new tax rebates in Spain will support higher EV uptake, the net effect will not be enough to balance out the negative influences. Europe’s EV market share is now forecast to reach 21.4% in 2023, climbing to 31.1% in 2025, then 68.6% in 2030, and 94.9% in 2035.

The forecast for 2035 includes some tolerance for timing interpretations of the zero-emission vehicle (ZEV) mandate in the EU and UK. It also allows for exemptions for ICE vehicles that may be deemed unsuitable for full electrification.

The EU zero-emission mandate for 2035 still leaves room for e-fuels, with support mounting in Austria and Germany for example. So, the BEV share forecast has been lowered slightly in the later forecast years.

EVs sourced from China keep gaining ground in Europe, exemplified by surging sales for MG, particularly the MG4. With other Chinese players such as BYD extending their presence in the region, the share of EVs produced in China increased from 11% in 2021 to 16.6% in 2022. However, up to 60% of these EVs are Chinese exports for European brands.

This percentage is forecast to climb to 18.6% this year, before falling from 2024. This is because of Tesla ramping up production in Germany, alongside European carmakers localising production.

Chinese EV expansion

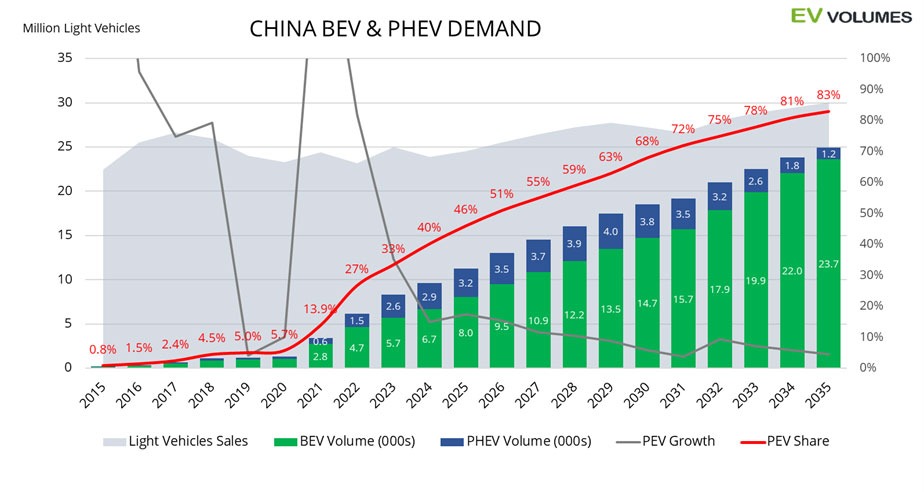

In China, the EV boom continued into the second half of 2022. This brought the EV market share to 26.7% last year versus 13.9% in 2021.

New-energy vehicles (NEVs) – including BEVs, PHEVs and hydrogen fuel-cell electric vehicles (FCEVs) – were given an official government target share of 20% by 2025, meaning the objective was reached three years early.

By 2030, the stated aim is for the NEV share to reach 40%, then at least 50% by 2035, which is an unlikely scenario for the long-term outlook. For 2023, EV-volumes forecasts a 33.4% EV share, with year-on-year volume growth of 35%, reaching 8.35 million units.

While EV-share expectations have been reduced, the resilience of the wider light-vehicle market means plug-in volume assumptions still exceed previous forecasts. This is despite an underwhelming economic recovery, post-COVID-19 restrictions, and an ailing domestic real-estate sector. However, this may also mean consumers are turning their attention back to vehicle purchases.

Our forecast for China is not restricted by target shares or capacity limitations. EVs are expected to account for 46% of light-vehicle sales in 2025, growing to 68% in 2030, and 83% in 2035. Growth rates suggest even faster electrification of the market, but caution remains due to high regulatory and economic uncertainties.

With recent policy reversals emphasising higher priorities, crackdowns on sectors with hyper growth are possible. EV-volumes’ Chinese figures cover retail sales (not wholesales) for both historic and forecast volumes, excluding exported units and inventory build-up.

The Chinese EV market has swung towards PHEVs in recent years. The powertrain accounted for 18% of all EV sales in 2021 and rose to 25% in 2022. This is largely the result of growing sales of BYD PHEVs and range-extended hybrids from Li Auto.

This trend is likely to persist, with PHEVs forecast to make up 31% of the EV mix this year. However, BEVs are likely to gain ground again from 2024 onwards.

A-segment (city car) EVs are particularly exposed to the turbulence in China, whereby their share of the EV market plummeted from 23% in 2021 to 15% in 2022. It is expected to decline further until the economy can overcome the prevailing headwinds.

Three key new models now dominate the segment, namely the Changan Lumin BEV, the Geely Panda Mini BEV, and the Wuling HongGuang Mini BEV. This has compounded the volume woes of OEMs such as BAW, Chery, Dongfeng, Great Wall, JAC, Leapmotor, and SAIC.

The A-segment is also being squeezed by consumers buying new B-segment (small car) EVs in their droves, such as the BYD Dolphin and Seagull, as well as the Wuling Bingo. The A-segment share of the Chinese EV market is forecast to halve this year, falling below 8%. Meanwhile, the B-segment is expected to jump from a share of 1.7% in 2022 to 5.5%.

North American fall

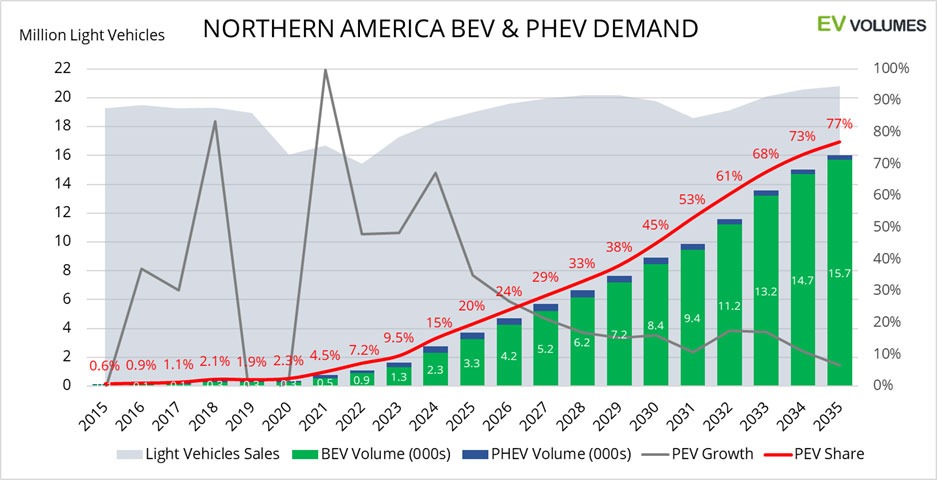

North America, including the US and Canada, saw EV sales increase by 48% year on year in 2022, following 100% growth in 2021. The EV share of light-vehicle sales is forecast to reach 19.5% in 2025, increasing to 45% in 2030 and 77% in 2035.

In terms of the BEV-PHEV mix, all-electric models are expected to account for 80.5% this year, rising to 88.1% in 2025, then 95% in 2030, and 98% in 2035.

The Inflation Reduction Act (IRA) supports further EV growth in the US, even if compliance with upcoming battery and material-sourcing requirements remains unclear for many EV entries. The IRA is assumed to stay effective until 2032.

The incentives for producing vehicles and batteries in the region remain strong but also imply handicaps for imported brands and models. However, there is a loophole whereby imported EVs can qualify if they are leased instead of purchased.

Furthermore, strikes by the Union of Auto Workers (UAW) have highlighted the risk that EVs may pose to domestic OEMs and jobs, which may shift consumer sentiment.

Alongside the comparatively slow growth in EV uptake so far this year, EV-volumes has reduced its growth forecast to 48% for 2023, with 1.64 million units equating to a 9.5% share of light-vehicle sales.

While the overall market recovery is stronger than expected, the EV share and volume forecasts for 2023 to 2025 have been lowered following confirmations of capacity constraints for several popular models.

The medium and long-term forecasts have not changed significantly. EV growth is supported by localised product portfolios and expansion into the popular full-size SUV and pick-up segments. This includes the Ford F-150 Lightning, Chevrolet Silverado, Equinox and Blazer, Jeep Recon and Wagoneer S, Ram 1500, and VW’s Scout brand.

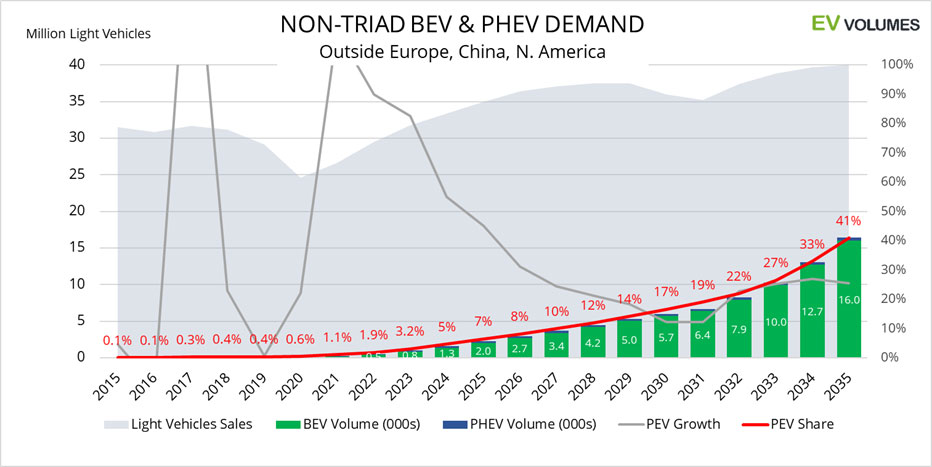

Non-triad rise

The non-triad region includes Asia (excluding China), Eastern Europe, Middle East and Africa, Central and South America. This market saw EV volumes rise sharply for a second consecutive year in 2022, albeit from a low base.

This was thanks to better availability of products, higher EV incentives, and lowered import tariffs in some countries. The strong recovery of the wider light-vehicle market since 2020 has also contributed.

Combined EV sales in the non-triad markets hit 292,000 units in 2021 and reached 554,000 units in 2022, with growth of 90%. The largest contributors were South Korea (over 55,000), Japan (over 51,000), India (over 35,000), and Australia (over 20,000). Other beacons were Hong Kong, Taiwan, and New Zealand, which are all small vehicle markets but have a high EV share.

Nevertheless, the combined EV share sat at just 1.9% in 2022 as large vehicle markets like Japan, Russia, Turkey, Brazil, Argentina, Mexico, and the ASEAN (Association of South East Asian Nations) countries still sell very few electric vehicles relative to their market size. This also pulled down the global average EV share, as the non-triad countries account for over 35% of the world’s light-vehicle sales.

However, the potential in these markets is increasing, as lacklustre economic growth in China is likely to favour many of the non-triad economies. Increasing EV export volumes from China and localisation plans by Western, Chinese, and Japanese OEMs for EV and battery production, provide strong encouragement.

Many developing countries impose high tariffs on vehicle imports. Unless EVs are exempt, these countries will need to develop their own EV industry to catch up with the adoption in mature markets.

For 2023, we expect an EV share of 3.2% in the non-triad countries and just over one million EV sales. The EV share is forecast to hit 6.5% in 2025, reaching 16.6% in 2030 and 41% in 2035, trailing global EV adoption by about six years.

Close

Close