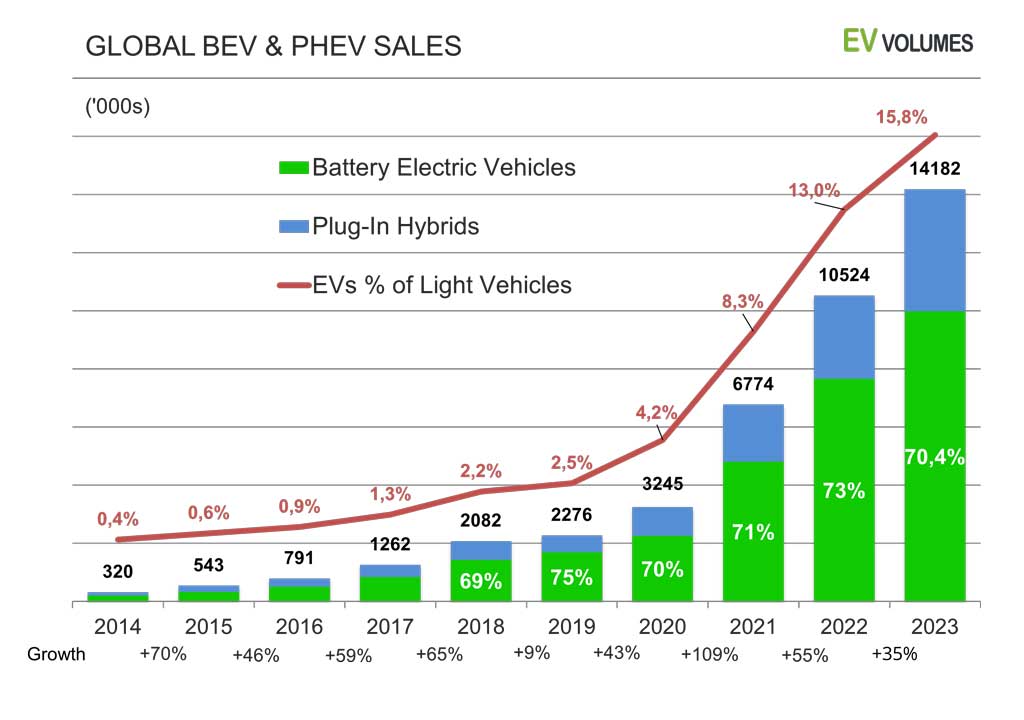

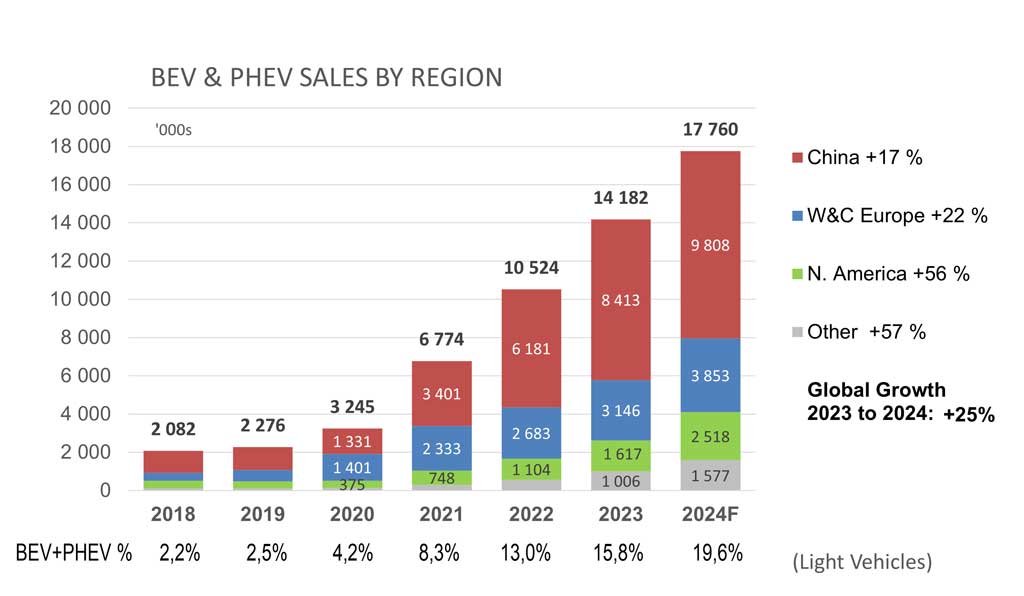

Global EV sales continued as expected by us at the beginning of 2023. A total of 14,2 million new Battery Electric Vehicles (BEV) and Plug-in Hybrids (PHEV) were delivered during 2023, an increase of +35 %. 10 million were pure electric BEVs and 4,2 million were Plug-in Hybrids (PHEV) and Range Extender EVs (EREV).

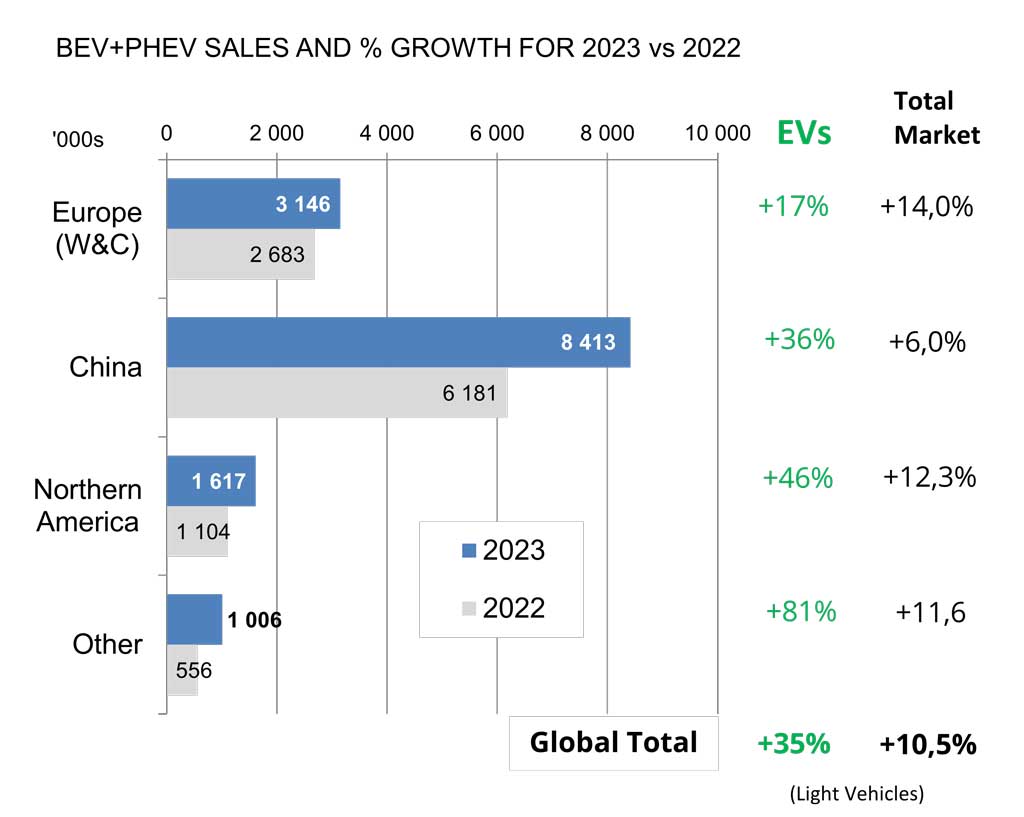

Media reporting that EV adoption is in reverse is not evident in our monthly tracking. Global deliveries of BEVs and PHEVs increased by 3,66 million units over 2022 and all monthly sales were between 8 % and 52 % higher than in the year previous. 5 months of 2023 witnessed new all-time highs for EV sales, Market share increases were consistent throughout the year. The exception was Germany, Europe’s largest EV market, where a series of significant cuts in EV grants lead to s decline in EV sales and market shares. European EV registration were up by a meager +17 % vs 2022; excluding Germany, the increase was +32 %. China EV sales increased by +36 % in 2023 y/y, EV sales in USA and Canada were +46 % higher than the year previous. EV sales outside the aforementioned markets increased by +81 %, albeit from a low base.

In most countries the EV increases were accompanied by a strong recovery in overall light vehicle markets, increasing by +10,5 % globally. EV adoption does not follow auto market slumps and recoveries in lockstep. Successful EV launches, financial incentives, improving charging infrastructure and environmentalism are stronger forces. Slowing overall auto sales typically lead to faster EV share increases while strong auto market recoveries slow down EV share gains.

EV shares still continued to increase in most markets. BEVs (11,1 %) and PHEVs (4,7 %) stood for 15,8 % of global light vehicle sales in 2023, compared to 13,0 % in 2022. Norway had the highest market share of EVs in 2023 (BEVs 72 % + PHEVs 7 %), followed by Hong Kong and the Nordic countries in Europe. China had 33,9 %, Europe 21,4 % and USA 9,4 %. The fastest growing markets were Turkey with 86 600 units, up +805 %, Brazil with 50 400 units, up +359 %, Thailand with 89 000 units, up +328 %, Malaysia with 10 400 BEV & PHEV units, +886 % and Australia with 93 00 units, up +141 %.

PHEVs stood for 29,6 % in the global BEV-PHEV mix in 2023 compared to 27,2 % in 2022, a deviation from the long-term trend. The PHEV volume increase was 1,33 million units, most of it (1,2m) in China. High sales of BYD PHEVs and the renaissance of Range Extender Electric Vehicles (EREVs) are the main reason. EREVs have larger batteries and longer all-electric range than PHEVs, carrying a small petrol engine as a “back-up” generator. The Chevrolet Volt and the BMW i3 were early examples of this concept, the current EREV leader is Li Motor with 376 000 units delivered in 2023. Total EREV sales were 705 900 units, of which 98 % in were sold in China. Sales of Fuel Cell Vehicles (FCEV) in the light vehicle sector have declined by -38 % vs 2022 and stayed below 10 000 units annually. Current sales are from five vehicle models and most sales are in South Korea and USA. We estimate their current population to be about 60000 units.

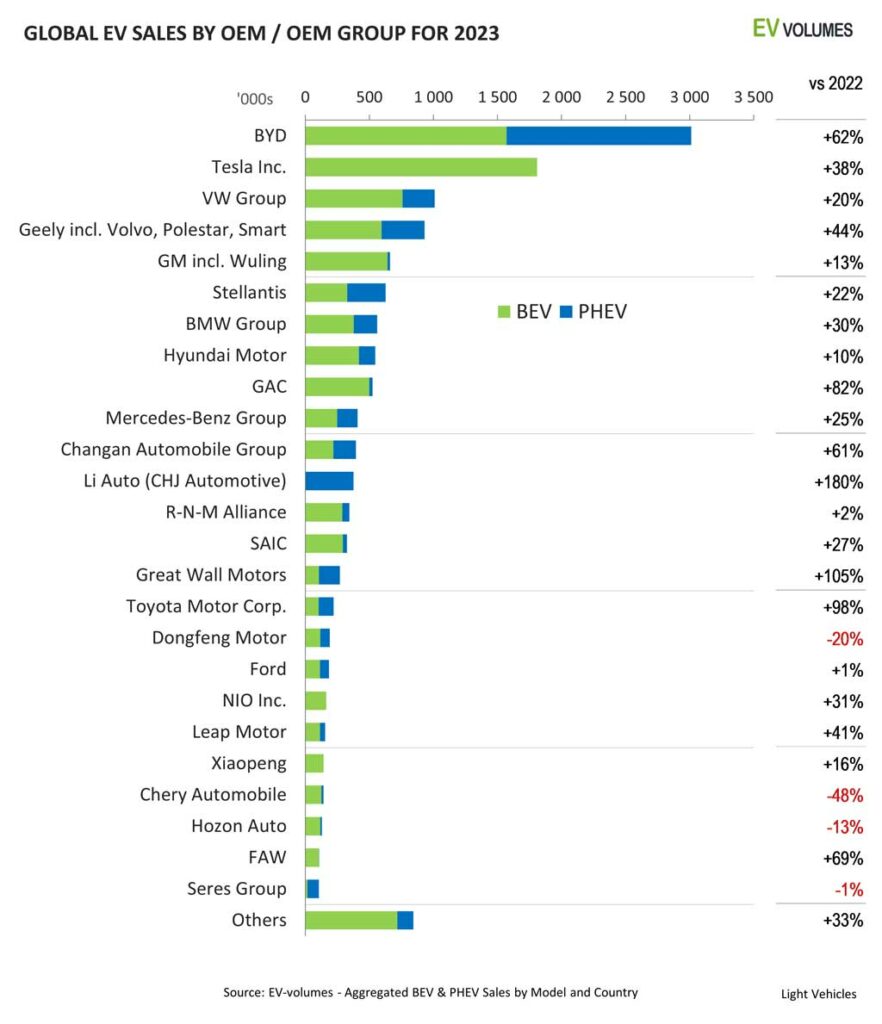

BYD increased sales to 3 million units (+62 % y/y), remaining as the #1 in the global EV sales ranking, with their 1,44 million PHEV sales included. Counting BEVs only, Tesla still leads with 1,81 million units delivered in 2023, an increase of 38 % over 2022. A common observation is that pure EV players grew their sales faster than legacy OEMs.

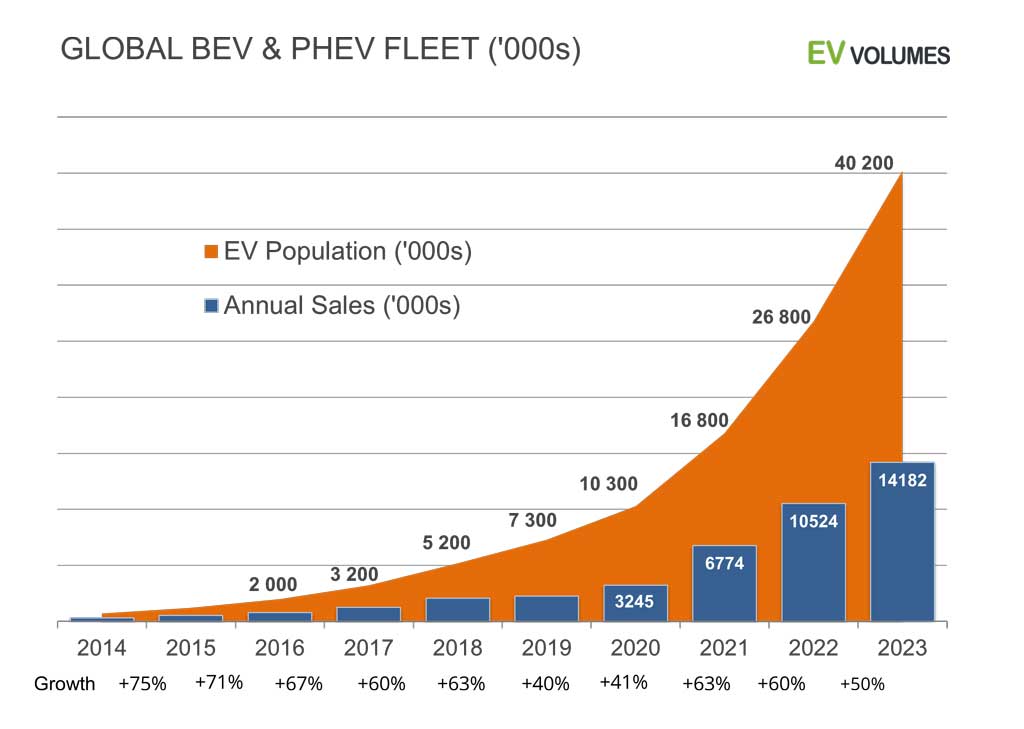

By the end of 2023 we expect 40 million EVs in operation, counting light vehicles, 70 % of which are BEVs and 30 % PHEVs. For 2024, we expect sales of 17,8 million EVs, growth of +25 % over 2023, with BEVs reaching 12,8 million units and PHEVs 5 million units.

EVs Outperforming the Auto-Market Recovery

Finally, 2023 saw a worldwide, robust recovery of auto sales. Following the Covid crunch of 2020 and supply constraints during 2021 and 2022, better availability, lower prices and pent-up demand pushed global light vehicle sales to a 10,5 % increase over 2022.

Globally, EVs outperformed the market by a good margin, increasing volume by 35 %. Exceptions were in Germany, Norway, Italy and South Korea, where EVs lost market share compared to 2022. The German drawback was particularly painful with a 6 % loss in EV market share and 122 000 fewer units delivered. A series of EV incentive cuts were the main reason, legacy OEMs acting more margin-conscious was another.

EV deliveries in USA grew by 48 % over 2022 (46 % for USA & Canada combined), having increased 50 % from 2021 to 2022. It appears that the EV grants in the Inflation Reduction Act (IRA), available since January 2023, had limited impact on EV adoption. The grants require EV production within the USMCA (fmr NAFTA) and battery material sourcing from Free Trade Agreement partners (China is not). Battery supply constraints were a frequent occurrence among domestic OEM during 2023.

China is, by far, the largest EV market with 8,4 million units in 2023 and 59 % of global EV sales. With 9,3 million EVs made, China’s role as the largest EV production base is even stronger: 65 % of global EV sales in 2023 came out of China. 900 000 EVs were exported from China, most of them (530k) by Western brands. The largest exporters were Tesla, SAIC (MG, Maxus), Geely (Volvo, Polestar, Lynk, Smart) BYD, Renault (Dacia), BMW and Great Wall. All others exported below 20 000 units each.

OEM Ranking for BEV & PHEV Deliveries

Most OEMs have again grown their sales in 2023. Global EV deliveries increased by +35 % y/y in total; OEMs with higher growth have increased their share in the EV sector. Comments for the Top-5:

BYD extended it’s lead, by boosting sales of existing models and successfully introducing new models. The BYD vehicle portfolio covers 10 product segments with a total of 30 vehicle models. Since BYD phased out ICE-only versions in 2022, they became the largest maker of PHEVs and moved from rank #3 in 2021 to #1 for BEVs & PHEVs combined. Among over 3 million unit sales in 2023, only 130k were exported; seven times more than in 2022.

Tesla still leads global sales of BEVs but by a smaller margin, with a share of 18 % in all BEVs sold worldwide. Year-on-year volume growth for Tesla was +38 %, compared to a 30 % increase of total BEV sales.

The VW Group increased EV sales by +20 % over 2022; BEVs gained 31 %, while PHEVs lost volume. Growth in China was only 5 % y/y to 232 000 units, with a decline only avoided by a strong boost of Audi Q4 BEV and VW ID.e BEV sales in the second half of the year. Sales in USA & Canada increased by +61 % from a surge in Audi Q4 BEV sales and the ramp-up of US production of the VW ID.4 BEV. Sales in Western & Central Europe increased by +21 % y/y to 636 000 units, representing 63 % of the Group’s BEV & PHEV volume.

Geely, including their international brands Volvo, Polestar, Lynk & Co, Lotus and Smart increased sales by +44 %. The highest contributors were the new Geely Panda Mini, the Lynk & Co 08 PHEV, the new Smart #1, various models from Volvo, Zeekr and their new Galaxy Brand. The Emgrand, Geometry and Maple are in strong decline and may be phased out. Polestar disappointed by just 11 % growth, still offering only one volume model, the Polestar 2.

The Wuling Mini EVs have passed their sales peak; GM gained only +13 % for that reason. Excluding the Mini EVs, GM’s combined growth for EVs was +70 %.

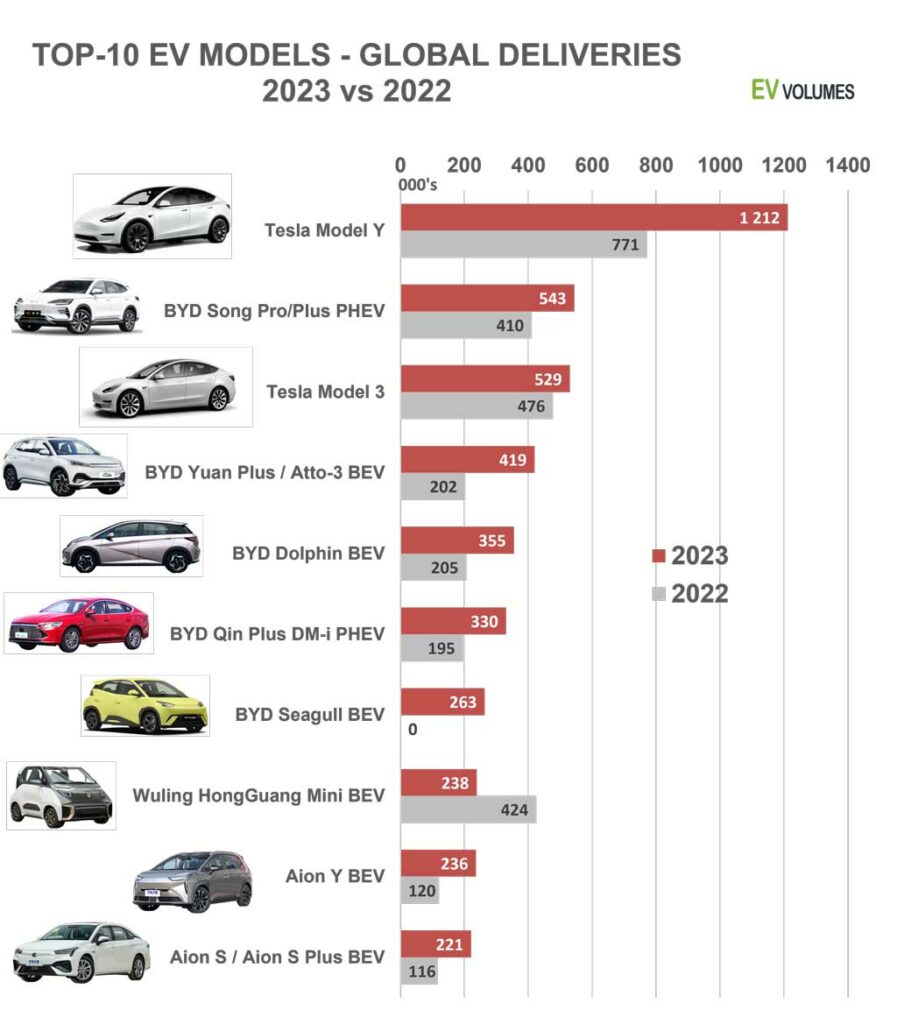

Tesla and BYD are Dominating the Top-10

The world’s best selling automobile is a BEV. Tesla delivered over 1,2 million units Model Y, more than any other vehicle model, including ICEs. Meanwhile, the Model-3, in its sixth year of production, increased by 11 % to 529 000 units. The face-lifted version started in China in Q4 and represents less then 10 % in this volume.

BYD had five models in the global top-10, with the Song and Qin as the world’s best selling PHEVs; a legacy from their regular ICE business which BYD abandoned in April 2022. The Song PHEV is a mid-size SUV of 470cm length / 168cm height, starting at 160 000 RMB in 2023, 100 000 RMB below a Tesla Model Y. There is a Song BEV variant with 72 kWh, alternatively 87 kWh battery capacity for 190 000 RMB, which sold 93 200 units in 2023. The newcomers Dolphin, Yuan Plus and Seagull, all BEVs had a flying start, shifting BYD growth towards more BEVs. BYD exported 15 000 units Yuan, Dolphin and Seagull in December alone.

GM-Wuling’s Mini EV sales are in decline since the launch of the larger Wuling Bingo (168k sales) and the brand revival of the Geely Panda Mini (110k sales).

The Aion brand is the New Energy Vehicle division of Guangzhou Automobile a state owned enterprise. The Aion Y is a compact SUV, the Aion S is a mid-size Sedan. Both offer relatively large batteries (long range) at very competitive prices.

The VW ID.4 is the best selling model from any European brand, on rank #11 with 174k units. Sales include the ID.4 X and ID.4 Crozz made by VW’s joint ventures with SAIC and FAW in China.

Outlook for 2024

Sales of EVs in 2023 were supported by a broad vehicle market recovery amounting to +10,5 % over 2022. For 2024, we expect global Light Vehicle sales growth to be lower and less consistent, including a likely decline of overall vehicle sales in China.

Our monthly EV sales tracking does not indicate a drop in EV demand as recent media reporting would suggest. Q4 volumes of 2023 compare to elevated sales of Q4-2022, ahead of incentive cuts effective in January 2023, notably in China, Germany and Norway. 29 % EV sales growth in Q4 compare to +35 % for the entire 2023.

Upgraded EVs, maintained financial incentives, improving charging infrastructure and environmentalism continue to support EV growth. OEMs are reducing prices where margins allow, as a further catalyst for higher sales. We expect 17,8 million global EV sales in 2024 with a market share of 19,6 % in global light vehicle sales. EV sales grow by +25 % in a global light vehicle market increasing by +1 %.

For China we expect an NEV share of 41 % with volume growth of 17 % y/y to 9,8 million units BEVs & PHEVs, which is below e.g. CPCA expectations as they still expect an increase of overall vehicle sales. Provinces may stimulate vehicle sales to support their local OEMs. This includes ICE vehicles, slowing EV share growth.

For USA and Canada combined we expect BEV & PHEV sales to grow by +56 %, for a share of 13,8 % in total light vehicle sales. The Inflation Reduction Act (IRA) stimulates EV growth in USA, once the complex conditions for obtaining grants are better understood. BEVs and PHEVs assembled in USA, Canada and Mexico stood for ca 77 % total PEV sales in the US last year; we expect this share to increase in 2024.

Subsidy cuts and achieved CO2 compliance dampen the volume and share growth for EVs in Europe compared to the 2020 and 2021 boom. For 2024 we still expect Europe EV sales to increase 22 % over 2023 as EV subsidies cuts are completed in many countries and annual tax savings vs ICE vehicles stay intact. Pure-play EV makers will see high growth as many legacy OEM prioritize margins instead of maximizing sales.

40 Million BEVs and PHEVs on the Road by December 2023

The number of EVs in operation world-wide reached 40 million at the end of 2023, counting light vehicles. With approximately 1,5 billion light vehicles in operation, this is still just 2,7 % of the global fleet and 1,9 % counting BEVs only.

The number of light vehicle on the road worldwide increases by around 40 million units on average every year, as many as the entire current vehicle population of the UK. Last year, 10 million of this increase (25 %) were BEVs and 30 million additional vehicles (75 %) are still burning petrol or Diesel.

In a scenario towards 100 % zero-emission global light vehicle sales in 2045 (as an example for the math), the total number of BEVs in operation reaches 1,1 billion, while the total number of vehicles in operation reaches 2 billion in 2045. Assuming normal scrapping rates, over 55 % of the stock are BEVs in 2045 but the sobering truth is also that over 40 % of vehicles in operation still need to burn fuels.

The full transition to BEVs needs to accelerate, because the positive impact on CO2 emissions comes with a considerable delay. Fast EV adoption is a prerequisite for sustainable personal mobility.

Close

Close