Electric vehicle (EV) registrations in Europe recorded double-digit growth in February, as Tesla dominated the market. José Pontes, data director at EV Volumes, evaluates the figures with Tom Hooker, Autovista24 journalist.

A total of 202,542 EVs took to the road in Europe during February, recording a growth of 10% year on year. This meant battery-electric vehicles (BEVs) and plug-in hybrids (PHEVs) accounted for 20% of deliveries in the overall market in February and the year-to-date.

BEVs achieved a 13% share of all passenger-car registrations during the month. The powertrain saw deliveries rise 10% year on year, despite a lack of mass-market EVs. Models that may help boost the sector, such as the Renault 5 and Citroen e-C3, are not yet available in Europe.

Additionally, many markets are still suffering from the ending of incentives. The negative incentive impact is expected to ease in the second quarter of 2024. However, significant BEV growth is not predicted until the second half of the year.

Elsewhere, PHEVs registrations increased 9% year on year. Meanwhile, hybrids (including full and mild powertrains) enjoyed a surge of 24%. The technology accounted for 29% of all new-car registrations in February, meaning almost half of the European market is now electrified.

EV and hybrid growth has come at the expense of diesel, which endured a delivery drop of 5% compared to one year ago, holding 12% of the market. This contrasts with its 50% share in 2015.

Total Tesla domination

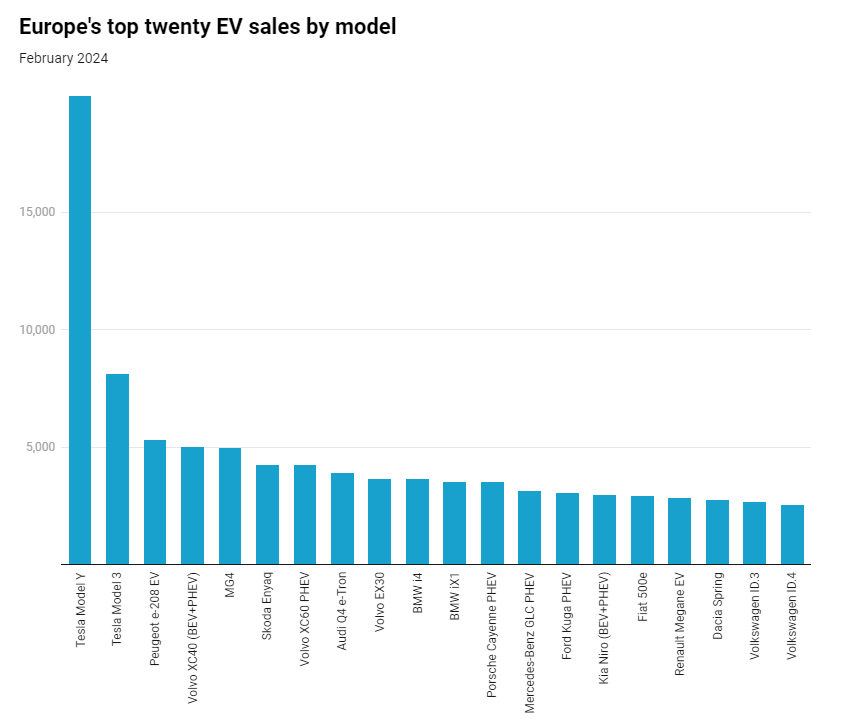

Once again, the Tesla Model Y was the best-selling EV in Europe, thanks to its 19,946 registrations in February. The mid-size crossover is expected to post similar results in the next few quarters, although it is not predicted to significantly improve on current volumes.

The Model Y’s biggest European market was Germany (5,482 units) followed at a distance by France (1,982 units). Also achieving four-digit demand was the UK (1,759 units), Norway (1,749 units), Belgium (1,737 units), and Italy (1,252 units).

The Tesla Model 3 secured second, meaning the carmaker took the top two positions in the February best-sellers table. The sedan reached 8,120 deliveries, as demand was boosted by its recent refresh. It is expected to limit volumes for the Model Y in future months.

However, the Model 3 could be challenged for its runner-up position if the Volkswagen (VW) ID.4 recovers and the Renault 5 has a strong production ramp-up. The sedan saw strong performances in the UK (1,410 units), France (1,216 units) and Portugal (762 units).

Positives for Peugeot

Third place went to the Peugeot e-208, which posted its best registration tally since September 2023, with 5,319 models taking to the road. The hatchback has struggled in the last few months following its refresh. Yet, strong demand is now expected after the end of the e-208’s production constraints.

The model is making a big push in its domestic market, as France (4,132 units) was responsible for over 75% of deliveries. The Netherlands (326 units) and the Italy (173 units) followed far behind.

In fourth was the Volvo XC40, reaching 5,034 registrations. The BEV version accounted for the majority of this volume, with 4,808 units. The SUV is not yet being cannibalised by its younger sibling, the EX30.

The strongest market for the model was Germany (1,367 units), while Belgium (636 units) and Sweden (561 units) also had positive results.

The MG4 finished in fifth, thanks to 4,990 deliveries. Its main markets were Germany (1,503 units), France (1,491 units) and the UK (850 units).

Valiant Volvo

The Volvo XC60 PHEV came in seventh (4,251 units), becoming the best-selling plug-in hybrid model in February.

Its sibling, the Volvo EX30, made its first top 10 appearance, reaching ninth with a record 3,675 registrations. This meant three models from the Swedish brand featured in the top 10. The compact crossover is expected to continue climbing the best-sellers chart, with multiple top-five presences likely in the next two quarters.

Elsewhere, the BMW iX1 had a strong February in 11th place, posting 3,540 deliveries. Just behind, the Porsche Cayenne PHEV achieved its best-ever result, with 3,516 registrations placing it in 12th.

This performance was helped by a refresh that improved performance, including a bigger battery. The German SUV was February’s best-selling full-size model and was the second most popular PHEV.

Finally, the VW ID.3 (2,687 units) and ID.4 (2,538 units) returned to the table in February, in 19th and 20th place respectively.

Model Y magic

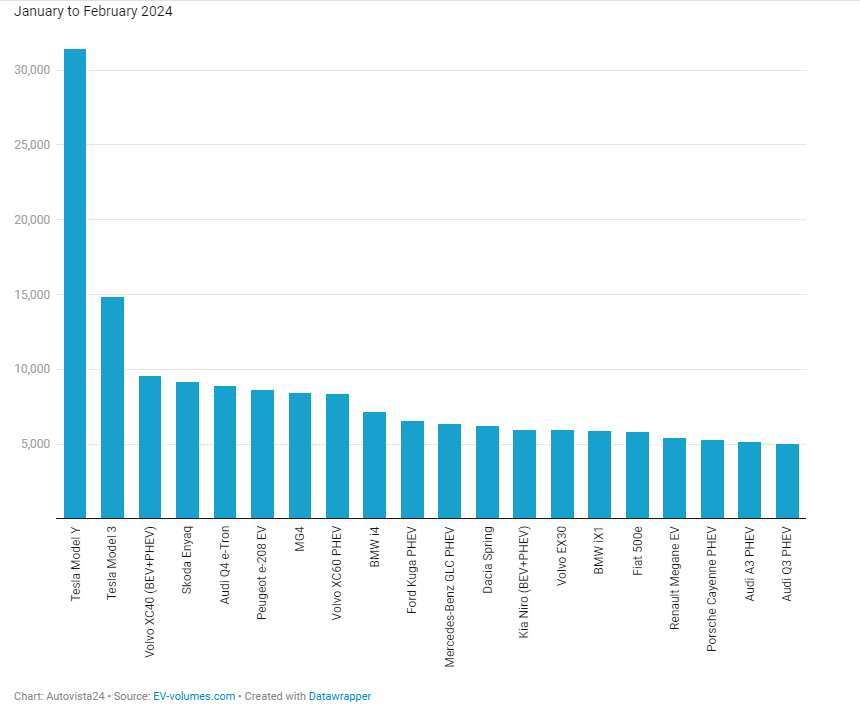

Looking at the year-to-date table, the Tesla Model Y maintained its lead, thanks to 31,410 deliveries. The crossover doubled the deliveries of the Model 3 in second (14,815 units).

Europe’s top twenty EV sales by model

Thanks to a strong February, the Peugeot e-208 rose five positions to sixth with 8,594 registrations. The hatchback sits just one unit behind the Audi Q4 e-Tron and is predicted to continue climbing up the table over the next couple of months.

Meanwhile, the Mercedes-Benz GLC PHEV moved into 11th (6,342 units). In 14th, the Volvo EX30 (5,927 units) was a new entry to the year-to-date chart and is expected to join the top 10 soon. Another new model in the table was the BMW iX1 in 15th (5,897 units).

Elsewhere, the Renault Megane EV jumped up two positions to 17th (5,439 units). Below, the Porsche Cayenne PHEV joined the table in 18th (5,281 units).

Last year’s third-place finisher, the VW ID.4, was absent from the top 20 due to a slow start to 2024. March could see the crossover return to the table, along with its sibling, the ID.3.

Tesla on top

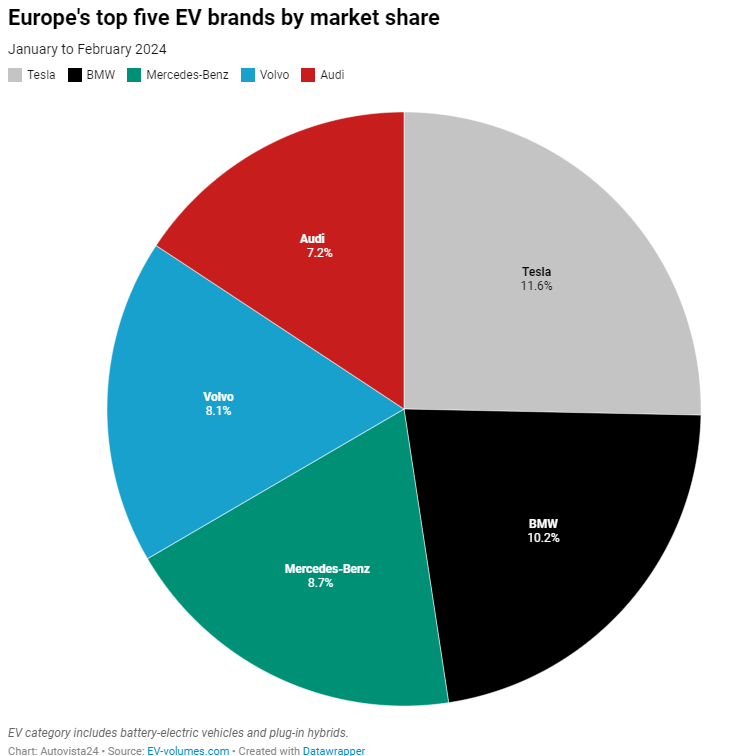

Tesla was comfortably Europe’s best-selling EV brand in February, accounting for 11.6% of all plug-in registrations, up 2.5 percentage points from January. BMW came second, with a 10.2% market share down marginally from the previous month.

Mercedes-Benz maintained its third position (8.7%, down from 9%), but its lead over Volvo in fourth (8.1%, up from 7.8%) dropped.

Audi lost significant ground in fifth, dropping 1.1 percentage points to a 7.2% share. This meant all of the top five EV carmakers in February were premium brands. VW, the most popular mainstream manufacturer, finished in sixth (5.1%, up from 5%).

With brands grouped together under their parent companies, the VW Group kept its commanding lead but dropped one percentage point to a 19.5% market share.

In second, Stellantis accounted for 12.2% of all EV deliveries (up from 12%), while Tesla took 11.6% of the market. The US carmaker could challenge for the runner-up spot in March.

Meanwhile, the BMW Group dropped marginal share in fourth (10.9%), as fifth-placed Geely-Volvo continued its rise (9.9%, up from 9.6%). The OEM stretched its advantage over Mercedes-Benz Group in sixth (9.2%, down from 9.5%).

This content is brought to you by Autovista24.

Close

Close