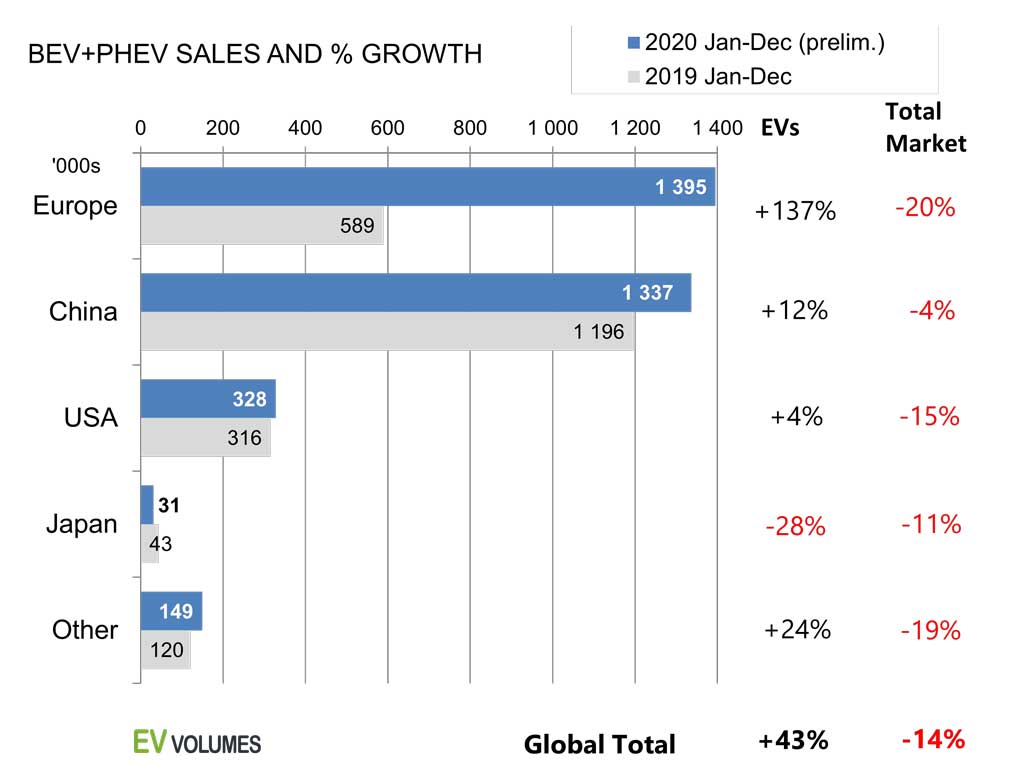

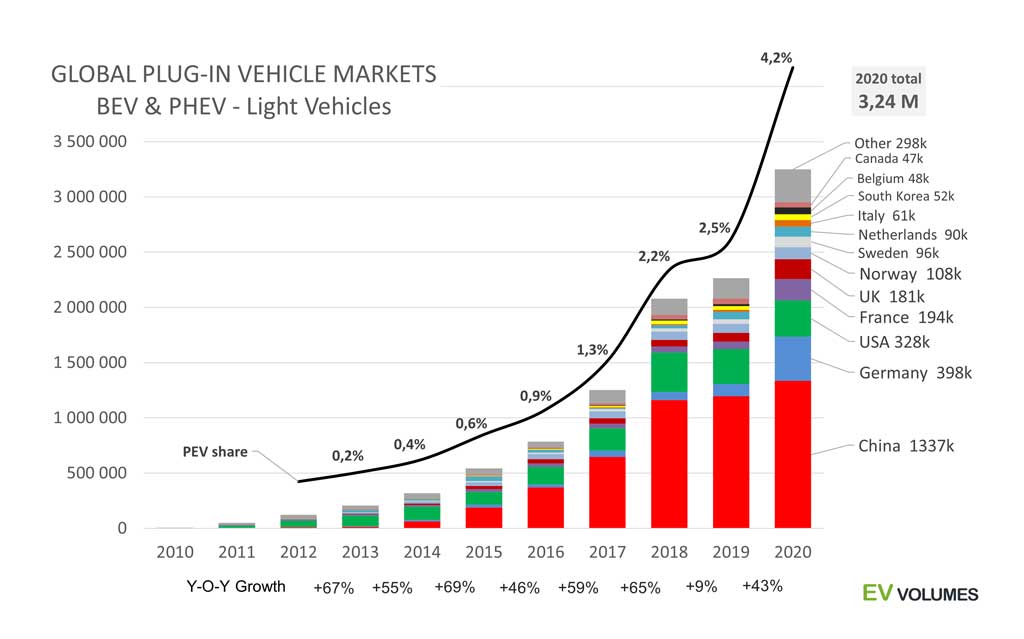

2020 became a great year for plug-in vehicles, in the end. With only a few details still to be reported we are expecting global BEV+PHEV sales of 3,24 million, compared to 2,26 million for the year previous. What started with an unprecedented economic downturn during the 1st COVID-19 wave became a success story for EVs in Europe. Nearly 1,4 million BEVs and PHEVs were registered in Europe during 2020, 137 % more than in 2019, in a vehicle market that was down by 20 % year-on-year. It was the combination of new attractive models, incentive boosts by green recovery funds, the 95g CO2 mandate, much improved availability and intense promotion of EVs.

Europe has superseded China as the motor of EV growth. For the first time since 2015, EV sales in Europe have outpaced NEV sales in China. Europe is further ahead in terms of EV share: BEVs+PHEVs increased from 3,3 % 2019 to 10,2 % in 2020, counting the EU and EFTA countries, including UK. The NEV share in China increased from 5,1 % to 5,5 % during this period.

Outside Europe growth of EVs was slower, but still significant. China NEV sales recovered strongly during the 2nd half and were up by 12 % for the year. EV sales in USA increased by a meager 4 %, despite the sales start of the Tesla Model-Y. Fortunes varied in other markets, with declines in Japan, Canada and Australia, while increases in South Korea, Taiwan, India, Israel, UAE and Hong Kong outweighed these losses.

We think that these good news deserve an early reporting, even if the final numbers could see very minor changes below 0,5 %. We will enhance this post and follow up with more regional analysis as the results solidify. Stay tuned.

Europe Leads EV Up-take

In most countries, BEVs and PHEVs were more resilient to the Corona crisis than the auto markets in general. In volume terms, global BEVs+PHEVs deliveries increased by 43 % year-on-year, while the the global light vehicle market decreased by 14 %. Their global market share increased from 2,5 % in 2019 to 4,2 % in 2020. Europe passed China in EV sales with a 137 % increase in a disturbed auto market, which had suffered volume losses up to 80 % during the 2nd quarter. The real EV boom in Europe started in June and July and reached its peak in December with nearly 285 000 sales, +260 % y/y growth and a market share of 20 %. All OEM did their very best to reach their CO2 emission targets. Also China NEV sales recovered in the 2nd half, with an average +80 % volume growth y/y from July to December. As these volumes compare to the weak results of 2019 H2, they were back to normal at best.

EV sales in USA (+4 % y/y) outperformed the auto-market (-15 % y/y) mostly from the introduction of the Model-Y. Tesla extended its sector domination, with 62 % of all Plug-in Vehicle sales and 79 % of all BEV sales in the US coming from Tesla.

The losses in Japan continued, with broad based decreases, especially among domestic brands.

“Other” markets include Canada (47k sales, -7 %), South Korea (52k sales, +55 %), Taiwan 7k, +308 %) and many smaller EV markets around the world, some of them growing very fast in spite of adverse conditions.

Germany becomes the 2nd largest EV Market after China

Plug-in sales in Germany increased by 254 % over 2019, 191 % for BEVs and 351 % for PHEVs, witnessing the high representation of German OEM in PHEV variants. PHEVs stood for half of German plug-in vehicles sales; the global average for 2020 was 31 % PHEVs and 69 % BEVs. One out of eight global plug-in sales were in Germany last year.

Many European markets have doubled or tripled their EV sales vs 2019 and Europe captured 43 % of global EV sales in 2020 vs 26 % in 2019. The US fell further behind, volumes hinging on the capacity of Tesla and the commitments of the ZEV Alliance states. China NEV sales returned to normal in the 2nd half of 2020, reaching 240k units in December alone. The total for 2020 reflects the weak sales during the 1st half.

The overall picture is that global EV sales have returned to the S-Curve in terms of volume and are somewhat above trend in terms of share. For the ongoing year, we expect 4,6 million plug-in sales with higher growth in North America and China. Europe is not likely to repeat the 137 % increase of last year, but 2 million sales are within reach.

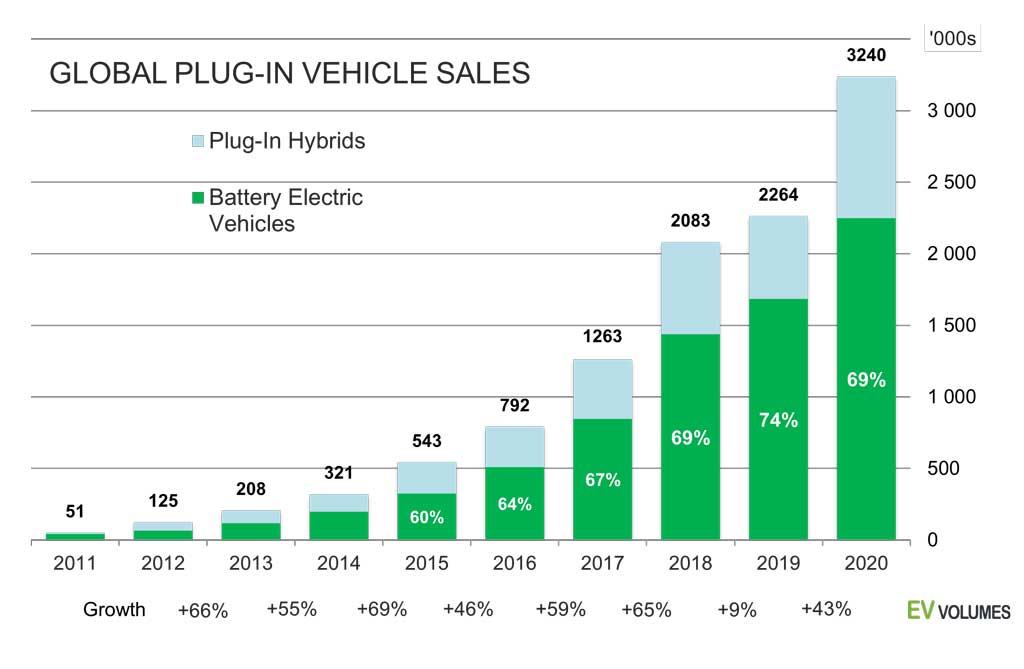

PHEV Renaissance

Since they appeared 10 years ago, 2019 was the first year that PHEVs decreased in sales. The reasons were the transition form the lenient NEDC test cycle to the tougher WLTP in Europe. Consequently, the CO2 emissions of most PHEVs exceeded the 50g limit for incentives in many European markets. Sales were paused for many PHEV variants during the 2019 model-year to install larger batteries for more E-range. For 2020 they came back, updated, meeting pend-up demand and more generous purchase grants.

This put an end to ever higher BEV shares in the plug-in mix. Not that BEV sales (2250k for 2020) suffered much from this; they still increased by 33 % or 560k units over 2019, with 386k contributed from Europe. 990 000 PHEVs were sold worldwide, 410k, or 71 % more than 2019.

PHEVs ease the transition to real ZE transport for OEMs and car buyers alike, but the 2020 trend reversal will be short lived. PHEVs are only as green as their users and their charging habits. The debate has started and PHEVs are likely to see reduced incentives in some European markets, starting this year. Long term, the cost, design and emission advantages of BEVs speak for more growth in BEVs than in PHEVs, anyway.

Close

Close