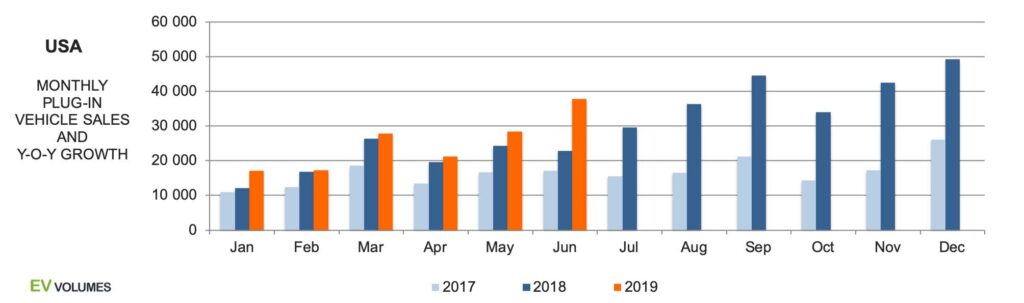

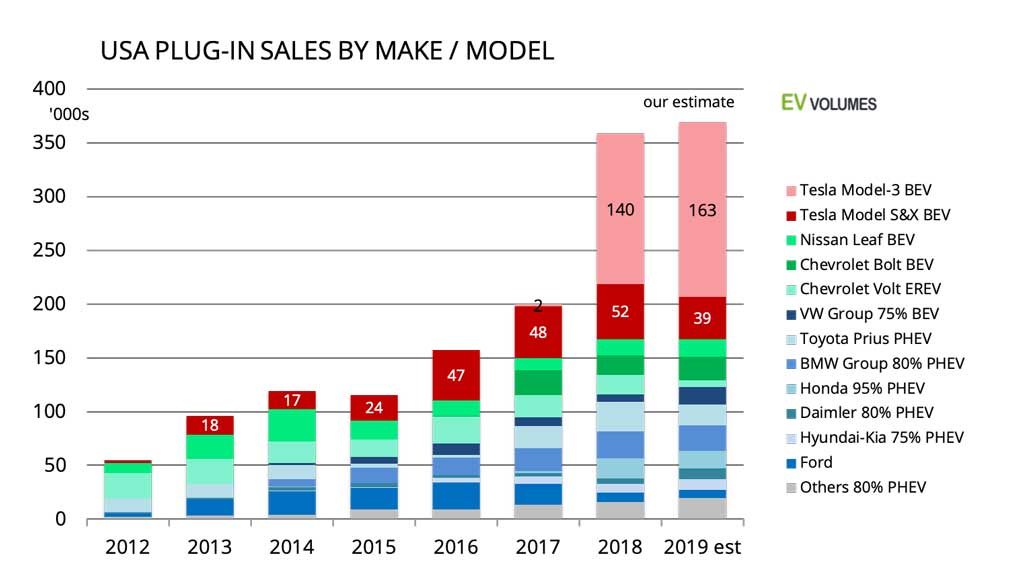

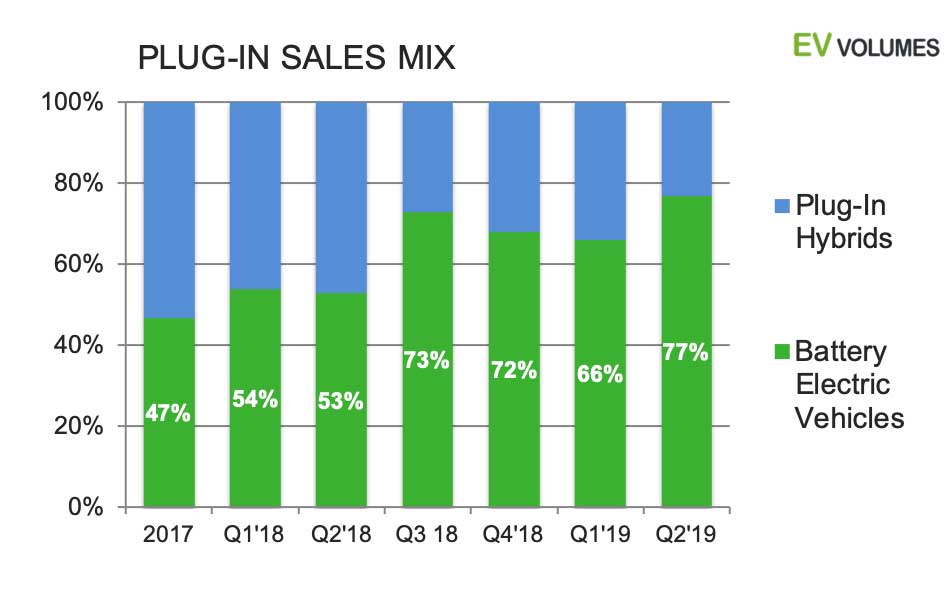

149 500 plug-in vehicle were delivered in the first half of 2019, an increase of 23 % compared to H1 of 2018. 72 % were pure electric (BEV) and 28 % were plug-in hybrids. The plug-in share of the total light vehicle market was 1,8 % for the 1st half of 2019, compared to 1,4 % in H1 of 2018. Despite the sufficiently lamented Q1 result, Tesla represented 57 % of all plug-in deliveries in the US. Counting BEVs only, Tesla’s share was 78 %. Four out of five Tesla sales in USA were for the Model-3, which remains the best selling plug-in, worldwide.

The Model-3 did not inspire the market towards more plug-in sales in general. Its qualities are in a class of its owns and most other plug-in models posted lower sales than in the previous H1, esp. in the car category, while SUVs faired better. Other inhibitors are the discontinuation of the GM Volt, the change-over to the new BMW X5, BMW 3-Series, Kia Soul and the Sonata/Optima siblings from Hyundai-Kia. Nissan Leaf sales remained sluggish, as battery and charging capabilities are questioned for the current version and sales of the revised 60 kWh version have just started.

For the 2nd half of 2019 we are expecting around 220 000 plug-in sales, for a total of 370 000 units for the year. Even if the increase over the 1st half of 2019 is significant, growth rates y-o-y will be negative, comparing the coming months with the same period of last year, when Tesla filled the huge reservation back-log and had no sales outside USA and Canada.

Back to Trend

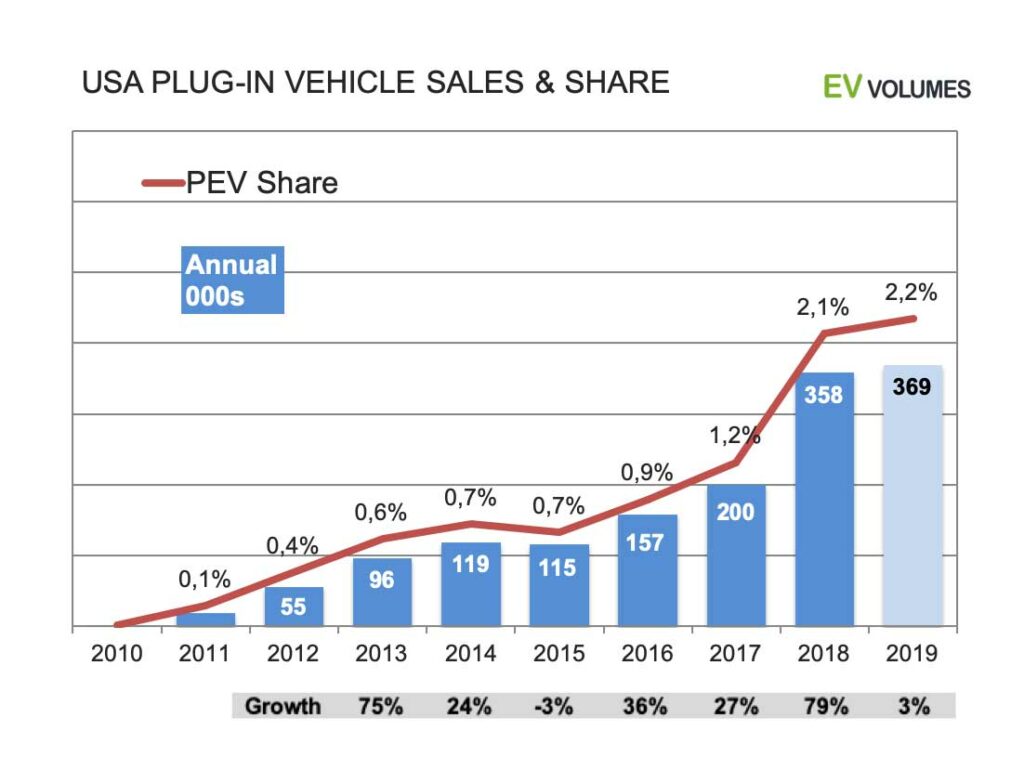

The US had exceptional plug-in growth in 2018 and nearly all of it was created by just one new entry, the Tesla Model-3. While 2018 looked like overshooting, 2019 is back to the long term trend.

Achieving the 2017-18 growth for another year is hardly possible this year, simply by the math. Tesla delivered 140 000 Model-3 in USA last year and exports were to Canada only. This year, Model-3 deliveries in the US may increase by another 20 000 units, but there is not enough momentum in the sales from other OEM to generate significant growth.

The situation is likely to improve in Q4, when new, European and Asian import models become visible in the sales statistics. Late in the year, their impact on the overall result will likely be small. For 2019 we are therefore expecting only around 370 000 plug-in sales in total. The uncertainty in this number relates mostly to the extend that Tesla delivers on the 360-400 000 guidance for global 2019 sales. 55 % of global Tesla sales are typically in USA. We are expecting slightly more than 200 000 units to be delivered to US customers.

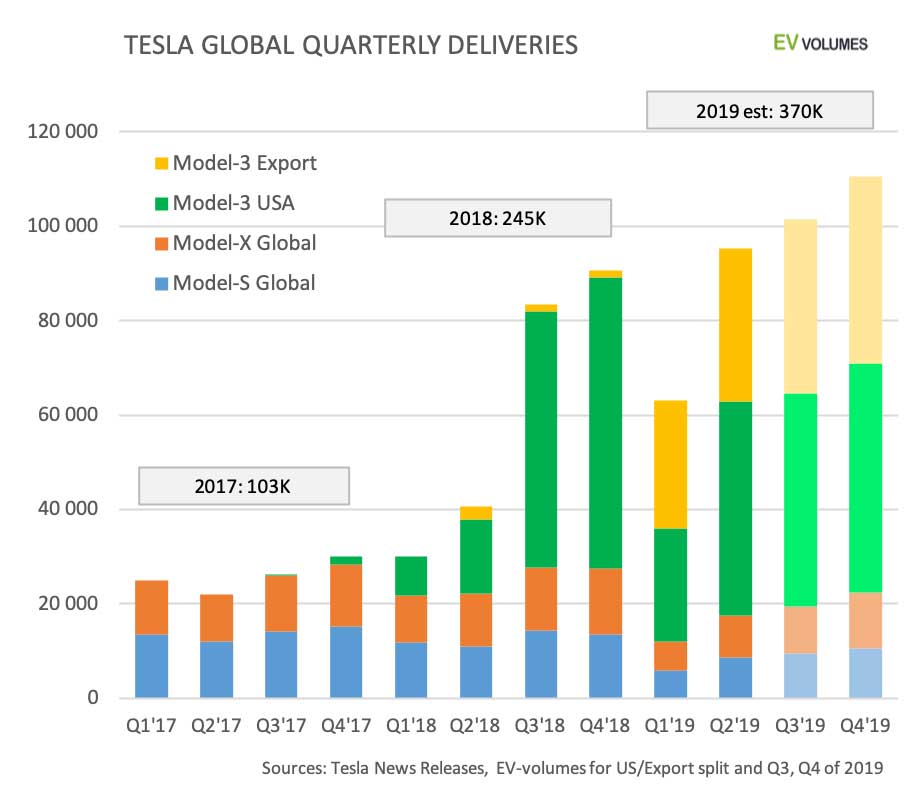

Tesla quarterly deliveries back on track

Tesla is dominating the US plug-in market and any 2019 outlook has little bearing without a Tesla outlook. The diagram shows the global deliveries of Tesla as reported in the quarterly updates and the Model-3 USA / export volumes as we have collected them from our sources around the world. Q3 and Q4 of 2019 are our estimates based on the guidance of 360 000 – 400 000 Tesla deliveries for the year. We think that 370 000 units from Tesla is a safe, doable volume for the year. That is is the same number as for our USA 2019 plug-in sales outlook is a pure coincidence. There could be additional deliveries of 5-10k Model-3 from the Shanghai plant, which starts production in November or December this year.

A short recap for the last 12 months of sales: Q3 and Q4 of 2018 addressed the huge reservation/order back-log for the Model-3, with sales in USA and Canada only and few build-combinations available. Tesla entered Q1 of 2019 with depleted inventories and had to fill the pipeline for export sales. On top of that handle the intricacies of logistics and paperwork in 20 additional markets. Q1 can be considered an exception and Q2 proofed that neither lack of demand nor supply were persistent issues.

Despite an average sales price of nearly $50 000, the Model-3 has 30 % share in the US mid luxury segment and outsold contenders like the Mercedes C-Class, BMW 3-Series and Audi A4 by a factor of two and more. Tesla reported that order books grew faster than Q2 supply and we are therefore confident that Q3 and Q4 deliveries exceed those of Q2.

Limited growth this year

Comparing the YTD sales of OEM other than Tesla with last year’s reveals a bleak picture: a combined decrease of 19 % for H1. BEVs held up better (+3 %, excl. Tesla) than PHEVs (-28 %), thanks to a boost in e-Golf sales and the new Audi E-tron Quattro. The losses for PHEVs were caused by the demise of the Chevy Volt, the run-out of previous generation 3-Series and X5 and weak sales of the Toyota Prius.

The 2nd half of 2019 will see several new model introductions with decent volume potential, like the new BMW 3-Series PHEV, BMW X5 PHEV, VW Passat PHEV. Hyundai-Kia will bring the Tucson and Sportage PHEVs, JLR could bring the Evoque PHEV and may even introduce their large Range Rovers in the US. We spotted 20 sales in Canada for June. Most of these new entries are imports and will arrive late in the year, if at all.

Nissan Leaf sales suffered from the “rapid gate” and should recover with the new 60 kWh version, available now. The Big-3 and Toyota likely remain in contraction mode for the remainder of 2019. Together, they stand for 58 % of US light vehicle sales, but no news from them in sight for this year. Our optimism for this year is therefore limited. 370 000 plug-ins is our best estimate for now, more than half to come from Tesla.

Heavy losses for PHEVs

H1 of 2019 marks a trend change: PHEV not only lost share in the EV mix, in H1 they also lost volume (-28 % vs H1 of 2018). We have noted this in Europe, too, when WLTP and reduced tax incentives for PHEVs caused the decline. Are the days of PHEVs counted sooner than expected? BEVs are the much likely end-game, with zero emission, design potential and cost reductions all superior to PHEVs. Today, PHEVs ease the transition to electrification for parts of the industry and consumers. They still make sense where duty cycles exceed BEV capabilities or when charging is not ensured.

These arguments become weaker, as new BEVs offer more range, power and versatility at constant or lower prices. GM axed the Volt partly by this reasoning. Many European PHEVs are being upgraded for the 2020 model-year, for longer e-range and lower test cycle emissions. This will recover some of their decline. Mid and long term, our view is that PHEVs will keep loosing share in the EV mix, not at least because of Tesla growth with Model-3 and Model-Y. For volumes they are likely to stay flat, or show small growth at best.

A word on Fuel Cell EVs, not shown in the chart. They represent 0,7 % of this years EV sales, with a mere 1124 units delivered in the first 6 months, down 20 % from H1 of 2018. The Toyota Mirai stands for 85 % of the volume. The other two are the Honda Clarity FCEV and the Hyundai Nexo FCEV.

Close

Close