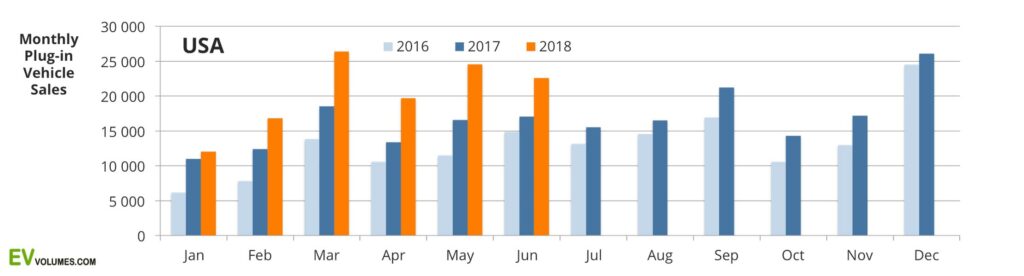

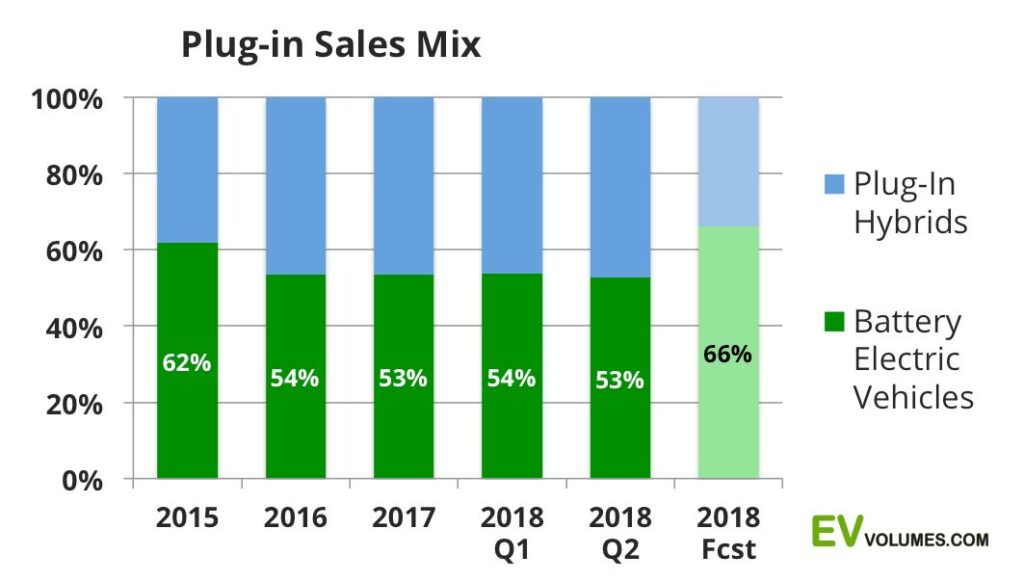

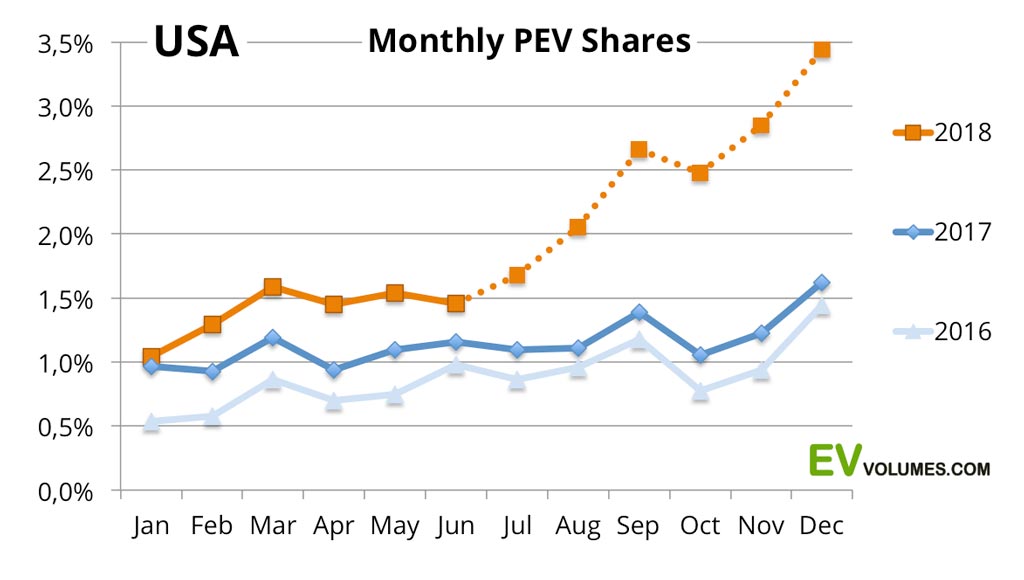

122 000 plug-in vehicle have been delivered in the first half of 2018, an increase of 37 % compared to H1 of 2017. 53 % were pure electric (BEV) and 47 % were plug-in hybrids. The plug-in share of the total light vehicle market was 1,4 % for the 1st half of 2018, compared to 1,1 % in H1 of 2017. The increases were consistent, month-on-month, like in 2017.

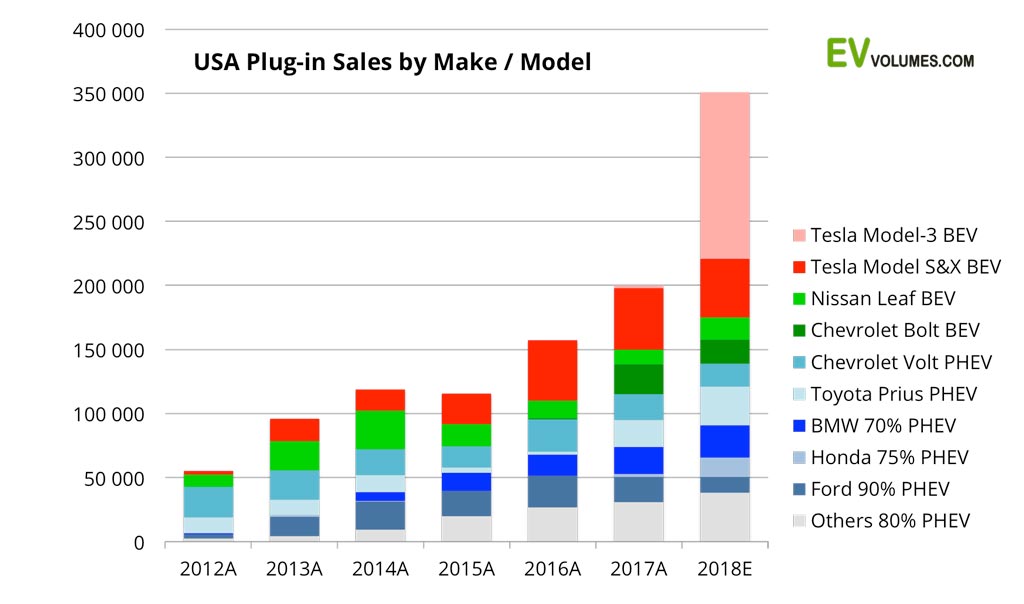

Growth is accelerating, even if many of us expected more. The reason is not only in the ramp-up delays of the long awaited Tesla Model-3: US sales of the new Nissan Leaf remain sluggish (unlike in Europe and Japan), as battery and charging capabilities are questioned for the current version and many wait for the 60 kWh version of the coming model-year. The Chevy Volt, selling 23 300 units in 2017, is down to 7 858 sales during the first half of this year. Both models have plenty of inventory in their large distribution networks.

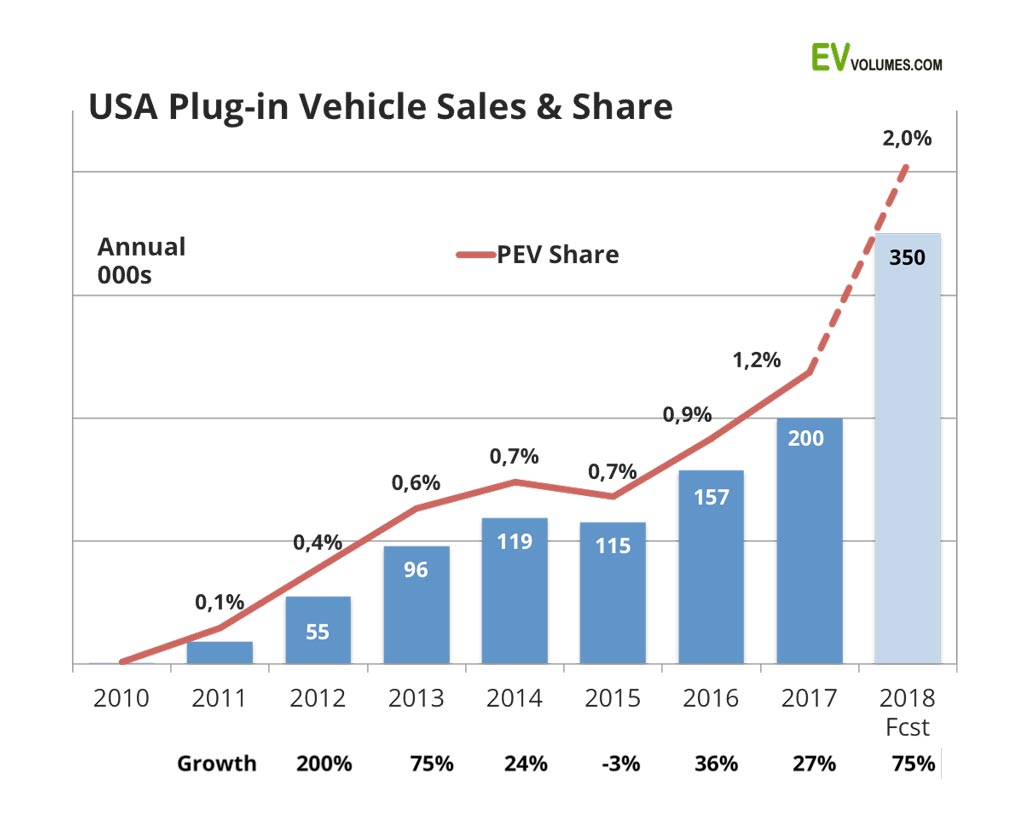

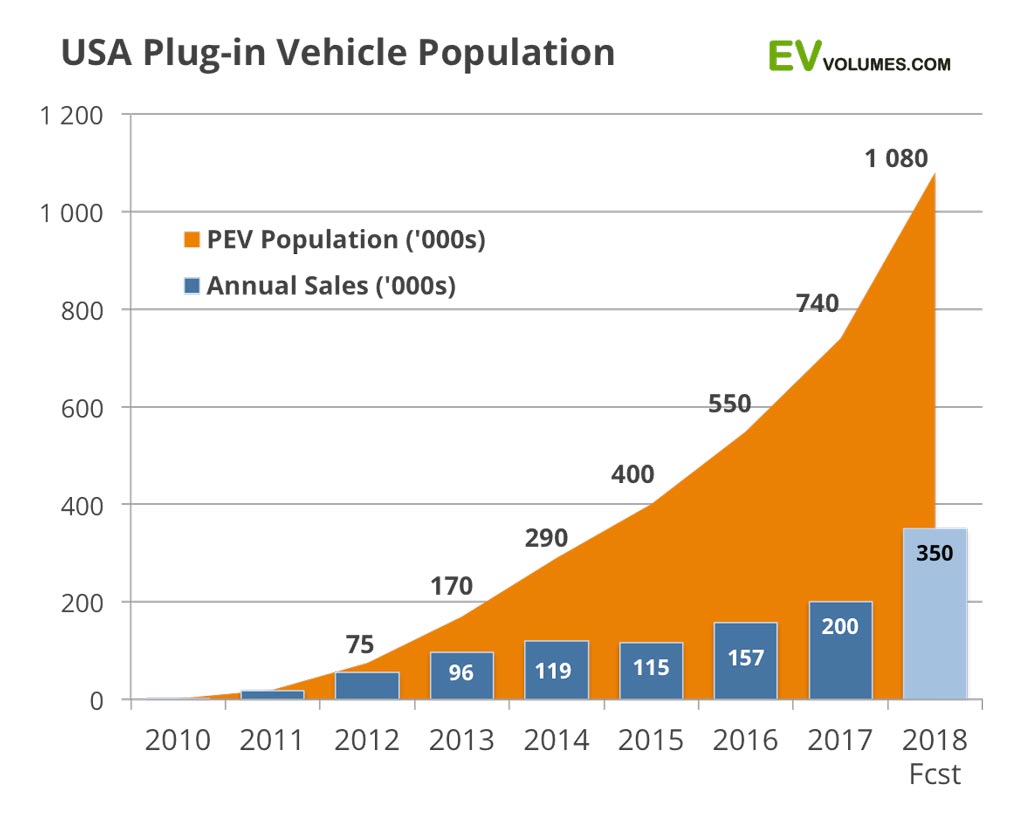

Sadly, we have to reduce our outlook of for the complete 2018 to 350 000 units (was 400k), as 3 big-sellers did not reach the H1 volumes to be expected. Strong sales of Toyota Prius PHEV and Honda Clarity PHEV could not quite compensate. Fuel cell powered models (3 available) sold a mere 1400 units during the first 6 months, 400 more than January to June last year.

Better news can be expected for the 2nd half of 2018: Unprecedented growth rates and volumes with better Model-3 supply and the 1st million plug-ins on US roads, in November.

The wait is soon over

USA is the 2nd largest country for Plug-ins, after China, but growth and market share are less impressive than in many other developed economies. Sales remain concentrated in few states: According to the Auto Alliance’s ZEV tracker, nearly 50 % of USA plug-in sales are in California, 12 % are in other states with ZEV mandates and 38 % are outside the 10 states with ZEV mandates.

2018 will be a game changer in the US, as the Tesla Model 3 will start to be produced in high numbers, essential for Tesla to satisfy the six-figure long waiting list and to show a profit. We expect total plug-in sales to reach around 350 000 units this year, a 75 % increase over 2017. The plug-in share for 2018 is likely to reach 2 %, which is getting the US closer to other larger car markets.

US plug-in vehicle market to be dominated by Tesla

For Q1 and Q2, our sales estimates are 24 100 units Model-3 in the US and 2500 in Canada. Tesla produced 38 300 Model-3 during this period, the balance being “in transit” to customers. Likely, some late June deliveries were postponed to early July. This, in order to stay below the 200 000 accumulated sales mark, where the federal tax incentive is phased out. Reaching this number a couple of days later, in July, prolongs incentives for another quarter.

The weekly production rate is a matter of high interest. Tesla has reached the 5000/week rate during single day sprints. Checking Bloomberg’s Model-3 Tracker, the average for June was around 2100/week. In a recent meeting with investors and analysts, Tesla expressed 7000/week as a target by the end of 2018. We interpret this as an average, not a sprint peak rate. Based on this, we expect ca 160k production and 130k sales to US customers for 2018.

Despite restricted supply, the Model-3 has been the best selling plug-in for every month since January. For the complete 2018 we expect Tesla to stand for half of USA plug-in volume and, counting BEVs only, 3 out of 4 to be from Tesla. For the first half of 2018, all Tesla models were among the top-5, already.

More Tesla, more BEVs in the mix

More Tesla volume means more BEVs in the mix, which is a healthy development towards real zero tailpipe emissions. 45-50 % of plug-in buyers still prefer PHEVs and for good reasons: Light trucks now stand for 60-70 % of vehicle sales and there is only one BEV, the Tesla Model-X, starting at $80k, 8400 sales this year. The Jaguar i-Pace has not landed, yet. PHEV buyers can choose among 8 models from 7 brands starting at $27k, total sales 9100 this year. The other reasons are BEV range and charging, where only Tesla has offered widely acceptable solutions.

The Model-3 lowers the price barrier, without sacrifices on range and charging (ok, you will pay for the juice). The additional 100 000 deliveries in 2018 H2 (our expectation) will leave a clear trace in the BEV / PHEV ratio.

It does not solve the issue of a more affordable BEV SUV, where the coming Hyundai Kona (already completely oversubscribed in Europe), the future Tesla Model-Y and others will do the job. In China, this segment is red-hot and new BEV SUVs appear on a monthly basis. It’s just a question of time until this trend reaches Europe and the US.

3,5 % share by the end of 2018 and 2 % for the year

Plug-in vehicle shares tend to develop in accordance with peaks in Tesla deliveries, high at the end of the quarters and with troughs after that. The June peak did not happen this year, as Tesla stayed clear of the 200 000 limit for full federal tax incentives. Presumably, this volumes shows up in the July sales, instead. Assuming that the expected production increases materialise, the remainder of the year will see rapid share growth towards over 3 % in December, for an average of 2 % for the year. It means that USA is catching up with other larger car markets, which have 2 % and more electrically chargeable vehicles in their total sales.

This is for the average of all US States. California is likely to surpass 10 % plug-in share in December, while staying below 1 % in at least 20 other US States. It took 7 years for California to get from 1 % to 10 %, some indication for the future potential for other US States.

Reaching the 1st million

The current plug-in population is around 860 000 vehicles on the road. The first 1 million can be celebrated in November this year. By the end of 2018 we expect it to be 1080 000, nearly twice the number in operation in December 2016. Charging logistics remain an obstacle for most EV doubters, esp. when they lack access to charging at home or at work.

In April this year, we counted 23 000 public charging locations with ca 65 000 connectors of all types in the US. Since April 2016, the number of stations with DC fast chargers (CCS or Chademo) increased by 66 %. Stations with Level-1 and Level-2 charging were up 24 %, Tesla Supercharger stations became 85 % more. The EV population (52 % BEV and 48 % PHEV) was up by nearly 100 % in the same period. Level-1&2 charging PHEV owners will find it increasingly difficult to find a charging occasion, unless they charge at home/ at work.

Close

Close