Germany is phasing out electric-vehicle (EV) incentives. Autovista24 senior data journalist Neil King considers the implications for total cost of ownership (TCO) and market electrification.

Germany ended government incentives for plug-in hybrids (PHEVs) on 31 December 2022 and is reducing subsidies for battery-electric vehicles (BEV) between 2023 and 2025. Incentives will only remain available for private buyers from 1 September 2023.

The registration date of a vehicle also determines its eligibility for the subsidies, and this is where current supply-chain disruptions and semiconductor shortages come into play. Delivery times for new vehicles have increased and a waiting period of a year has become the norm rather than the exception.

The TCO impact depends on the models in question, the age-mileage scenario, as well as fuel and electricity costs. The effect on depreciation and leasing rates can be significant too.

This would suggest that the electrification of the German new-car market will decelerate, however, the withdrawal of the Plug-in Car Grant (PiCG) has not slowed EV uptake in the UK. Furthermore, tax benefits remain in place for company-car buyers in Germany and more EV models are coming to the market.

TCO analysis

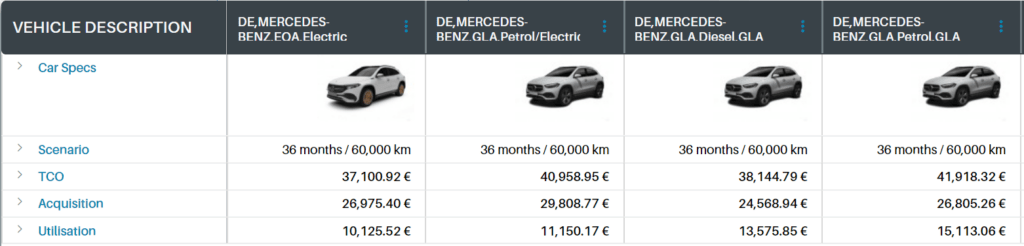

Comparing the Mercedes-Benz EQA BEV against the PHEV, diesel, and petrol variants of its GLA sibling, the TCO of the EQA and the GLA PHEV was about €5,000 lower than for the diesel in 2022 over 36 months and 60,000km. Compared to the petrol GLA, the savings amounted to more than €8,000.

TCO comparison: Mercedes-Benz EQA versus GLA PHEV, diesel and petrol variants (including 2022 incentives)

On 1 January 2023, the government incentive for the EQA reduced from €5,000 to €3,000 and the GLA PHEV is no longer eligible. Furthermore, manufacturers are only obliged to grant 50% of the government part for BEVs and €0 for PHEVs. So, the EQA and GLA PHEV are entitled to incentives amounting to €4,500 and €0 in 2023 respectively in this analysis. Consequently, the EQA now has a TCO advantage of almost €4,000 over the GLA PHEV, but the advantage over the diesel and petrol versions is reduced to only €1,000 and less than €5,000 respectively.

A key caveat is that utilisation costs are increasingly becoming a focal point for TCO due to rising fuel and energy costs. High electricity prices threaten to derail the attractiveness of BEVs and PHEVs but, conversely, rising fuel prices have the potential to negatively impact the TCO of internal-combustion engine (ICE) models.

TCO comparison: Mercedes-Benz EQA versus GLA PHEV, diesel and petrol variants (including 2023 incentives)

This TCO analysis does not factor in discounting, which could lower the TCO of the diesel and petrol variants of the GLA to below that of the EQA.

‘We expect that OEMs will be hesitant to decrease list prices to compensate for the loss of cost advantage because list-price increases are risky, and it will be not so easy to raise prices again if circumstances should change. Rather, we expect more hidden discounts such as cheap leasing and financing offers to boost sales,’ explained Andreas Eggerth, senior market analyst at Autovista Group.

No discernible impact in UK

In June 2022, the UK government pulled the plug on the PiCG, which offered up to £1,500 (€1,740) off the cost of a new BEV. Transport Minister Trudy Harrison claimed the country’s electric-car market has been successfully kick-started and signalled the need to send funds elsewhere.

The UK’s Society of Motor Manufacturers and Traders (SMMT) underlined the poor timing of the decision. With rising fuel prices and supply shortages exacerbated by the war in Ukraine, more consumers were considering an electric vehicle.

The BEV incentive offered in the UK was significantly lower than in Germany but the £1,500 price increase aligns with the €3,000 hike for the Mercedes-Benz EQA since 1 January 2023. Conducting the same TCO analysis in the UK shows that the EQA has a higher TCO than the PHEV and ICE versions of the GLA.

TCO comparison: Mercedes-Benz EQA versus GLA PHEV, diesel and petrol variants

However, this disadvantageous TCO did not restrain the electrification of the UK new-car market in 2022. According to the SMMT, BEVs ‘comprised 16.6% of registrations, surpassing diesel for the first time to become the second most popular powertrain after petrol.’

PHEVs saw their share fall to 6.3% in full-year 2022, replicating the downward trend across Europe. Nevertheless, EVs accounted for 22.9% of new cars registered in the UK last year, up from 17.6% in 2021.

The penetration of fully-electric cars is far greater in the crucial fleet sector, which is responsible for about 50% of all new cars registered in the UK. ‘BEVs already dominate the order books of our sector, and could meet the 2030 phase-out early. BEVs have overtaken petrol among British Vehicle Rental and Leasing Association (BVRLA) members, and this will remain, assuming the government does not need to apply the handbrake, such as a change to the Benefit in Kind (BiK),’ said Gerry Keaney, chief executive of the BVRLA, at the association’s Fleets in Charge conference on 7 July 2022.

With fleets deriving demand for EVs, the SMMT forecasts 353,000 BEV and 130,000 PHEV registrations in 2023. Based on their prediction of 1.808 million new-car registrations, this gives respective market-share forecasts of 19.5% and 7.2%. The combined EV share is thus forecast to rise to 26.7% this year.

This forecast aligns with EV-Volumes.com, which forecasts that EVs will gain a 27.1% share of the UK new-car market in 2023, climbing further to 33.8% in 2024 and 42.4% in 2025.

Divergence in Germany

Considering the potential impact of the phase-out of incentives in Germany, Eggerth highlighted the need to ‘differentiate between PHEVs and BEVs as the situation is different for these fuel types.’

‘The PHEV market is driven by fleet sales. The withdrawal of the incentives is not expected to have a significant impact on PHEV sales. We still have very advantageous taxation for company cars, which is a more important influence and will help support sales figures for PHEVs. Private sales are more important for BEVs than PHEVs. With the end of incentives, there will be more pressure in the market and it will become harder to keep up sales figures,’ Eggerth explained.

The German new-car market ended 2022 on a high note, driven by a record number of electric-vehicle registrations. EVs made up 31.4% of all new-car registrations during 2022 – the equivalent of around 833,000 units. Among these, 470,600 were BEVs and 362,100 were PHEVs.

Combined registrations of BEVs and PHEVs amounted to 174,000 units in December alone – the first time more than half of newly registered cars were EVs. It is also noteworthy that more than 100,000 BEVs were registered in the month.

Given the pull-forward effect of EV registrations into 2022, along with the impact of lower incentives on new-car prices and TCO, Reinhard Zirpel, president of the association of international motor vehicle manufacturers (VDIK), is cautious about the potential for EVs in 2023.

‘At the end of the year, manufacturers, dealers, transporters, and registration offices created the conditions that enabled many EV customers to still secure the higher subsidy. In the coming year, the momentum will slow down considerably. We expect only about 800,000 new electric vehicles in 2023,’ he said.

However, Roland Irle, managing director of EV-Volumes.com, points to more positive influences on the electrification of the German market.

‘Many factors support a further increase in Germany, like the Tesla ramp-up combined with the recent price reductions of 4% to 17% depending on the model, to meet the price caps for grants. We see 55 new BEV and five new PHEV models entering the European market in 2023 and Germany usually gets them first. There will be value improvements en masse in them, with prices more civilised than during 2021/22, and there are still lots of unfulfilled orders too,’ he explained.

Taking these positive elements into consideration, Irle forecasts 975,000 EV registrations in Germany in 2023, equating to a market share of 34.3%. The EV share is forecast to rise further to 38.8% in 2024 and 45% in 2025.

Taxation, supply, and charging infrastructure

The upshot is that a proliferation of new EV models and attractive tax benefits for company-car drivers will continue to support electrification as governments seek to phase out incentives.

This is crucial for both governments and carmakers to achieve climate targets. Conversely, the share of new ICE cars is in sharp decline. Although this benefits the environment, it presents a financial problem as tax breaks for EVs mean revenues generated by the automotive sector are in retreat. Accordingly, Switzerland plans to tax EVs to plug the funding gap created by diminishing returns from fossil-fuel cars, and changes to vehicle-tax regimes across Europe will inevitably follow.

‘Governments and manufacturers now have a hard decision in front of them, because the charging infrastructure is also not prepared to manage high demand. In some countries, the infrastructure is suffering a lot because demand is higher than expected,’ said Alberto Jimenez, product manager, RV and TCO, at Autovista Group.

Finally, Eggerth cautioned that supply continues to dictate the volume of new EV registrations. ‘The further development also depends on when production will return to normal. With the new COVID outbreaks in China, the supply-chain crisis and semiconductor shortages are still a factor of uncertainty, making it difficult for OEMs to plan for the future and make long-term decisions,’ he concluded.

Close

Close