With Europe’s light vehicle market slowing, how have electric vehicle (EV) forecasts been affected? Neil King, head of forecasting at EV Volumes, presents the latest outlook with Autovista24 special content editor Phil Curry.

Europe’s light-vehicle market, made up of passenger cars and light-commercial vehicles (LCVs), has experienced a rollercoaster ride this year. Major markets across the continent enjoyed relatively consistent growth following the end of the supply-chain crisis in August 2022.

However, this year has seen instability, with strong overall increases offset by large declines. With high interest rates and the cost-of-living crisis, the automotive market is in a state of flux.

EV Volumes has reduced its forecast for Europe’s light-vehicle market in 2024. It now expects growth of 2.4% across the continent by the end of the year, down from the 2.6% forecast in June 2024.

At almost 15.1 million units, this falls far short of the 18 million light vehicles registered in Europe in 2019. Moreover, EV Volumes does not see the European market returning to this level during the current forecast horizon, up to 2035.

Difficult forecasts for EVs

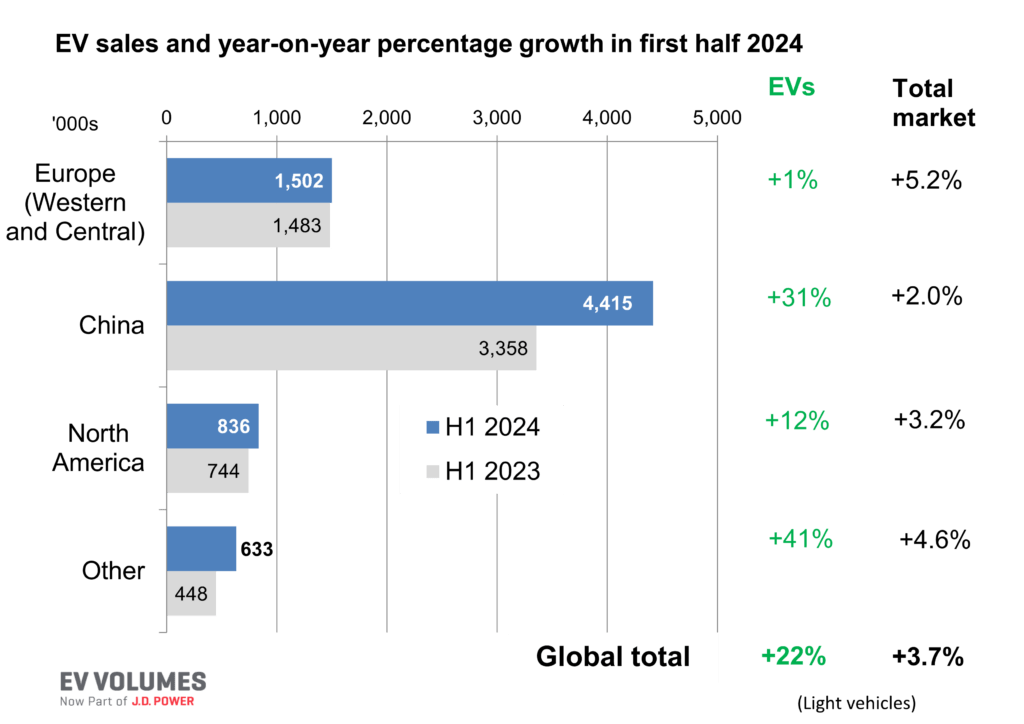

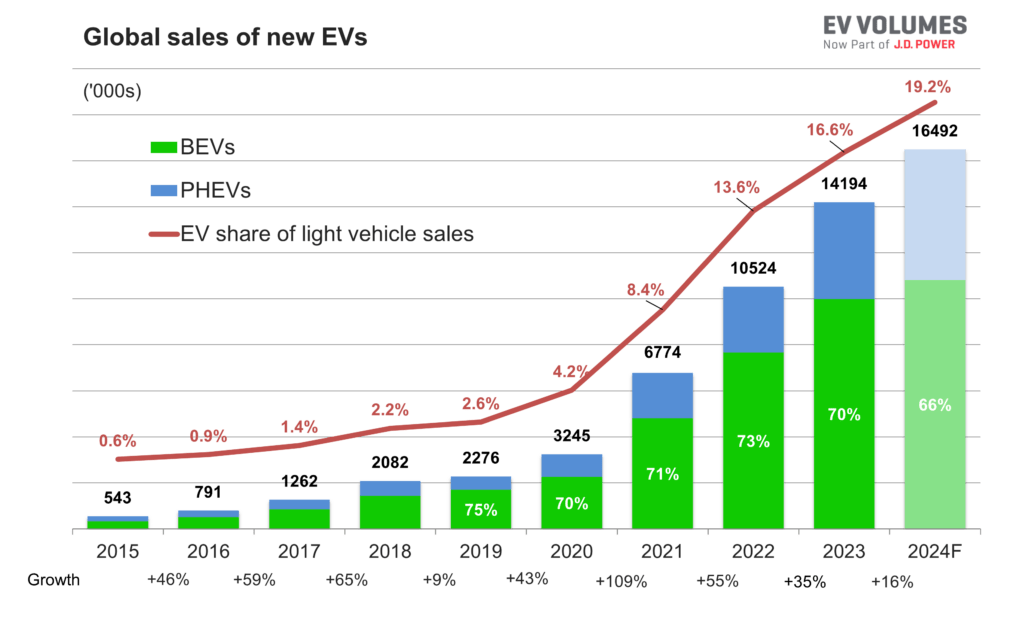

Europe’s EV market, made up of battery-electric vehicles (BEVs) and plug-in hybrids (PHEVs), has seen a significant slowdown. The electric light-vehicle market saw deliveries in Europe increase by 17.4% in 2023, with 3.15 million new units taking to roads across the continent.

However, some major markets changed their incentive schemes in the past 12 months. Germany ended all subsidies by the end of 2023. Meanwhile, France reduced the number of eligible models based on new carbon footprint figures. Even EV-friendly Norway has ended its VAT exemption for EVs.

Although Italy introduced an incentive scheme in May 2024, the funds dedicated to BEVs were totally depleted within a day. This caused a spike in passenger-car BEV registrations during June, with figures having returned to normal since July.

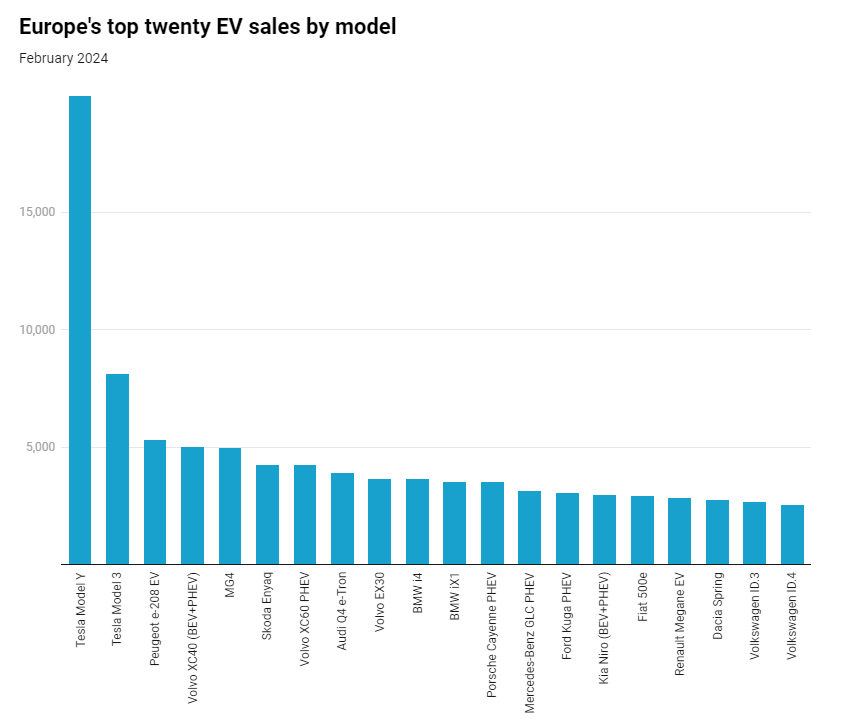

On a positive note, countries such as Spain and Poland are considering the revision of EV purchase subsidies. More affordable BEVs such as the Citroen e-C3 are rolling out too. Additionally, global EV-leader BYD has expansion plans for the region, as do other Chinese OEMs.

Provisional tariffs impact

This expansion is despite the EU imposing provisional import duties on BEVs manufactured in China.

Imposed on 5 July, the tariffs remain provisional and are subject to change. Discussions with the Chinese authorities are ongoing, hoping to ‘explore possible ways to resolve the issues identified in a WTO-compatible manner.’

Furthermore, OEMs have only had to provide bank guarantees at this stage. No additional duties are to be collected until a final agreement becomes definitive in November.

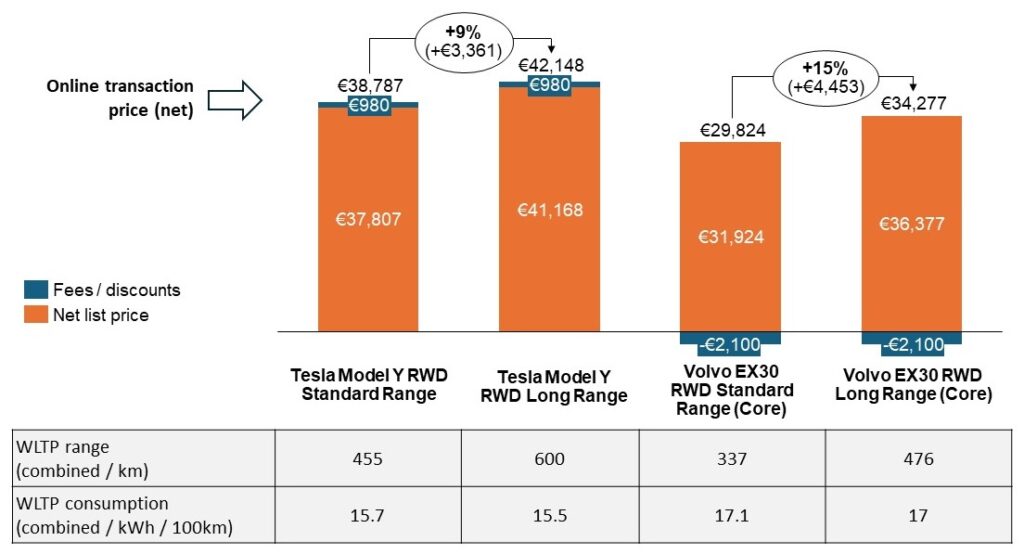

So far, only Tesla has announced a modest price increase of about €1,500 for the China-sourced Tesla Model 3. Meanwhile, both Nio and Xpeng stated they will not change prices in the EU. BYD is expected to absorb the tariffs without increasing prices.

MG-parent SAIC stated that it has sufficient stock to supply the market until the tariffs become definitive in November. Finally, falling lithium prices are also allowing OEMs to put off price increases of China-built BEVs.

EV Volumes assumes that prices will largely be unchanged until the tariffs become definitive in November, and these could yet be applied at a lower rate too. The impact on the 2024 BEV sales forecast for Europe is therefore negligible. However, it has considered price changes and demand elasticities, adjusting the forecast accordingly for 2025 and beyond.

EV declines ahead

Considering these market trends and tariffs, EV Volumes forecasts that European EV sales will fall 2.5% year on year in 2024. This equates to 3.07 million unit deliveries.

This equates to only 20.4% of all light-vehicle sales. This is lower than the 21.4% share achieved in 2023, and even the 20.7% gained in 2022.

There is a high risk that the EV share does not even exceed 20% this year. Volumes of BEVs are forecast to decline 3.5% year on year, with the technology accounting for 67.8% of all EV deliveries.

However, EV Volumes only forecasts a modest 0.2% decline in PHEV sales. This is because they offer a stepping stone to full electrification. Additionally, incentive changes mean BEVs have lost their price advantage in major markets like Germany.

Volumes to drop in forecasts

In terms of electric volume and share expectations, EV Volumes has lowered its forecasts for this year. This is partly because of a reduced outlook for total European light-vehicle sales. However, it also reflects weaker EV adoption in multiple countries and the lacklustre recovery of Germany’s BEV market.

Electric vehicles are also forecast to see slightly lower market shares in the years ahead. This follows the reduction or complete withdrawal of incentives as governments contend with high debt levels. Alongside this, more countries are pushing back on the EU zero-emission mandate for 2035.

Compared to the previous forecast, the European market share of BEVs and PHEVs is now expected to reach 24.2% in 2025 (was 25.9%), 61.1% in 2030 (was 62.3%) and 93.4% in 2035 (was 94.1%).

The forecast for 2035 includes some tolerance for timing interpretations of the zero-emission vehicle mandate. It also allows for exemptions for internal-combustion engine vehicles that may be deemed unsuitable for full electrification.

However, EV Volumes foresees a return to registrations growth next year, with EVs predicted to gain a 24.2% share. This is thanks to the rollout of new EVs and the implementation of more ambitious CO2 emission targets for new cars and vans in the EU, set at 93.6g/km for 2025-2029.

Tough times for electric LCVs

LCVs still lag far behind in electrifying, but a 49% growth in electric deliveries last year is encouraging, especially compared to the 16% growth for passenger cars.

High prices for EVs in this market, compared to diesel models, are still inhibiting. However, key new products such as the Ford Transit, Renault Trafic, and VW Transporter BEVs will help the market. So too will upgraded versions of the small, medium, and large electric vans offered by Stellantis brands Fiat, Peugeot, Citroen, and Opel/Vauxhall.

EV Volumes now forecasts that the EV share of the LCV market will decrease from 7.5% in 2023 to 6.6% in 2024. This will be followed by an increase to 9.8% in 2025, and 51.6% in 2030. Long term, the 2035 ZEV mandate will further accelerate the transition to pure-electric LCVs.

The forecast assumes that all Western and Central European markets will follow the directive, allowing for some exemptions and grace periods. Therefore, the ZEV share is unlikely to reach 100% in 2035, but EV Volumes forecasts a 92.6% share, compared to 93.5% for passenger cars.

Go to Autovista24 for related articles.

Close

Close