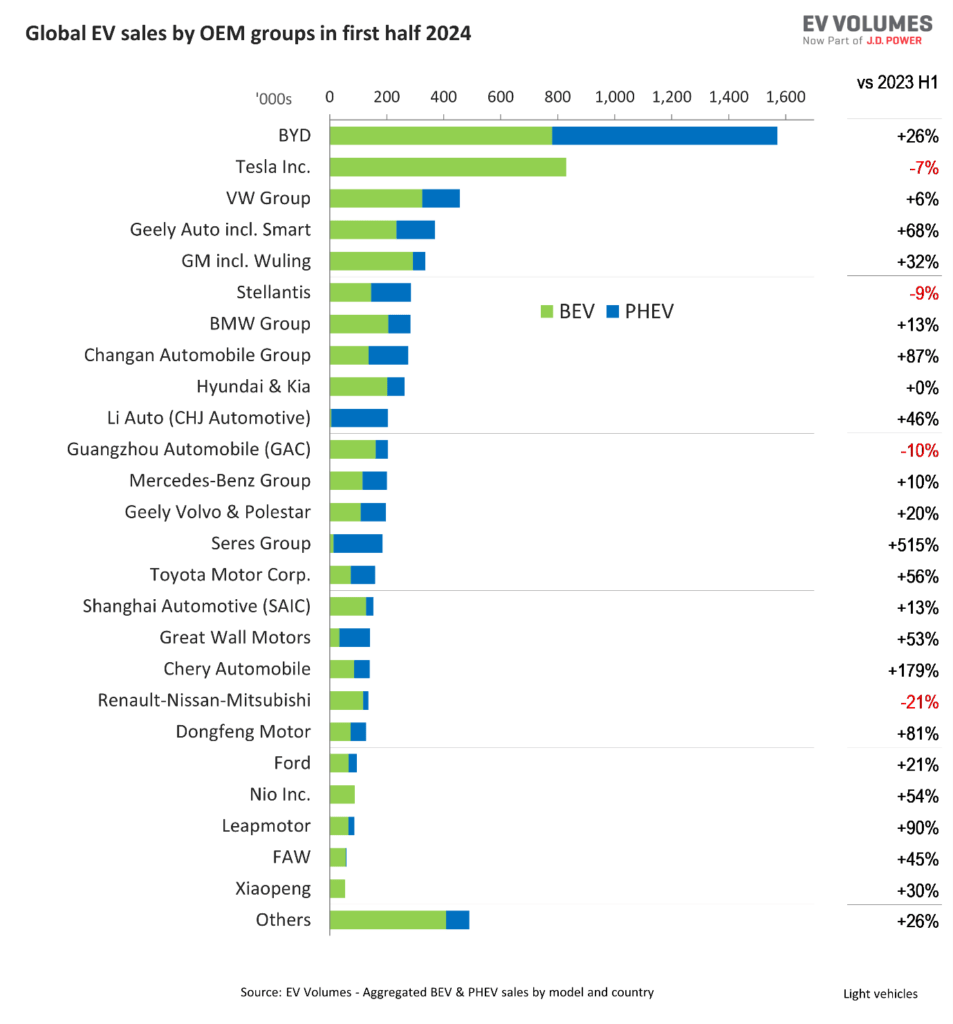

As Europe’s electric vehicle (EV) market grows, newer entrants such as BYD are establishing themselves. Autovista24 journalist Tom Hooker examines the latest figures from EV Volumes.

EV sales in Europe have continued to charge forward, with a year-on-year uptick of 27.1% between January and September. According to EV Volumes, a combined total of 2,720,459 battery-electric vehicles (BEVs) and plug-in hybrids (PHEVs) were sold.

This growth was spearheaded by a 34% improvement in the third quarter, as 926,519 new EVs were delivered.

So far this year, PHEVs have recorded greater growth rates than BEVs. EV Volumes does include extended-range electric vehicles in its plug-in hybrid figures. PHEVs enjoyed a 31.5% rise in demand during the first nine months of 2025, with 919,112 deliveries. This is an improvement from the 21.7% growth in the first half of the year.

Monthly PHEV volumes have ramped up throughout 2025, peaking with a 55.7% increase in September, reaching 130,179 sales. This marked the powertrain’s best year-on-year growth since June 2021, and its highest monthly figure since December 2022.

This means PHEV’s share of the EV market increased to a 33.8% slice between January and September. This was a 1.1 percentage point (pp) rise from its position during the same period of 2024.

BEVs saw greater volumes across the first three quarters of the year. A total of 1,801,347 all-electric models took to European roads from January to September. This was an improvement of 25% year on year.

The technology saw 257,297 deliveries in September alone, capping a ninth consecutive month of double-digit growth. This was its highest monthly total since December 2022 and marked a 20.3% increase compared to one year prior.

So, with growth in almost every month so far this year for both powertrains, which brands have capitalised, and which have fallen behind?

Chinese brands increase EV share

Chinese brands have undoubtedly increased their EV presence in Europe. Many carmakers from the country have seen their market shares rise this year, as volumes have surged.

One example is BYD, which recorded a 302.6% year-on-year EV sales improvement over the first three quarters of 2025. This means out of the top 10 best-selling EV brands in Europe this year, it is comfortably the fastest-growing.

BYD was eighth in the EV sellers ranking between January and September. The carmaker’s 119,085-unit total translated to a 4.4% market share, up 3pp compared to the first three quarters of 2024.

Between July and September, the Chinese brand’s volumes rose by 284% to 48,336 registrations. This placed it seventh in the quarterly table, with a 4.8% market hold, up from 1.8% during the third quarter of 2024.

Seal U steals the show

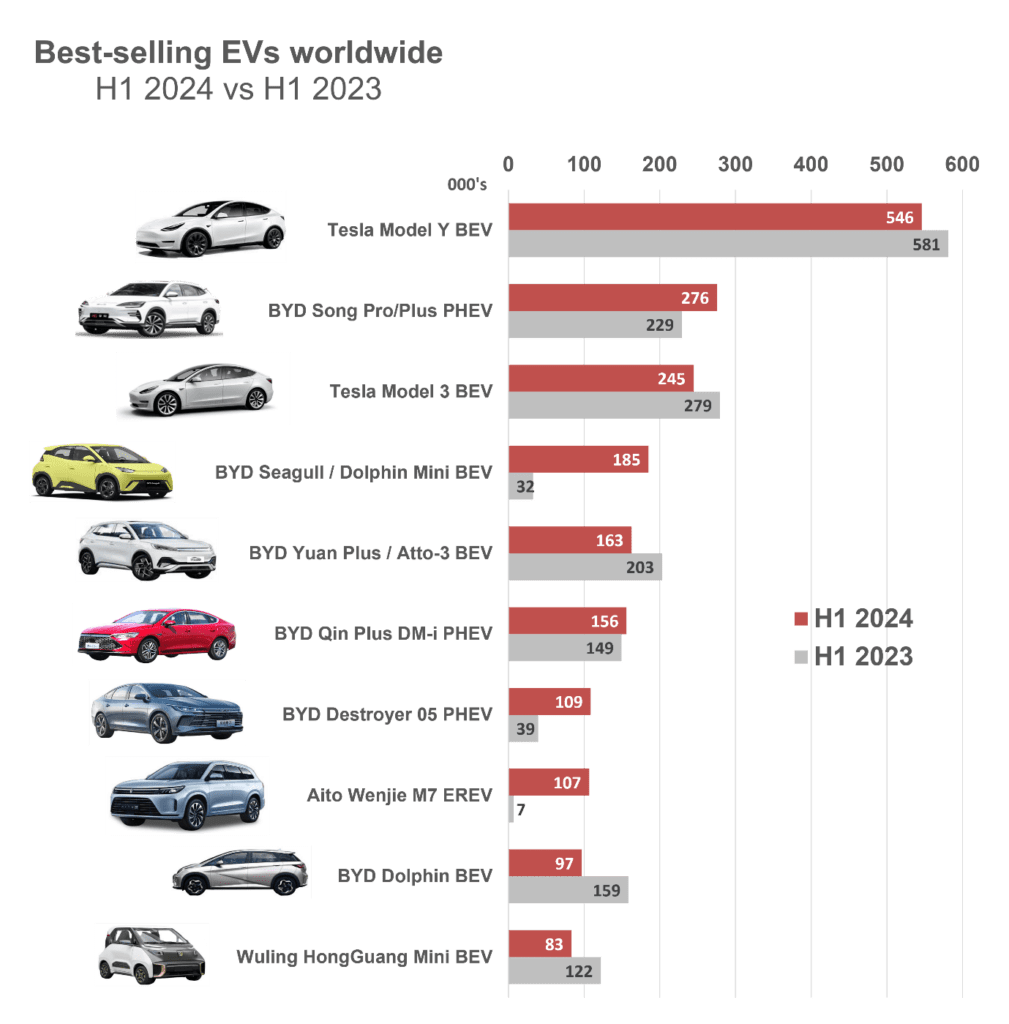

The highlight of BYD’s EV range was the Seal U plug-in hybrid. It led Europe’s year-to-date PHEV market for the first time in September, moving past the VW Tiguan with 45,837 units. This also marked the first time a model from a Chinese brand has led Europe’s cumulative PHEV or BEV standings.

This was thanks to a 10,089-registration tally in September alone. This made it the month’s third-best-selling EV in Europe, behind only the Tesla Model Y and Tesla Model 3.

Xpeng has also made significant progress in Europe this year. The brand’s volumes soared by 185.3% to 12,729 units after nine months of 2025. Its G6 SUV has been its best performer, with 8,751 so far this year.

Meanwhile, Lynk & Co saw a 20.8% increase in deliveries from January to September, with 6,351 registrations. The majority of the carmaker’s volume came courtesy of its 01 PHEV.

Barriers to entry remain

The entrance of new brands does not come without hurdles, however. BEVs produced in China still face steep EU import tariffs, which were imposed in October 2024. This means increasing their European EV presence is not easy. Carmakers may consider localising production or raising list prices.

Some brands are focusing on plug-in hybrids. While PHEVs are subject to the regular 10% EU import duty, the technology does navigate around the BEV tariff rate.

For example, PHEVs made up 85.1% of Lynk & Co’s EV sales. Conversely, Xpeng focused solely on BEVs, which represented 100% of its EV deliveries. BYD had a more balanced strategy, with PHEVs accounting for 40.1% of its EV total.

VW doubles down on EVs

Volkswagen (VW) continued to sell the greatest volume of EVs in Europe after the first nine months of 2025. The brand’s total of 305,746 deliveries equated to a 104.6% surge. In turn, VW’s market EV share rose by 4.2pp to 11.2%.

The German marque’s pace is not slowing down. It recorded the most EV registrations in Europe from July to September, with 101,683 units equating to an 84.8% year-on-year improvement.

The brand has seen many of its EV models perform well this year. In the BEV market, the VW ID.3 sat fourth after the first three quarters of 2025, with 57,699 units. The ID.4 took seventh, followed by the ID.7 in eighth, with 56,186 and 53,570 registrations, respectively.

For nine months in 2025, the VW Tiguan has been in a hotly contested battle at the top of the PHEV market. It sat in second with 45,277 deliveries, putting it just 560 units behind the BYD Seal U.

BMW’s comfortable position

BMW’s EV sales recorded a 15.6% improvement from January to September, posting 245,276 deliveries. It was secure in second position at the end of September. The brand trailed VW by 60,470 units, while sitting ahead of third by 60,046 deliveries.

The manufacturer captured 9% of the European EV market. However, due to increased competition, this was a 0.9pp drop compared to the first three quarters of 2024. In the third quarter alone, its share fell by 1.3pp to 8.7%. This was despite a 17% rise in volumes to 80,809 units, which placed it in second.

However, the brand only placed one model in the cumulative top 10 of both the BEV and PHEV rankings. The BMW iX1 was the 10th best-selling BEV in Europe, with 46,775 deliveries, 3,446 units behind ninth. Meanwhile, the BMW X1 landed fifth in the PHEV standings, posting 30,314 deliveries from January to September.

Stagnation for Mercedes-Benz?

Mercedes-Benz was the third German brand to make Europe’s EV top three. This was thanks to 185,230 sales across the first three quarters of the year.

However, this was down 0.6% compared with the same period of 2024, mainly caused by a poor first quarter. Consequently, its share in the first nine months of 2025 dropped from 8.7% to 6.8%.

Yet, Mercedes-Benz managed a 5.4% increase in registrations between July and September, with 63,412 units. Should Mercedes-Benz be able to replicate this result in the last three months of the year, it could avoid a full-year decline.

Just one of its models sits in the BEV or PHEV top 10, namely the Mercedes-Benz GLC plug-in hybrid. The SUV is in seventh in the year-to-date BEV standings with 25,847 units. It was closely followed by the MG eHS, just one delivery behind in eighth.

Tesla banks on Model Y

Tesla deliveries took a 29.2% drop in Europe between January and September, equating to a loss of 71,131 units. Meanwhile, its share slumped by 5.1pp to 6.3%. Yet, the brand still took fourth in the year-to-date table, with 172,582 units.

Tesla’s decline was less pronounced in the third quarter, with a 20.4% drop, to 62,557 registrations.

The Model Y and the Model 3 made up 99.3% of Tesla’s sales in Europe after three quarters of 2025. The crossover comfortably led Europe’s all-electric market after nine months of the year, with 109,524 units.

Meanwhile, the Model 3 moved up to second in September. It sat 47,738 deliveries behind its sibling, recording 61,786 registrations from January to September. Both models also locked out the top two spots in the month’s BEV table, despite their volumes falling year on year.

Audi’s growing EV presence

Audi moved up to fifth in Europe’s year-to-date EV standings, thanks to 151,005 deliveries. This represented year-on-year growth of 14.2%. However, its share fell by 0.6pp to 5.6%. In the third quarter alone, the German marque enjoyed a 33.4% uptick in demand to 51,034 units, placing it in sixth.

No Audi models featured in the BEV or PHEV top 10 tables after nine months of the year. However, the Q6 e-tron did place 10th in September’s monthly all-electric standings, with a 253.9% delivery surge to 5,323 units.

Yet, it was the Audi Q4 e-tron that was the brand’s most popular EV model after three quarters of 2025. It represented 29.3% of the carmaker’s overall plug-in figure.

Falling EV registrations for Volvo

Volvo suffered a 17.3% fall in EV sales from January to September, dropping to sixth in the year-to-date table. Its 147,339-unit total gave it a 5.4% share of the market, down from 8.3%.

The manufacturer endured an even steeper decline of 17.8% in the third quarter alone, with volumes dropping to 44,849 units. Its market hold in this period was 4.4% down from 7.9% in the third quarter of 2024.

Its Volvo XC60 sat in third in the year-to-date PHEV table with 42,555 units, just behind the VW Tiguan. The model landed fourth in September’s monthly standings, pipped by the Jaecoo J7. The SUV made its first-ever appearance in the PHEV top 10, with a record 6,122 registrations.

Skoda’s mixed EV performance

Skoda posted a 129.3% surge in plug-in deliveries during the first nine months of 2025. It sat seventh in the cumulative table with 145,385 units, as its share grew by 2.3pp to 5.3%.

This improvement was foreshadowed in the third quarter. The brand saw a 95.7% rise in volumes between July and September alone, putting it fifth. Two BEVs have led Skoda’s EV efforts, although they faced contrasting fortunes.

The Elroq moved up to third in the year-to-date BEV table, with 58,680 registrations, just 3,106 units behind second. It also took third in September’s monthly BEV standings, with 9,972 deliveries.

Its older sibling, the Enyaq, fell two spots to sixth in the cumulative BEV chart, with 56,581 units delivered.

Cupra and Renault fall

BYD’s improvement came at the expense of Cupra and Renault, who were victims of the continent’s competitive nature. The brands dropped to ninth and 10th, respectively, in Europe’s EV standings after the first three quarters of the year.

This was despite a volume increase of 80.4% for the former, as its share grew from 2.9% to 4.2%. Meanwhile, Renault’s EV registrations surged by 82.8%, equating to a 1.3pp rise in share to 4.1%. Yet, neither brand featured in the third quarter’s EV top 10.

The combined total of the Renault 5 and Alpine A290 represented over half of Renault’s EV total between January and September. The hatchback sat fifth in the BEV chart after three quarters of 2025, with 56,642 deliveries.

Cupra’s most notable model was the Formentor, which secured ninth in the PHEV top 10 after three quarters of the year. This was thanks to 21,480 deliveries.

Close

Close