The EU’s new-car market has not seen a good start to 2025, underlined by another registrations drop in February. Autovista24 special content editor Phil Curry assesses the latest figures.

Europe’s new-car market struggled in February, with petrol and diesel registrations the culprit once again. The market saw increased battery-electric vehicle (BEV) and hybrid registrations. But these were not enough to offset major collapses in deliveries of fossil-fuel powertrains.

The latest data from ACEA shows that the EU market fell 3.4% in the month, with 853,670 units delivered. This was a gap of 30,168 units compared to the same period last year.

Changes in regulations

At the start of March, the European Commission submitted its industry action plan. It set out a roadmap to relax the CO2 emissions regulation timetable on new cars.

Previously, manufacturers were required to reach an average emission level no higher than 93.6g/km across their fleets. Otherwise, they would face fines for each 1g/km over.

Carmakers will now have a period of three years to comply. The average emissions figures between 2025 and 2027 will be taken into account. This means any emissions over the limit can be balanced out in the remaining period.

Before this, some carmakers may have withheld petrol and diesel sales, lowering the number of models available. This would have been countered with a greater availability of hybrid and electric vehicles (EVs), resulting in lower fleet emissions.

Moving forward, carmakers will be wary of not being able to balance out high average fleet emissions in one year. However, they may look to offer a more rounded powertrain range to boost sales and profits.

BEVs buck the decline in registrations

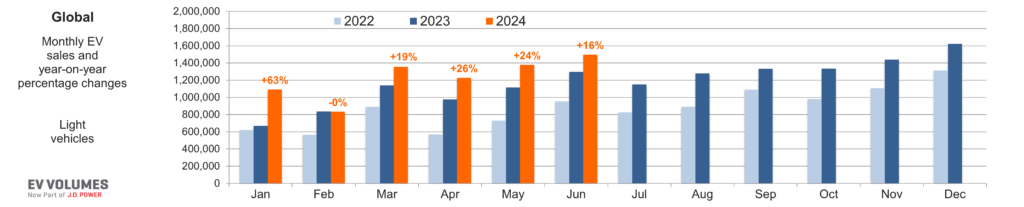

Whether a result of the previous emission regulation or a surge in popularity, the BEV market is currently riding high. During February, the market was up 23.7%, with 131,275 registrations. This was a difference of 25,109 units compared to February 2024, highlighting the improvement of the technology.

In terms of market share, BEVs made up 15.4% of total registrations in the month. This was up 3.4 percentage points (pp) compared to the same month last year.

Across the big four markets, Germany saw the highest volume, with 35,949 registrations, up 30.8%. Spain saw the biggest increase, with 6,112 units equating to year-on-year growth of 60.6%.

Italy’s BEV market grew 38.2% with 6,922 units. Only France saw a decline, down 1.9%, with a volume of 25,335 units. This was still the second-highest total in Europe.

With both Italy and Spain recording low BEV volumes, the market is more balanced than most. Both Belgium and the Netherlands can be considered major markets for the all-electric powertrain. Last month, Belgium saw 13,040 BEV deliveries, up 38.9%. Meanwhile, the Netherlands was up 22.4%, with 10,174 units.

Registrations building back

BEVs struggled in the EU last year. A mix of incentive changes, subsidy cancellations and tariff implementations affected the market. However, the technology has started this year well, with two high double-digit increases in the first two months of 2025.

This means in the year-to-date, BEVs were up 28.4%, with 255,489 units delivered. Three of the four largest EU markets accounted for 46.4% of all BEV registrations, and recorded robust double-digit gains. These included Germany, up 41%, Belgium, up 38%, and the Netherlands, up 25%. This contrasted with France, which saw a slight decline of 1.3%.

BEVs have taken a 15.2% share of the EU new-car market so far in 2025, up from 11.5% at the same point last year. The increase in the year-to-date figures may be due to fluctuations in the BEV market at the start of 2024. This is backed up by the strong result in Germany.

At the end of 2023, the country abruptly stopped its incentive scheme for private buyers. This impacted registration totals at the beginning of last year, which the market is now making up for. With increased uptake in other markets and the potential effects of emission regulations, the EU BEV market is pushing forward.

Hybrids remain popular

Hybrids were the only other powertrain to record growth in February. Made up of full and mild-hybrids, this sector saw 304,062 units registered, an increase of 19% year on year.

The result meant that hybrids once again led the new-car market in the month, with a 35.6% share of deliveries. This was an improvement on the 28.9% hold 12 months ago. At this point the technology was closing in on the once market-leading petrol powertrain.

Across the first two months of the year, hybrids improved their volume by 18.7%. A total of 594,059 units have been registered. This is nearly 100,000 more than in the same period last year. Their share of 35.2% of the market was up by 6.4pp.

Meanwhile, plug-in hybrids (PHEVs) suffered a minor decline in February. Figures were down by 1.4%, with 63,570 deliveries to customers. However, due to fluctuations elsewhere in the market, the powertrain’s share grew by 0.1pp, to 7.4%.

PHEVs have had a tricky start to the year, seemingly being bypassed by drivers in favour of hybrids or BEVs. The technology was 5% down across the first two months of 2025, with 124,947 registrations. This gave it a 7.4% hold of the total market, a drop of 0.2pp.

Electrified market dominates

These individual results combine to show that the EU market is moving further towards an electrified future.

The EV market, made up of BEVs and PHEVs, grew 14.2% last month, hampered slightly by the plug-in hybrid decline. 22.8% of all models delivered in February were plug-ins, as the sector edges towards a quarter of the market. This was up from 19.3% recorded in the same month last year.

Between January and February, EVs were up 15.1%, again thanks to the strong performance of BEVs. Their combined market share of 22.6% was up from 19% at the same point in 2024.

Adding hybrids into the mix, electrified models dominated the EU new-car market. In February, the market share increased by 10.2pp, to 58.4%. The grouping saw registrations grow by 17.1% in February, equating to 72,823 more electrified model deliveries.

In the year to date, the result was similar. Electrified vehicles lead with a 57.8% market share. This was up by 10pp year on year, while registration totals improved by 17.3%. This equates to an increase of 143,667 units compared to the same point in 2024.

ICE slide continues

While electrified models fly high, internal-combustion engines (ICEs) have pulled the overall EU registration figures into decline.

Petrol registrations in February plummeted 22.4% year on year. A total of 244,073 units were delivered to customers in the month, equating to a market share of 28.6%. This was a drop of 7pp compared to the same period last year.

Meanwhile, diesel registrations fell 28.8%, to 80,569 units. This meant the powertrain took a 9.4% hold of total figures, down from 12.8% last year.

Over the first two months of 2025, petrol registrations fell by 20.5%, with 489,838 units. The fuel type’s market share of 29.1% was down from 35.5% in the same period last year. Diesel was down by 28%, with 163,452 registrations. It made up 9.7% of the market, down 3.4pp.

Combined, the ICE market fell 24.1% in February. Its year-on-year deficit of 102,988 deliveries could not be plugged by electrified models, leading to the EU market’s overall decline. The powertrain grouping captured 38% of overall volumes, a decline of 10.4pp year on year.

The same situation occurred in the year to date. ICE registrations fell 22.5%, with a gap of 189,720 units. This was too large to be bridged by electrified registrations. So, the EU market ended the period with a total loss of 51,458 deliveries.

Petrol and diesel models accounted for 38.8% of new-car volumes across the first two months of 2025. This was a significant distance from the 48.5% recorded in the same period last year.

Whether the changes to emissions rules will help ICE registrations remains to be seen. However, the market has been in decline for some time. This suggests that the EU’s shift towards electrification is caused by the changing attitudes of buyers and overall model range options.

Close

Close