Battery certificates and state of health (SOH) checks are at the forefront of a growing used electric vehicle (EV) market. How will they help answer the big used-EV questions from retailers and buyers? Tom Hooker, Autovista24 journalist, investigates the subject.

For the modern used-car buyer, it has become commonplace to access a plethora of information about any model online. This research can be done through portals or directly from retailers. Yet, the sector is in the midst of a big shift.

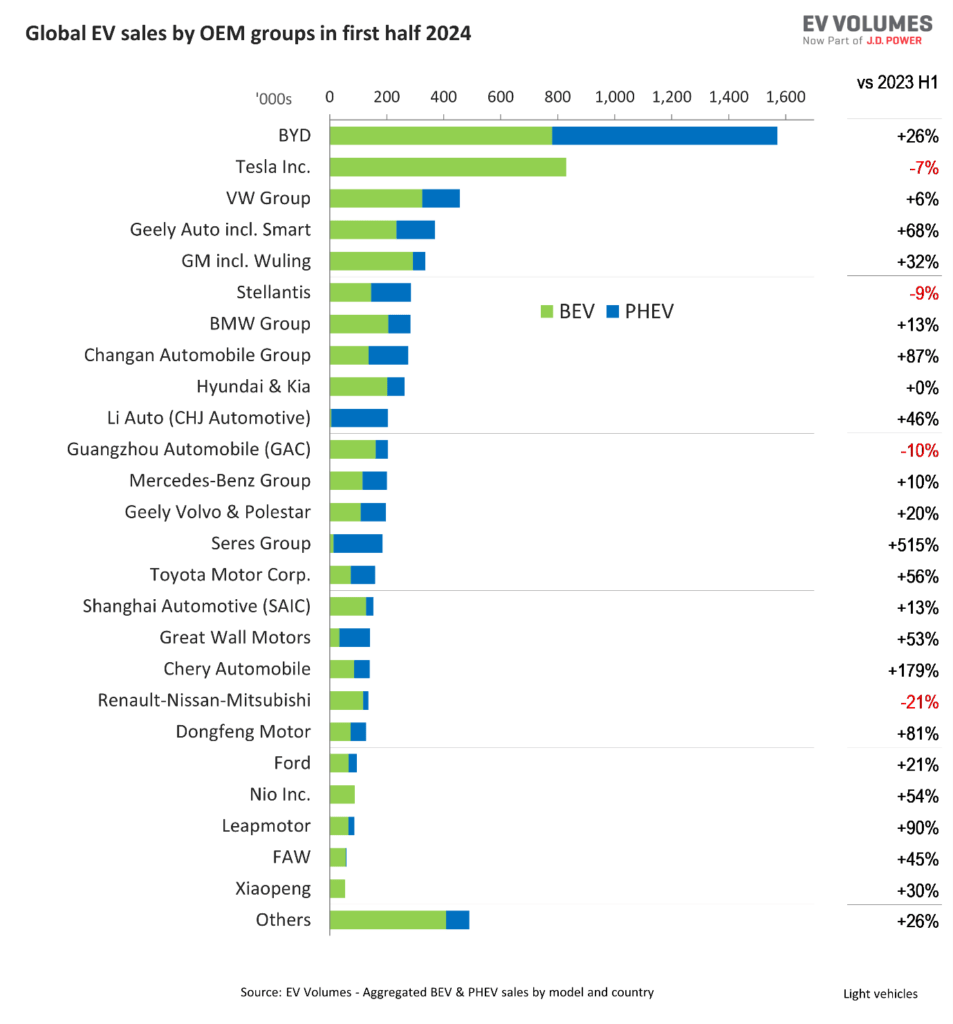

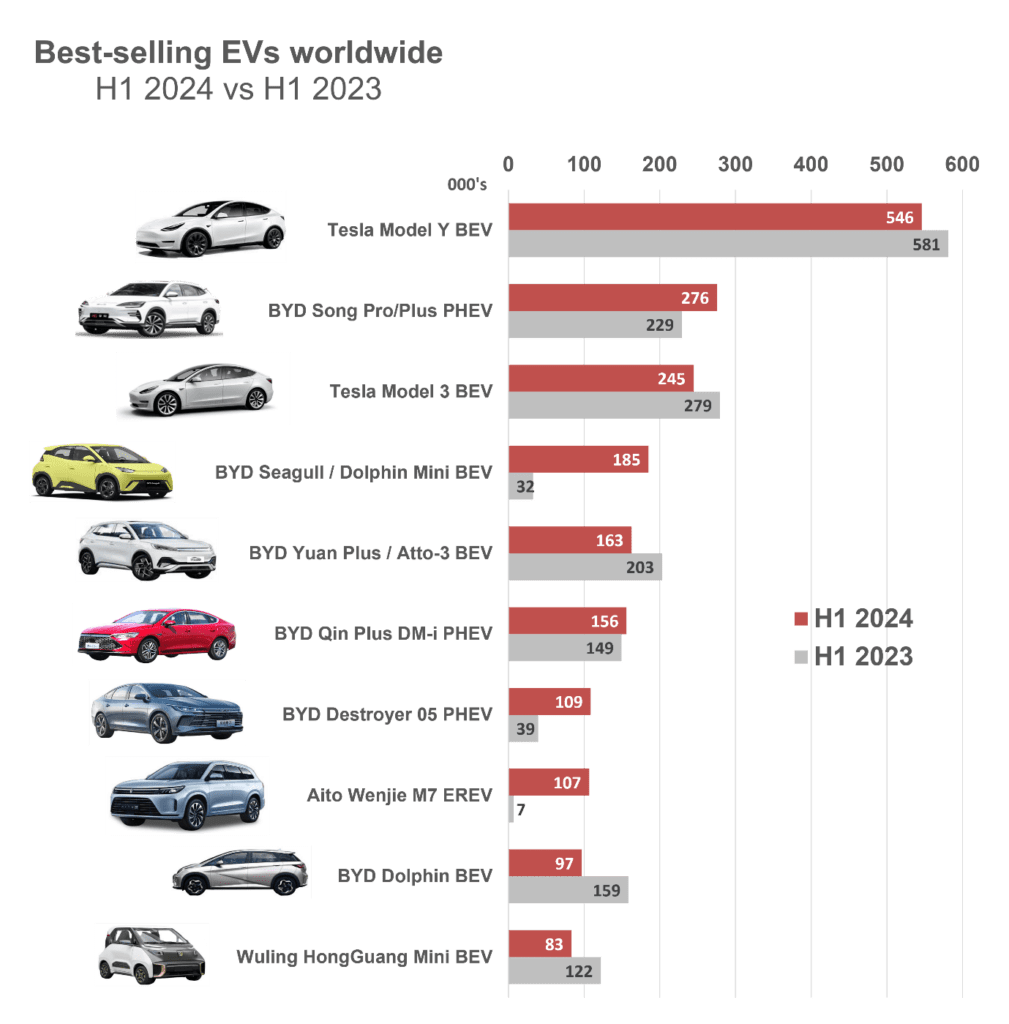

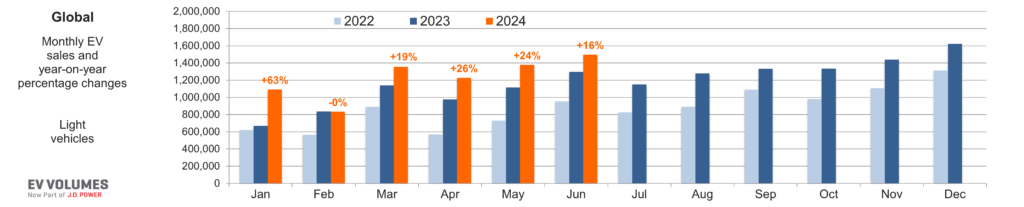

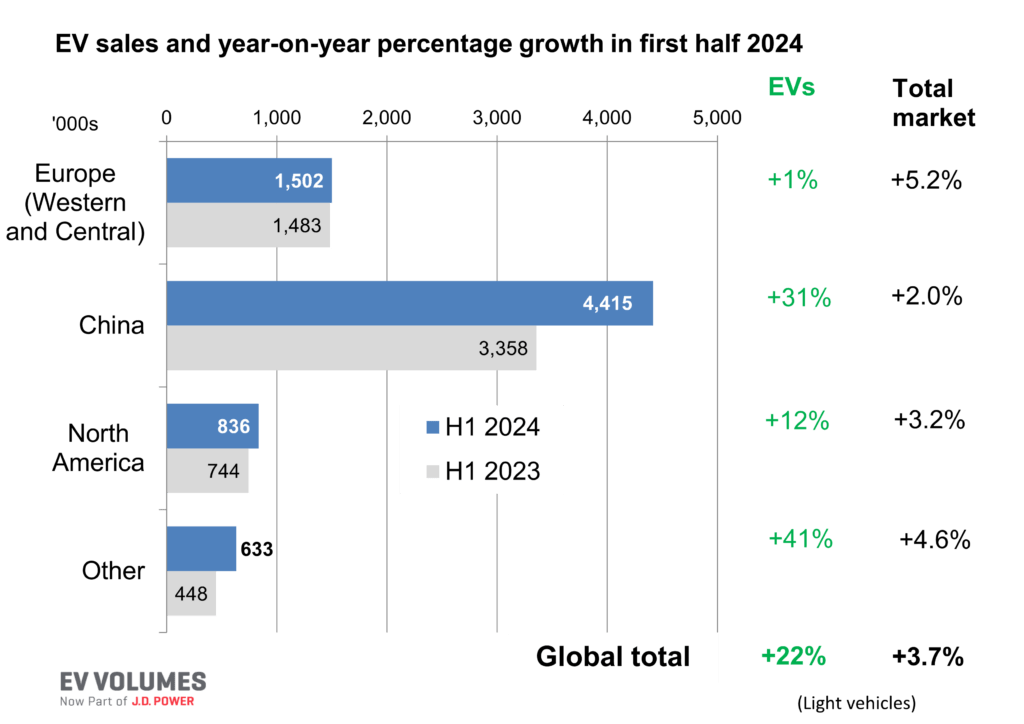

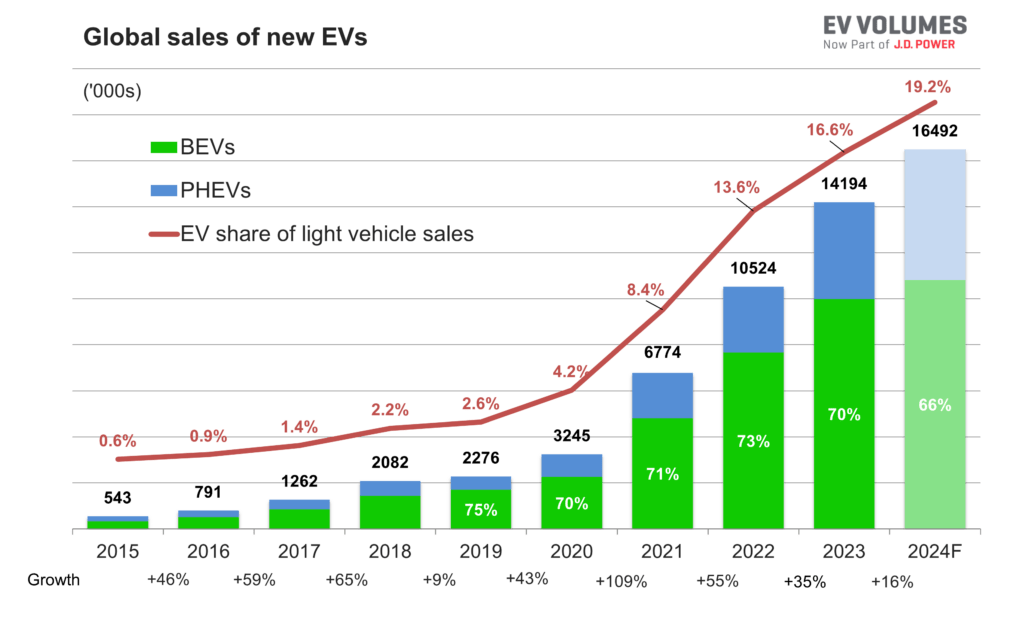

As battery-electric vehicle (BEV) and plug-in hybrid (PHEV) registrations increase across new-car markets, the supply of used EVs rises. This presents a new challenge for retailers. They need to convince consumers to buy EVs, while also learning how to accurately price them and make profits.

Battery SOH checks could be a solution to this challenge. They can provide customers with peace of mind while revealing a car’s history, value, and selling potential to retailers.

‘EVs are not degrading the same way as petrol or diesel vehicles. Mileage is not sufficient to have a clear view of the current health of an EV. That means for the exact same mileage, you can buy two EVs with a very different fate,’ BIB batteries CEO Pierre-Amans Lapeyre told Autovista24.

‘Knowing the SOH, you can have the history, the current value and the future. It gives you what should be the real residual value of the vehicle. I would much rather have the SOH of an EV than know its mileage, because from what we have seen on the market, two vehicles with the exact same SOH could have a completely different mileage,’ he added.

Fostering used-EV uncertainty

‘Nowadays, you can advertise a car with photographs, with descriptions, and with diagnostics. Everybody can do that. So, I think as an industry we have solved the problem fairly well with the technology available,’ outlined Roland Gagel, CARA board member at the Used Vehicle Retail Summit.

‘We see that this market is very rational, buyers are looking for transparent offers and want to see pictures and descriptions,’ he added. Gagel then explained that BEVs are a different prospect, with the most important aspect of the car being the battery.

He highlighted that current advertisements of used EVs are not clear enough and can foster uncertainty among potential buyers. Late entrants to the EV space could be particularly impacted.

Convincing late adopters

Gagel explained that when buying or selling a three-year-old petrol or diesel car at 70,000km, you can assume it has a well-maintained engine. This means you can easily drive the car for ten more years.

However, the buyer confidence around longevity is very different for electric devices. Mobile phones are one such example. ‘We are not talking about the early adopters, the people who already wanted to have an EV five years ago,’ said Gagel.

‘We are talking about the people who now start to think about it and will maybe finally be convinced. They know that after four or five years, their mobile phone is dead, and the battery is not okay. So, what does that mean for my three or four-year-old EV?

‘I am maybe going to want to resell it after eight or nine years and want to buy another one. So, we have this problem, which is very often the range, because in the end, that is what the driver feels.’

There are tools available to help drivers understand more about the lifespan and health of their EV. Most models now show average energy consumption on their infotainment screen. This can be divided by the total energy storage of the battery, which provides the real, approximate range of the vehicle.

So, customers can be provided with a wealth of information on the condition of a used EV. However, how this information is used and shared by the retailer makes all the difference.

Limited certificate usage

Gagel showed an example of an online used-car portal from a remarketing company. Here, the price of a BEV was marked down by €2,000 without any information on why the model’s price had been reduced.

Additionally, Gagel searched the mobile.de website for a popular German BEV. With certain parameters selected, he got 160 results. Out of this, 50 had a battery SOH certificate. However, in most cases, the actual SOH value could not be found in the description.

‘Imagine you sell a car without mileage, and the buyer calls the dealer to know the mileage. What do you do with such an advertiser? Just skip it and go to the next,’ he commented.

Gagel then went on to show the carmaker’s own website for its used cars. He selected two of their BEV models, which gave him 2,600 search results. However, only 40 of these models had a battery certificate shown on the portal. Lapeyre also noted the lack of SOH certificates on online adverts.

‘There are a lot of studies about the fear of individuals buying EVs, they do not trust the lifespan of the battery. I would say around 50% of dealers today put SOH on their vehicle adverts. You will not sell your EV if you do not have this information,’ he stated.

Regulatory impacts

The introduction of new regulations could also help improve the clarity between used EV sellers and potential customers. SOH checks would be a pivotal technology in achieving this clarity.

For example, the upcoming Euro 7 regulations state that passenger cars must retain at least 80% of their original battery capacity after 5 years or 100,000 km, whichever comes first. Then, after 8 years or 160,000 km, the battery capacity must be at least 72%.

Furthermore, the regulation states that EVs must have SOH monitors onboard. Data from these monitors must be displayed to users, retrievable from diagnostics, and included in the vehicle’s Environmental Vehicle Passport.

‘The regulation that comes with Euro 7 and the battery passport will foster the transparency of the SOH. The regulation will start in 2027, so in the used-car sector, you will see it from 2028 with the first short-term rentals,’ noted Gagel.

‘But I think the real effect will come in 2029 and 2030. So, we have five years to go to sell used cars without the battery pass and Euro 7,’ he added.

Increasing consumer transparency

‘There is an unsourced fear about the end of warranty for EVs. When they end, people are freaked out, and it is not rational,’ said Lapeyre.

According to a 2024 McKinsey & Company survey, 31% percent of prospective EV buyers say they are likely or very likely to consider a used EV for their next vehicle purchase. For those EV sceptics, 49% were concerned about unclear battery degradation.

So, the industry cannot wait another five years to start improving the used EV sales experience and calming EV concerns.

‘The key point for us is how to get this into a B2C sale and how to show the positive part of the batteries. How do we convey this message? How can we train the salespeople to sell this off to the consumer? That will be very important for the industry,’ said Gagel.

‘On the dealership side, I think they need to provide their clients with battery certificates. They need to train their salespeople so that they can show and express the value of an EV to their clients,’ commented Lapeyre.

‘What can you do as an industry? For me, it is very clear, used-car offers need to become more transparent. They are not transparent today,’ said Gagel.

‘In the end, if the buyers do not have clear information about the battery, they will assume there is a problem. The clearer we are and the more we are pushing in the direction of transparency, the more likely it will be that BEVs will recover from their residual values.

‘It is not just good to measure the vehicle, but we have to make sure it gets into the vehicle description, so the customer knows we have good cars to sell,’ concluded Gagel.

Close

Close