From repair to solid-state advancements, electric vehicle (EV) batteries are a complex equation for fleets. How can these businesses better understand and work with the technology? Autovista24 journalist Tom Hooker assesses the latest battery advancements.

The battery-electric vehicle (BEV) share has grown across Europe this year. In major new-car markets such as France, the fleet sector is a driving force behind electric registrations. Fleet-oriented incentives have helped encourage uptake, as in Germany.

This shift makes it vital for those in the sector to understand the batteries powering their vehicles. In turn, they can make smarter purchasing decisions, optimise maintenance and retain the highest profit margins when defleeting.

Cloud-based battery management

Digital battery health certificates and data can provide clarity for both private consumers and fleets. It can also help increase transparency, streamline remarketing and maximise residual values.

From February 2027, EV batteries sold in the EU must have a Battery Passport. The digital identity will be similar to a vehicle logbook, where battery charge cycles, energy efficiency and degradation trends must be included.

How can fleets stay informed until then? One solution is a cloud-based battery management solution that supports the resale of EVs.

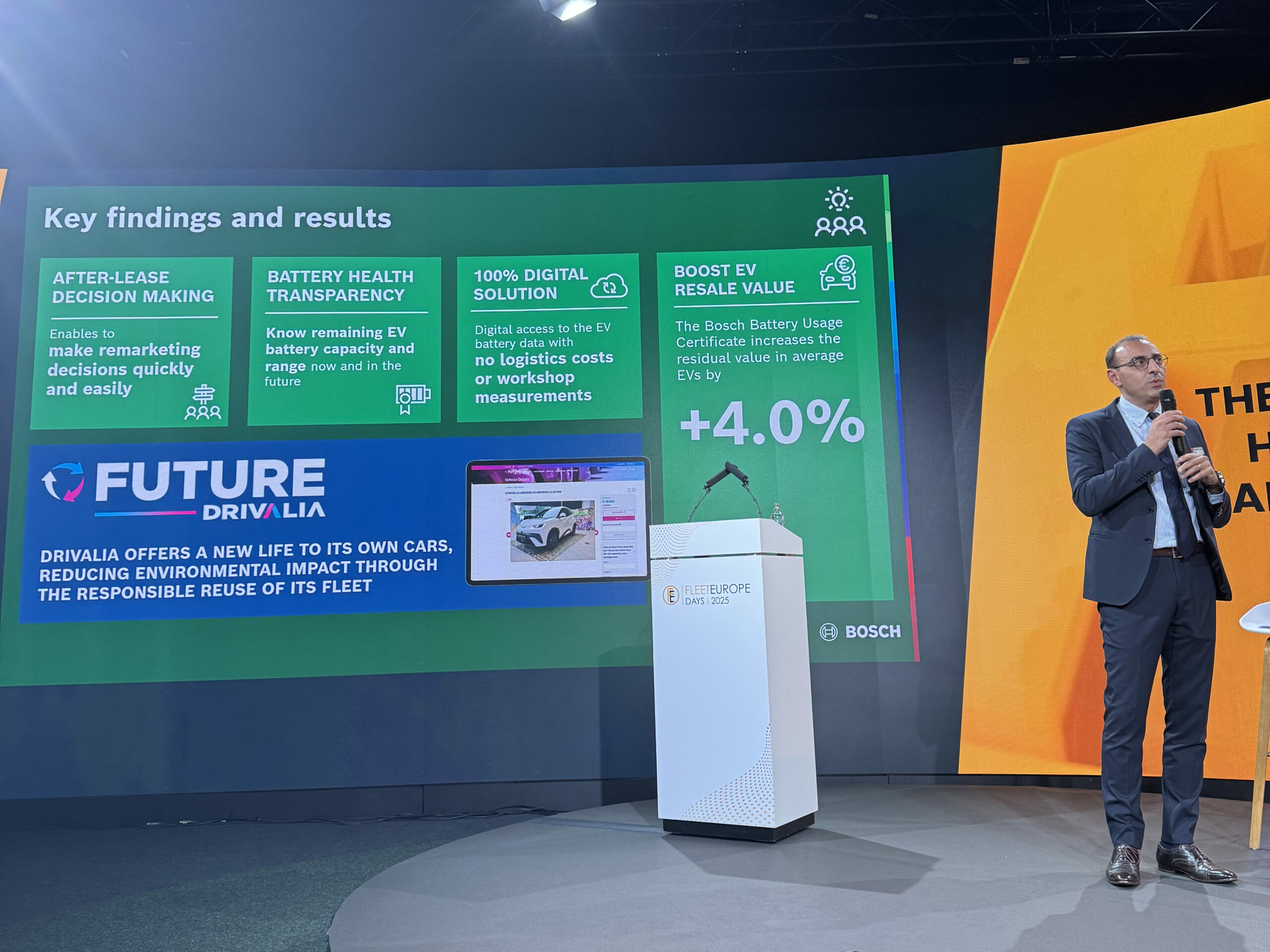

‘Together as leaders in mobility and technology, we have the unique opportunity, especially for EVs, to use remarketing and the right point of resell to make not only a transaction out of it but make it a data-driven business model,’ outlined Christiane Soppa, director of business development at Bosch, at Fleet Europe Days.

Bosch conducted a pilot programme together with European mobility and car rental company Drivalia. This involved monitoring the data of approximately 100 vehicles between January and June 2025.

‘The heart of an EV is the battery. So, we took the heartbeat of the EV and put it online. The target was to take away the EV friction we have in remarketing. We looked at stress factors and anomalies based on very simple data,’ explained Soppa.

From transaction to database

There are three steps to the process. Once the EV is connected, data can be collected. Bosch was able to track battery temperature, voltage, charging behaviour and driver usage. This provided a real-time picture of the power-storage unit.

Second, a cell-by-cell digital twin of the battery was created in the cloud. This combined AI machine learning with data taken from 150,000 vehicles tracked by Bosch worldwide to regularly review its algorithm. Third, the system detected anomalies and any battery issues.

‘The twin can completely monitor the battery. By spotting issues very early, you can redesign the right point of resell. We take the battery measurements, the state of health and anomalies before the decision point when you sell the car, not afterwards,’ she stated.

‘That is turning remarketing from a transaction to a database strategy. As a fleet manager or a leasing company, this is changing everything, because you suddenly get into the driver’s seat,’ Soppa continued.

Bosch was also able to produce a certificate at any time, revealing driving behaviour, anomalies, and charging history.

‘You could even use this data to discuss with your clients early, to change their behaviour. Decision making is not a best guess or dependent on lifetime and mileage anymore. It is based on data. What we see from all the pilots we did in the past years, in Bosch and all the data we have, sales can be boosted by up to 4% on average for resale,’ she commented.

However, Soppa highlighted that this requires monitoring of the battery to optimise the point of resale.

‘This is a very important digital platform that will permit the company more in the future to retrieve and collect data from the fleet, and let the company adjust it as best as possible,’ highlighted Drivalia CEO Roberto Sportiello.

Is battery repair the solution?

While Bosch’s tool can be used to boost resales, another way to maximise profit margins within a fleet is to reduce maintenance costs. So, what options do fleet managers have in this instance?

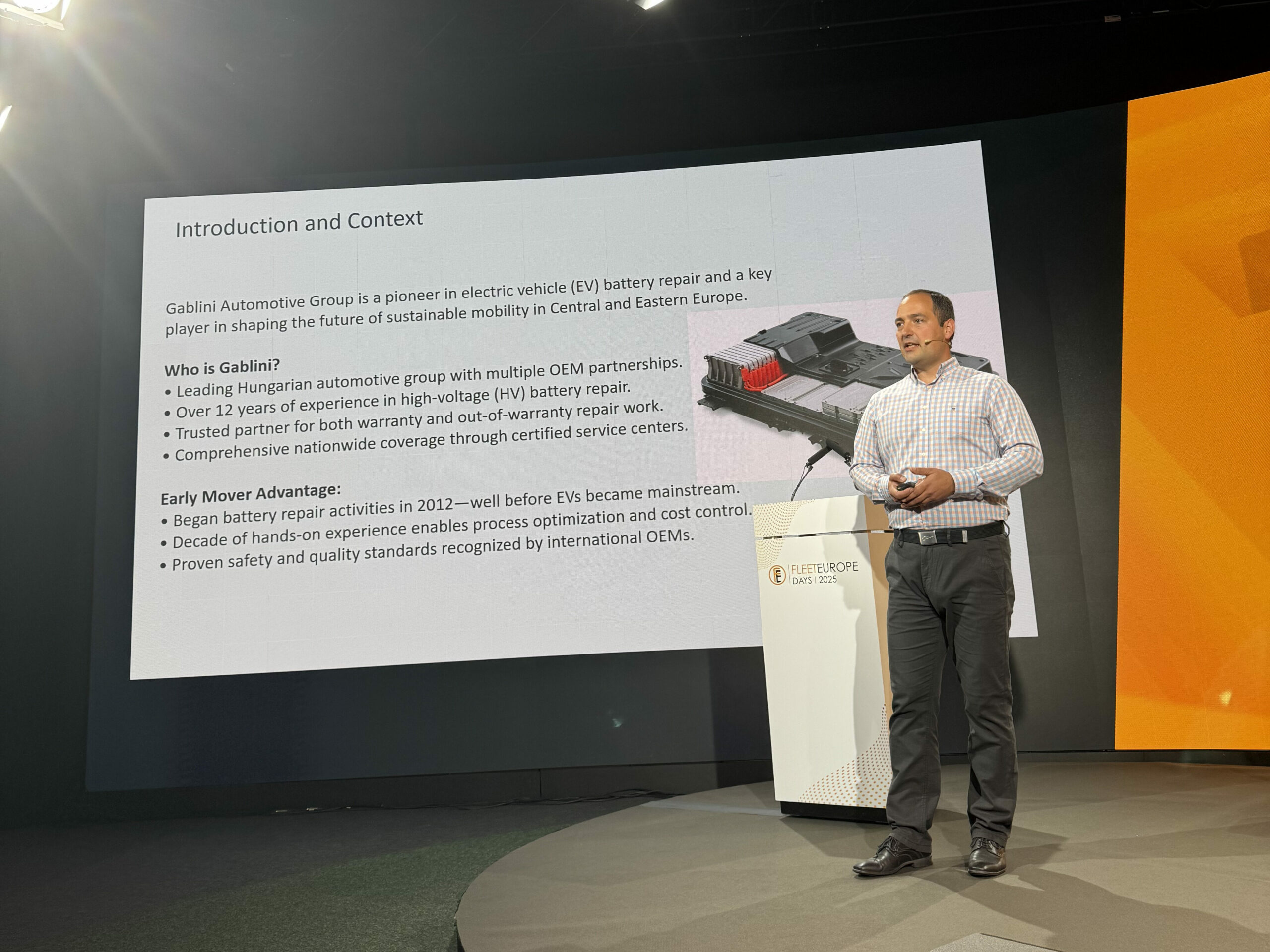

According to Gablini Automotive Group, the cost of repairing a battery pack is around 80% lower than replacing it. This makes battery repair more financially attractive while supporting circular economy goals.

‘To be sustainable, we cannot throw away a 10-year-old vehicle. We should keep it on the road. Because, if we throw it away, the environmentally friendly behaviour of EVs will not be there anymore,’ stated Daniel Pataki, general manager of Gablini Automotive Group, at Fleet Europe Days.

‘The question is if we can repair the battery packs in case of any failure, because OEMs are not interested in selling battery packs. They are interested in selling new vehicles,’ he said.

Pataki explained how demand for battery repair is growing. As old EVs are getting cheaper, people are beginning to use them as an entrance point to the EV sector. However, he highlighted that an EV with a faulty battery has a resale value of close to zero.

Repair constraints

Pataki presented a diagram of a dismantled EV battery pack. He explained that if one cell has a lower voltage than the rest, this affects the entire battery’s performance. By replacing the module containing that cell, the EVs’ range will improve. The battery management system and thermal management system can also be replaced.

‘If one sensor gets broken in a battery pack and you cannot repair it via the OEM, you should replace the battery pack due to the fault of a €10 sensor. This is not sustainable. You should be able to repair this,’ said Pataki.

However, he explained that there are some constraints. There are still no standard criteria for technicians looking to repair high-voltage batteries. Pataki said that OEMs do invite technicians to their headquarters to get a certificate.

‘According to our experience of more than 12 years, 85% of faulty battery packs were economically repairable. That means only 15% of the battery packs coming to us needed to be replaced,’ he noted.

Pataki pointed out that buying parts from the OEM will mean reduced margins compared with individual battery repair. For a 14-hour job, a profit margin of around 40% to 60% can be achieved Pataki calculated. He highlighted that the solution opens up profit potential within the after-sales process.

‘You will provide sustainability. You will gain customer satisfaction because all customers will come back to you for battery repair. We can reduce waste, we can extend the lifespan of vehicles, we can have high-margin jobs in the workshop, and we can make the customer happy,’ outlined Pataki.

Battery market domination

So, the fleet sector needs to be aware of current battery developments, such as real-time data analysis and battery repair. However, it is equally important to know what to expect in the future.

Currently, the EV market is dominated by lithium iron phosphate (LFP) and nickel manganese cobalt (NMC) batteries. From January to August 2025, these two chemistries accounted for over 90% of the megawatt-hours installed across the global passenger car market, according to EV volumes data. However, the market’s composition could change over the next few years.

Mix and match approach

‘What we see is quite a detailed chemistry layout. In the US, you have the nickel cobalt aluminium (NCA) component that is mainly used by Tesla. While in Europe, you have NMC batteries. In China, you have the majority of vehicles or batteries that are LFP batteries,’ said Octavian Chelu, advisory director at Frost&Sullivan at Fleet Europe Days.

‘You might think the picture is quite clear. The US, Europe and China use a certain technology. It is not that easy. When we look towards the future, what we see happening mainly is the fact that carmakers are going to match certain batteries, technologies and chemistries depending on the type of vehicle and its use, he added.’

‘Carmakers are going to try to mix and match from now on. This is something that is going to be keeping revenue from the remarketing business because it needs to juggle very well between different types of technologies, different battery markers, the degradation of those batteries and how much the residual value is going to be impacted by all of that,’ Chelu explained.

‘We have NMC and LFP; those are the main two technologies being used today. However, we also see a lot of heavy research and development, encouraged by all major governments worldwide, because they want to break dependencies,’ Chelu highlighted. ‘We are trying to find alternatives, so that our batteries and our vehicles are not going to be dependent on one source,’

The next battery technologies

Chelu explained that sodium-ion batteries are the next technology being tested. In China, the first vehicles using this technology have already been seen. There are also solid-state batteries in development. However, he believes both chemistries will not completely wipe out LFP’s market share.

‘We are still going to be dependent on precious materials for quite a while. There are pluses and minuses with all these new technologies,’ he said.

Chelu estimated that in the future, sodium-ion batteries are likely to be 30% to 50% cheaper than their LFP counterpart. They also perform extremely well in cold temperatures. This means vehicles using the chemistry can have better charging cycles.

However, sodium-ion batteries have a lower energy density than LFP units. So, models using the chemistry instead of LFP on a like-for-like basis will have less range. Yet, this does mean the emerging technology is slightly safer, due to it being less reactive.

Chelu noted the emerging technology could be well-suited to last-mile deliveries, but less so for long-range vehicles.

Meanwhile, solid-state batteries are safer and more stable than LFP ones, with no flammable liquid electrolyte. Chelu also pointed to a higher energy density, enabling longer distances and faster charging. However, the new technology will be much more expensive to begin with.

‘Sodium-ion is the next to come in line, not to replace LFP batteries, but as a new technology. Solid-state batteries are not going to happen before 2028 and probably will be fully commercial by 2030,’ Chelu concluded.

Close

Close