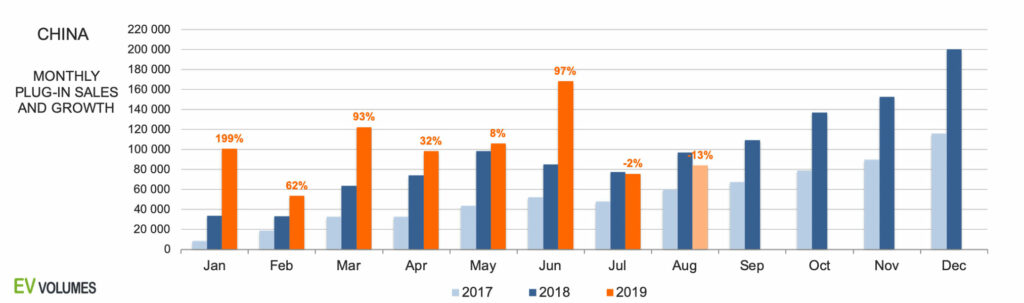

We held off the 2019 H1 summary for a while in order to get a better idea about the impact of sharply reduced NEV subsidies from July onwards. The overall Chinese car market has been in decline for 14 consecutive months now, while the sales of NEVs continued with rapid growth, at least until June. From January to June, ICE-only vehicles lost nearly 2 Million sales (-15%) compared to 2018 H1 and NEVs increased by 260 000 units (+66 %) for the same period.

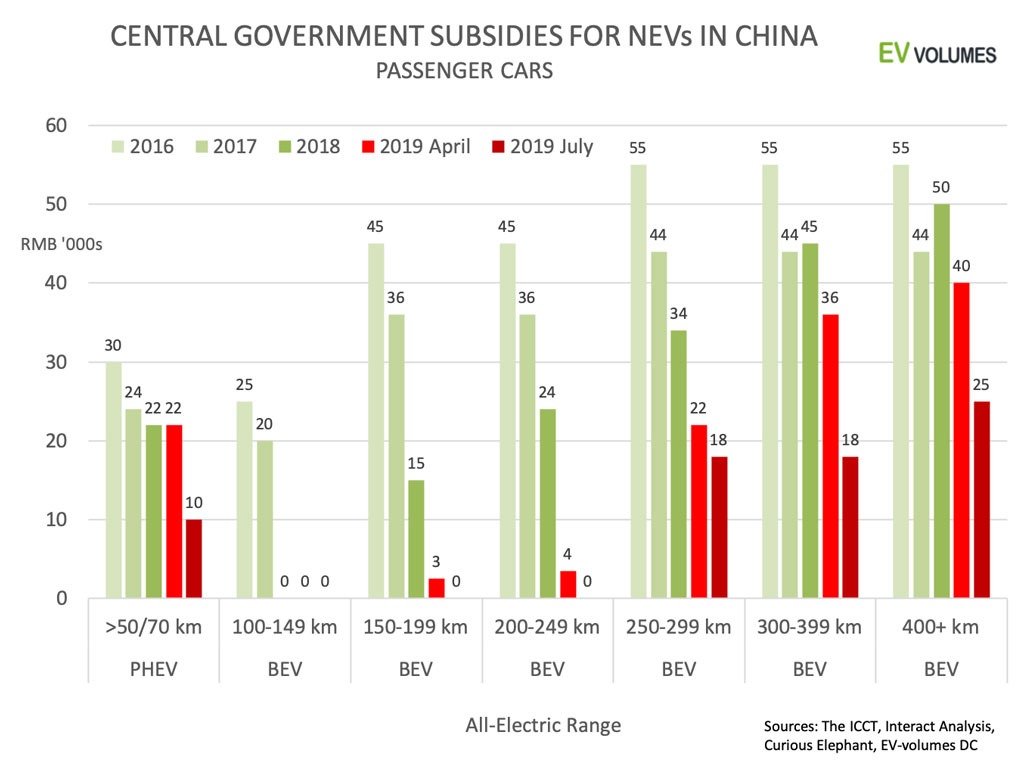

Since then, the tide has changed for NEVs as well: July NEV sales were off by -2 %, including imports and LCVs; preliminary results for August show a 13 % decline year-on-year. In summary, the changes in Government support were as follows: NEVs with an e-range below 250 km (up from 150 km last year) do not qualify for subsidies anymore, those with longer e-range have subsidies cut by around 50 %. Direct local subsidies expire, in favour of charging infrastructure investments. The new rules became fully effective in July; following a 3 month transition period with partial subsidy cuts. Some OEM have indicated to lower list prices to compensate, still, NEVs above 250 km e-range can become up to 10 % more expensive for buyers. Those under 250 km range, mostly mini- and small cars, will become much less attractive as NEVs.

Ahead of the July cuts, demand was pulled into June, which has 1/3rd higher sales than normal. The weak July and August sales partly reflected the payback for the June rush. In addition, the supply of several low-range BEVs was reduced or halted, either for further battery upgrades, or infinitely. Smaller makers of EVs in the lower price categories we affected the most during H1, but in July and August, losses have also spread among the more resilient players.

The forecast for 2019 has a lot more uncertainty than last year. Year-to date August, plug-in sector sales in China are still up 44 % compared to 2018, but in decline for the first time since 18 months. Makers of cars with less than 250 km e-range must upgrade batteries yet another time to keep them in the market. Above that barrier there is now only little incentive for EV makers to escape subsidy cuts by e-range upgrades. To make things worse, new cases of battery fires (less than 100 incidents, but still) have disturbed the confidence of consumers and legislators. The overall Chinese car market is still in reverse; the rates of decline are lower now, but they compare to the weakening monthly data of 2018 H2.

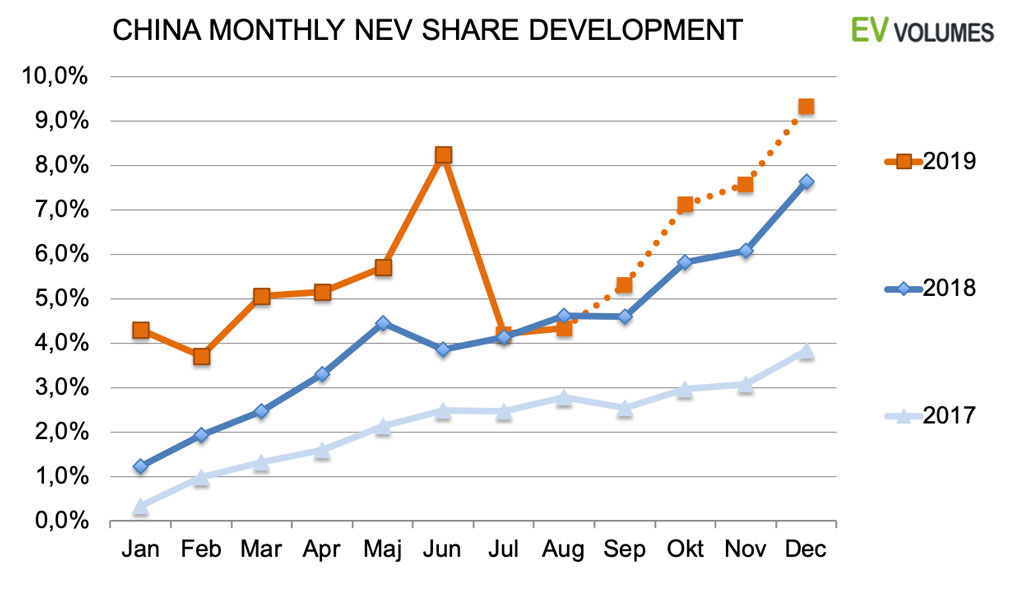

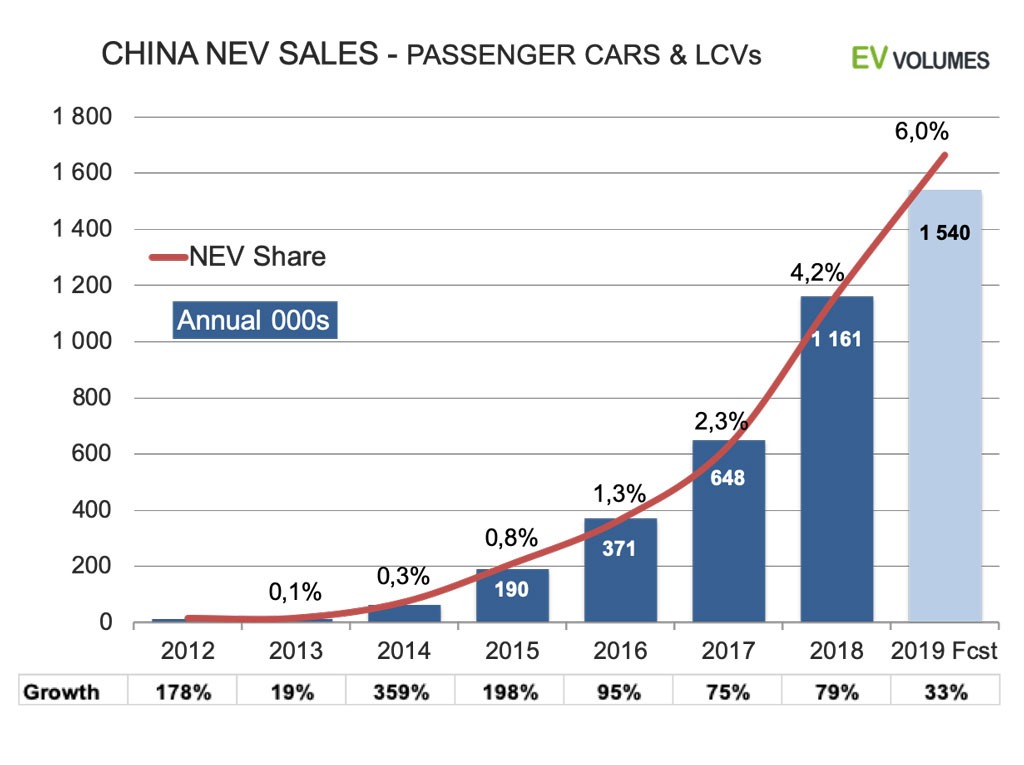

The fundamentals, like Government targets for EV deployment, ICE restrictions, EV portfolios and charging infrastructure investments speak for further NEV growth, but it will we slower than the 75 % rsp 79 % of the previous two years. Our outlook for 2019 is a volume of 1,5 to 1,6 million NEVs, (Cars, SUVs, MPVs and LCVs) in a light vehicle market of 25,6 million, 7 % lower than 2018. The best estimate, 1540k, converts to a NEV share of 6,0 % and a growth of 33 % over 2018.

Reducing dependence on subsidies

Subsidy reductions in China are not a new thing. The Government has risen the bar for approvals several times to push the EV and battery industry towards longer e-range and more advanced battery technology. The picture shows the stepwise reductions of central subsidies, which were considerable. Until 2018, EV makers have mostly succeeded to avoid cuts by battery upgrades and amazingly fast changes in product portfolios to meet new requirements.

The new regime goes further and enforces targets to consolidate the auto industry to fewer and more competitive players, which are not depending on generous state support. In addition, direct local subsidies from provinces and cities were dropped and replaced by support for the necessary charging infrastructure. Times will get tougher for makers with insufficient capital / development funds and sub-standard models.

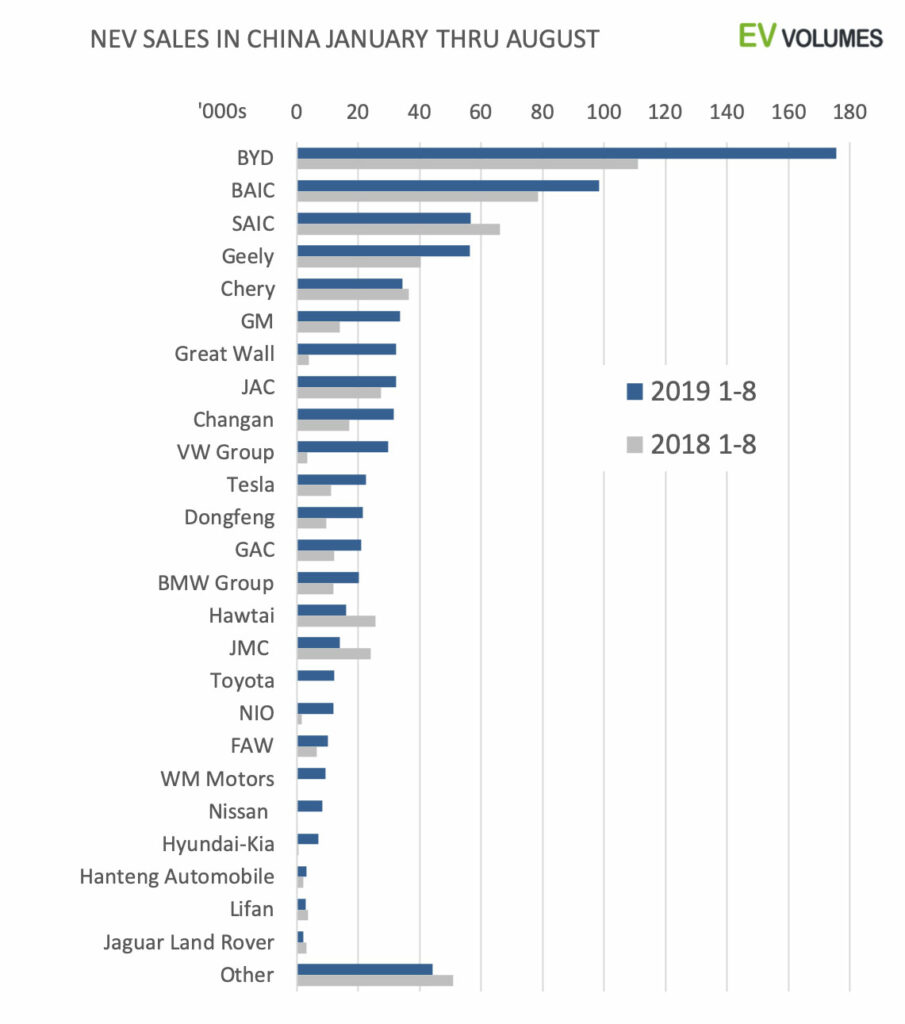

Impact on NEV sales by OEM’s so far

Year-to-date, growth in NEV sales is still positive for most OEMs. Among the larger players, SAIC, Chery, Hawtai and JMC lost sales, while others, notably Great Wall (new ORA brand) and VW (new Passat PHEV, Tiguan PHEV and e-Lavida, all China made) multiplied their sales compared to last year. Also Toyota, Nissan and Nissan have introduced locally produced models, which explains their growth from next to nothing last year. None of the EV start-ups (e.g NIO, WM) made it into the top-10, yet.

Until August, overall NEVs were still 60 % higher than Jan-Aug last year, but the slump in July and August has also affected more resilient makers like BYD, BAIC, Geely, Changan and JAC, which posted double digit %-losses in volume compared to July-August sales last year.

On model-level, 2019 sales were highly erratic and can hardly be explained by consumer preferences. Sales of big-sellers like e.g. the BAIC EC series and BYD e5 were on and off and on again, revealing the struggle of Chinese EV makers to adjust portfolios and production to new requirements and restrictions. We expect this turmoil to calm down in Q4, but we do not see the sector returning to the relentless 60-100 % growth rates of previous years.

Recovery in sight

The comparably modest increases in April and May gave a first indication of the impact of the stepwise reductions in EV support. Then, June sales were overshooting by at least 30 %, prior to further subsidy cuts in July. The slump in July and August therefore contains a good portion of “pay-back” and is unlikely to reflect a new, downward trend in NEV sales.We expect a gradual recovery starting in September and increases of 20-30 % over last year for the remaining months. The resulting average NEV share for 2019 is 6 %, which is #5 in the world ranking and two times higher than in any other vehicle market with more than 1 million annual sales. Only Norway, Sweden, Iceland and the Netherlands have higher EV shares, so far.

Spectacular sales and growth history

China is, by far, the largest market for Plug-Ins. 2018 NEV sales reached 1 160 000 units, counting passenger cars and light commercial vehicles. This compared to 410 000 in Europe and 360 000 in USA. In 2019, China stood for 55 % of all 1,45 million global plug-in sales, so far, counting light vehicles. On top of that come 75 000 medium and heavy commercial vehicles, most of them electric metro buses.

Regarding the weak July and August numbers, is the party over? Some math on this: Volume/share growth of successful, new technology is usually along S-curves and progressive until the deflection point. In %-terms, the increases get lower year by year, but deviations from the long term trend are common. By this logic, the 2018 result (+79 %) was over-shooting relative to trend, which translates to lower growth for 2019 to get back to the trend-line. So much for theory.Our best estimate for 2019 is a NEV total of 1,5 to 1,6 million, with a share of 6 % in light vehicle sales.

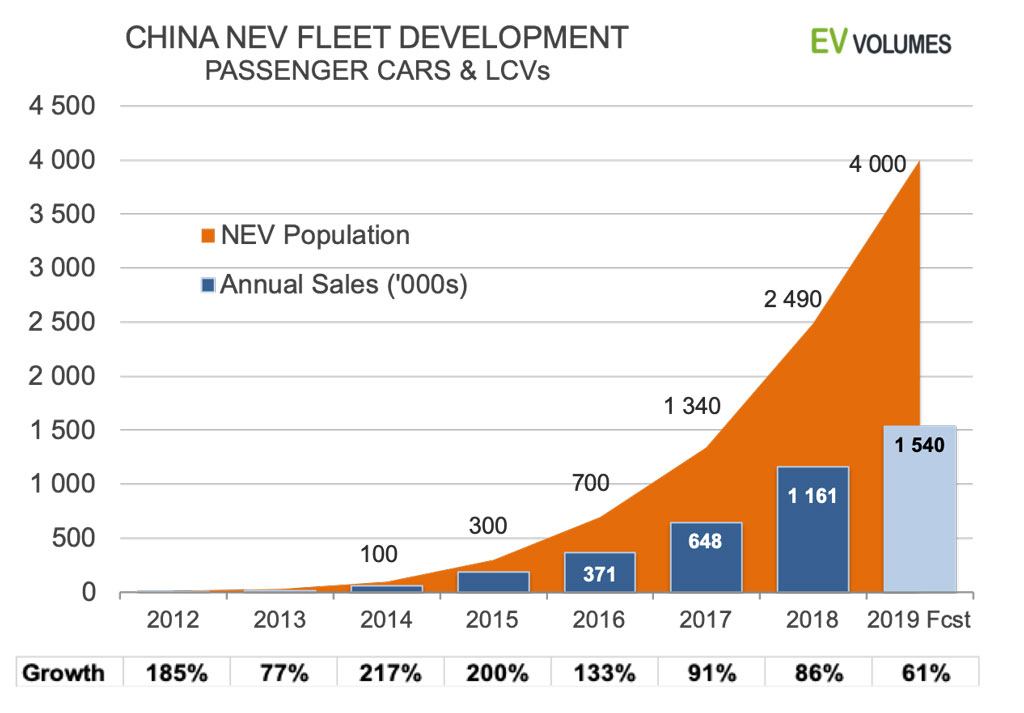

EV population above targets

The Chinese NEV fleet (vehicle population) is likely to reach 4 million in December 2019, counting light vehicles, 60 % more than at the end 2018. In addition, there are 600 000 heavy electric vehicle on the road in China, most of them buses in metro areas.

5 million NEVs on the road by the end of 2020 is a previously stated target of Chinese authorities. This is for all vehicle types combined, including LCVs, trucks and buses. Even with a slower pace for this this year and the next, this target will be met ahead of time. The drastic subsidy cuts this year can be seen in the light of this: Avoiding a bubble and creating a more competitive EV industry.

Close

Close